Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

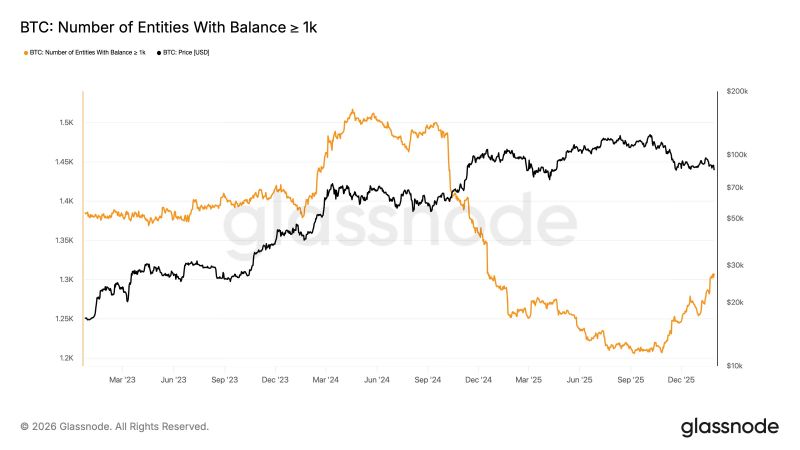

Bitcoin is experiencing severe sell-off pressure, with one of the worst days of the decade similar to past crisis moments (COVID crash, Terra Luna, FTX).

BTC is extremely oversold: daily RSI hit 16 and weekly RSI fell below 30 for only the 4th time ever. Historically, buying at these levels and holding for one year has delivered strong returns (+112% in 2015, +136% in 2019, +26% in 2022). Source: Trendspider

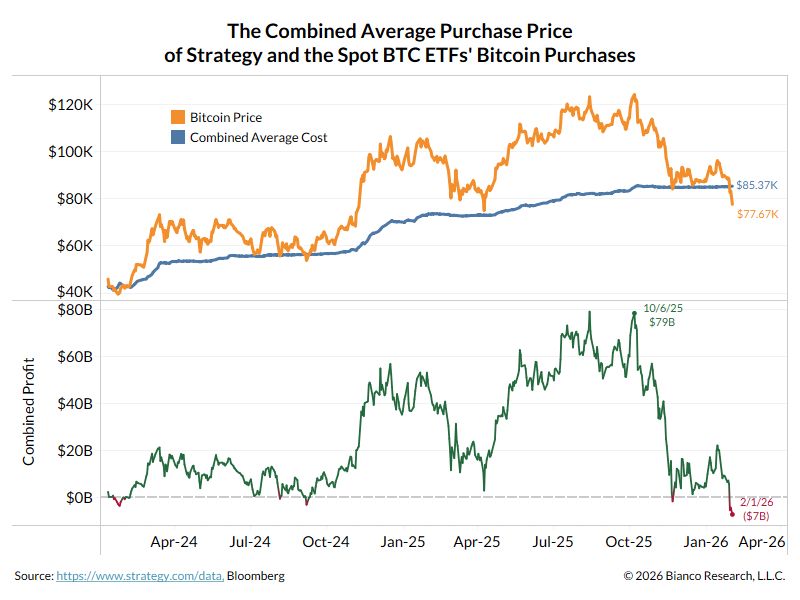

10% of the outstanding $BTC is held by $MSTR and the 11 Spot BTC ETFs.

These are the ways normies hold $BTC in regulated brokerage accounts. Collectively, the avg purchase price is $85.36K, meaning the average is now ~$8k underwater, with an unrealized loss of ~$7B. Source: Bianco Research

The unwinding of popular strategies such as the yen carry trade in traditional markets have been adding to the selling pressure on bitcoin.

The yen carry-trade strategy involves borrowing the relatively low-yielding yen and investing in other currencies offering higher returns. According to Matt Maley, chief market strategist at Miller Tabak & Co, “Bitcoin and other cryptocurrencies are assets that tend to move with liquidity. When liquidity is more plentiful, cryptos rally, and when it’s less plentiful, they decline.” “Well, one of the best indicators for the level of liquidity in the system is the yen carry trade.” Source: zerohedge

Bitcoin investors are now eyeing the $80,000 price level for support

- Rate cuts can't pump BTC. - Pro-crypto President can't pump BTC. - Weak dollar can't pump BTC. - Institutional adoption can't pump BTC. - Fed injecting liquidity can't pump BTC. - Stocks new ATH can't pump BTC. Is there anything that could pump BTC now? Which comes first? BTC $300k or a massive suck out of global liquidity??? Source: Zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks