Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨HAVE US TECH STOCKS PEAKED?

Tech, telecom, and healthcare stocks now make up 44% of global market cap, matching the 2000 Dot-Com bubble peak. Back then, this level marked a major turning point, followed by years of underperformance. Meanwhile, financials, energy, and materials have risen to 25%, mirroring the same early-cycle recovery pattern seen after the Dot-Com peak. Will industrials OUTPERFORM over the upcoming decade? Source: Global Markets Investor

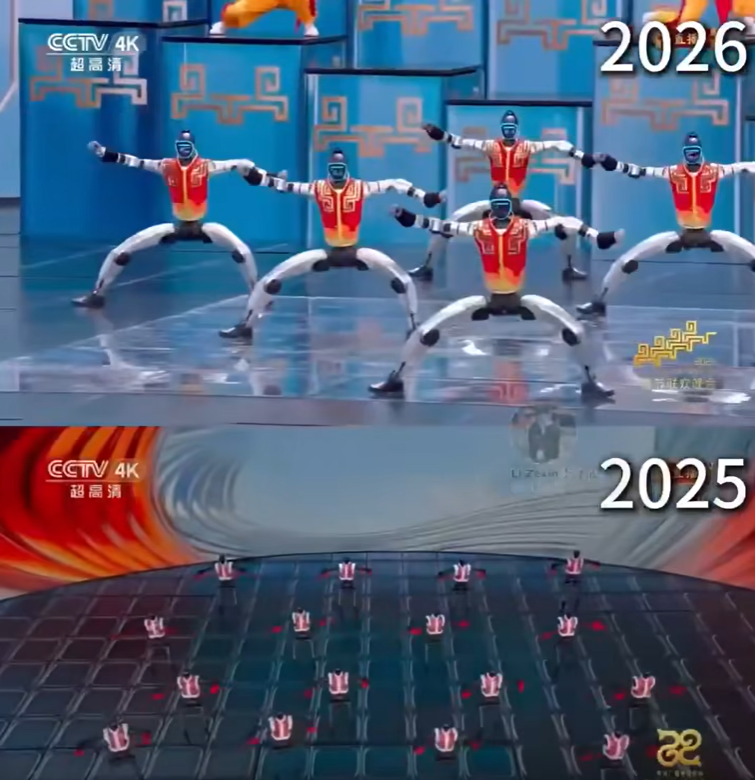

China Dominates the Humanoid Robot Market

China’s Unitree Robotics stunned 1 billion viewers with fully autonomous kung-fu humanoid robots, available today for $16,000. Germany’s Chancellor visited Hangzhou, signaling the West is noticing. Unitree leads globally with 90% of shipments, 330+ models, and 140+ manufacturers, while Tesla’s Optimus remains in R&D and unavailable commercially. State support, aggressive pricing, and mass deployment mirror China’s EV strategy. The physical intelligence revolution is live in China, leaving Silicon Valley behind unless Tesla captures significant market share by 2027. Source: Shanaka Anslem Perera @shanaka86

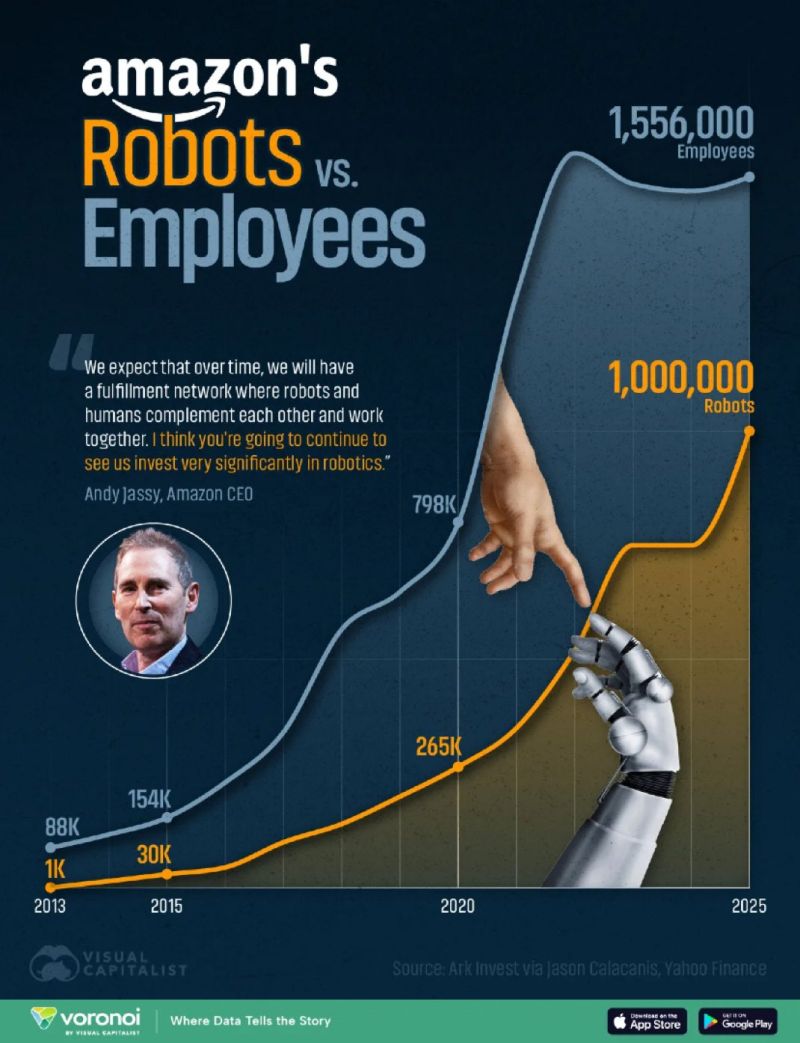

Amazon Is Hiring Robots While Cutting Human Jobs

Source: Visual Capitalist

A tale of two tech markets semis versus software

Source. TME, Bloomberg / Kevin Gordon

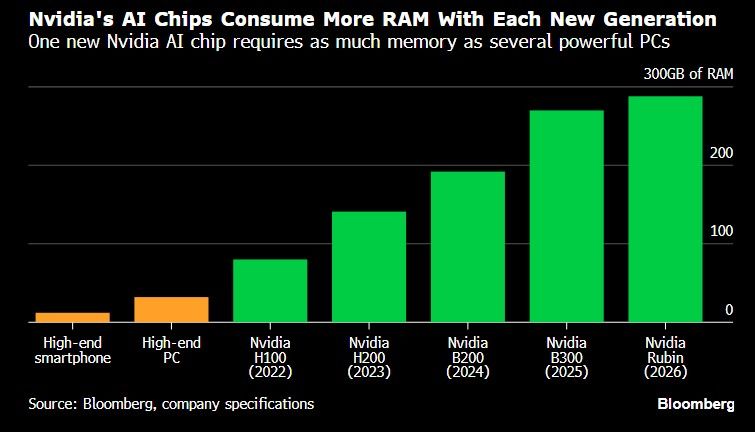

Wondering why memory chips stocks are on fire? Just watch the chart below courtesy of Bloomberg.

Nvidia's chips consume more RAM witch each generation. Rubin requires as much memory as several powerful PCs.

A mind-blowing robot kung fu show took place during China’s 2026 Spring Festival Gala (Lunar New Year Gala) on February 16.

It was entirely real not AI or CGI. Humanoid robots from Unitree Robotics performed synchronized martial arts routines with swords, poles, and nunchucks alongside children on live national television. Described as the world’s first fully autonomous humanoid robot kung fu performance, it highlighted major advances in balance, precision, and hardware within just 12 months. While commercialization still faces challenges like cost and reliability, the performance signals China’s rapid progress in humanoid robotics. Source: Evrim Kanbur (@WhileTravelling), Cyrus Janssen on X (@thecyrusjanssen)

Anthropic has raised $30bn from investors including GIC, Coatue, Founders Fund and Nvidia

reaching a $350bn pre-money valuation ahead of a potential IPO. Founded in 2021 by former OpenAI researchers, the company focuses on enterprise AI tools. About 80% of its $14bn revenue run rate comes from business clients. Its Claude Code product has gained strong adoption, with over 500 customers spending more than $1mn annually. Source: Financial Times

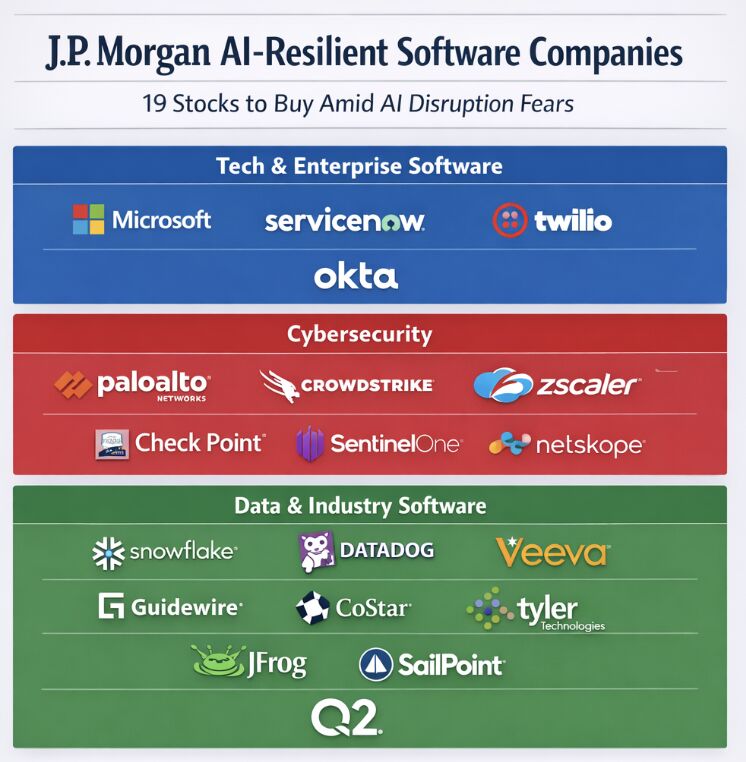

JP Morgan analysts just compiled a list of 19 software stocks that they believe 'are AI resistant'.

What do you think of their list? Source: Dividendology

Investing with intelligence

Our latest research, commentary and market outlooks