Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

🚨WHAT? US stocks fell after a 0.50% rate cut?🚨

Markets were very mixed after the Fed 'Jumbo' reduction. Big cuts are not usually a good sign BUT... Day 1 is usually not the REAL reaction. We need to wait 2 more trading sessions to see what's really going on. Market performance today: S&P 500 -0.3% Nasdaq -0.3% Russell 2000 +0.0% Dow Jones -0.3% Bitcoin +0.1% Bank Index +0.4% VIX +4%, front month futures VIX -1% Gold -0.6% WTI Crude Oil -1.3% Source. Global Markets Investor

FED cuts rates by 50bp to 4.75%-5% range

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, in an aggressive start to a policy shift aimed at bolstering the US labor market.Committee sees another half-point of cuts in rest of 2024Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast.

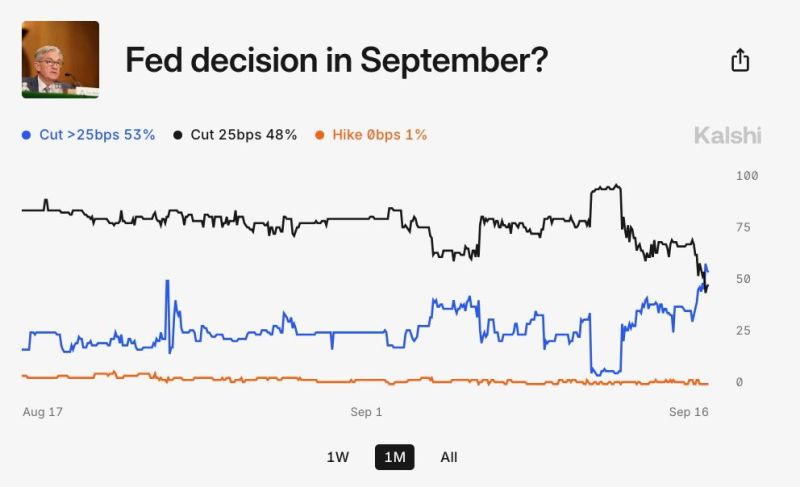

BREAKING: Prediction markets are now pricing-in a 48% chance of a 50 basis point Fed rate cut this week.

Odds of a 50 basis point rate cut have gone from 2% to 48% in just 5 days, according to Kalshi. This will be the first Fed policy decision without a 90%+ consensus since 2020... Source: The Kobeissi Letter

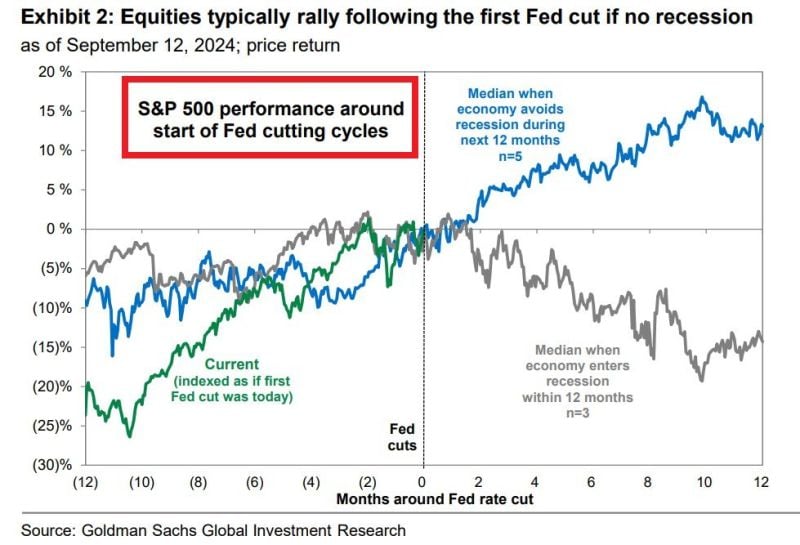

FED WILL CUT RATES ON WEDNESDAY FOR THE 1ST TIME IN 4.5 YEARS Stocks usually fall ~15% within 12 months following the 1st cut if there is a recession

If no recession, stocks rise by >10%. Key caveat is, that we will know if there was a recession a few months after the cut. Source: Global Markets Investor

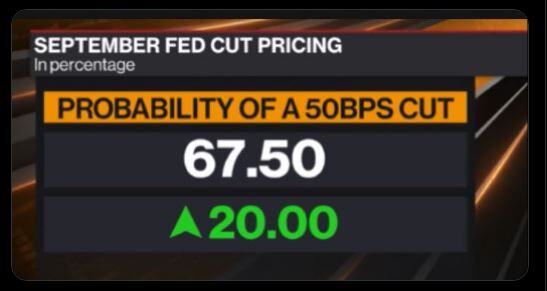

Market pricing now suggests a 50bps cut from the Fed is now base case (nearly 70% probability)

Source: Bloomberg, David Ingles

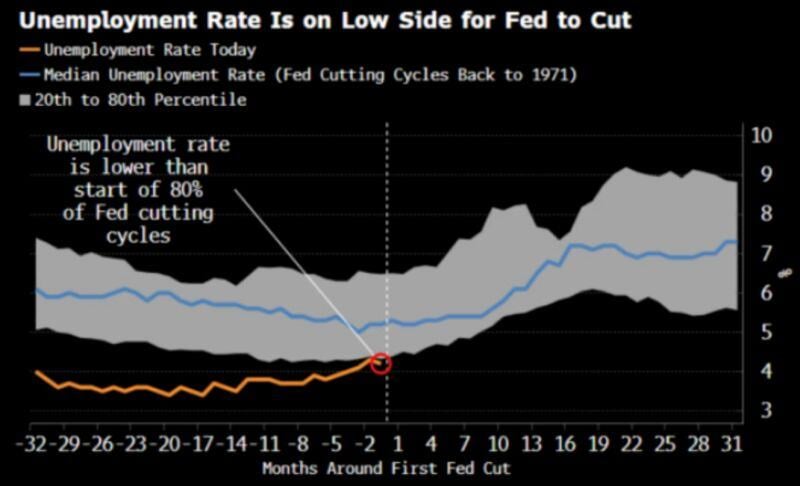

Should the FED cut rates next week, the easing cycle will start with an unemployment rate which is on the low side vs. history

Source: RBC, Bloomberg

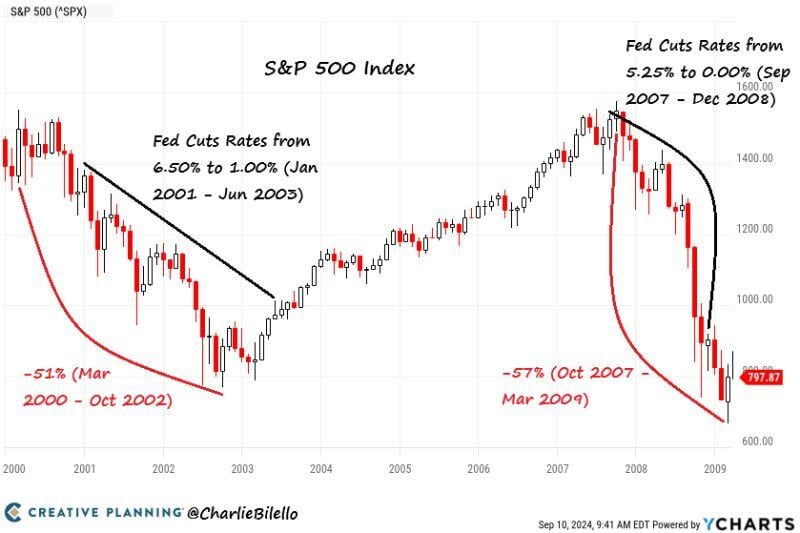

Are rate cuts necessarily bullish for stocks?

Not if they're associated with an economic downturn and earnings decline. E.g 2007-2008 Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks