Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it... 30-Year US Mortgage Rate plunges to 6.49%, the lowest level in almost 12 months

Source: Barchart

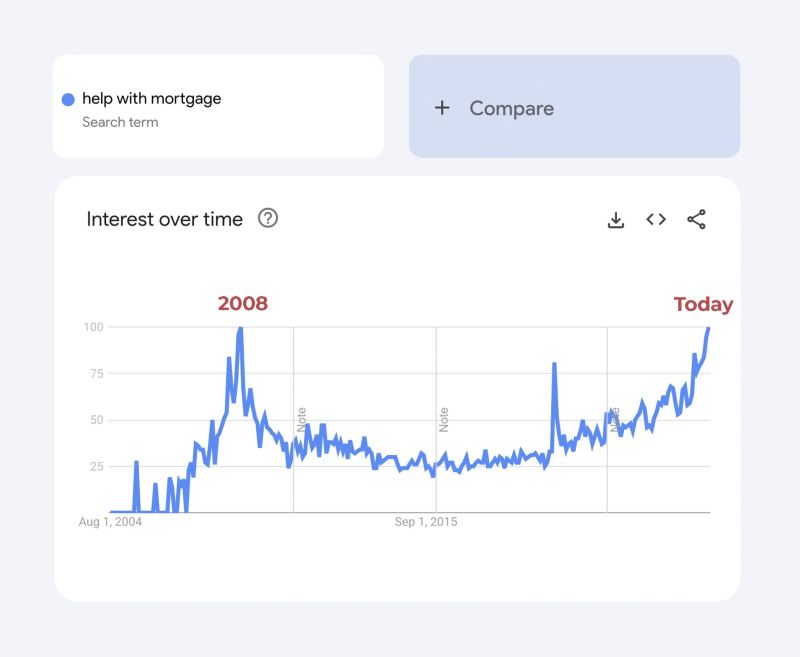

In the US, searches for "help with mortgage" surpass 2008 housing crisis.

Source: Polymarket @Polymarket

Real estate has held its spot as America’s favorite long-term investment for the 12th year in a row, ahead of stocks, gold, and savings accounts

Source : pacaso, chartr

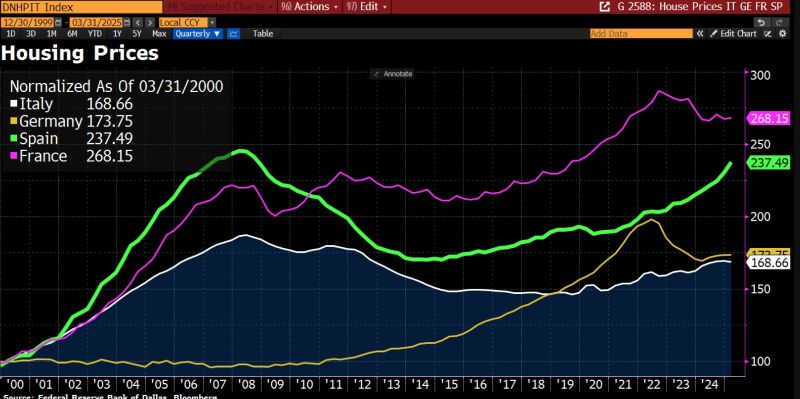

Housing market in Spain is booming.

Home sales and prices are closing in on the record highs set before the 2008 financial crash. The strong momentum is supported by a classic supply / demand imbalance. On the supply side, only about 100,000 new apartments are built each year – roughly a third of what’s needed. On the demand side: strong economic growth, a surge in tourism, and rising migration The house price index now sits just 3.2% below its 2008 peak. Source: Bloomberg, HolgerZ

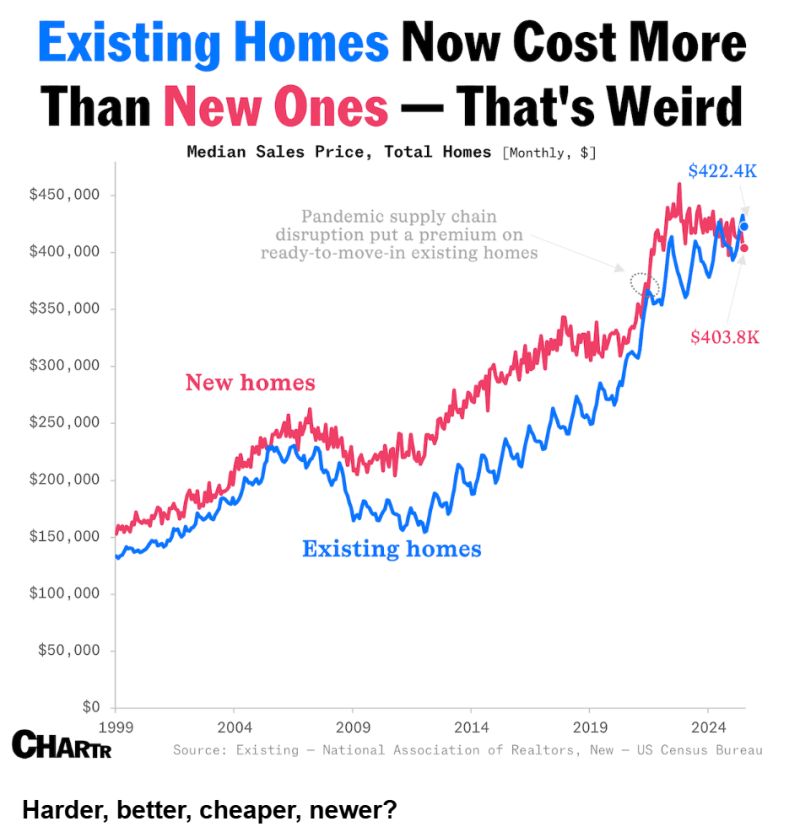

Marrying two datasets from the Census Bureau and the National Association of Realtors.

This reveals that the median $403,800 sales price of new homes was lower than the $422,400 median price of existing homes nationally as of July. The reason? There’s simply way too many newly completed homes. As of July, the inventory of unsold new homes on the market would take more than nine months to clear, the highest level in 15 years excluding the pandemic, compared to the 4.6-month supply of existing homes. To attract buyers and trim their overflowing inventories, homebuilders are adding discounts to new home deals, like mortgage rate “buydowns” of about 5% on average — even if it hurts their margins. In fact, a record 38% of builders said they cut home prices in July, per the National Association of Home Builders. Source: Quartr

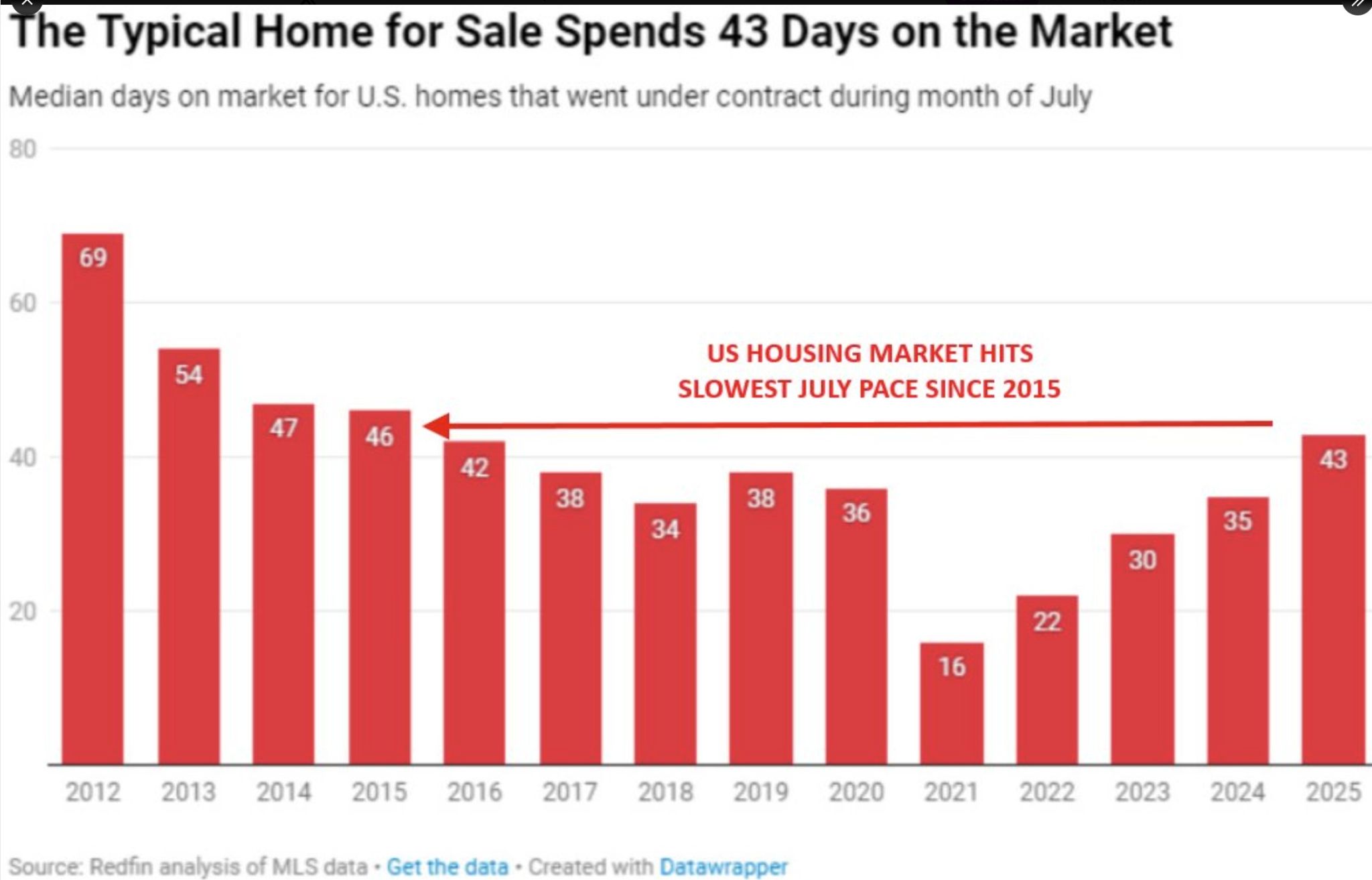

US housing market activity is rapidly slowing down

In July, the typical home sat on the market for 43 days, the slowest July pace in 10 years. By comparison, it was just 16 days in July 2021. Additionally, pending home sales fell -1.1% MoM, to their lowest since November 2023. Despite this, prices are still rising, with the median home sales price up +1.4% YoY, to a record July high of $443,867. Many homeowners are choosing to rent or delay selling rather than accept lower offers, further limiting supply. The housing market is stalling. Source: The Kobeissi Letter

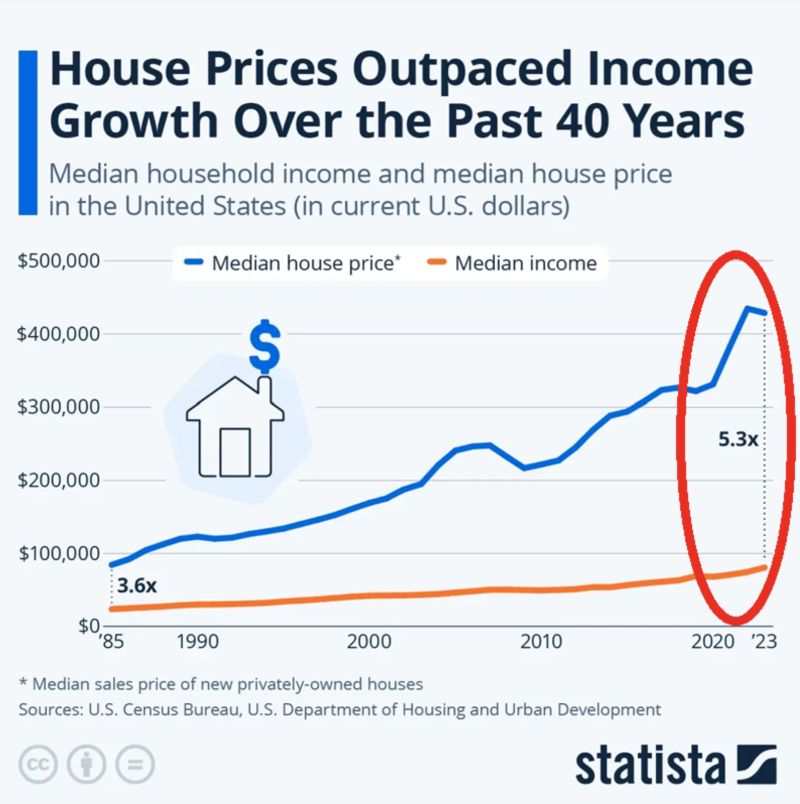

US housing affordability has NEVER been worse:

House prices have outpaced median income growth over the last 40 years. Median house price is now 5.3 TIMES larger than the annual median US income. By comparison, in the 1980s, the difference was 3.6x. Source: Global Markets Investor, Statista

PRESIDENT TRUMP JUST SAID:

- WE ARE THINKING ABOUT NO TAXES ON CAPITAL GAINS ON HOUSES Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks