Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- tech

- nvidia

- earnings

- Forex

- oil

- Real Estate

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- assetmanagement

- Middle East

- UK

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

What goes up must come down...

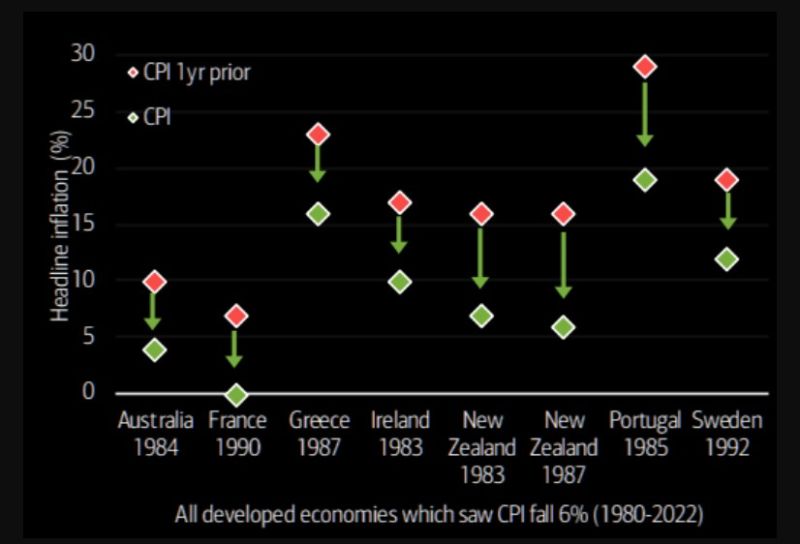

The collapse in US CPI over the past year is extreme, falling from 9.1% to 3%. BofA writes: "...since 1980, only in 8 cases had inflation fallen by more than 6% in a year, and only in France in 1990 from a starting point lower than 10%." Source: TME, BofA

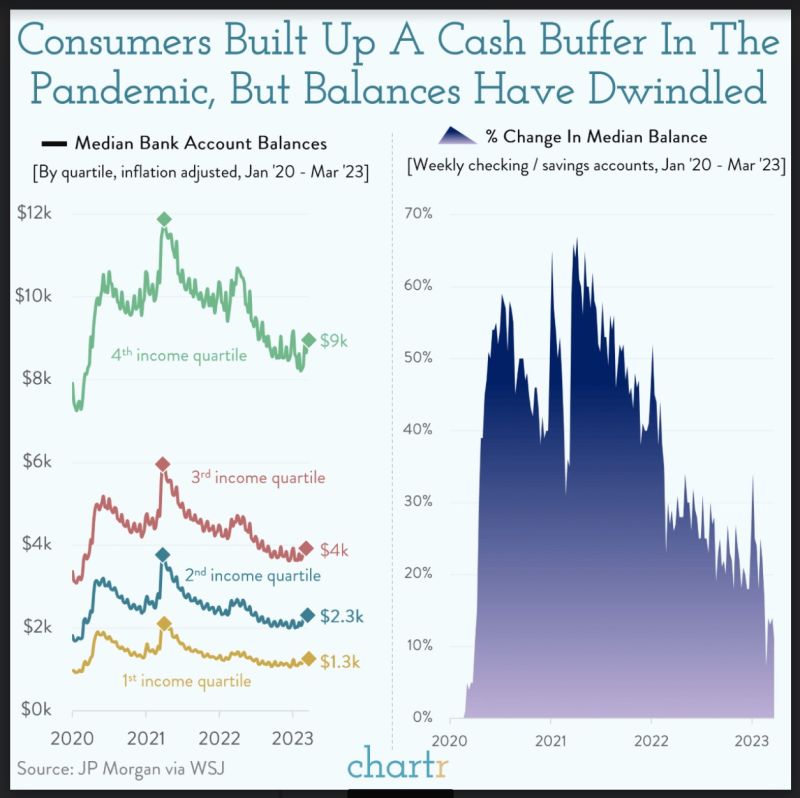

Interesting charts by Chartr on US consumers cash buffer

When the pandemic hit, many of us instinctively reigned in our spending — partly out of choice, and partly because there weren’t a lot of fun things to splurge on. That set of circumstances coincided with stimulus checks and tax credits in April 2021, leading to many Americans building up healthier-than-usual cash balances in their bank accounts. However, new data from JPMorgan reveals that much of the buffer has now disappeared. Although US households still hold approximately 10% to 15% more cash in their savings accounts than before the pandemic, analysis of 9 million Chase customers reveals that the median account balance has dropped significantly in the last 2 years. That could help explain why the much-feared recession has yet to materialize, as consumers have had strong reserves to combat rampant inflation and rises in borrowing costs. Interestingly, the trend is seen across all income brackets. The nation's top quarter of earners have seen their savings accounts decline from a median high of nearly $12,000 to $9,000, as of March this year — though their 25% decrease is a smaller relative drop than that experienced by lower earners. Indeed, people in the lowest income quartile — who likely have to allocate a larger portion of their income to essentials — have seen a 41% decline since their savings peaked.

Is the yield curve a flawed recession indicator?

While the deeply inverted yield curve has stoked anxiety among investors about the prospect of a recession, Goldman Sachs has a different message: stop worrying about it. Indeed, the bank's Chief Economist Jan Hatzius just cut his assessment of the probability of a recession to 20% from 25%, following a lower-than-expected inflation report last week.

So far, in fiscal year 2023, the US government has a total deficit of $1.393 TRILLION.

In June 2023 alone, the deficit was $228 billion, up from just $88 billion in June 2022. On average, the US deficit has risen by ~$155 billon per MONTH in FY2023. At the current rate, total US debt would rise by $18.5 TRILLION in 10 years. Source: The Kobeissi Letter

Economists polled by German research institute Ifo expect global inflation to avg 7% in 2023, before slightly easing to 6% in 2024.

The avg expectation of 4.9% for the long term until 2026 is still high, Ifo said, though marginally below the 5% estimate in Q1. Lowest level of inflation expectation was recorded in Europe, yet economists do not expect the rate to return to ECB's 2% target by 2026. Source: HolgerZ, Bloomberg

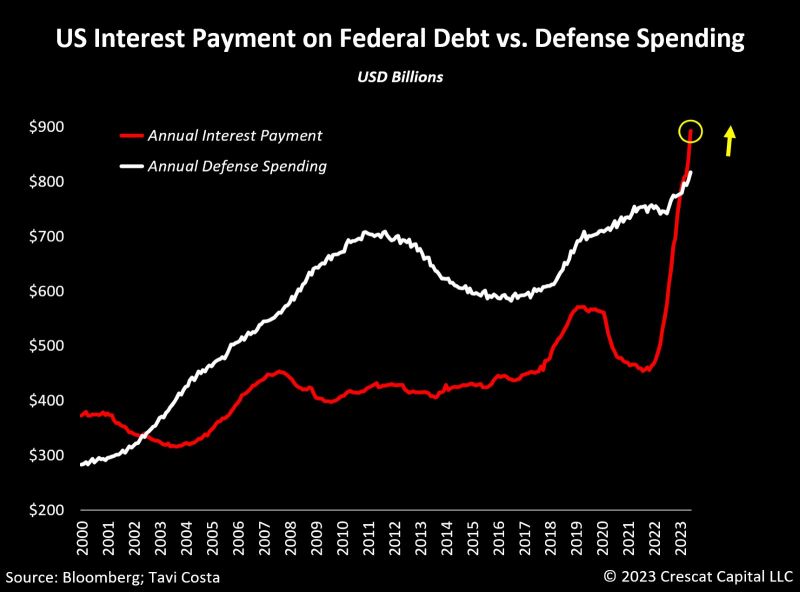

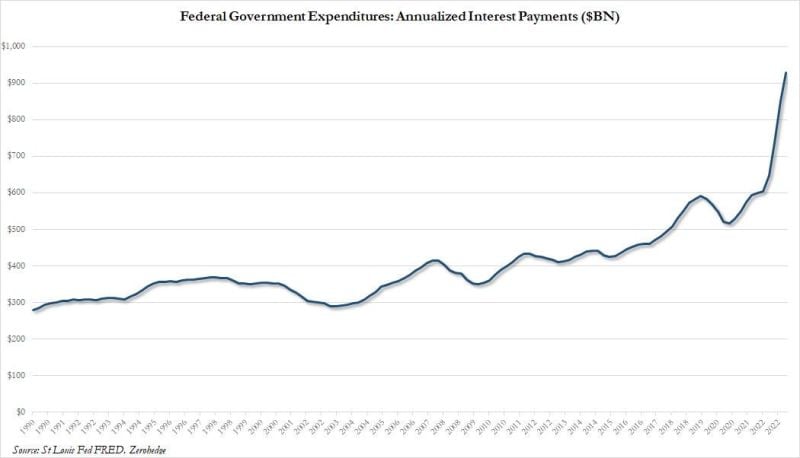

According to new US government data, annualized interest payments on US debt just crossed $900 BILLION for the first time in history

Government spending jumped 15% in June, the same month we had the debt ceiling “crisis.” Ironically, in the same month we had a debt ceiling crisis, US Federal spending hit a near record and annualized interest expense crossed $900 billion. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks