Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Over the last two days (February 11–12, 2026),CBRE Group Inc. (CBRE) stock plummeted approximately 25% to 30% from its recent all-time highs.

CBRE stock fell despite record revenue and strong core earnings due to shifting investor narratives and accounting impacts. AI disruption fears triggered multiple contraction, reducing valuation. GAAP net income declined 14.6% due to one-time pension and safety charges, creating negative headlines. Revenue slightly missed expectations, disappointing a market pricing perfection. High institutional ownership amplified technical selling through stop-loss triggers. Overall, sentiment, valuation reset, and temporary accounting effects—not business weakness—drove the sharp decline recent market reaction after earnings announcement period release. Source: CBRE Group

THE HOUSING MARKET JUST WOKE UP

The U.S. housing market is showing a sharp revival, driven by a 28.5% surge in mortgage activity last week. Triggered in part by President Trump’s plan for Fannie Mae and Freddie Mac to buy $200 billion in mortgage-backed bonds, the 30-year fixed rate briefly dipped below 6%, fueling demand. Refinances jumped 40% week-over-week (up 128% vs. last year), while total applications soared as long-idle borrowers finally acted. Economists note this reflects pent-up demand rather than just temporary post-holiday noise, signaling a potential broader market rebound. Is the sub 6% era back for good, or is this a temporary window? Source: CNBC

Is Trump launching his own QE? Buying MBS via Fannie and Freddie…

Source: Bloomberg, Geiger Capital

President Trump announces steps to ban large institutional investors from buying single-family homes.

"People live in homes, not corporations." Blackstone shares are tumbling. Source: Brew markets

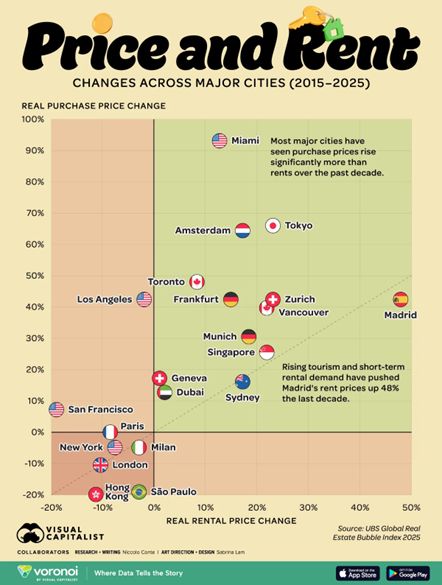

The global real estate map has been completely rewritten in the last 10 years. 🌍🏠

The gap between buying and renting isn't just growing—it’s exploding. The latest data from the UBS Global Real Estate Bubble Index (2015–2025) reveals a massive divergence. If you’re an investor, homeowner, or renter, you need to see these numbers: 🚀 The Rocket Ship: Miami Miami is in a league of its own. Real home prices have skyrocketed by 93.1%. Compare that to a modest 12.7% rent increase. The "Magic City" is officially the world's capital for capital appreciation. 🇪🇸 The Rental Crisis: Madrid While most of the world watches home prices, Madrid is seeing a rental surge like no other. Home Prices: +42.4% Rent Prices: +48.0% This is the steepest rental hike of any major global city, fueled by a massive tourism rebound and a booming short-term rental market. 📉 The Cooling Giants: London & Milan Not every "safe haven" stayed safe. London: Prices and rents have both dropped 10.5% since 2015. Between Brexit's shadow and a significant millionaire exodus, the luster is fading. Milan: A quiet decline, with property values down 4.9% and rents down 3%. 🥨 The Stability Zone: Zurich & Munich German-speaking hubs remain engines of growth. Both saw double-digit increases across the board: Zurich: +42.4% (Home) | +23.1% (Rent) Source: Visual Capitalist, Voronoi, UBS

UK house prices rose at the fastest rate last month since January.

Source: Financial Times

China Sept. used home prices -0.64% m/m; drop faster than Aug.

China Sept. new home prices -0.41% m/m; drop faster than Aug. China's largest asset by a factor of 2 continues to disintegrate... Source: zerohedge, GS

Investing with intelligence

Our latest research, commentary and market outlooks