Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

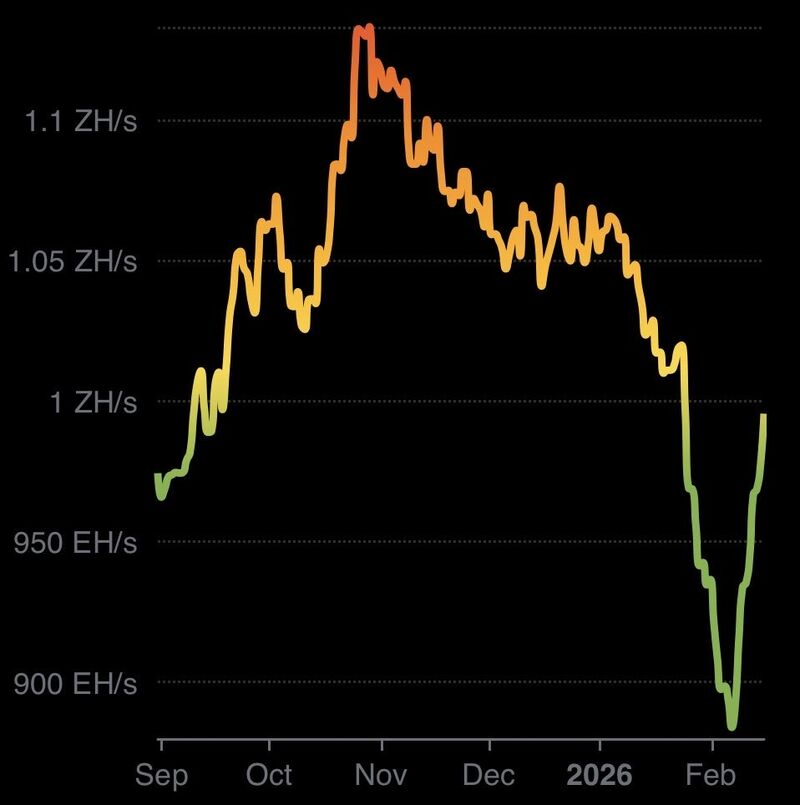

The February hashrate drop was a "perfect storm" that triggered an 11.4% downward difficulty adjustment, the largest since 2021.

Why it happened: - Texas Weather: Severe winter storms forced industrial miners to shut down to save the power grid (or sell their energy back for higher profits). - Price Correction: Bitcoin’s drop toward $60,000 made older rigs unprofitable. Some firms pivoted their hardware toward AI training for better margins. - Regulation: Renewed crackdowns on "gray" mining in Russia and China removed significant hardware from the network. The Result: The network has already begun a "V-shaped" recovery. The lower difficulty has made mining profitable again for the remaining operators, and hashrate is already bouncing back. This is actually one of the sharpest V shape recovery in hashrate we've ever seen. Source: ₿ Isaiah ⚡️ @BitcoinIsaiah

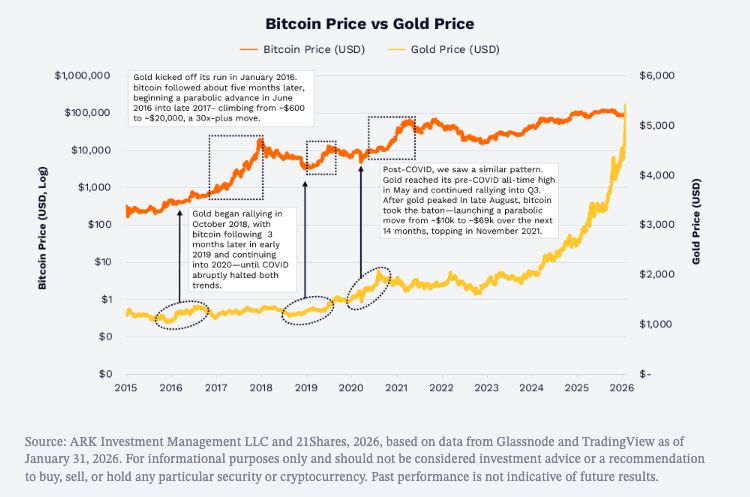

BITCOIN VS GOLD

- Gold rallied first in 2016 → Bitcoin followed months later (+30x into 2017) - Gold rallied again in 2019 → Bitcoin followed into 2020–21 - In 2025, gold surged to new highs while Bitcoin lagged - Since 2020, BTC–gold correlation: 0.14 Historically, gold has led. Source: Ark Invest Tracker @ArkkDaily

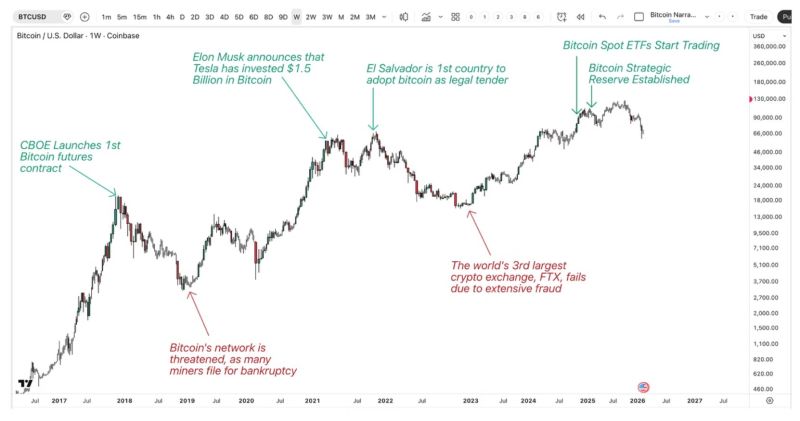

IS THE BOTTOM IN FOR BITCOIN? Aggregated data says "Squeeze Incoming

Aggregated data shows extremely negative Bitcoin funding rates, signaling overcrowded short positions. Historically, similar conditions preceded a market bottom and an 83% rally within four months. Negative funding means short sellers pay longs, increasing squeeze risk if prices rise. High leverage amplifies liquidation potential, forcing rapid buying. This imbalance reflects widespread fear and low confidence. Although not guaranteeing immediate gains, such extreme sentiment often creates conditions for reversals. Investors should remain patient, avoid emotional reactions, and monitor funding dynamics closely. Source: Santiment

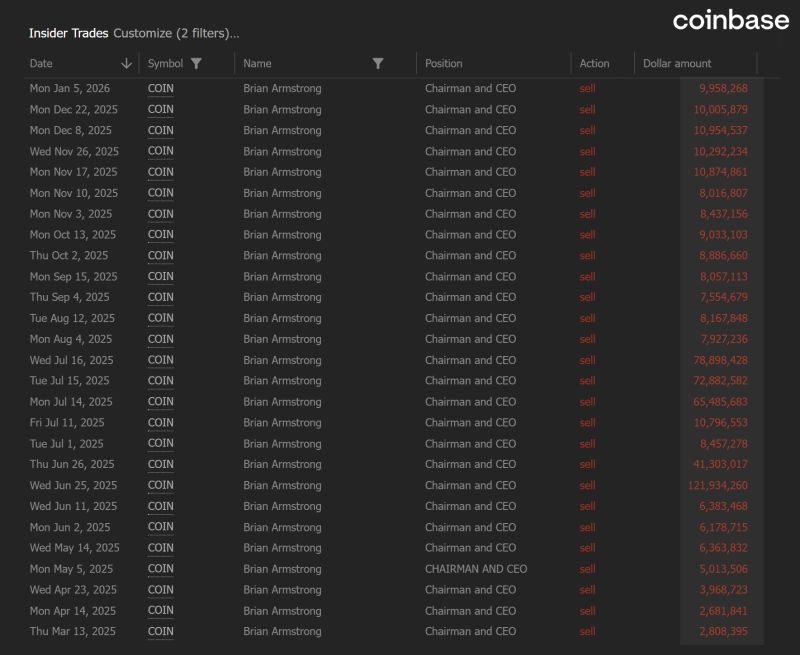

$COIN is now down -69% from its highs.

Over the past year, CEO Brian Armstrong has sold 1.5M shares, totaling $743M. Source: Trend Spider

🚨NEXT WEEK COULD DECIDE THE FUTURE OF US CRYPTO REGULATION 🚨

Next week, the White House is hosting a high-stakes meeting that could change the U.S. financial system forever. 🇺🇸⛓️ The entire Crypto Market Structure Bill is currently deadlocked over one single, explosive question: Should stablecoin holders be allowed to earn yield? 💰 Here is what you need to know about the "Yield War" happening behind closed doors: 🏦 THE BANKS’ PERSPECTIVE: Traditional banks are terrified. If a stablecoin offers 3-4% yield while a standard checking account offers 0%, the math is simple. Industry groups warn that $6 TRILLION in deposits could migrate out of the banking system. They see this as an existential threat to their liquidity. ⚖️ THE CRYPTO PERSPECTIVE: Crypto firms and exchanges view yield as the heartbeat of the digital economy. They’ve made their stance clear: They would rather have no bill at all than a bill that bans yield just to protect legacy banks. ⏳ THE TICKING CLOCK: With the 2026 Midterm Elections looming, lawmakers are running out of time. If a compromise isn't reached by the end of February: The CLARITY Act remains stalled. Regulatory uncertainty continues. The U.S. risks falling further behind in global fintech. This isn't just about "crypto." It’s about the future of how money moves, how it grows, and who controls the rails. The Feb 10 meeting is the pressure point. Will the White House force a "Grand Bargain," or will the divide between TradFi and DeFi become a canyon? Source: Crypto Rover

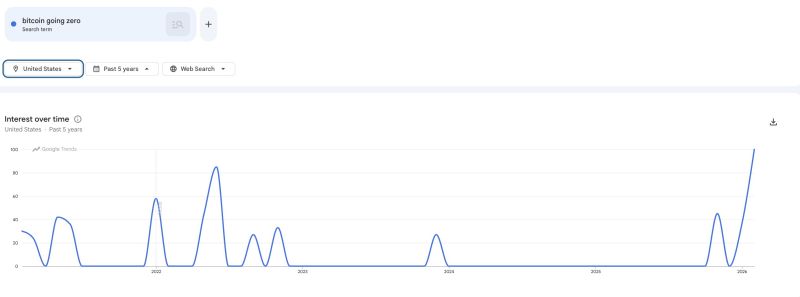

The "Bitcoin is dead" narrative just jumped the shark

Each cycle, Bitcoin is declared “dead,” but this ignores a deeper structural shift in monetary sovereignty. Behind the negative headlines, fundamentals are advancing: major U.S. regulation (CLARITY Act), rapid institutional adoption through asset tokenization, and crowded bearish positioning near the 200-week SMA. The transition from speculative asset to institutional financial infrastructure is painful but ongoing when the bear case relies on fear narratives, it often signals that the structural shift is already underway.

Investing with intelligence

Our latest research, commentary and market outlooks