Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

IS KEVIN WARSH A DOVE OR A HAWK ?

Interestingly, since his name came up yesterday, markets have been pricing in more his hawkish reputation than his more recent dovish tilt: - Risk assets lower: equities down, bitcoin / cryptos down, gold down and silver in bear market! - Steeper yield curve: could be related to the fact that he is in favour of a smaller Fed balance sheet - Stronger dollar So how should we interpret market erratic moves over the last two days? Stop labeling Kevin Warsh as just a "Hawk." 🦅❌ The social media "chattering class" loves a simple label, but the reality of the next Fed Chair is far more nuanced. If you’re building a strategy based on the idea that Warsh is purely a rate-hiker, you’re missing the bigger picture. Here is the "Warsh Playbook" that the headlines are missing: 1. The "Productivity Boom" Pivot 🚀 Warsh isn't looking to keep rates high for the sake of it. He believes the U.S. is in a massive productivity surge. If that’s true, the Fed can actually lower rates without sparking inflation. It’s a growth-friendly view that most "hawks" wouldn't touch. 2. The Policy Mix: Lower Rates + Tighter Balance Sheet ⚖️ This is the sophisticated play. Warsh wants to shrink the Fed’s massive balance sheet while simultaneously keeping interest rates manageable. It’s a "tighter but lower" approach that aims for long-term stability rather than short-term sugar rushes. 3. Pragmatism Over Ideology 🛠️ History check: During the COVID-19 onset, Warsh was weeks ahead of Jay Powell in calling for an aggressive response. When the alarm bells ring, he’s shown he’s a practical crisis manager, not a rigid academic. The Bottom Line: Calling him a hawk is a convenient narrative for his confirmation hearings—it shows independence from the White House. But in practice? Expect a Fed Chair who is data-driven, productivity-focused, and ready to move fast when the situation demands it.

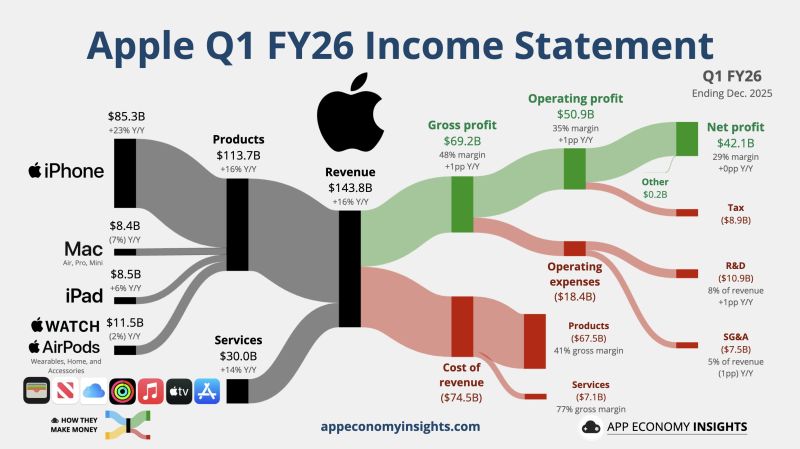

📢 Apple reported fiscal first-quarter earnings on Thursday that surpassed expectations, with revenue soaring 16% on an annual basis.

📌 The company reported $42.1 billion in net income, or $2.84 per share, versus $36.33 billion, or $2.40 per share, in the year-ago period. 🚀 Apple saw particularly strong results in China, including Taiwan and Hong Kong. Sales in the region surged 38% during the quarter to $25.53 billion. Apple quarterly results by App Economy Insights $AAPL Apple Q1 FY26 (Dec. quarter): 📱 Products +16% Y/Y to $113.7B. 💳 Services +14% Y/Y to $30.0B. • Revenue +16% Y/Y to $143.8B ($5.2B beat). • Operating margin 35% (+1pp Y/Y). • EPS $2.84 ($0.17 beat).

The unwinding of popular strategies such as the yen carry trade in traditional markets have been adding to the selling pressure on bitcoin.

The yen carry-trade strategy involves borrowing the relatively low-yielding yen and investing in other currencies offering higher returns. According to Matt Maley, chief market strategist at Miller Tabak & Co, “Bitcoin and other cryptocurrencies are assets that tend to move with liquidity. When liquidity is more plentiful, cryptos rally, and when it’s less plentiful, they decline.” “Well, one of the best indicators for the level of liquidity in the system is the yen carry trade.” Source: zerohedge

Bitcoin investors are now eyeing the $80,000 price level for support

- Rate cuts can't pump BTC. - Pro-crypto President can't pump BTC. - Weak dollar can't pump BTC. - Institutional adoption can't pump BTC. - Fed injecting liquidity can't pump BTC. - Stocks new ATH can't pump BTC. Is there anything that could pump BTC now? Which comes first? BTC $300k or a massive suck out of global liquidity??? Source: Zerohedge

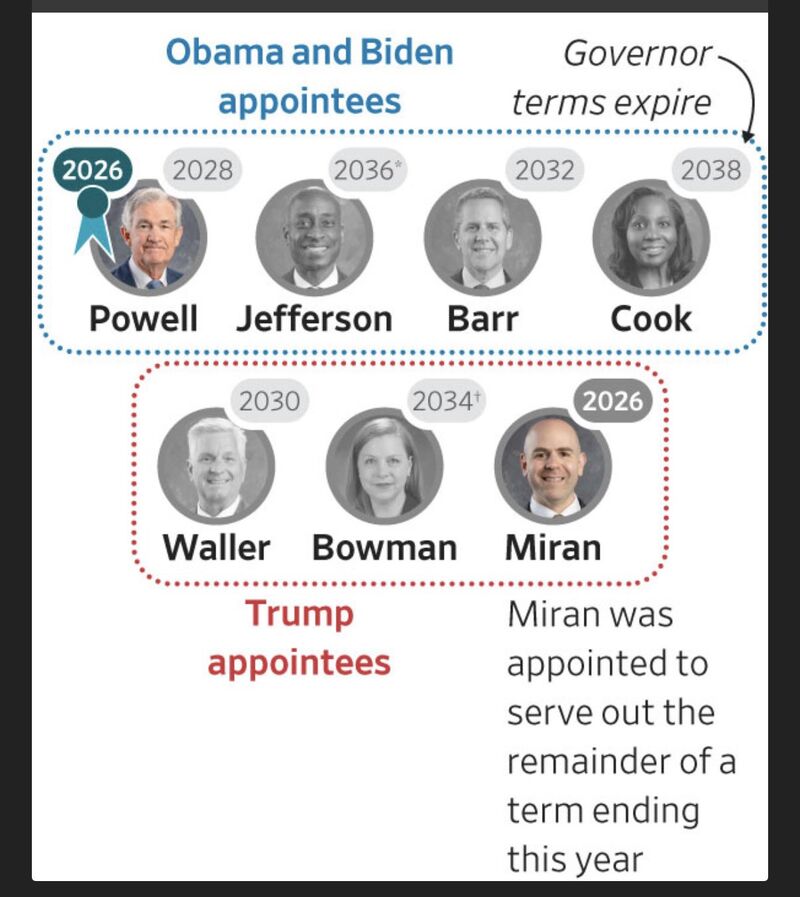

From "Hawks and Doves" to "Red and Blue"?

In a sign of the times, this Wall Street Journal chart characterizes members of the Federal Reserve Board by their political nominations rather than their expertise, experience, or hawkish/dovish inclinations. Source: Mo El Erian

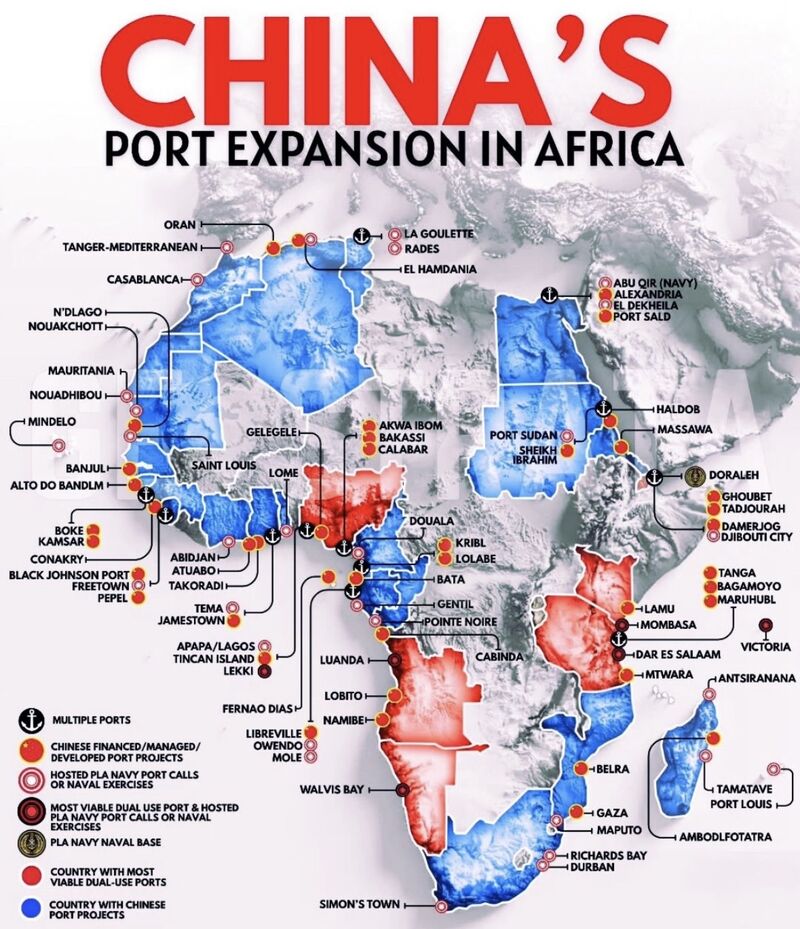

The map of global trade is being rewritten. 🌍⚓ And most people aren't looking at the right coordinates.

While the world discusses "influence," China is building infrastructure. Not just a few docks, but a literal nervous system for the African continent. Here is the reality of the "New Maritime Silk Road": 40+ African Ports: Financed, built, or operated by Chinese state-backed firms. Total Coastal Coverage: From the Atlantic to the Indian Ocean and the Red Sea. Dual-Use Potential: What starts as a commercial hub today can become a naval asset tomorrow. Beyond Djibouti: The PLA Navy’s reach is no longer confined to one base—it’s moving into the heart of global shipping lanes. Why this matters for the global economy: In 2026, Ports = Power. By controlling the gates, you control the flow of: ⚡ Energy 🌾 Food 📦 Commodities 🛡️ Security The Takeaway: China isn't just "surrounding" Africa. It is wiring itself into the very bedrock of global trade. When you own the infrastructure, you own the future of the supply chain. The board is being set. Are we playing the same game? Source: Jack Prandelli on X

Investing with intelligence

Our latest research, commentary and market outlooks