Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

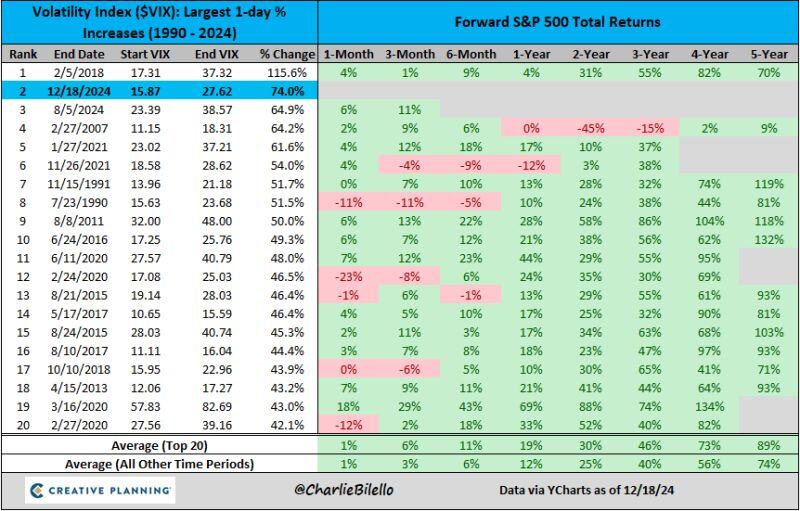

The $VIX spiked 74% higher yesterday, the 2nd biggest 1-day % increase in history

Volatility is back. Source Charlie Bilello

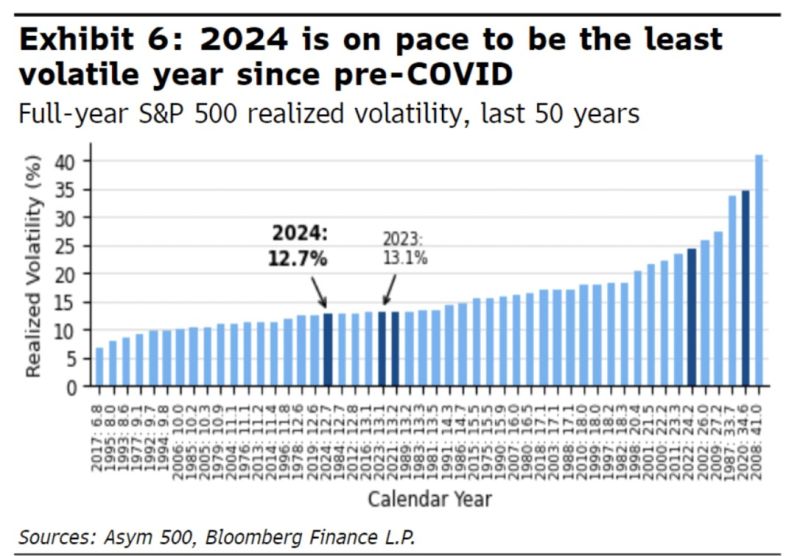

It has been a very quiet year... Can we expect the same in 2025???

Source: Asym 50, RBC

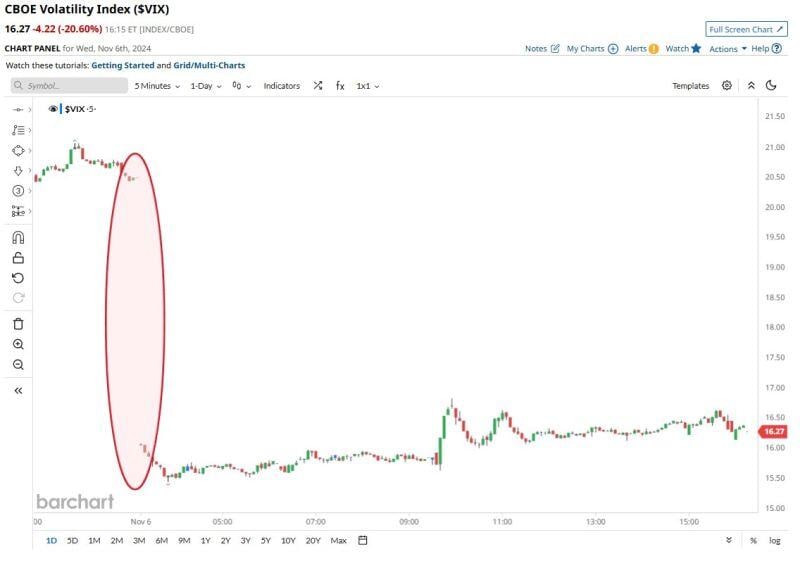

CBOE Volatility Index $VIX drops more than 20%, one of the largest declines in the last 2 decades

Source: Barchart

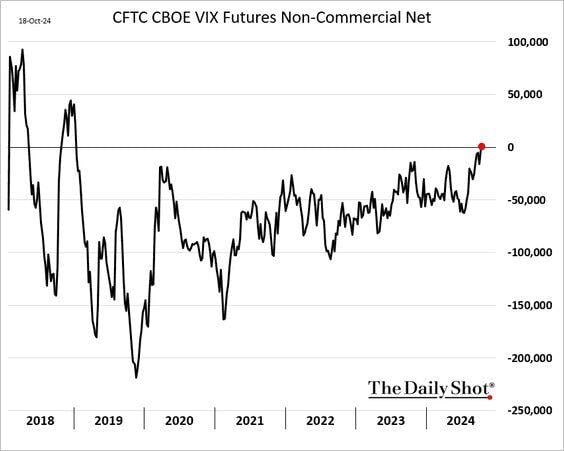

Hedge funds are net long VIX futures for the first time since 2019 ahead of the US elections.

Source: (((The Daily Shot))) @SoberLook

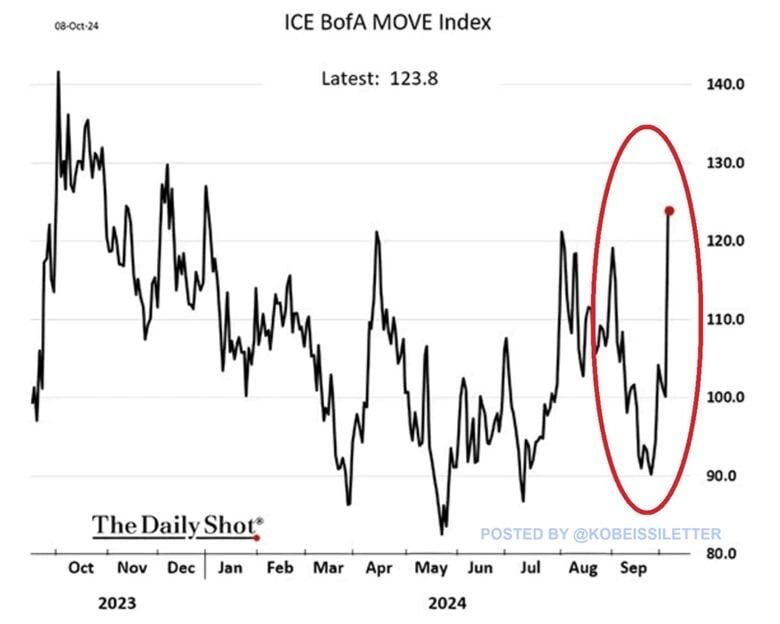

Bond market volatility is spiking:

The ICE BofA MOVE Index hit 123.8 points last week, the highest level since January. The MOVE index, also called the “VIX of bonds” is a metric measuring yield volatility of 2-year, 5-year, 10-year, and 30-year Treasuries. The index has skyrocketed 38% in just 3 weeks as yields started rising following the Fed's decision to cut rates by 50 bps. Over this period, the 10-year Treasury yield jumped from 3.64% to 4.10%. At the same time, the popular bond-tracking ETF, $TLT, fell by 6.8%. What happened to the "Fed pivot?" Source: The Kobeissi Letter, The Daily Shot

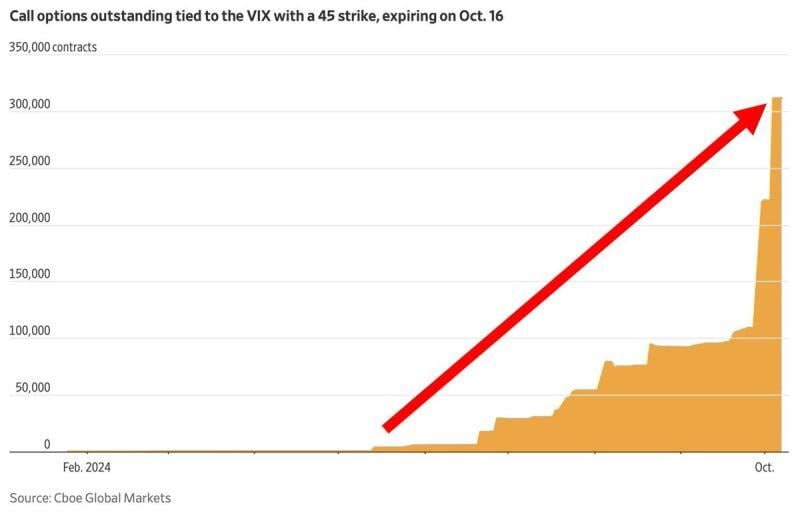

⁉️IS THE VOLATILITY INDEX VIX SET TO SPIKE FURTHER⁉️

VIX spiking bets (via call options) soared to one of the highest levels of 2024, according to the WSJ analysis. Call options betting the VIX index will skyrocket to 45 points by October 16 HAVE TRIPLED in a matter of days. Source: Global Markets Investor, WSJ

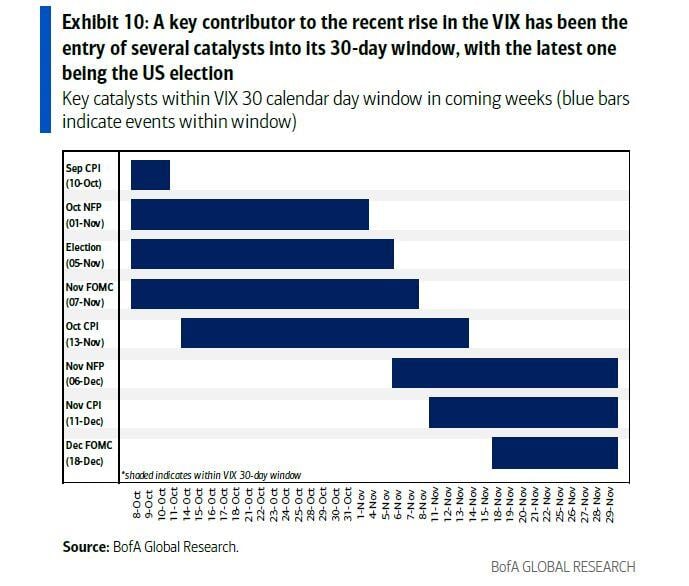

Why the VIX is acting bananas: look at the events that are now in its 30 day window

Source: BofA, zerohedge

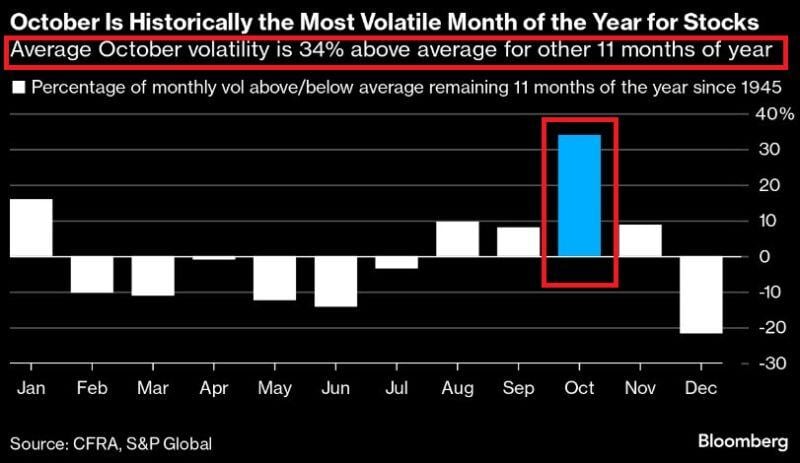

‼️MARKETS JUST ENTERED THE MOST VOLATILE PERIOD OF THE YEAR‼️

In October, equity markets volatility is ~34% above average for the other 11 months of the year. October is also the worst period for the S&P 500 during election years as uncertainty spikes... Sourcre: Bloomberg, Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks