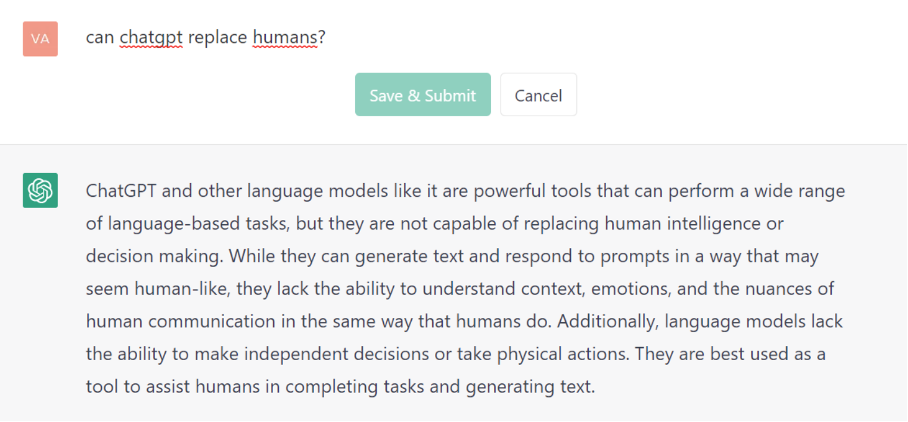

ChatGPT is the technological attraction of the beginning of this year. Available to the general public for two months, this chatbot - or conversational robot - has passed the million user mark in just 5 days. A record adoption curve, when you know that it took 74 days to the iPhone and 10 months to Facebook to do the same...

Time to 1 million users

Source: Exceptional view via Linas Beliunas

ChatGPT was developed by OpenAI, a startup founded in San Francisco in late 2015 by Sam Altman (its current CEO), Elon Musk and other artificial intelligence enthusiasts. Musk resigned from the board in February 2018 but remained a donor. In 2019, OpenAI LP received a $1 billion investment from Microsoft (with whom it has since had a strategic partnership) and Matthew Brown Companies.

Launched in November 2022, the GPT3 version of the ChatGPT project is capable - in record time - of the following tasks:

- Generate text (human language) for a variety of purposes, such as creating chatbots and content, in many foreign languages.

- Answer questions: ChatGPT can be trained to understand and answer questions, making it suitable for use in applications such as customer service chatbots or information retrieval systems. ChatGPT can write a movie script, develop a diet or sports training plan, write a description of a new job opening, and more. The chatbot can even develop an investment strategy for 2023...

-

Classify texts: ChatGPT can be used to classify texts into different categories, such as spam or non-spam, or to interpret the general sentiment of a text (e.g. positive, negative, neutral).

-

Write summaries even on the basis of relatively long texts, which makes it useful for tasks such as summarizing press articles or research papers.

-

Generate dialogue systems: it can be used to create sophisticated chatbots capable of conducting intelligent conversations with users.

Translate text from one language to another, making it useful for tasks such as translation applications or website localization.

ChatGPT is so effective that it has just been banned for all students in the State of New York.

Even more impressive, especially to developers, is that the chatbot is able to create entire chunks of code in a multitude of programming languages, but also identify bugs and propose solutions to rectify them.

ChatGPT is able to achieve these feats thanks to an artificial intelligence that uses a sum of information already acquired, based on 175 billion parameters and declined in different initiatives such as Dall-E for image generation from text (see example below), Whisper (automatic language recognition) and ChatGPT for the chatbot.

Mural image with DALL-E 2 by David Schnurr

If the release of this chatbot became so viral, it is mainly because it has been made available to the general public, which has thus taken the measure of its revolutionary character. Many specialists dare to talk about a real "game changer", i.e. a technology that can radically change our daily life but also disrupt a large number of industries.

Won't artists, writers, teachers and programmers have to reinvent themselves if each of us can effortlessly generate art, articles, texts and programming scripts?

Although it is already incredibly powerful, the widespread use of OpenAI's services could spur many innovations in the near future.

However, the fact that this revolutionary digital assistant is free - even if it still has some flaws - raises many questions.

What is ChatGPT's business model? How do they generate revenue?

.png)