Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

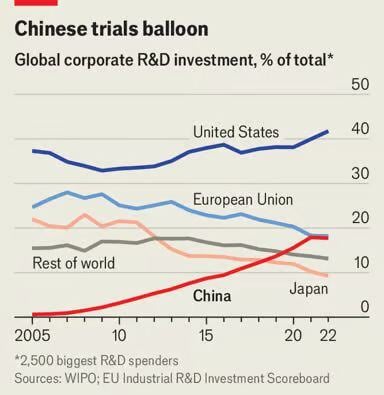

The US remains (by far) the world leader for corporate R&D, accounting for ~40% of global total

• China and EU are competing for second place in global league table • Japan has been in free fall over past two decades, now accounting for only 10% of global private R&D Source: Agathe Demarais

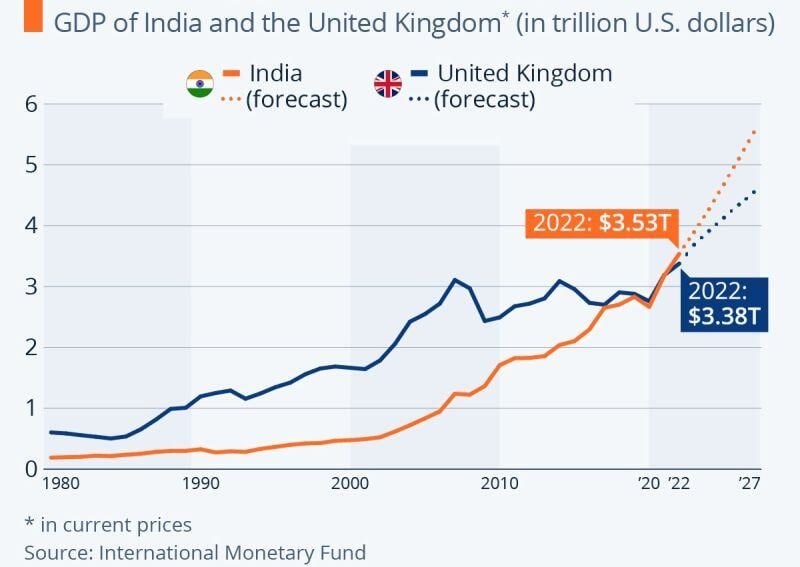

India‘s economy is overtaking UK, the former colonial power.

And this is most likely just a start. Source: The Economist, Michel A.Arouet

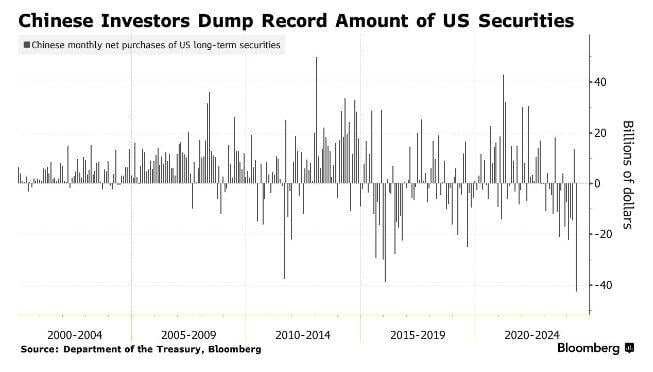

JUST IN 🚨: China dumped an ALL-TIME HIGH $42.6 billion worth of U.S. Securities in May

Source: Barchart

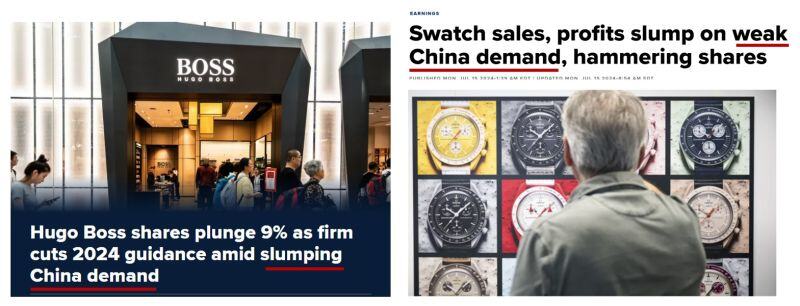

Weak China demand is weighing on European luxury & consumer discretionary stocks.

- Swatch Group (UHR SW) reported a steep fall in first half sales and earnings on Monday as the world’s biggest watchmaker struggled with weaker demand in China. The company’s drop in turnover was triggered by a slump in demand for luxury goods in China, including Hong Kong and Macau, with only the Swatch brand bucking the negative trend, increasing its sales in China by 10%, the company said in a statement. - Hugo Boss (BOSS GY) shares plunged as much as 10% Tuesday after the company cut its sales outlook. The German fashion house said Monday that it expects full-year sales of up to 4.35 billion euros ($4.73 billion) on macroeconomic challenges, particularly in China. The retailer becomes the latest high-end fashion line to warn of persistent woes in the luxury sector. Source: CNBC

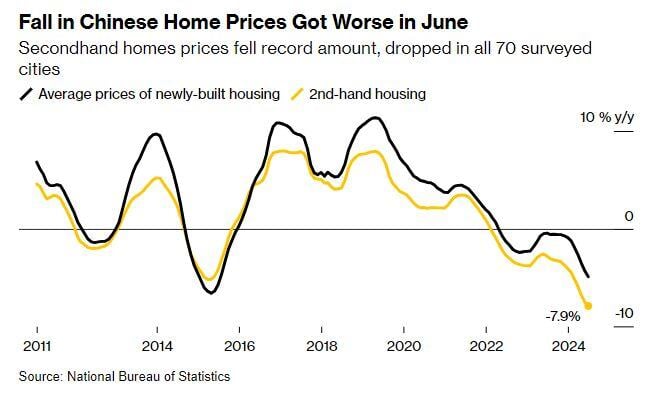

🚨 Chinese Existing Home Prices declined by 7.9% year-over-year last month, the largest decline in history!

Source: Bloomberg

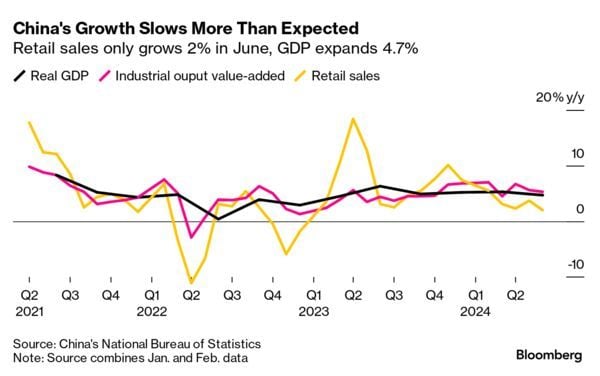

China Q2 GDP growth slowed more than expected (+4.7% yoy vs. +5.1% yoy expected), but the big surprise is just how weak retail sales were - growing only 2% in June.

-> China’s National Bureau of Statistics on Monday said the country’s second-quarter GDP rose by 4.7% year on year, missing expectations of a 5.1% growth, according to a Reuters poll. -> June retail sales also missed estimates, rising 2% compared with the 3.3% growth forecast. -> Industrial production, however, beat expectations up by 5.3% in June from a year ago, higher than Reuters estimate of 5% growth. -> Urban fixed asset investment for the first six months of the year rose by 3.9%, meeting expectations. Investment in infrastructure and manufacturing slowed their pace of growth on a year-to-date basis in June versus May, while real estate investment declined at the same 10.1% rate. The National Bureau of Statistics did not hold a press conference for the data release. China’s high-level policy meeting, the Third Plenum, kicks off Monday and is set to wrap up Thursday. Source: Bloomberg, CNBC

BREAKING 🚨: Chinese Banks

40 Chinese Banks vanished during a single week in June Source: Barchart

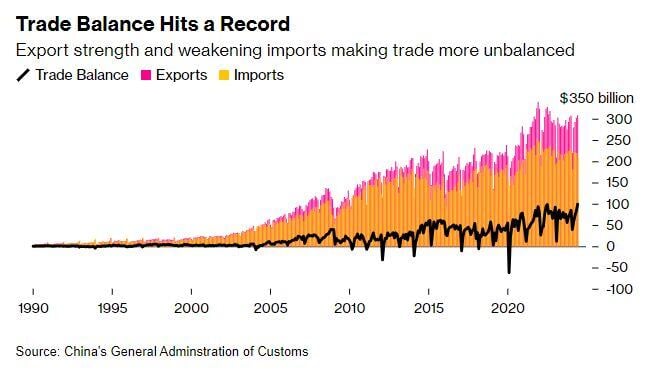

China posts biggest monthly trade surplus in at least 24 years, nearly $100B in June - Bloomberg

China’s trade surplus soared to an all-time high in June, with a jump in exports overwhelming an unexpected decline in imports and raising the risk of greater trade tensions. Exports rose to $308 billion, expanding for a third straight month to the highest level in almost two years, the customs administration said Friday. Imports fell to $209 billion, leaving a record trade surplus of $99 billion for the month. The growing imbalance has spooked China’s trade partners, who have responded with more tariffs on Chinese imports including electric vehicles. This tension has worsened ties between the European Union and Beijing, which this week opened a tit-for-tat probe into the EU’s trade barriers in what could bring the economies closer to a trade war. The surplus “reflects the economic condition in China, with weak domestic demand and strong production capacity relying on exports,” said Zhiwei Zhang, president and chief economist of Pinpoint Asset Management. However, “the sustainability of strong exports is a major risk for China’s economy in the second half of the year. The economy in the US is weakening. Trade conflicts are getting worse.” Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks