Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

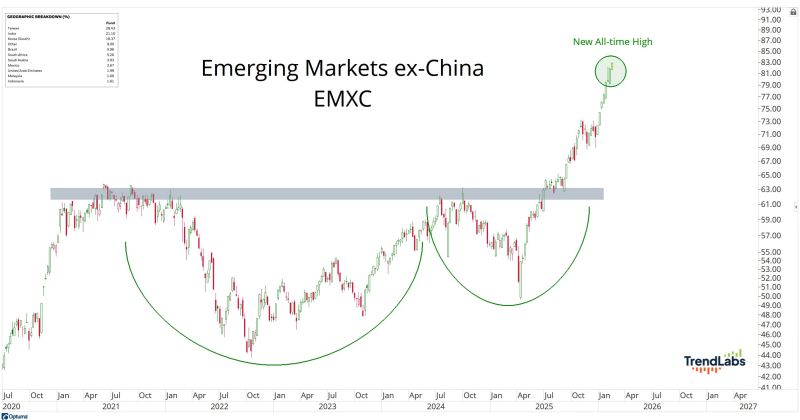

Emerging Markets Ex-China is up 50% in the past year and over 13% so far in 2026. New all-time highs again today.

Source: J.C. Parets @JC_ParetsX

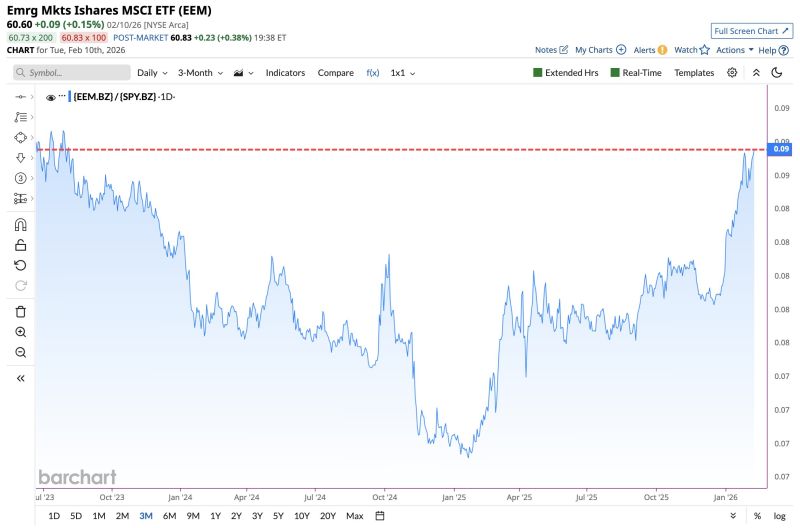

Emerging Market Stocks now outperforming U.S. Equities by the largest margin since 2023

Source: Barchart @Barchart

Emerging Market stocks now outperforming U.S. equities by the largest margin since 2023

Source: Barchart

Long EM. Short US large caps.

Is the Dalio playbook about to break out? Source: Trend Spider

US Treasury secretary Scott Bessent said that Washington was in talks to provide a $20bn swap line to Argentina

Source: FT

Saudi Arabia’s stocks soar after reports that foreign ownership limits will be axed ‼️

The Capital Market Authority (CMA) is moving toward allowing foreigners to own majority stakes in local companies, Bloomberg reported. The Authority is close to approving a major amendment to raise the cap on foreign ownership in listed companies, which currently stands at 49%, the agency quoted CMA board member Abdulaziz Abdulmohsen bin Hassan as saying. He highlighted that the regulator is almost ready for this step and is awaiting approval from the relevant government entities. “It is prepared to move forward,” said the official, without specifying the final ownership cap that will be permitted for foreigners, expecting the decision to come into effect before the end of this year. Allowing foreign ownership to exceed 50% of capital in listed companies will increase the relative weights of Saudi stocks in MSCI indices, which could attract significant capital inflows, as these indices reduce the weight of companies that impose foreign ownership restrictions. Source: Argaam, Reuters

Scott Bessent signaled that the U.S. is prepared to support Argentina amid its economic crisis, viewing the country as a key ally in Latin America.

He outlined possible measures—such as swap lines, dollar purchases, and using the Treasury’s Exchange Stabilization Fund to buy Argentine debt—showing Washington’s seriousness. The support is linked to President Javier Milei’s reform agenda, which Bessent praises for its focus on fiscal discipline and growth. U.S. backing could stabilize the peso, restore investor confidence, and counter China’s influence in the region. However, it carries risks: taxpayer exposure, Argentina’s history of failed reforms, and the danger of dependency. Bessent stressed that U.S. aid will only come with expectations of real follow-through from Buenos Aires, making success dependent on Argentina’s political and economic discipline. Source: StockMarket.news

UBS Ukraine Reconstruction Index hit a fresh ATH on Trump peace push.

Top gainers in the index include: Ferrexpo (+20%), Raiffeisen Bank (+12%), Wienerberger (+9.5%), CRH (+7%). Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks