Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

🚨 S&P500 erased $1.8 TRILLION of market cap on Fed "hawkish cut".

‼️ Big Tech, Bonds, Bullion and Bitcoin fell sharply after the Fed cuts rates by 25 basis points - which is exactly what 97% of market participants expected. So what happened❓ 👉 Actually, today's market reaction had NOTHING to do with the rate decision. Rather, it would about the Fed's outlook for 2025 which shifted SHARPLY in the hawkish direction. 👉Indeed, the hashtag#Fed reduced their outlook from 3 to 2 rate cuts in 2025. 👉Furthermore, the Fed now sees hashtag#inflation at 2.1% at the end of 2026, still slightly above their 2.0% target. ⚠️ The stock market's decline accelerated after Powell said one specific sentence in his press conference today: "Today was a closer call but we decided it was the right call." ⚠️The US Dollar surged to its highest since November 2022 after he said that. Clearly, the Fed has acknowledged that inflation is an issue, once again. ⚠️On top of this, Cleveland Fed President Beth Hammack dissented in today's decision. 1 out of 19 Fed officials sees no rate cuts in 2025 and 3 officials see just 2 rate cuts. Only 5 Fed officials currently see 3 or more interest rate cuts in 2025 in a sudden hawkish shift. This led to what appears to have been the biggest panic sell in the market since the Yen carry trade collapsed. Small cap stocks fell nearly 5% today and the Dow posted a 10-day losing streak for the first time since 1974. Sentiment is shifting as we look into 2025.

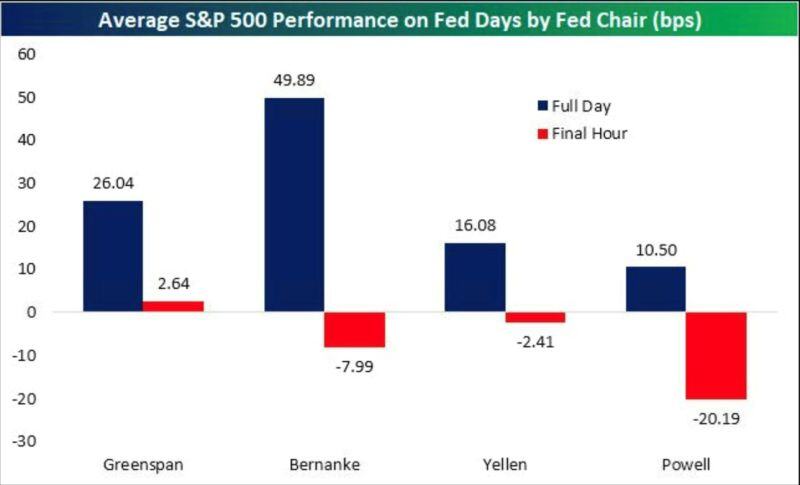

Powell is second to none when it comes to market reaction on Fed day.

He lived up to his reputation and track record yesterday. To say the least... Source: Bespoke

Santa Powell is coming to town.

Last FOMC interest rate decision of 2024 is today at 2PM ET, followed by the usual press conference. A 25bps rate cut looks like a done deal. Key questions:1) Why is he cutting while stocks are ATH and Core CPI above 3% 43 months in a row= 2) Will it be a "hawkish cut" with significant upside revisions to growth and inflation forecasts + downward revision to the dot plot? Merry Christmas Mr Powell Source image: TrendSpider

The stat of the day >>>

Yes, the Fed has already cut near all-time-highs and you know what ❓ The Bulls 🐮 Liked it 👍 The S&P 500 is less than 2% away from all-time highs the day before a Fed decision. Since 1980, there were 20 other times they cut rates within 2% of ATHs. The S&P 500 was higher a year later 20 times 🚀 Source: Ryan Detrick, CMT @RyanDetrick

Apollo made a HUGE call on Sunday:

For the first time since the "Fed pivot" began, Apollo has officially declared inflation back on the rise. They warn of a potential repeat the 1970s as the Fed cuts rates into rising inflation. Apollo says the probability of the Fed RAISING interest rates in 2025 is now rising. Here's why: 👉 First, measures of inflation stickiness are all now well above the Fed's 2% target. In fact, the Atlanta Fed Core Sticky CPI index has leveled off near 4%. ALL major measures of CPI stickiness are now above 3%. 👉 Meanwhile, core CPI has levelled off at 3.3% fore multiple months in a row. This was "fine" because headline CPI was moving in a straight-line to 2% all year. However, as of the latest CPI inflation data, it's now RISING and back to 2.7%. Source: The Kobeissi Letter, Apollo

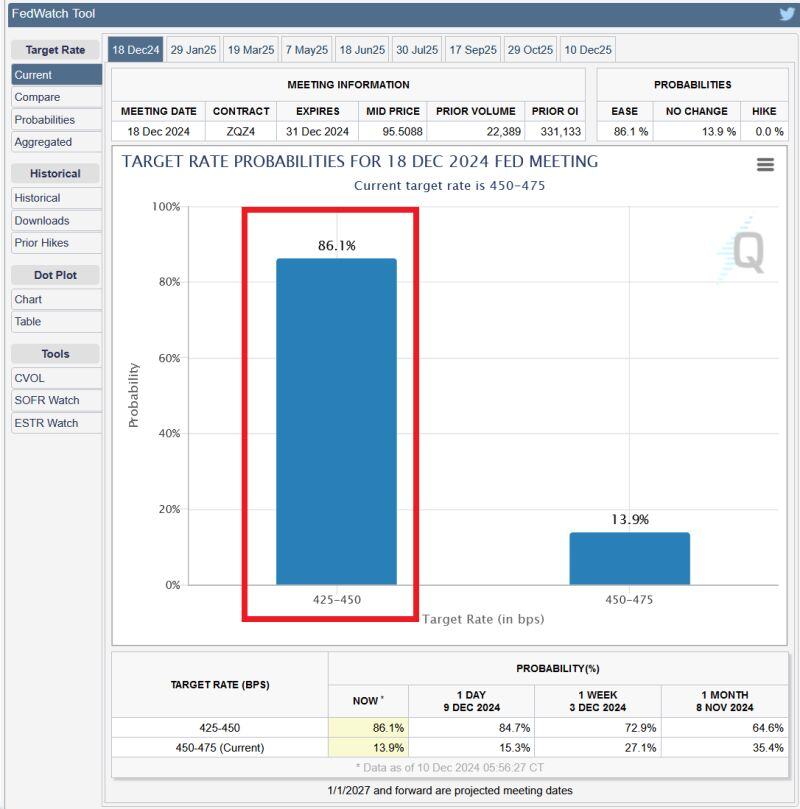

THERE ARE 7 DAYS TO THE LAST FED'S MEETING THIS YEAR

Market is pricing an 86% probability of a 0.25% rate cut, up from 73% last week. This comes after the November job report showed a lot of weakness under the surface. The Fed cut rates by 0.50% and 0.25% in Sep and Nov. Source: Global Markets Investor

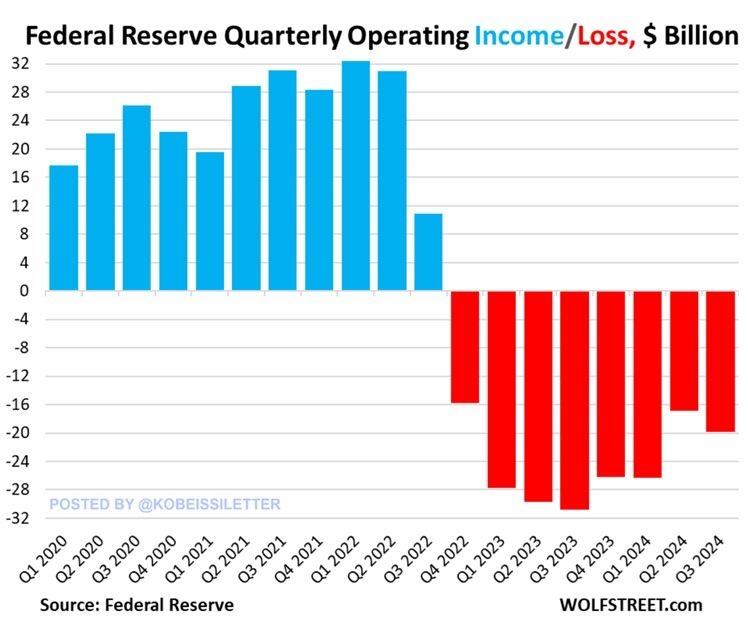

BREAKING: The Federal Reserve just reported a $19.9 BILLION operating loss in Q3 2024 up from $16.9 billion in Q2.

This marks the 8th consecutive quarter of operating losses for the central bank. As a result, cumulative operating losses reached a massive $210 billion over the last 2 years. This comes as the Fed has been paying hundreds of billions in interest to banks and money market funds. At the same time, income the Fed has earned on Treasuries and Mortgage-Backed-Securities has declined. Source: The Kobeissi Letter

US Fed officials see interest rate cuts ahead, but only ‘gradually,’ meeting minutes show - CNBC

Federal Reserve officials expressed confidence that inflation is easing and the labor market is strong, allowing for further interest rate cuts albeit at a gradual pace, according to minutes from the November meeting released Tuesday. The meeting summary contained multiple statements indicating that officials are comfortable with the pace of inflation, even though by most measures it remains above the Fed’s 2% goal. With that in mind, and with conviction that the jobs picture is still fairly solid, Federal Open Market Committee members indicated that further rate cuts likely will happen, though they did not specify when and to what degree.

Investing with intelligence

Our latest research, commentary and market outlooks