Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

JUST IN: 'America elected the most pro-crypto Congress ever with almost 300 pro-crypto elected to the House and Senate - CNBC

Crypto execs, investors and evangelists saw the election as existential to an industry that spent the past four years simultaneously trying to grow up while being repeatedly beaten down. In total, crypto-related PACs and other groups tied to the industry reeled in over $245 million, according to Federal Election Commission data. Nearly 300 pro-crypto lawmakers will take seats in the House and Senate, according to Stand With Crypto, giving the sector unprecedented influence over the legislative agenda. Link to CNBC article >>> https://lnkd.in/euj8FDqN

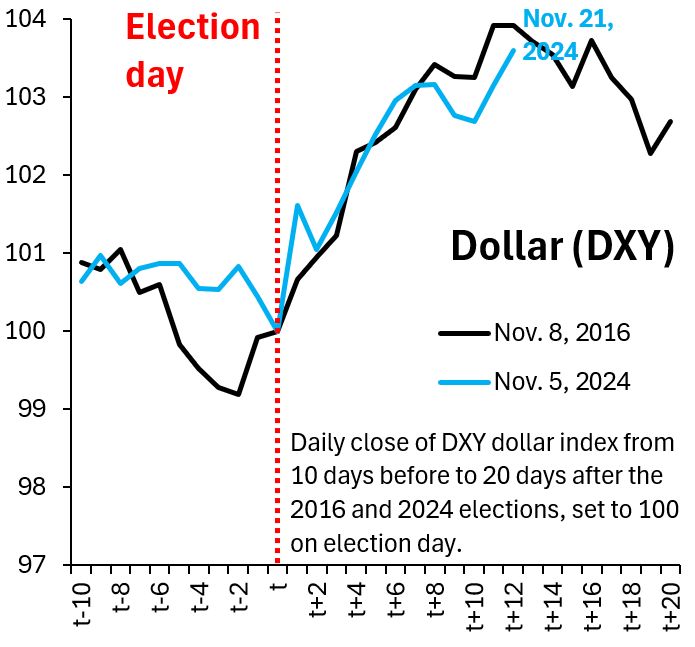

The similarity between the Dollar rise since the election and what happened in 2016 is uncanny.

In both cases, the Dollar was by this point closing in on a 4% rise, with an ultimate rise of around 6% by the end of the year. So - if 2016 is a guide - there's another 2% to go now. Source: Robin Brooks

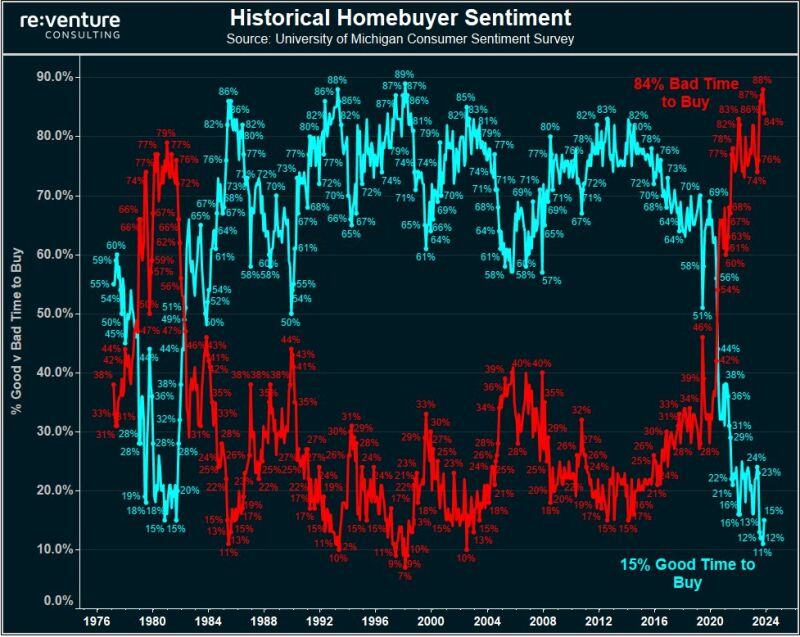

US HOUSING AFFORDABILITY HAS NEVER BEEN WORSE

84% of US consumers believe it is a bad time to buy a home, near the most on record. The share is greater than in the 1980s when rates were sky-high and as much as 20% versus 4.5% now. House prices are also near record highs. Source: Global Markets Investor

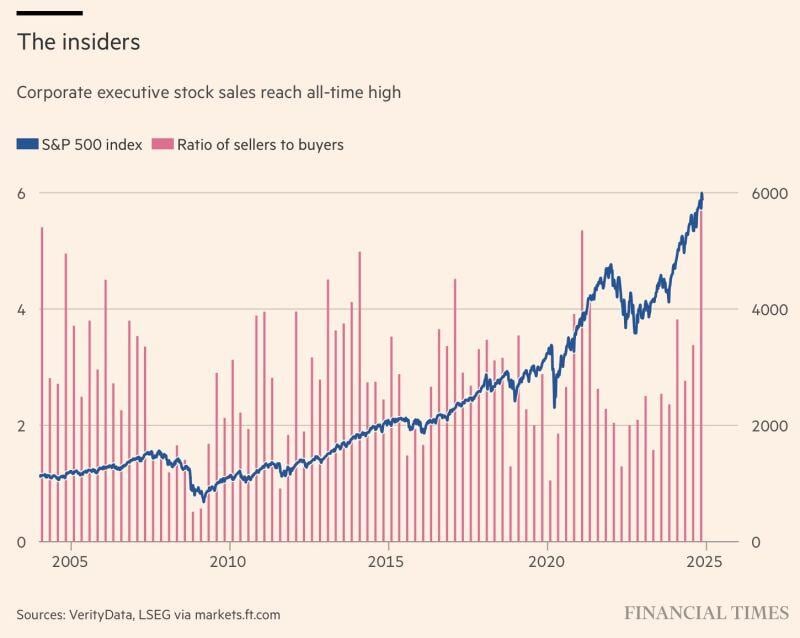

Record numbers of US executives are selling shares in their companies

as corporate insiders from Goldman Sachs to Tesla and even Donald’s Trump’s own media group cash in on the stock market surge that has followed his election victory. The rate of so-called insider sales has hit a record high for any quarter in two decades, according to VerityData. The sales, by executives at companies in the Wilshire 5000 index, include one-off profit-taking transactions as well as regular sales triggered by executives’ automatic trading plans. The Wilshire 5000 is one of the broadest indices of US companies. While insider selling is routine — especially as the stock market was already breaking records before Trump’s win — the surge following November 5 underscores how US executives are already profiting personally from his return before he re-enters the White House. https://lnkd.in/eYWW3E5M Source: FT

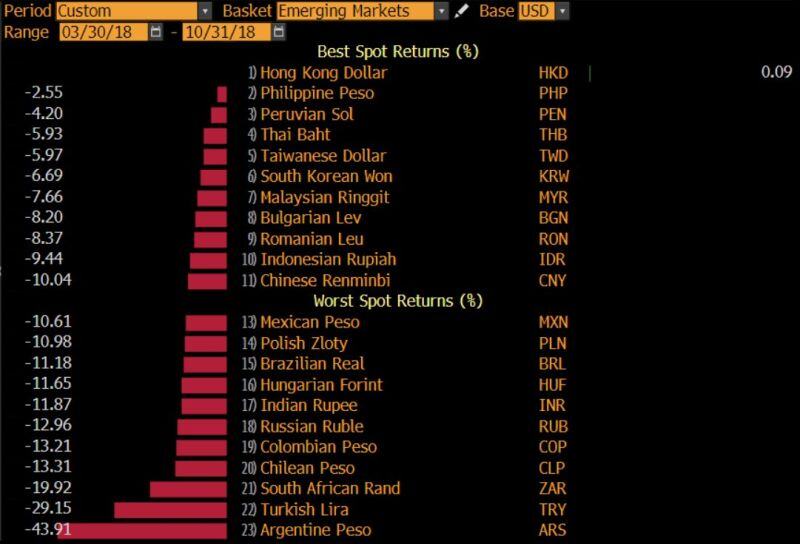

As a reminder... From April to October 2018, the US announced tariffs on half of all imports from China at 25%.

The Yuan fell 10% in an almost full offset. Turkey and Argentina had their own crises at the time and were blowing up constantly. But all of EM got hammered. Brazil was down 11%... History doesn't repeat but often rhymes... Source: Robin Brook, Bloomberg

🍕 BREAKING: Domino's Pizza stock, $DPZ, soars over 8%

after Warren Buffett discloses new position in the company...

Investing with intelligence

Our latest research, commentary and market outlooks