Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

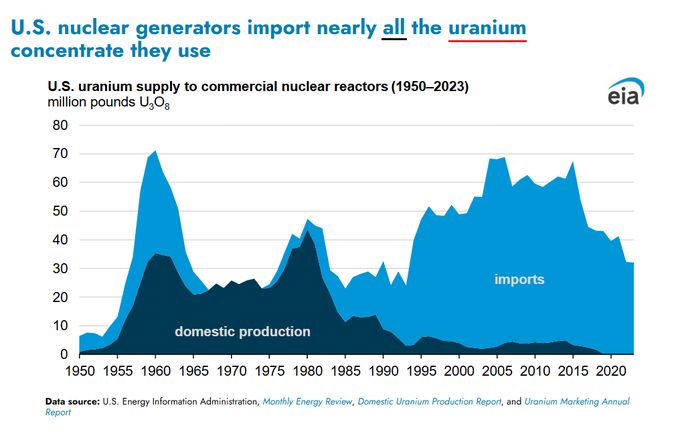

🤯 The Hidden Vulnerability Powering America: 20% of US Electricity is on Borrowed Time.

Did you know Nuclear energy generates 20% of all US electricity? That's our clean, reliable base load. But here’s the terrifying truth: 🇺🇸 The US once supplied nearly all its own Uranium fuel. TODAY: The US imports nearly 100% of the uranium we use. Let that sink in. One-fifth of US power generation is entirely dependent on foreign governments. In a world defined by geopolitical turbulence and supply chain risk, this isn't just an economic issue—it's a massive national security risk. The Mandate is Clear: The US must shift from relying on external sourcing to securing a resilient, domestic nuclear fuel cycle. Self-sufficiency is no longer optional; it’s paramount for energy independence and long-term stability. Source: Lukas Ekwueme @ekwufinance

🔥 OpenAI’s “Go Big or Go Bust” Strategy Just Went Public — and the numbers are insane.

According to leaked financials, OpenAI is preparing to lose $74B in 2028 alone — yes, one year — before expecting to swing to real profitability by 2030. What about this year? $13B in revenue $9B in cash burn A burn rate of ~70% of revenue ‼️ And it only gets wilder: OpenAI expects three-quarters of its 2028 revenue to be wiped out by operating losses. Meanwhile, competitor Anthropic expects to break even in 2028. OpenAI expects to burn $115B cumulatively through 2029. OpenAI’s commitments: Up to $1.4T over 8 years for compute deals Nearly $100B on backup data-center capacity Aiming for $200B in revenue by 2030 (a 15x jump from today) 💡 The read-through: This is the biggest strategic divergence in AI right now: Anthropic = disciplined scaling OpenAI = moonshot economics OpenAI is effectively saying: “We’ll lose tens of billions now to own the entire future later.” But there’s a catch: 95% of businesses still get zero real value from AI today. And OpenAI is funding its hyperscale buildout not from revenue (like AWS did), but from debt, investors, and chip-supplier deals — while losing money on every ChatGPT interaction. This ends one of two ways: 🚀 The most valuable company in history 💥 Or a case study in overestimating demand There’s no middle lane when you’re burning cash faster than any startup in history... Source: hedgie on X

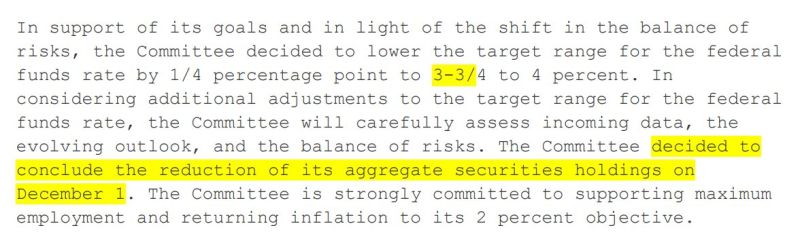

For 35 minutes, today’s FOMC meeting was painfully boring

The Fed cut rates ✅ Ended QT ✅ A few dissenters ✅ Markets? Totally unfazed. S&P flat. Yields steady. Commodities and crypto asleep. And then — 2:35 PM. Powell drops one line that flips everything: “December cut is not for sure, far from it.” Boom 💥 Rate-cut odds crash from 95% → 65% in minutes. Stocks wobble. Yields jump. Traders scramble. Moral of the story? In markets, boredom never lasts long — and one sentence from the Fed can move trillions.

THE FED WILL END QT ON DECEMBER 1ST

Moving from restrictive → supportive balance sheet policy. This is not QE, but it is definitely a positive development that provides a mild liquidity tailwind for markets. Source: Joe Consorti @JoeConsorti

BREAKING 🚨 Trump–Xi Meeting: Big Moves, Bigger Signals

Fresh headlines from the Trump–Xi summit 👇 🇺🇸🤝🇨🇳 Key outcomes: - US & China will collaborate on Ukraine. - Trump to visit China (April 2026) — Xi to visit the US soon. - China to restart soybean purchases and resume rare earth exports. - Ongoing talks on Nvidia chip restrictions. - Tariffs cut: overall from 57% → 47%. - Fentanyl tariffs slashed to 10%, with a joint pledge to curb its spread. 💬 Takeaway: this marks a real thaw in U.S.–China relations — trade, tech, and geopolitics could all shift from confrontation → cautious cooperation.

I would prefer to see better participation on the upside for the Nasdaq 100 $QQQ to extend its bull market.

Things have been improving lately but the negative divergence between price action and market breadth (% of Nasdaq 100 stocks above their 50-day MA) is not the best set-up. We remain long Tech though. Source: Trend Spider

Finally some US data... And it might please the markets... The September CPI was indeed softer than expected.

CPI MoM: 0.3% vs 0.4% exp. CPI Core MoM: 0.2% vs 0.3% exp. CPI YoY: 3.0% vs 3.1% exp. CPI Core YoY: 3.0% vs 3.1% exp. It’s still the hottest YoY print since January, but overall confirms inflation is easing again. Gasoline drove most of the increase, rising 4.1%, while electricity and natural gas fell. Food prices barely moved at +0.2%, with only small upticks in bakery and beverage costs. Shelter continues to cool. Rent inflation dropped to 3.4% YoY, the lowest since 2021 and monthly rent growth was the smallest in more than two years. Shelter overall rose just 0.28% MoM, signaling that housing, one of the biggest drivers of sticky inflation, is finally loosening its grip. Core CPI rose just 0.2% MoM, bringing the annual rate down to 3.0%, its lowest since June. Airline fares and apparel climbed, but used cars, insurance, and communication costs all declined. “Supercore” services ex-shelter fell to 3.3%, the lowest since May, showing that inflation pressure in service-heavy areas like travel, insurance, and recreation is softening across the board. Source: Charlie Bilello, StockMarket.news on X

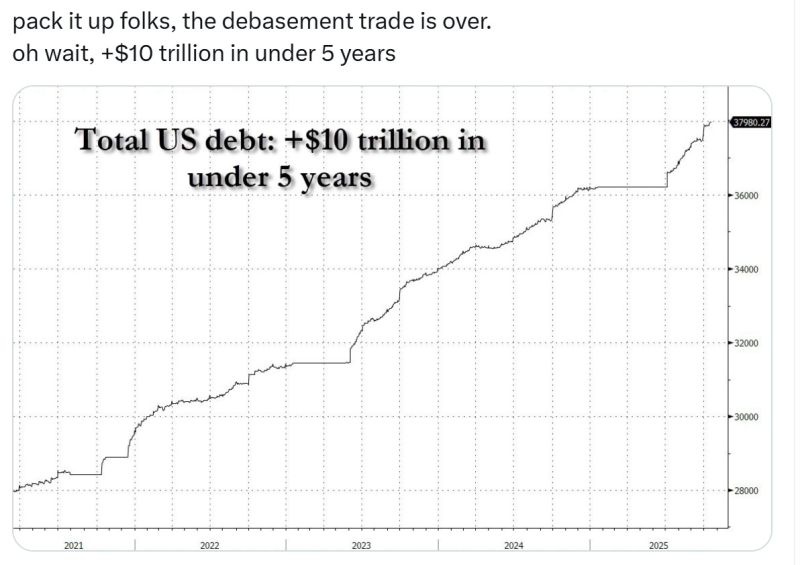

U.S. debt has surged by over $10 trillion in less than five years, largely due to massive pandemic-era spending.

Beginning in 2020, the government unleashed trillions through stimulus checks, unemployment aid, and small business loans under the CARES Act, followed by the $1.9 trillion American Rescue Plan in 2021. Although borrowing briefly slowed in 2022, new spending on infrastructure, social programs (Inflation Reduction Act), and defense reignited debt growth. Meanwhile, rising interest rates from the Federal Reserve’s inflation fight made servicing the debt far more expensive, pushing annual interest payments into the hundreds of billions. Despite strong tax revenues, the U.S. has run trillion-dollar deficits every year since 2019. Repeated debt-ceiling battles have failed to curb borrowing, as Congress consistently raises or suspends the limit. For investors, the result is a surge in Treasury supply that keeps long-term yields and borrowing costs high, while inflation expectations remain elevated—driving continued interest in gold, TIPS, and real assets as inflation hedges. Source: StockMarket.news, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks