Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

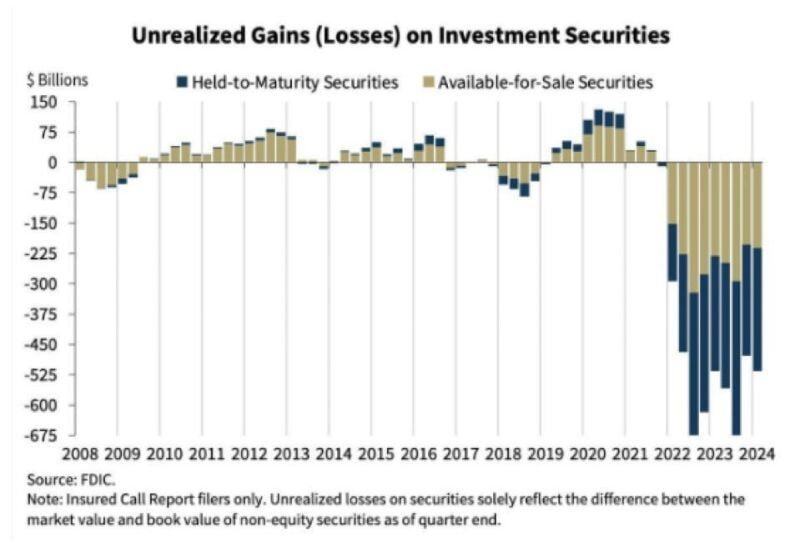

US banks are facing $517 Billion of Unrealized Losses - nobody wants interest rate cuts more than them

Source: Barchart, BofA

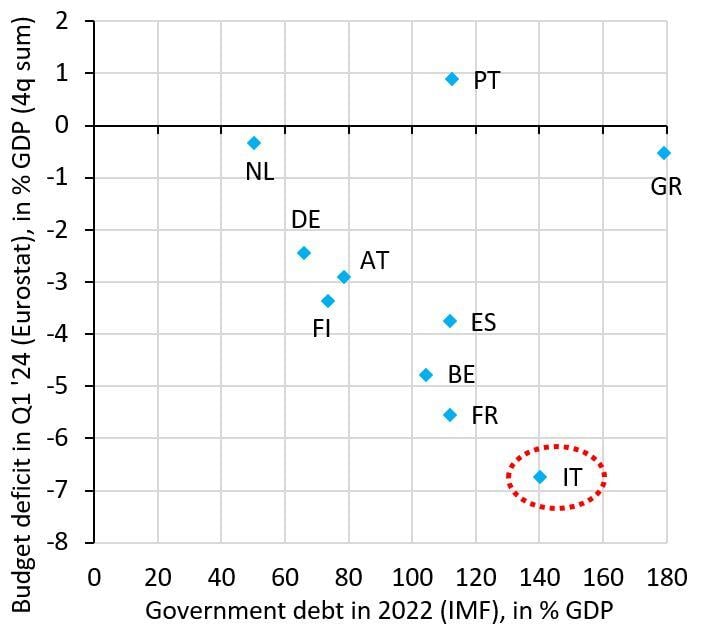

Why the ECB should keep interest rates at the lowest level possible explained in one chart

The Euro zone is an equilibrium where high debt countries like Italy, France and Spain run big deficits. The ECB enables this by capping yields when these spike like they did in 2022. This policy is an implicit subsidy of high debt countries by low debt ones... Source: Robin Brooks

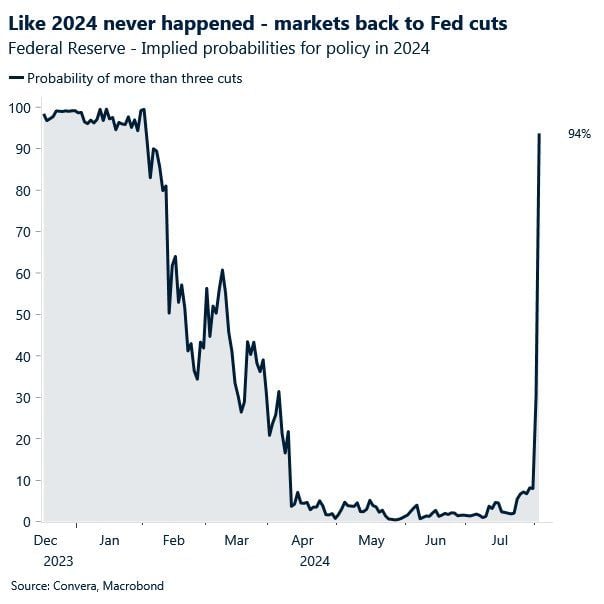

💥 Treasuries surge as traders bet on emergency Fed rate cut 💥

.

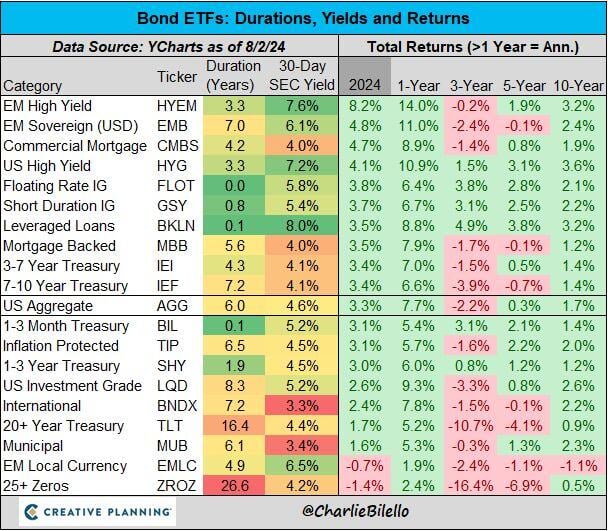

Bonds have surged higher with the collapse in interest rates and the US Aggregate Bond ETF is now up 7.7% over the past year, outperforming the Treasury Bill ETF ($BIL +5.4%)

Source: Charlie Bilello

What a chart...

Source. Michel.A Arouet, Ht @MacroKova, Convera, Macrobond

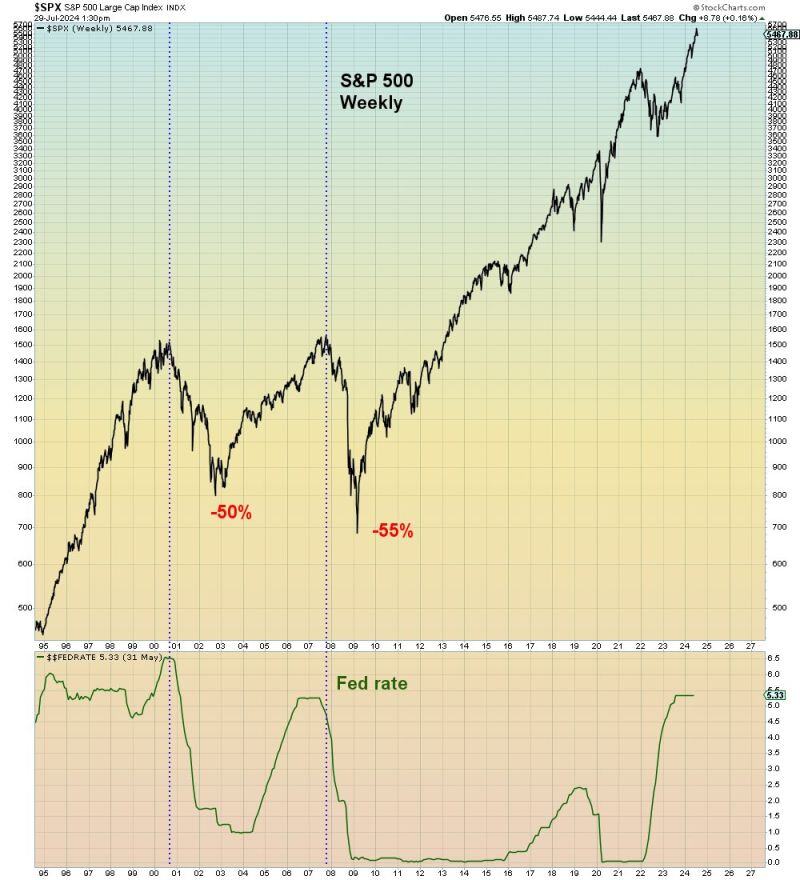

Should the FED wait for a financial accident to happen BEFORE cutting interest rates?

Source chart: Mac10

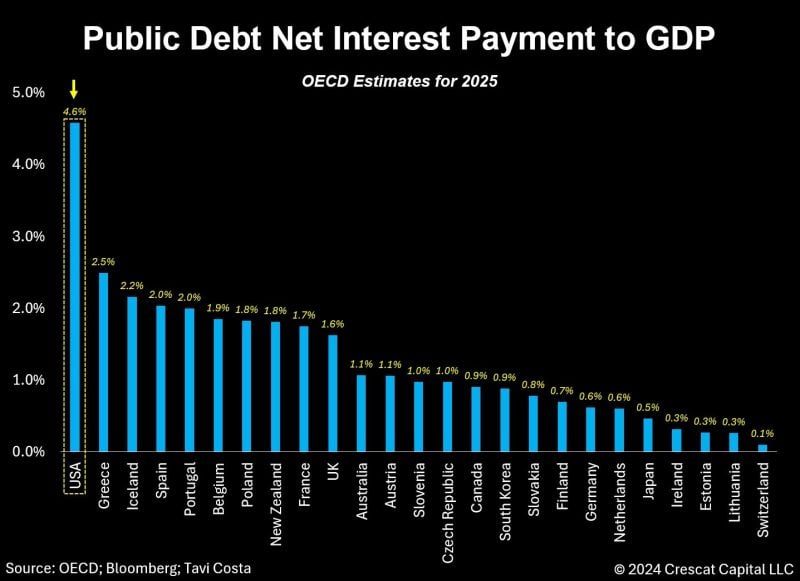

As highlighted by Otavio (Tavi) Costa, the need for the FED to cut interest rates is not driven just by labor data and inflation.

As shown on the chart below, the costs of servicing Federal debt in the US is soaring more than in any other country. Not just once, not twice, or even three times — multiple rate cuts would be needed to bring US interest payments as a percentage of GDP in line with the rest of the world. This is what financial repression is about. Source: Tavi Costa, Bloomberg

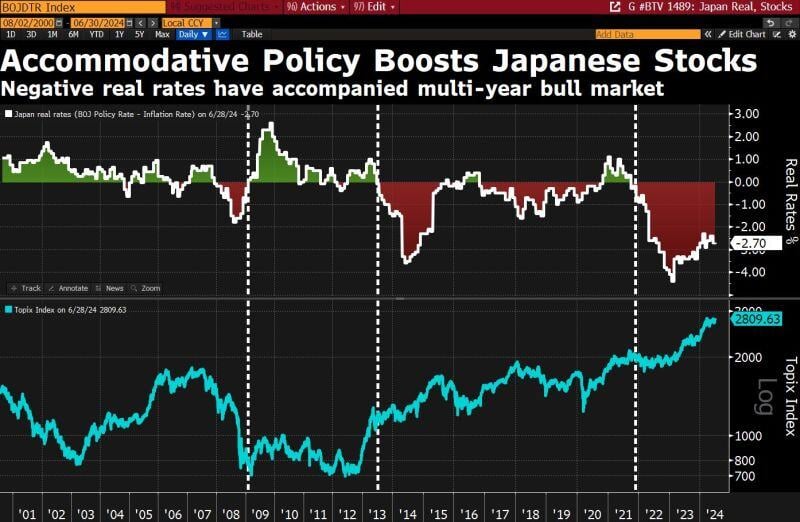

Loose policy = Bull market

Even if the BOJ hikes a few more times, real rates will remain deeply negative, a sign of accommodate policy. Chart tracks Japan real rates & market performance ➡️ 2009 -2013: period of high real rates, languishing stock market🔻 ➡️2013-2021: BOJ floors rates, pushes rates negative and fuels stock rally ✅ ➡️ 2021-2024: inflation picks up, real rates drop even further negative, Topix rallies 50% ✅✅ Source: David Ingles, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks