Chart #1 —

US stocks down slightly over the week

The Nasdaq 100 and the S&P 500 lost some of their gains from the previous week. The former fell by 1.1% by the end of the week and the latter by 0.7%. A restrictive speech by some Fed members and the missile fired in Poland prompted investors to take profits.

Source: Bloomberg

Source: Bloomberg

Chart #2 —

The market revises the Fed's terminal rate upwards

No less than 16 different speeches from Fed member took place last week. All delivered the same message: higher rates for longer; no pause or impending pivot...

Among the most prominent messages:

Bostic: more rate hikes are needed, "we need to keep rates up" until inflation reaches 2%.

Bullard: rates could reach 7%.

Waller: The Fed still has "a long way to go" in raising rates.

As a result, the market revised upwards the forecast of the interest rate at which the Fed will stop tightening (the "Terminal Rate"), after it had been revised downwards following the release of the inflation figures 2 weeks ago. As is often the case, an upward revision of the terminal rate de facto leads to an upward revision of the number of rate cuts expected afterwards.

Expected Terminal Fed ratwe ( in red ) and number of rate cuts expected in H2 2023 ( in green )

Source: Bloomberg, www.zerohedge.com

Chart #3 —

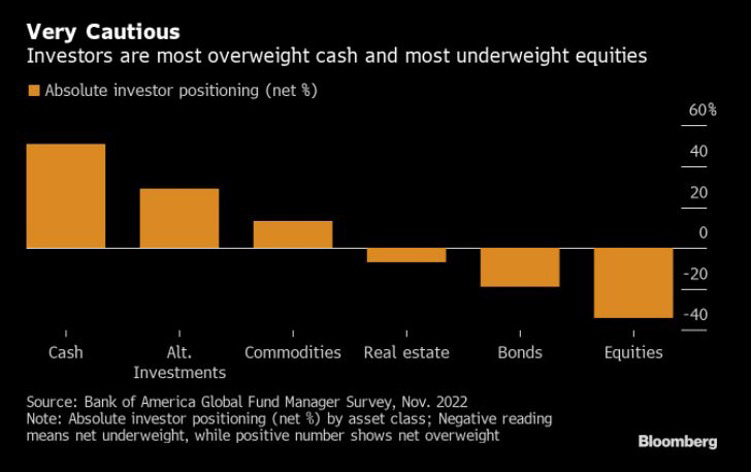

Investors' positioning remains cautious

Bank of America's survey of fund managers shows that they remain relatively cautious in their asset allocation (note that this survey took place before the US inflation figures). Cash is the most popular asset class with an overweight of 51%. This is followed by alternative investments and commodities. Stocks and bonds remain underweight in portfolios.

Source: Bloomberg

Source: Bloomberg

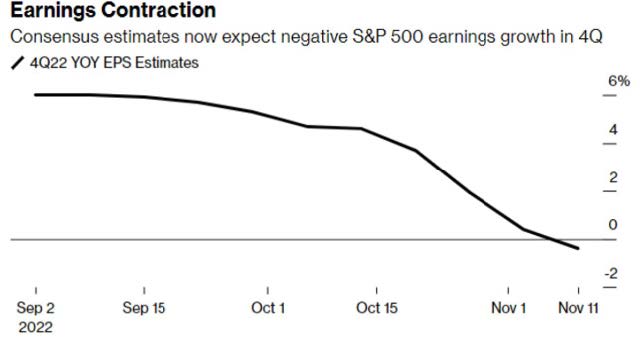

Chart #4 —

Earnings growth expectations for the S&P 500 in Q4 continue to be revised downwards

Wall Street's outlook for S&P 500 earnings is increasingly bleak. Analysts now expect earnings growth to be negative in the fourth quarter. Expectations for 2023 are also being revised downward for all S&P 500 sectors, with technology making the most negative contribution.

4Q 2022 YoY S&P 500 EPS estimates

Source: Bloomberg

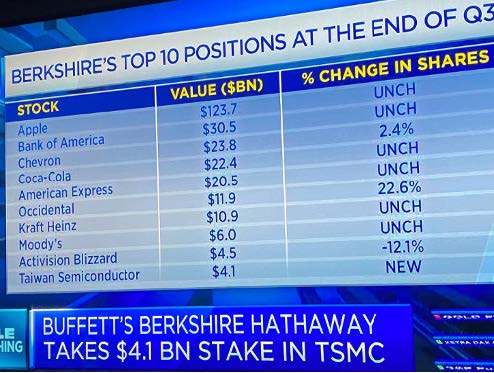

Chart #5 —

Some changes in Berkshire Hathaway's top 10 positions

The investment firm led by Warren Buffet has published its positions at the end of the third quarter. New purchases by the "sage of Omaha" include Taiwan Semiconductors, timber specialist Louisiana-Pacific Corp and financial firm Jefferies. Other new holdings include oil companies Occidental Petroleum and Chevron, furniture specialist RH, media stock Paramount and chemicals company Celanese.. Indeed, the US dollar had its worst week since March 2020 and, before that, since May 2009.

Berkshire Hathaway's top 10 holdings at the end of the third quarter

Source: CNBC

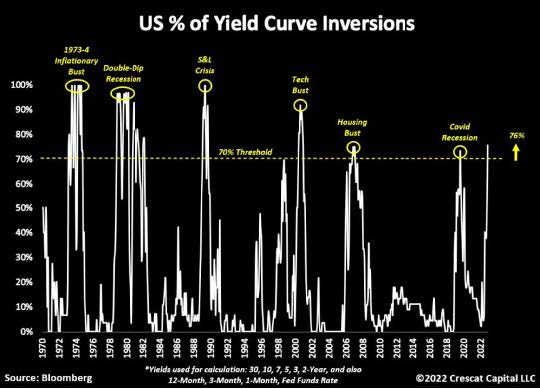

Chart #6 —

The US bond yield curve continues to invert

Recent developments in the US bond market include: 1) For the first time since the Covid recession, Fed yields are higher than 30-year Treasury yields; 2) The 2-year 10-year curve is the most inverted since 1982; 3) The 3-month 10-year curve reaches a new low in the current cycle. Currently, 76% of the US curve is inverted. In the last 50 years, whenever more than 70% of the curve was inverted, a recession followed. A macroeconomic figure released last week seems to corroborate this risk: the 6-month growth rate of the leading economic index fell into negative territory again in October and is at levels that have signalled a high probability of recession in the past (2020, 2008 and 2001)...

US % of Yield curve inverse

Source: Crescat Capital, Bloomberg

Chart #7 —

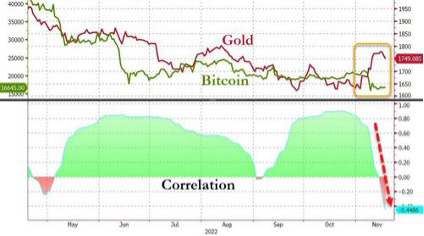

Gold and bitcoin's paths are diverging

While the correlation between gold and bitcoin had been rising steadily this year, the two assets have diverged since the FTX case. The correlation between gold and bitcoin has collapsed to -0.45, the lowest level since February.

Correlation between Gold and bitcoin

Source: Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

US inflation is accelerating, federal debt is projected to double from $20 trillion in 2017 to $40 trillion by 2025, but the S&P 500 continues to show resilience. Each week, the Syz investment team takes you through the last seven days in seven charts.

The U.S. Treasury is ramping up the issuance of Treasury bonds at an accelerating pace. Simultaneously, we are seeing gold prices rise while bond yields fall, while commodities are experiencing a resurgence. Each week, the Syz investment team takes you through the last seven days in seven charts.

The SNB unexpectedly cut rates, resulting in a drop for the Swiss franc versus the Euro and Dollar and the S&P 500 hits record high as FED signals future cuts in 2024. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)