Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another data source for analyzing BTC and Bitcoin ETFs on the Bloomberg terminal: BTC volatility

James Seyffart @JSeyff

Bond vol matters

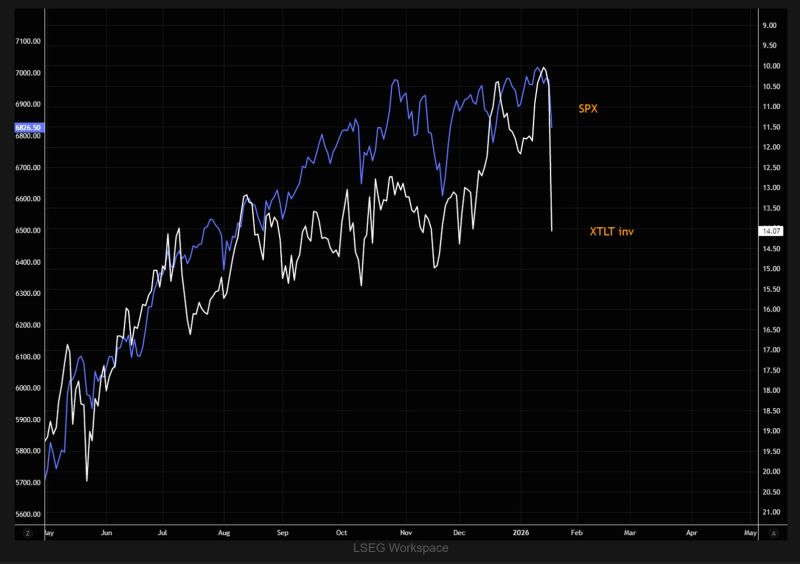

SPX vs VXTLT (inverted) needs little commenting. Source: TME

Is the volatility index VIX set to spike?

Asset managers have aggressively increased their VIX futures shorts to the highest level since July 2024. In other words, funds are betting heavily on continued low stock market volatility. Such extreme short VIX positioning often leaves markets vulnerable to sharp volatility spikes if sentiment turns. A similar setup occurred in July-August 2024, when a sudden shift in risk appetite drove a nearly -10% market drop. Are we heading for a pullback? Source. Global Markets Investors

VIX seasonality is about to kick in right here...

Source: Equity clock, The Market Ear

The great vol reset

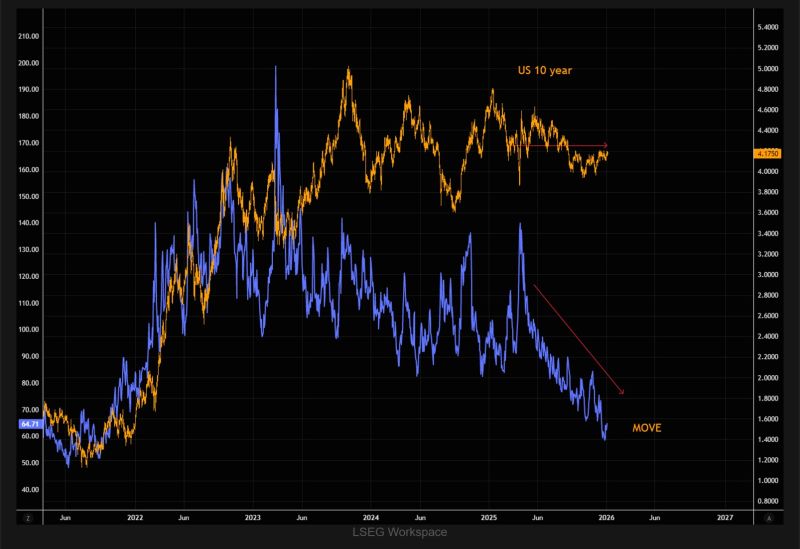

We’ve seen a massive reset in bond volatility since the Liberation Day chaos. US Treasuries yields have gone nowhere, but at these levels owning some bond volatility offers limited downside with asymmetric upside. Source: The Market Ear, LSEG

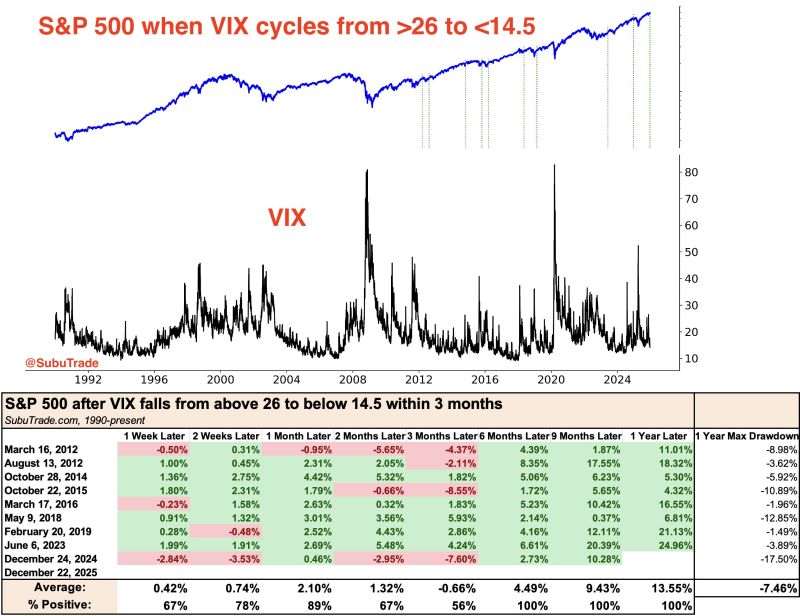

$VIX dropped to 14 today, down from 26 just a month ago

Is volatility "too low"? In each of the last 8 times this happened, $SPX was higher a month later. Source: Subu Trade

The hedge factor

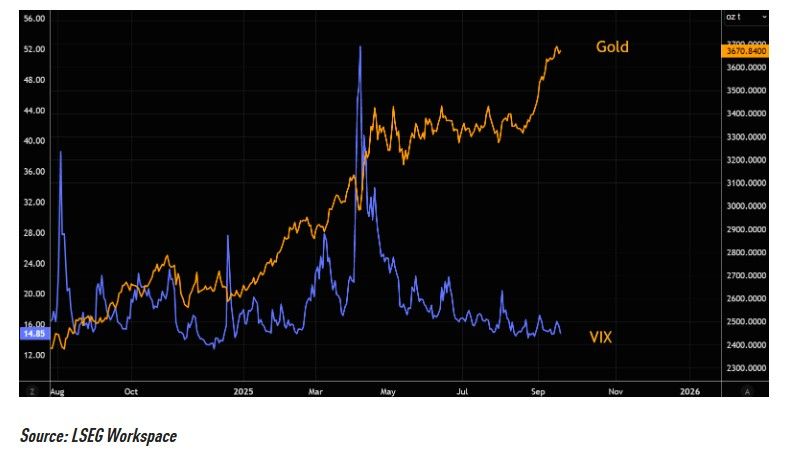

Gold is the "everything hedge", but if you are looking for global equity hedges, then VIX looks relatively more interesting compared to chasing gold here. Source: TME, LSEG

JPMorgan analysts believe Bitcoin ($BTC) is trading below its fair value as its price volatility falls to historic lows, narrowing the asset's risk-adjusted gap with gold.

Volatility in Bitcoin has slid from nearly 60% earlier this year to roughly 30%, the lowest level on record. Analysts led by Nikolaos Panigirtzoglou said this dynamic implies a fair value near $126,000, a target they expect could be reached by year-end, according to The Block. A major driver of the decline in volatility has been corporate treasuries, which now hold over 6% of Bitcoin's total supply. JPMorgan compared the phenomenon to the post-2008 bond market, where central bank quantitative easing dampened swings by locking assets into balance sheets. Source: Yahoo Finance, Coindesk

Investing with intelligence

Our latest research, commentary and market outlooks