Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

UK house prices rose at the fastest rate last month since January.

Source: Financial Times

Should we consider this as a leading indicator?

Sotheby’s revenue from commissions and fees on sales fell -18% Profit before tax at Sotheby’s Holdings UK fell -21% Source: The Coastal Journal

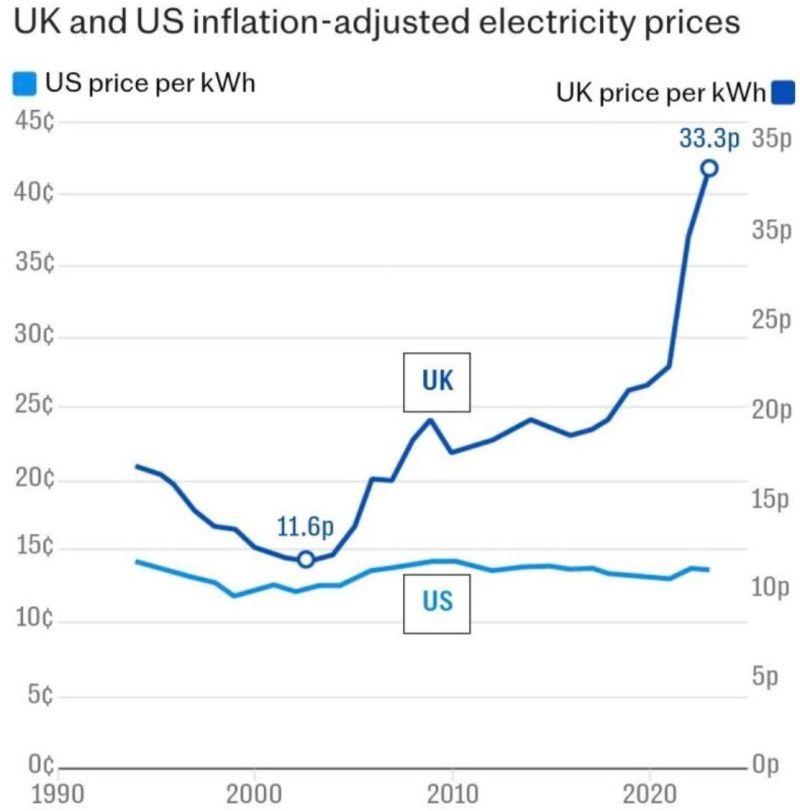

If you are in the manufacturing industry, do you produce in the U.S. or in the U.K.?

Source: Michel A.Arouet

The UK faces the doom loop of rising borrowing costs, growing deficits and a government facing a lot of bad choices to raise revenues

Yields on 30-year gilts have reached their highest levels since 1998. Source: Lisa Abramowicz @lisaabramowicz1, Bloomberg

Revolut employees are in line for big windfalls as the UK’s most valuable fintech allows staff to sell down their holdings in the company at a $75bn valuation

Revolut told staff on Monday that they would be allowed to sell up to 20 per cent of their shares to make way for other investors, according to people with knowledge of the matter and a document seen by the Financial Times. Source: FT https://lnkd.in/eRpjTMad

“Friendflation" is the growing cost of maintaining social connections and participating in our friends’ lives.

43% is the proportion of Americans who find it ‘difficult’ to have a wealthier friend 55% is the proportion of British adults who don’t feel comfortable talking about their financial situation, according to a study by the Money and Pensions Service "It may be true, as the adage goes, that money can’t buy you friends. But, it turns out, it comes in pretty handy if you want to keep them". Source: FT

In proportion to population the millionaires exodus from the UK is unprecedented

Main beneficiaries (in proportion of population): UAE, Italy, Switzerland, Singapore, Portugal and Greece Source: Michel A.Arouet

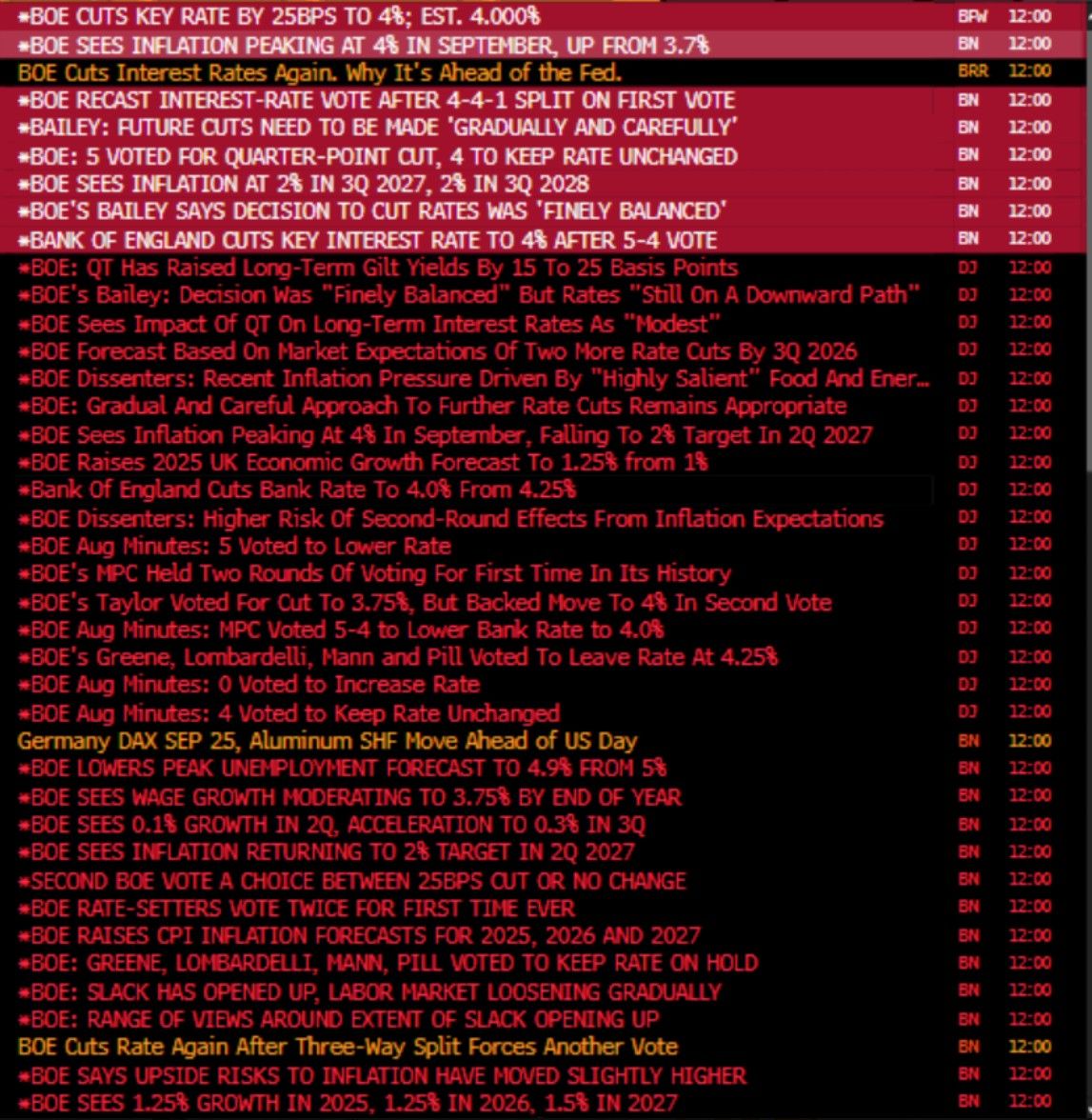

The Bank of England cut interest rates by 25 basis points to 4%, the lowest since March 2023, as it balances persistent inflation with mounting concerns over economic growth and the labor market.

BOE’s is front-running a deeper economic slowdown. They’re not cutting because things are good BUT they’re cutting because the cracks are showing. BOE cut = policy makers globally may follow ⚠️ BoE vote was recast after split! It probably NEVER happened. Taylor voted originally to cut 50 and then went 25. But it was finely balanced - but it shows that this was a HAWKISH 25bps cut. This most likely rules out a September cut unless substantial miss in jobs/CPI in Aug $GBP Source: Viraj Patel 2VPatelFX, Ananta @AnantaSumantera

Investing with intelligence

Our latest research, commentary and market outlooks