From Ethereum to Ethereum 2.0

Launched on 30 July 2015, Ethereum is a decentralised exchange protocol that allows users to set up smart contracts. These are pre-established contracts or applications that self-execute to ensure authenticity without the intervention of a third party. For example, Ethereum lets users establish a future contract to purchase an asset only when certain conditions are met. The Ethereum protocol allows for the verification as well as the enforcement of a mutual contract between parties on the blockchain. This protocol allows developers to create applications, store records and transfer funds according to past instructions.

Since 2017, thousands of companies have developed their own ‘smart contracts’ and often use the Ethereum protocol as well as Ether tokens (ETH) as a means of settlement.

One reason for Ethereum's growing success is its position as the blockchain of choice for many products and services that use DeFi - or decentralised finance - applications.

These new applications aim to replace traditional financial products - such as loans, savings, or derivatives - with the use of a decentralised technology, rather than relying on a company or a bank. Another favourable development for the Ethereum protocol is the exponential growth of NFTs (Non-Fungible Tokens). Many NFT projects such as CryptoPunks or Decentraland have their ‘smart contracts’ on the Ethereum blockchain. And as more users flock to interact with these applications, they need ETH to perform their transactions.

Ethereum's blockchain incorporates several principles introduced by Bitcoin, including ‘mining.’ Ethereum's growing success with the public has attracted an increasing number of new miners. The result is that mining is becoming increasingly difficult, which may eventually discourage independent miners for whom Ether will no longer be a profitable cryptocurrency. To avoid a surge in the difficulty of mining, updates were planned.

This was the case in 2018 with a new version named Serenity.

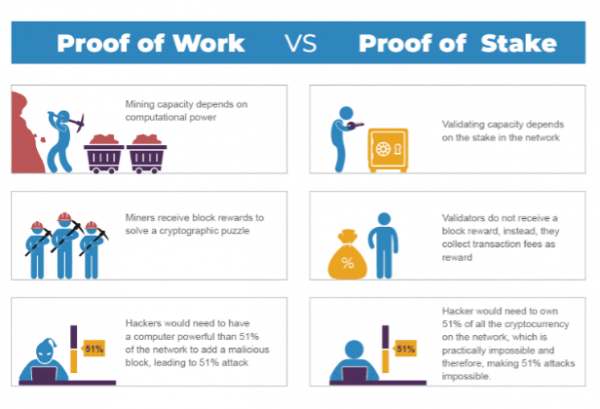

‘Proof-of-Work’ versus ‘Proof-of-Stake’

The current ‘proof-of-work’ (PoW) model is the original blockchain process. It is a system in which computers compete with the goal of being the first to solve complex equations. This process is commonly referred to as ‘mining’ because the energy and resources required to solve equations are considered the digital equivalent of the process of precious-metal mining. When a miner solves an equation before others, they are allowed to create a new block. Once everything is approved, the new block is ‘chained’ to the previous block, creating a chronological chain of transactions. The miner is then rewarded for providing their resources with cryptocurrencies.

In the proof-of-stake (PoS) system, ‘validators’ (the equivalent of miners) are chosen to generate a new block based on the number of tokens they hold, rather than letting an arbitrary competition between miners determine who can add a block. Those chosen receive rewards from the blockchain in exchange. This ‘staking’ system - the amount of ‘stake’ is the amount of crypto-currency tied up by a user – replaces the work done by miners. This PoS structure secures the network because a potential participant must purchase the crypto-currency and then hold it in order to be chosen to create a block.

Source: LeewayHertz

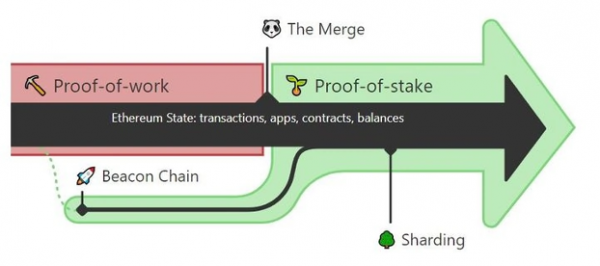

‘The Merge’

The Ethereum network’s transition from PoW to PoS involves the following steps:

Step 1: The creation and launch of the ‘beacon chain’ took place on 1 December 2020. This update introduced PoS on Ethereum. For this reason, it is called the ‘consensus layer.’

Step 2: replace the PoW consensus mechanism with PoS. The existing chain, the Mainnet, will then act as the ‘execution layer,’ as the current PoW system will be replaced by the beacon chain.

The consensus layer will take care of network security. The execution layer is where smart contracts are executed, and transactions are created.

‘The Merge’ is therefore the update that combines these two chains into one. It is this step that will allow the transition to Ethereum 2.0.

This merger will end the practice of ETH mining and replace it with a process in which ETH holders can pledge their existing tokens in order to create more. According to the Ethereum Foundation, the PoS model will make the Ethereum network 99% more environmentally friendly.

Source: CryptoPotato

However, this very important step has been postponed several times. It is now scheduled for 19 September 2022 and has already been tested many times.

However, this update is not the last. Indeed, according to Ethereum’s co-founder, the blockchain is only 40% finalised. After the merger, this figure will reach 55%. In comparison, he estimates that Bitcoin is 80% complete.

For the Ethereum blockchain, a series of important updates remain to be carried out. After ‘The Merge,’ stages labelled the ‘Surge,’ ‘Verge,' 'Purge' and ‘Splurge’ will follow to make the network more powerful and robust.

What will change for Ethereum and ETH

Staking

The change in validation model implies a different reward methodology. With PoS, validators tying up their ETH tokens as ‘collateral’ are rewarded. Instead of receiving a block reward, validators receive the fees spent by network users directly. The rewards depend on the total amount of Ethereum invested on the network. They can range from 18% per year for fewer than 1 million wagers, to 1.8% for more than 100 million. This process - staking - is already in place on the Beacon chain.

Investors will need to deposit a minimum of ETH 32 (worth about USD 50,000) to participate in staking, although some services offer staking for investors with as little as ETH 0.01. The returns offered may attract a large number of institutional and private investors.

Mining will no longer be possible

When Ethereum is switched to PoS, it will no longer be possible to verify transactions on the mainnet through mining. Instead, Beacon chain validators will then confirm all new transactions.

The rate of new tokens put into circulation will decrease by about 90%, as the rewards of mining, which are greater than those of staking, will cease.

Energy consumption is expected to drop by 99%

One effect of the transition to a more sustainable blockchain could be that investors and projects are more willing to adopt the Ethereum blockchain.

Reduced costs and increased security

The current PoW consensus model is extremely energy intensive. With PoS, overall costs should drop significantly and continue to decrease as the number of users rise.

The planned upgrades improve Ethereum's security, as validators must pledge large amounts of ETH. In the case of attempted fraud, the protocol can automatically destroy their ETH.

Finally, PoS is less expensive than mining. This should encourage more people to become validators, thus increasing the decentralisation of the network.

Sharding

Sharding is a process that breaks down the validation work into smaller quantities and should allow the network to handle more transactions. It may also increase the number of participants in the network by allowing transactions to be approved on small devices, such as phones. Sharding is not part of 'The Merge’ but will be rolled out in future updates and improve the performance of the blockchain.

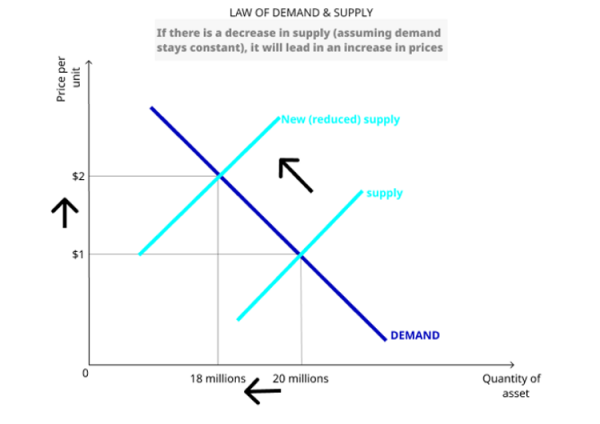

A deflationary asset

With the first version of Ethereum, the market perception was that Bitcoin's supply was limited in time while Ethereum's was unlimited. But the transition to Ethereum 2.0 involves a fundamental shift: the ETH could become a deflationary cryptocurrency for the following reasons:

- With the transition to PoS, there will be no more mining rewards. Therefore, the issuance of new ETH tokens will drop significantly.

- Staking will de facto reduce the number of tokens in circulation. Indeed, the Beacon chain (PoS) has already been operating since December 2020 and part of the ETH supply (12 million tokens, or about 10% of the current supply) is already in staked.

- An update in 2021 - EIP 1559 (named ‘London’) - introduced a ‘coin burn’ upgrade into the blockchain. According to this practice, for each transaction on the network, ETH are burned. The process has already begun, as it is estimated that on average, ETH 3.10 are now destroyed every minute.

From an accounting point of view, the increase in the supply of ETH generated via staking rewards will not be enough to compensate for the disappearance of block rewards (mining) and the burning of ETH taking place with each transaction. In other words, the net supply of ETH is expected to decrease. This may be a very attractive equation for investors since the growing success of the Ethereum protocol may not only increase the demand for ETH but also reduce the supply, creating a perfect ‘scissor effect.’ This development should encourage more investors to ‘hold’ ETH.

Law of demand & supply

Source: Monnos

Implications for ETH

While Bitcoin has attracted most of the popular attention on cryptocurrencies in recent years, interest in Ethereum is growing. Despite Ether's precipitous drop (-55%) in 2022, the Ethereum blockchain continues to innovate. Discussed for several months, ‘The Merge’ will allow Ethereum tomove from proof-of-work to proof-of-stake. The issuance of new tokens will drop sharply, cutting energy consumption considerably, making Ethereum a less energy-intensive blockchain. While Ether remains a highly speculative asset, the 19 September update may be a favourable catalyst for ETH to become a long-term investment, or as a yielding asset through staking.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

President Donald Trump signed an executive order relating to cryptocurrencies. The US is now one step closer to the creation of a strategic bitcoin reserve. Overview below.

"There are decades where nothing happens; and there are weeks where decades happen." - Vladimir Ilyich Lenin

Solana and Ethereum are two dominant blockchains in the crypto sector, each boasting robust DeFi ecosystems and a plethora of diverse applications. The two blockchains are often seen as competitors. How do they compare?

.png)