Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

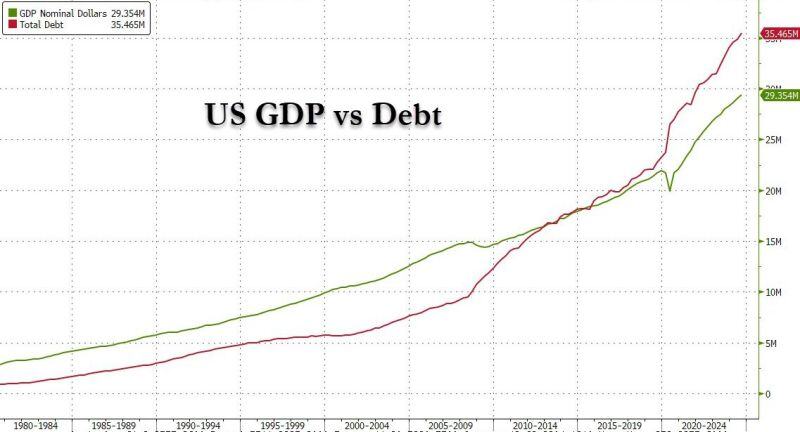

The problem in one chart

More $debt is needed to generate $1 of GDP Source: zerohedge

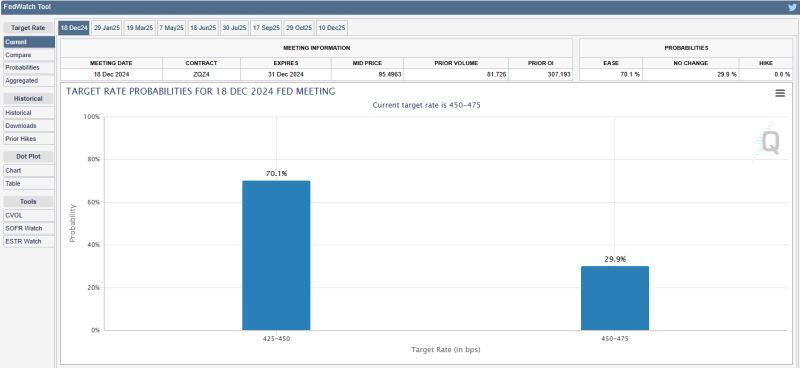

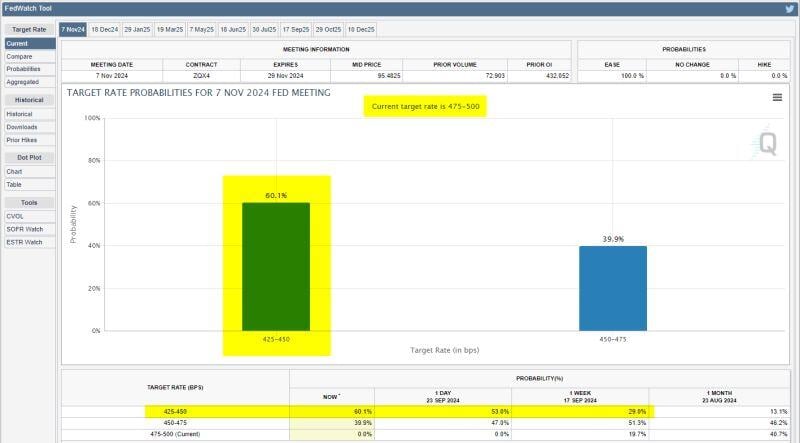

There is now a 70% chance of a 25 bps interest rate cut at this month's FOMC meeting 🚨

Source: Barchart

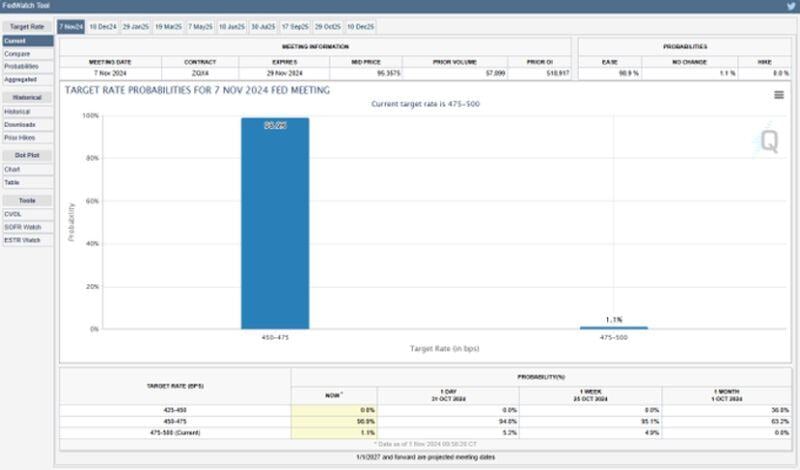

🚨 There is now a 99% chance of a 25 bps interest rate cut at next week's FOMC Meeting 🚨

Source: Barchart

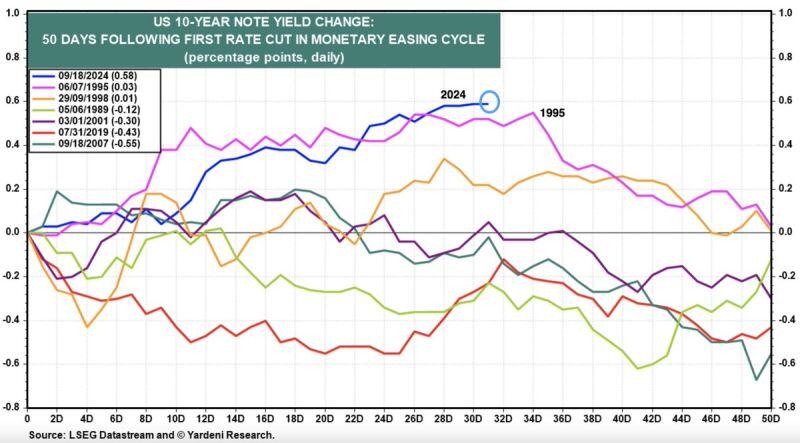

Interesting point of view by Dr. Ed Yardeni:

"28 days since the 1st rate cut and 10-Yr. yield is up nearly +60bps. The 1995 Soft Landing rate cut cycle is almost a mirror image, as it also started its descent a few days later, a potential post-election outcome". There is one big difference though: the fiscal 6 debt situation in the US now vs. 1995... Source: Seth Golden @SethCL

In case you missed it... Atlanta Fed President Raphael Bostic is okay with skipping rate cut in November 🚨

Source: Barchart

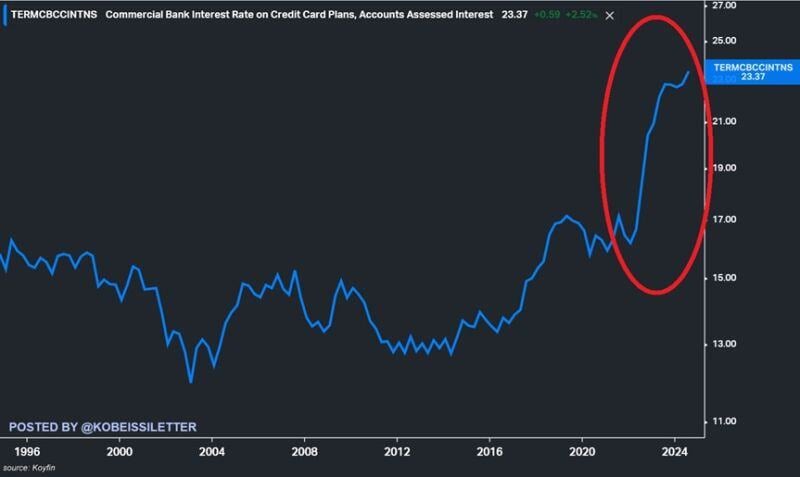

US credit card interest rates hit 23.4% in August, a new record.

Over the last 2 years, rates have soared by 7 percentage points. US consumers now have a record $1.36 trillion in credit card debt and other revolving credit meaning they pay a massive $318 billion annual interest. To put this into perspective, Americans paid just half of that in 2019 at ~$160 billion. Meanwhile, credit card serious delinquency rates are at 7%, the highest level since 2011. Source: The Kobeissi Letter

Market pricing for another 50 bps rate cut at the Fed's next meeting two days after the election is now up to 60%.

@CMEGroup

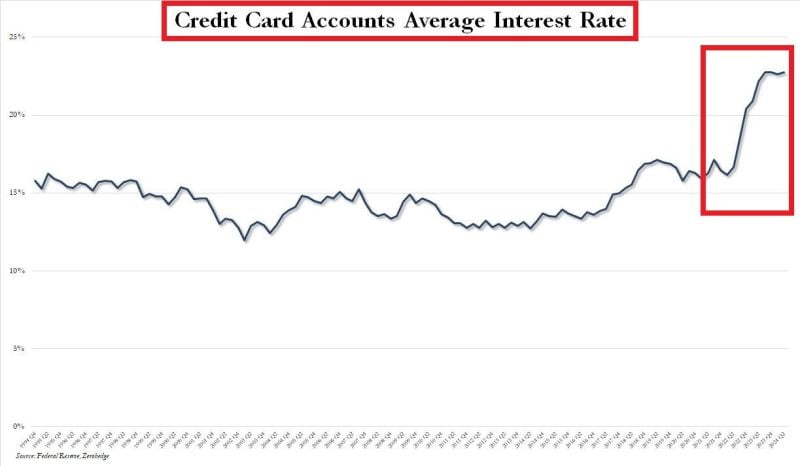

US CREDIT CARD INTEREST RATES ARE AT ALL-TIME HIGHS

US credit card rates remain at record highs of ~22%. US credit card debt is now ~$1.14 trillion, also at an all-time high. This means Americans pay ~$250 billion in average interest payments on credit cards a year. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks