Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

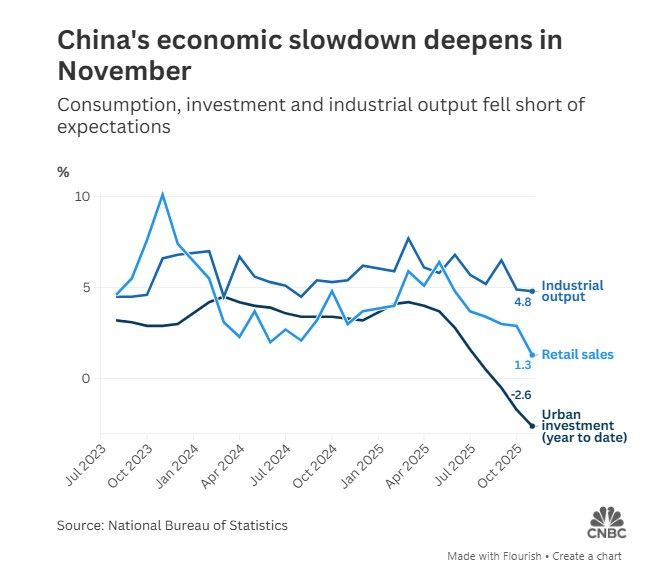

📢 China's Economic Slowdown Deepens in November 📉

China's economic performance in November fell short of expectations across key metrics, signaling a deepening slowdown as authorities grapple with weak demand, property sector decline, and supply-side constraints. Key data points: 🔴 Retail Sales: Rose 1.3% year-on-year (YoY), sharply missing the 2.8% forecast and slowing significantly from 2.9% in October. 🔴 Industrial Production: Climbed 4.8% YoY, missing the 5.0% forecast and marking its weakest growth since August 2024. 🔴 Fixed-Asset Investment (YTD): Contracted 2.6% over the January-November period (worse than the 2.3% forecast). This contraction deepened from the prior period (1.7% drop) and represents the sharpest slump since the 2020 pandemic outbreak. Source: CNBC

This monetary policy cycle is much less synchronized than it used to be

Source: Mo El-Erian

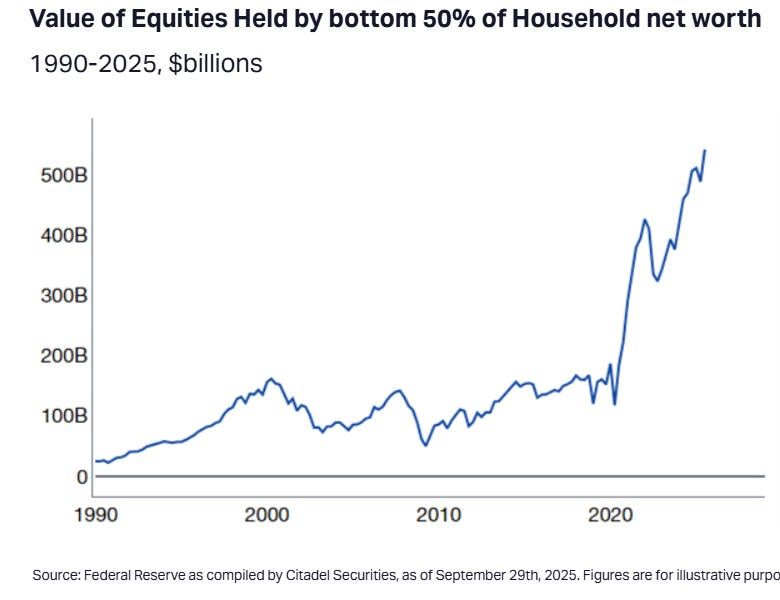

🤯 The Hidden Engine Powering the US Economy

Everyone is talking about interest rates and inflation, but here’s the underappreciated truth: The average US household’s net worth has silently exploded thanks to unbelievable equity returns over the last five years. 📈 That extra few hundred dollars on discretionary spending? It’s mentally offset by a stock portfolio that's sitting significantly higher. The Takeaway: This "wealth effect" isn't just a coincidence, it's likely among the reasons why the long-predicted recession keeps failing to materialize. When people feel richer, they spend! Source: Boring_Business @BoringBiz_

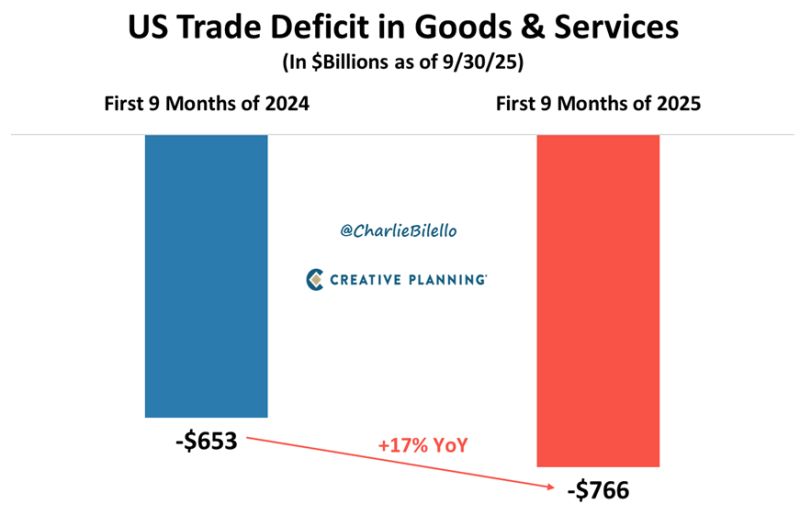

US Trade Deficit in Goods & Services...

First 9 months of 2024: –$653 billion deficit. First 9 months of 2025: –$766 billion deficit. +17% YoY 🚨 Record high. Source: Charlie Bilello

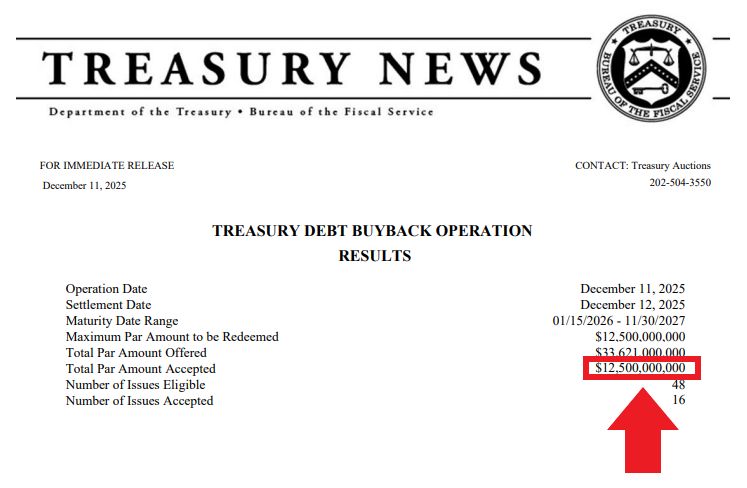

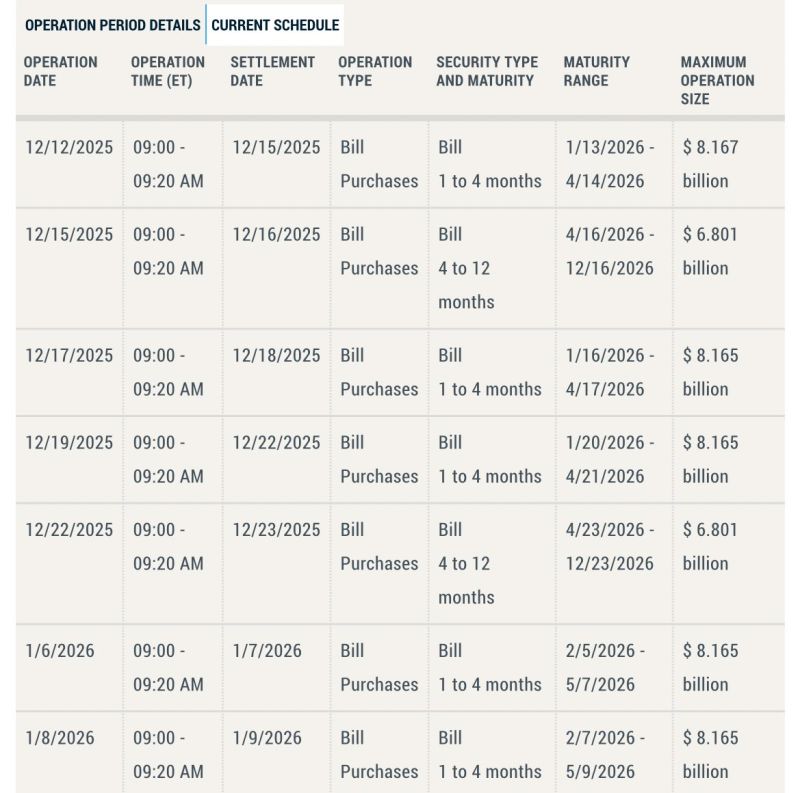

JUST IN 🚨: U.S. Treasury just bought back $12.5 billion of their own debt, equaling their largest buyback in history (which happened last week) 🤯👀

Source: Barchart

1) Repo fixed ✔️ : Fed launches Reserve Management Purchases (liquidity injections)

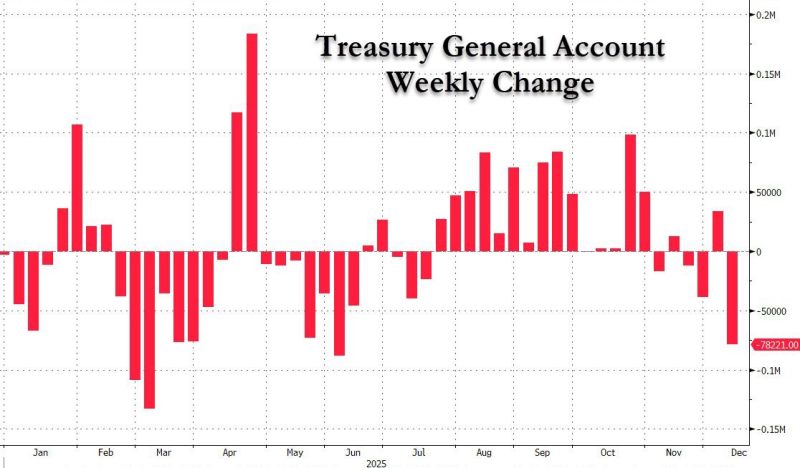

2) Treasury cash flood begins ✔️ : TGA balance down $78BN in one week (3rd biggest liquidity injection of 2025) 3) Meltup ✔️: stocks close at all time high Source: zerohedge

Here it is…

Fed’s first month of T-Bill purchases. $40 BILLION over the next month. Starts today at 9am.

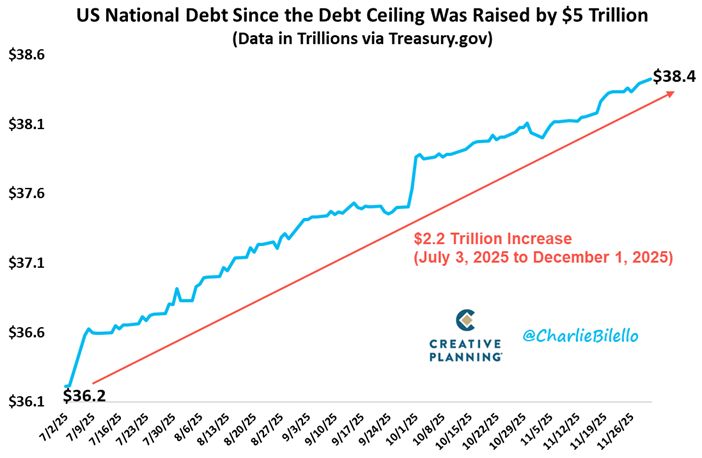

The US National Debt has now increased by $2.2 trillion since the Debt Ceiling was raised back in July.

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks