Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

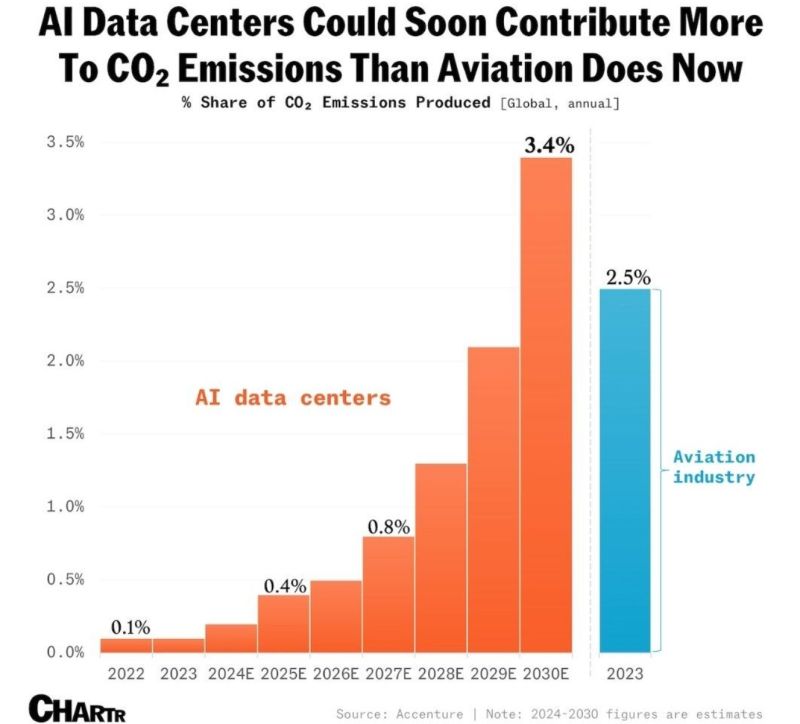

Interesting by Chartr showing that AI data centers could soon contribute more to CO2 emissions than aviation does now.

After boycotting flying, will climate activists make a push to start boycotting TikTok and YouTube with all the AI generated clips and stop using Google, Facebook and the like? Source: Chartr, Michel A.Arouet

Investors are pulling out money from ESG funds at a record pace:

US Environmental, Social, and Governance (ESG) funds posted a record $20 billion of outflows in 2024. This comes after an $18 billion outflow in 2023 and just $3 billion of inflows in 2022. Furthermore, a record number of funds have removed ESG and related phrases from their names last year. January 2022, the S&P Global Clean Energy Index has dropped 46%. ESG themes are underperforming. Source: Bloomberg, The Kobeissi Letter

BlackRock’s support for shareholder proposals on environmental and social issues has hit a new low in the 2023-24 proxy season

Source: FT

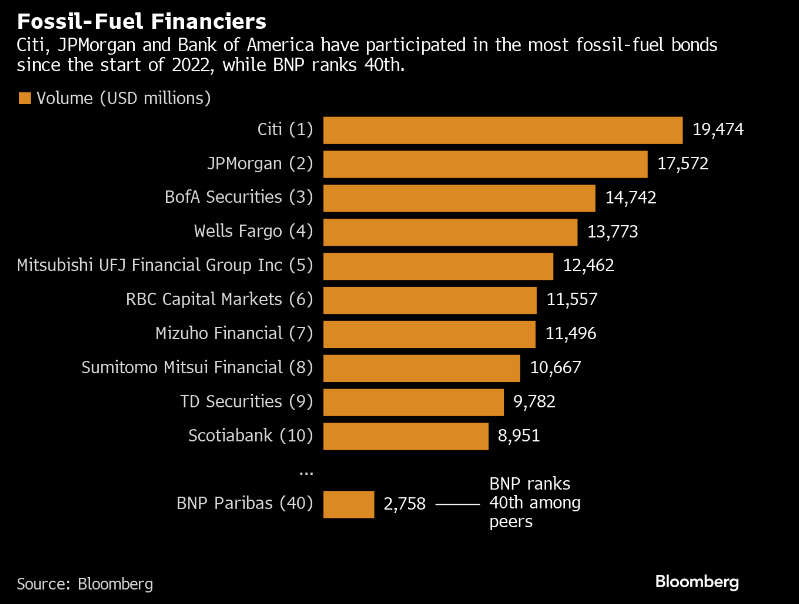

Credit Agricole’s bond desk is targeted by climate activists

The French bank is under pressure to reveal the carbon footprint of its bond business. A group of investment managers with $777 billion in combined assets is using the bank’s AGM to demand that it start disclosing the greenhouse gas emissions tied to its capital markets operations.

Source: Bloomberg

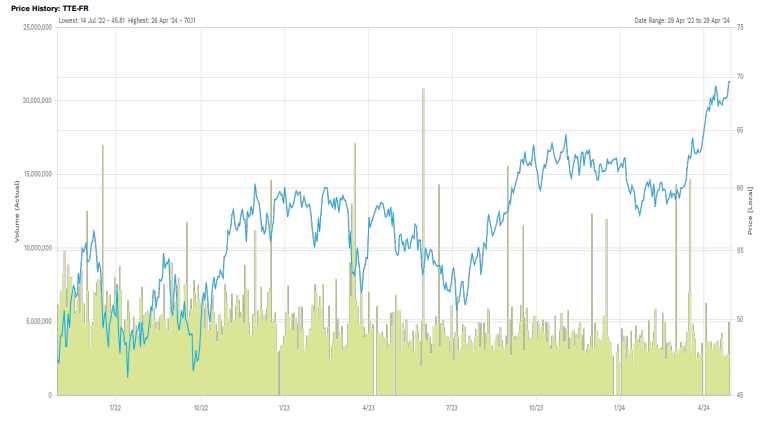

TotalEnergies is assessing to move its primary listing to the US.

On Friday, TotalEnergies’ CEO Patrick Pouyanné declared that the company’s board is considering moving its primary listing to the US as the European shareholder base now holds a minority position in the company’s capital mainly due to the strict European ESG standards that discourage investments in fossil fuels. The American shareholder base, on the other hand, represents over 45% of Total’s capital. Source: FactSet

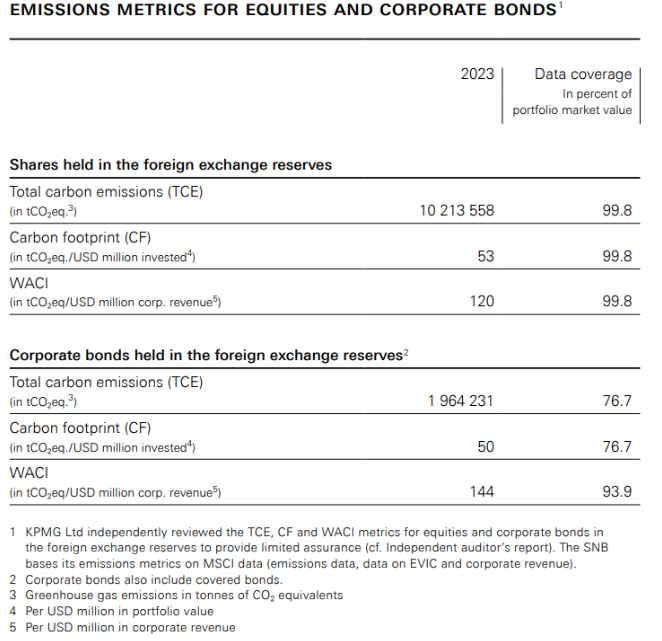

SNB reveals carbon footprint of its portfolio for first time

The Swiss National Bank disclosed the carbon footprint of its investment portfolio for the first time, responding to critics who have demanded it take a more active stance on climate change.

The SNB said it’s “not authorized to pursue structural policies” and pursuing such actions could make it more difficult for its to fulfill its primary mandate of inflation control.

The SNB’s environmental rules only ban coal miners. That means its holdings include firms involved in fracking, and the oil and gas industries.

Source: Bloomberg

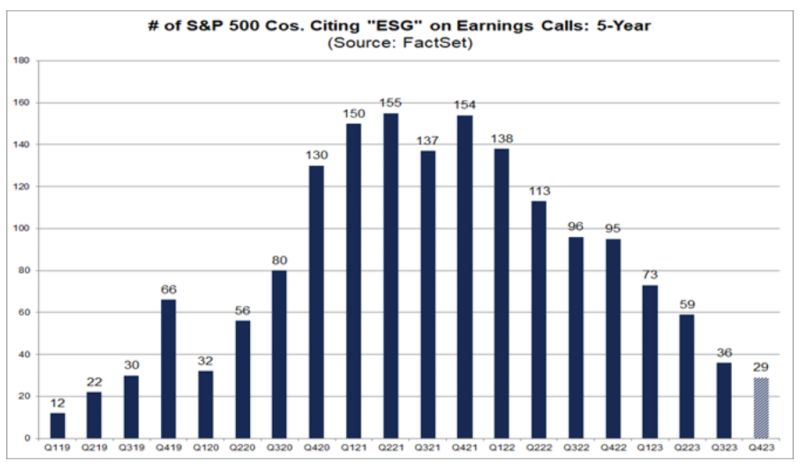

Lowest Number of S&P 500 Companies Citing “ESG” on Earnings Calls Since Q2 2019

Through Document Search, FactSet searched for the term “ESG” in the conference call transcripts of all the S&P 500 companies that conducted earnings conference calls from December 15 through March 7. Of these companies, 29 cited the term “ESG” during their earnings calls for the fourth quarter. This number is below the 5-year average of 82 and below the 10-year average of 43. In fact, this is the lowest number of S&P 500 companies citing “ESG” on earnings calls going back to Q2 2019 (22). Since peaking at 155 in Q4 2021, the number of S&P 500 companies citing “ESG” on quarterly earnings calls has declined (quarter-over-quarter) in nine of the past ten quarters. At the sector level, the Financials (6), Utilities (5), and Health Care (4) sectors have the highest number of S&P 500 companies citing “ESG” on earnings calls for Q4. On the other hand, the Utilities (17%) and Energy (15%) sectors have the highest percentages of S&P 500 companies citing “ESG” on earnings calls for Q4. source : factset

Investing with intelligence

Our latest research, commentary and market outlooks