Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

How far can this go?

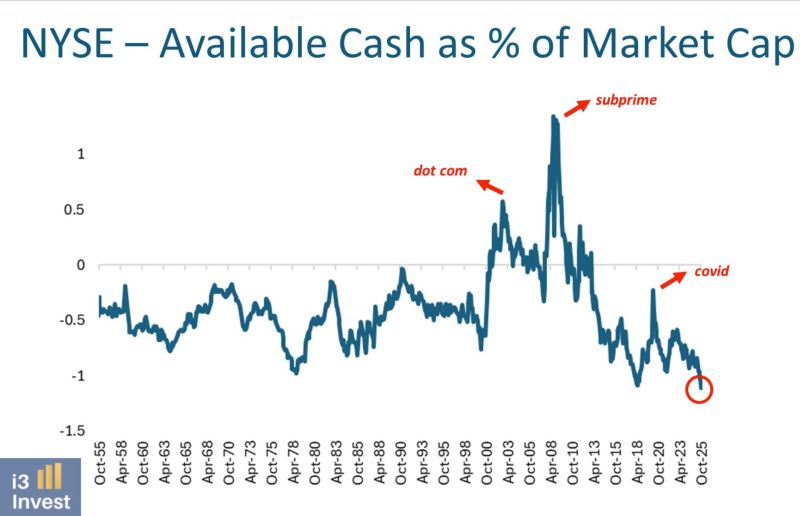

Investors are in "all-in mode", as NYSE available cash as a percentage of market cap has just reached its lowest level ever. Source: Guilherme Tavares i3 invest

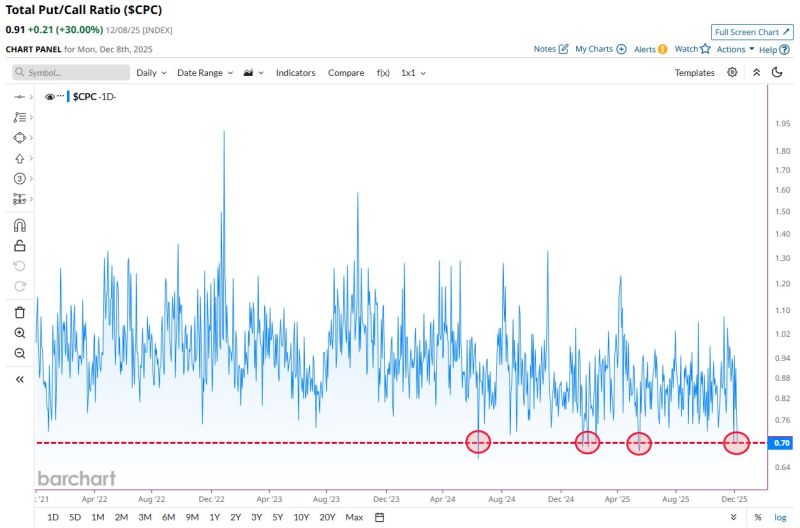

Total Put/Call Ratio fell to 0.70 on Friday, one of the lowest levels in the last 4 years 👀

Source: Barchart

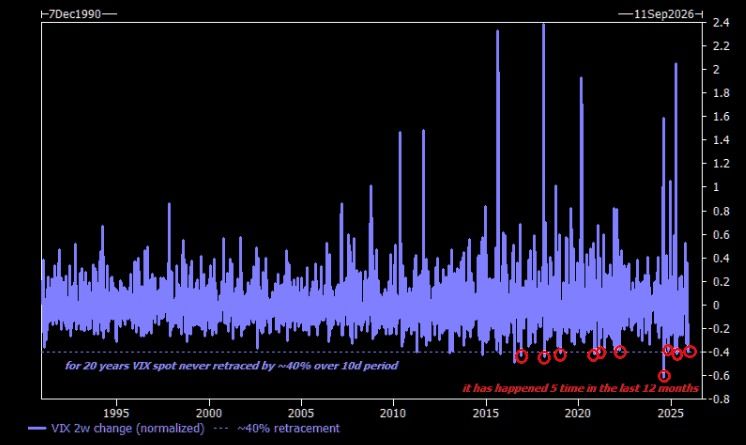

Before 2011, VIX never retraced 40% in two weeks…

It’s happened five times in the past twelve months. Source: The Market Ear @themarketear

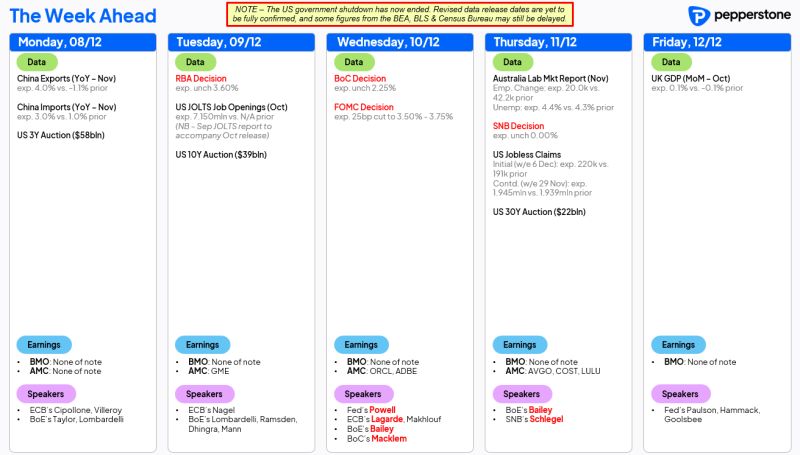

Key events for the week ahead...

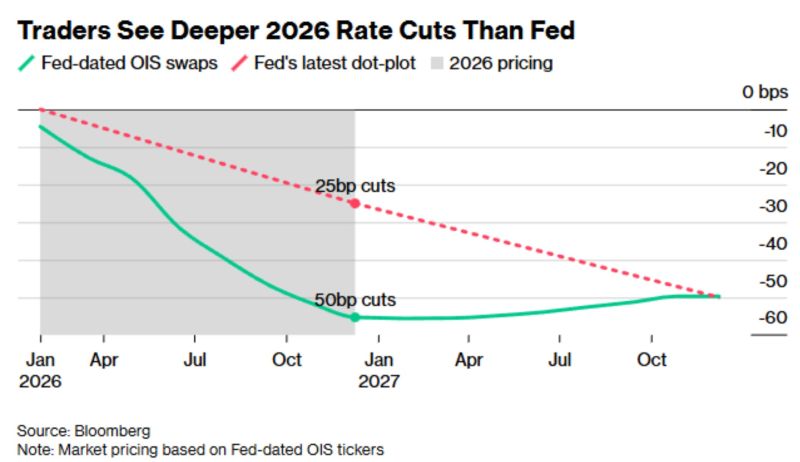

FOMC set for a third straight 25bp cut...while RBA, BoC & SNB should stand pat...JOLTS & UK GDP highlight the data docket...while a chunky slate of Treasury supply awaits... ORCL & AVGO highlight the earnings calendar... Source: Pepperstone

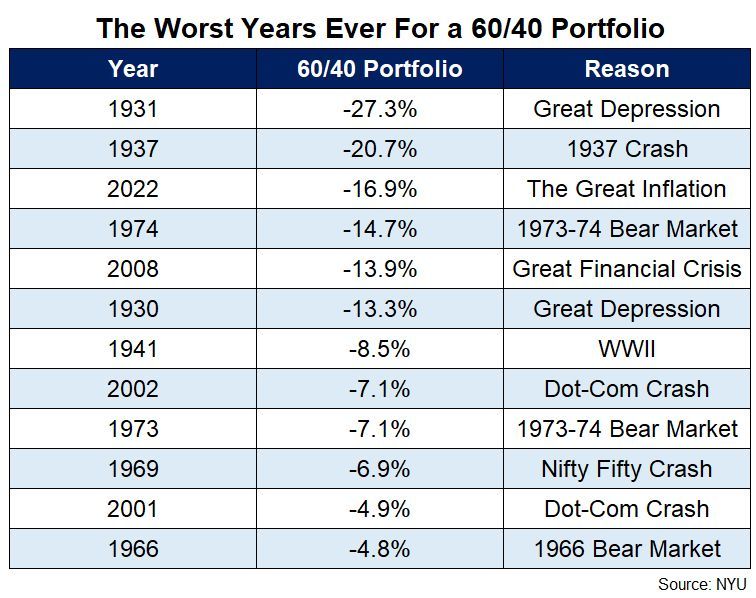

Boring Investing Still Works

"Introducing more complexity into your portfolio can make it much harder to manage. The fees are higher, they’re more illiquid, it’s harder to rebalance, and there isn’t nearly as much transparency." Source: Ritholtz @RitholtzWealth NYU

Investing with intelligence

Our latest research, commentary and market outlooks