Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

✔️ The move is an early sign that the US president-elect intends to resume the high-level engagement with China's leader that marked his first term.

US president-elect Donald Trump has invited President Xi Jinping to his inauguration in January, in an early sign that he intends to resume the high-level engagement with the Chinese leader that marked his first term. Karoline Leavitt, the incoming White House press secretary, told Fox News on Thursday that Trump wanted to create an “open dialogue” with countries that were American adversaries, not just with allies and partners. “We saw this in his first term. He got a lot of criticism for it, but it led to peace around this world. He is willing to talk to anyone, and he will always put America’s interests first,” said Leavitt. Leavitt said it was “to be determined” if Xi would accept the invitation. The Chinese embassy did not immediately respond to a request for comment. The invitation comes as Beijing is bracing for an escalation in the trade war that Trump launched against China in 2018. The US president-elect has already threatened to impose a 60 per cent tariff on imports from China, which would be a big increase from the levies he imposed on the country’s goods in his first term. Trump will enter office as US-China relations remain close to their worst state since the countries established diplomatic relations in 1979. Source: Financial Times, https://on.ft.com/4ir5yzY

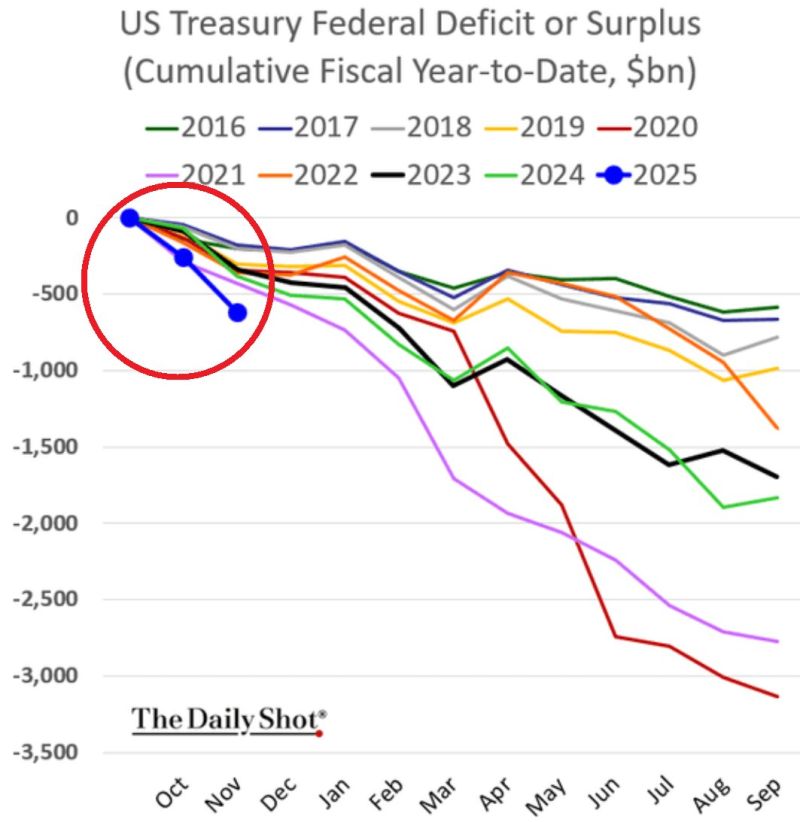

‼️ US budget deficit hit a GIGANTIC $367 BILLION in November 2024.

This puts the total deficit for the first 2 months of the Fiscal Year 2025 to a TREMENDOUS $624 BILLION, the highest EVER. This has even surpassed the 2020 CRISIS LEVELS. Source: Global Markets Investor, The Daily Shot

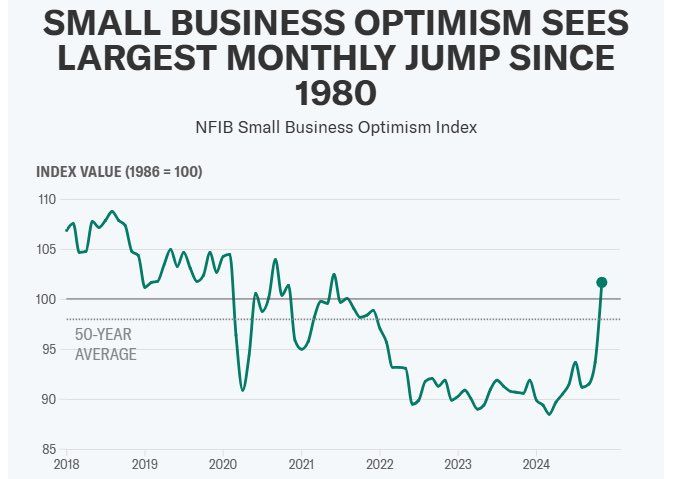

What can wonder what happened in the US last month?

Source: NFIB

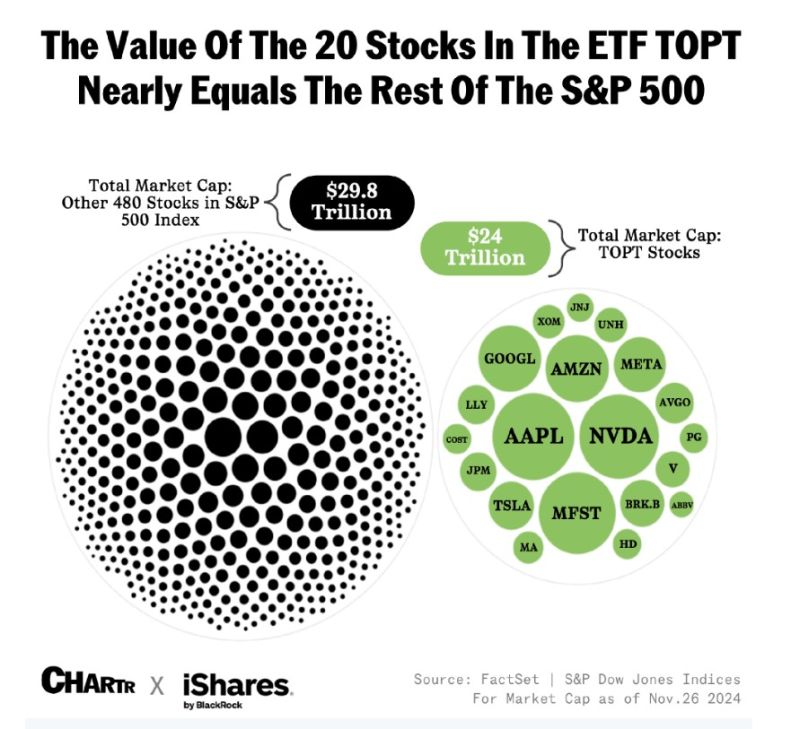

The 20 largest US stocks represent $24 trillion in market cap

Close to the total of the 480 other stocks in the S&P 500 ($29.8T) as well as the entire U.S. economy, measured at $27T in GDP in 2023.2

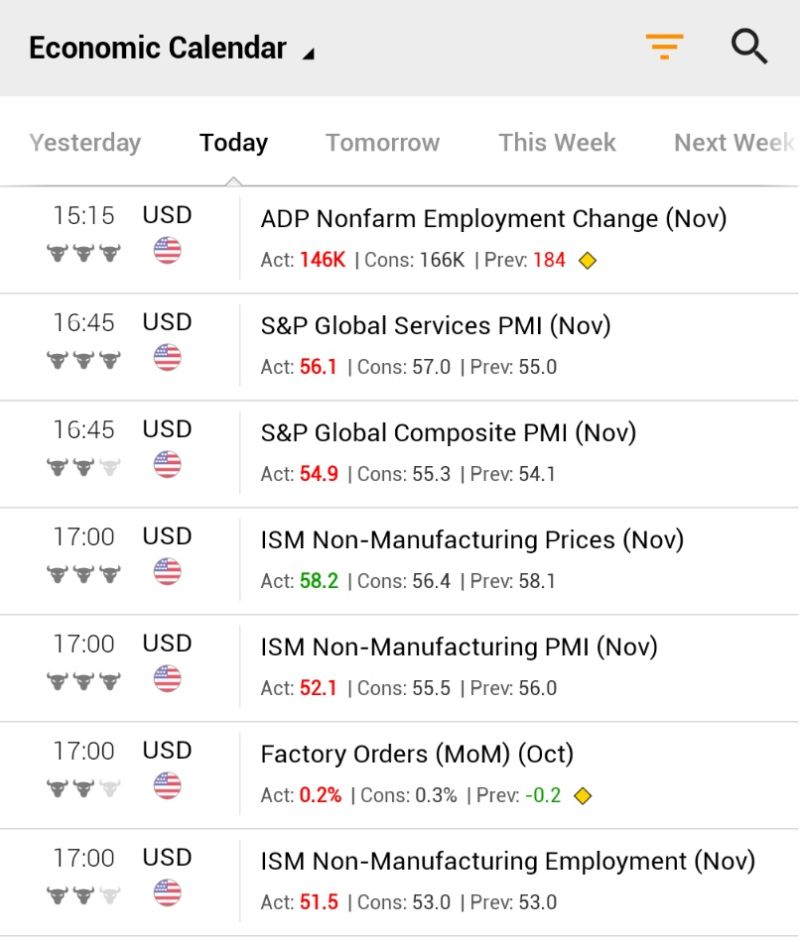

US Economic Surprises are starting to roll out.

See below yesterday macro numbers - majority of them missed estimates (hard & soft data) *ADP Payrolls: Miss 🔴 *S&P Services PMI: Miss 🔴 *ISM Services PMI: Miss 🔴 *ISM Services Employment: Miss 🔴 *Factory Orders: Miss 🔴 Source: Jessie Cohen

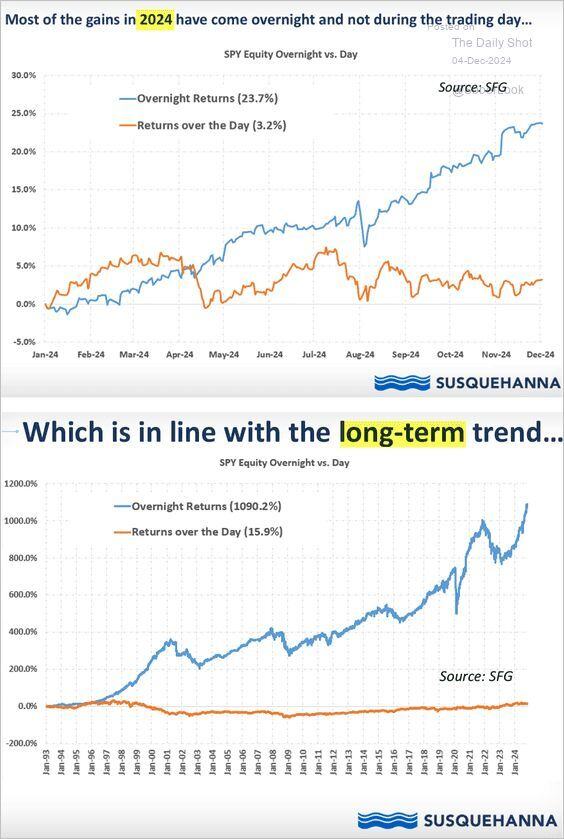

Overnight gains in US equities have massively outpaced intraday gains.

Source: Chris Murphy, Susquehanna International Group, The Daily Shot

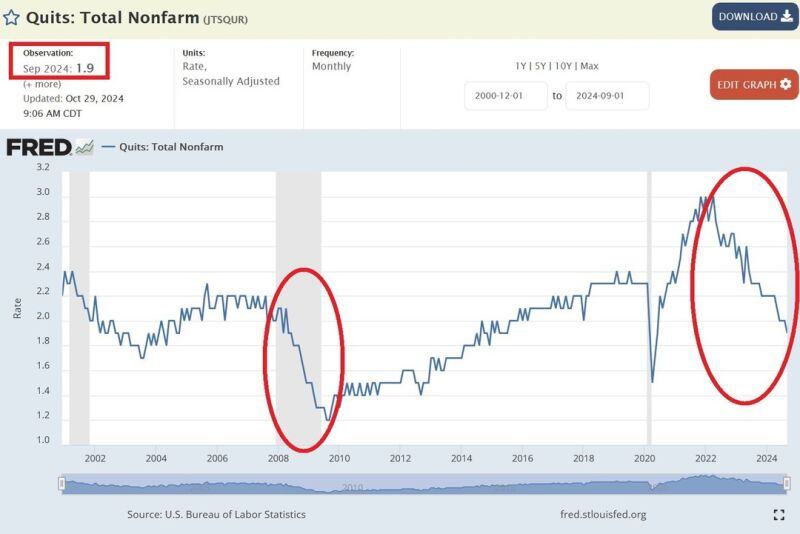

⚠️US QUITS RATE IS FALLING QUICKLY⚠️

The quits rate, the % of workers voluntarily exiting their jobs fell to 1.9% in September, the lowest since June 2020. Americans are increasingly depending on their current jobs as the hiring pace has declined. Data for October is due today. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks