Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

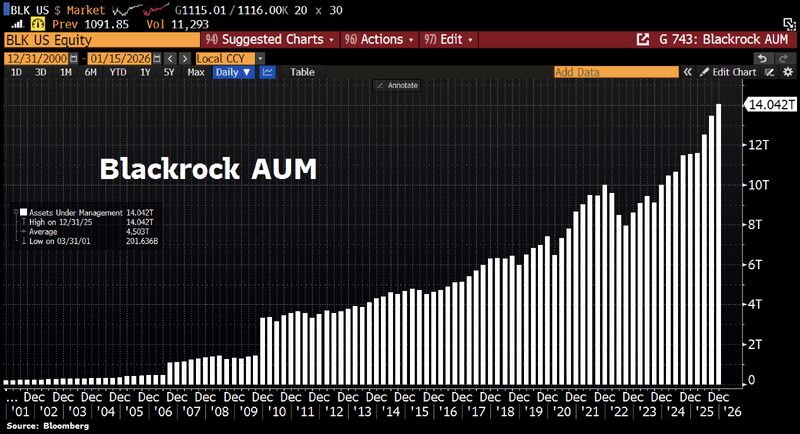

BlackRock is eating the world. Total assets under management hit a record $14 TRILLION after the firm pulled in $342bn of client money in Q4 alone.

Source: HolgerZ, Bloomberg

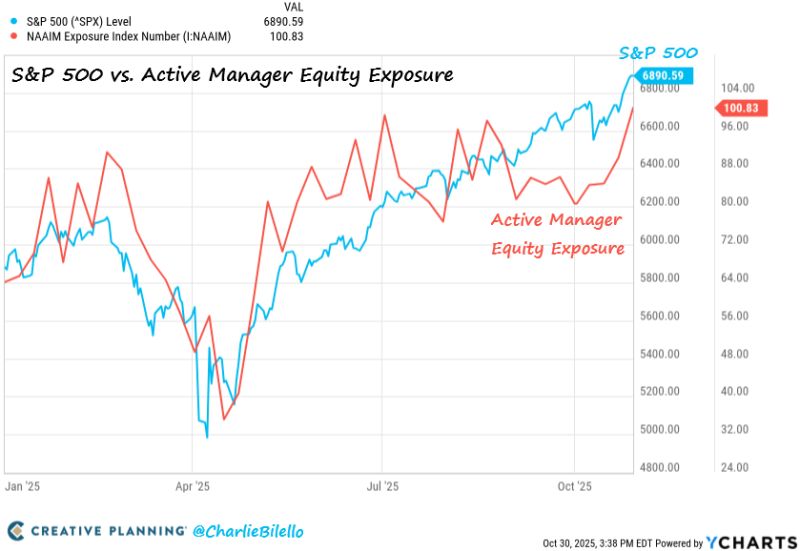

Active Managers are leveraged long equities (>100% exposure) for the first time since July 2024.

Back then, we saw a 10% correction in the S&P 500. $SPX Source: Charlie Bilello

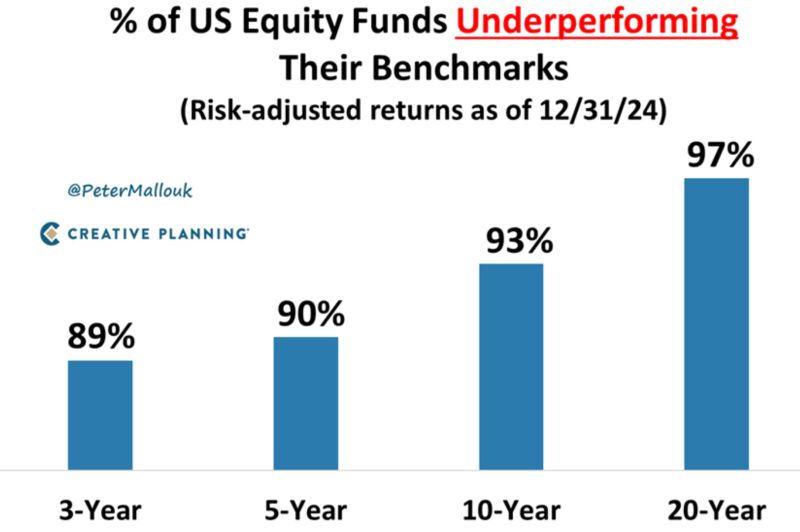

Only ~20% of active equity managers have outperformed their benchmarks this year.

Source: Bloomberg, Jefferies

Norway, a country with just over 5 million people, manages the world’s largest sovereign wealth fund, worth nearly $2 trillion.

This translates to around $340,000 for every citizen, making it one of the richest countries per capita. Source: Massimo @Rainmaker1973, Quartr

"Don't look for the needle in the haystack. Just buy the haystack!" - Jack Bogle

Source: Peter Mallouk @PeterMallouk

Based on futures market positioning, hedge funds and asset managers have been missing the rally

Source: Trend labs

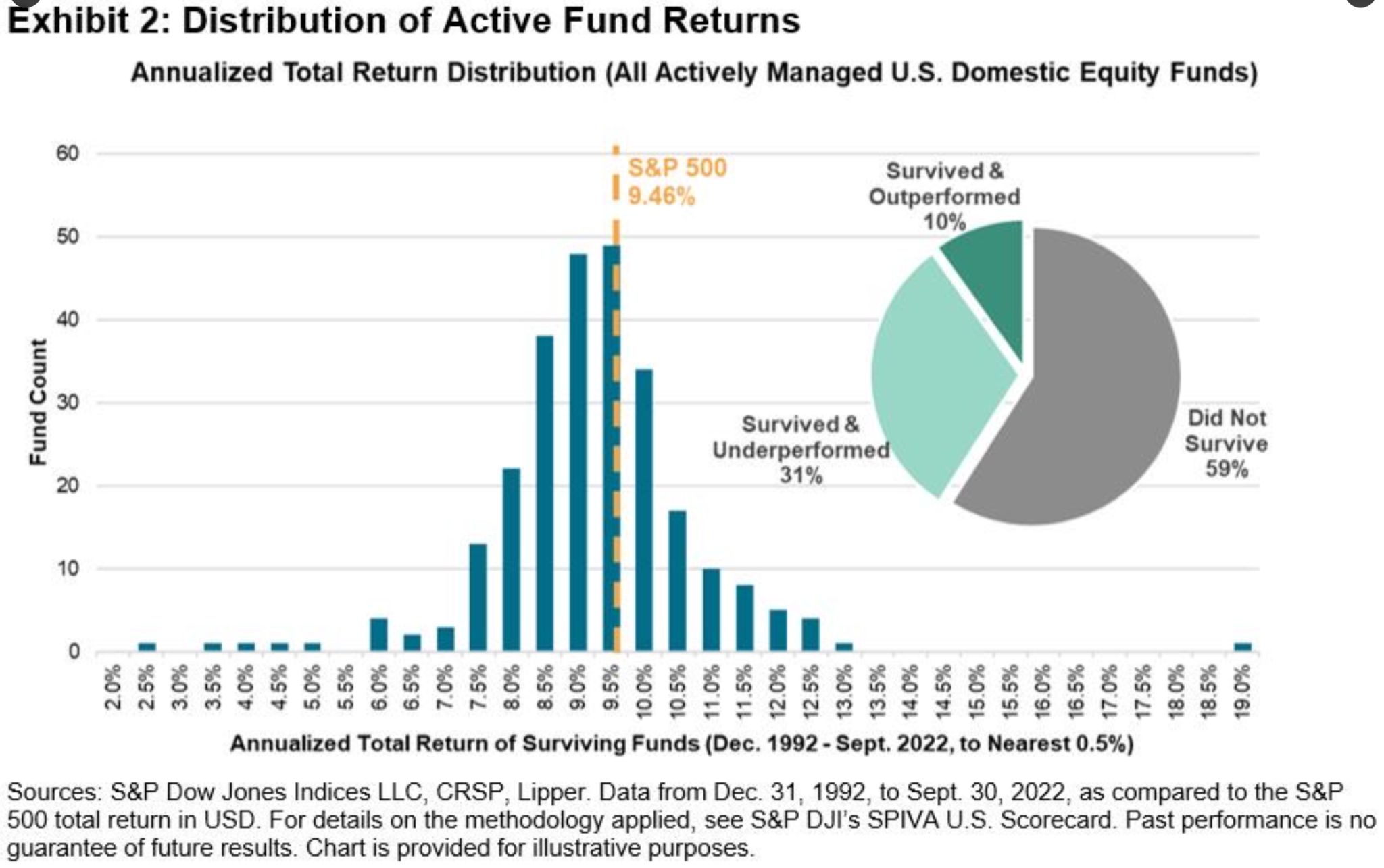

Fund management is a rough business... especially when you try to beat the sp500

Source: Invest in Assets

Investing with intelligence

Our latest research, commentary and market outlooks