Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

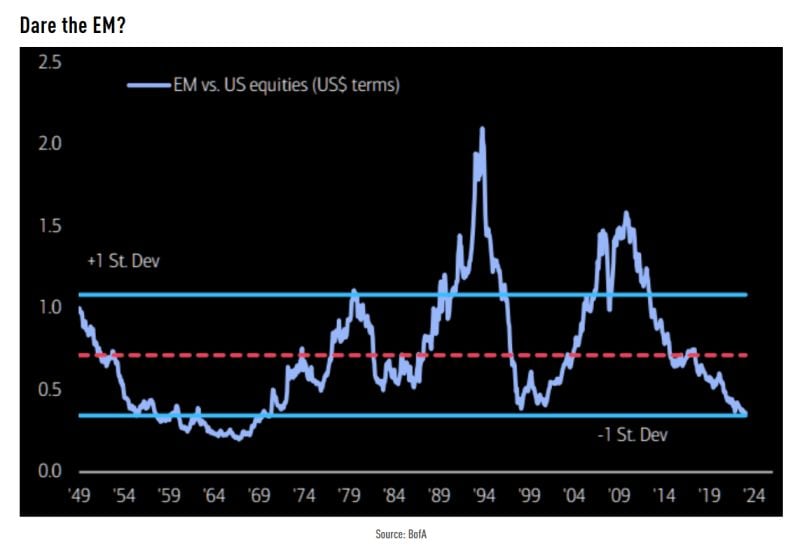

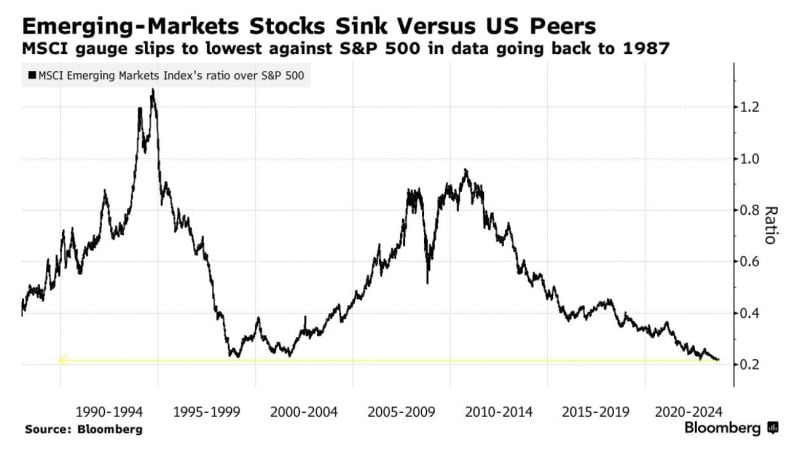

BofA Harnett: "...new 'BRICS 10’= 51% of global CO2 emissions, 46% of population, 45% of energy consumption, 45% of oil production, 37% of GDP (at purchasing power parity)…

yet <25% of global market cap, and EM equities also at 52-year low vs. US" Source: BofA, TME

🚨BRICS DOUBLES OVERNIGHT Yesterday, the UAE, Saudi Arabia, Ethiopia, Egypt, and Iran are officially members of BRICS.

They join Brazil, Russia, India, China, and South Africa as a formidable economic powerhouse, representing 29% of global GDP and 43% of global oil production. Although tensions exist between member states such as China and India, BRICS is a growing challenge to the G7. President Xi: “I wish to extend a warm welcome to leaders of new BRICS members.” Source: IMF, Reuters, China Daily, Mario Nawfal

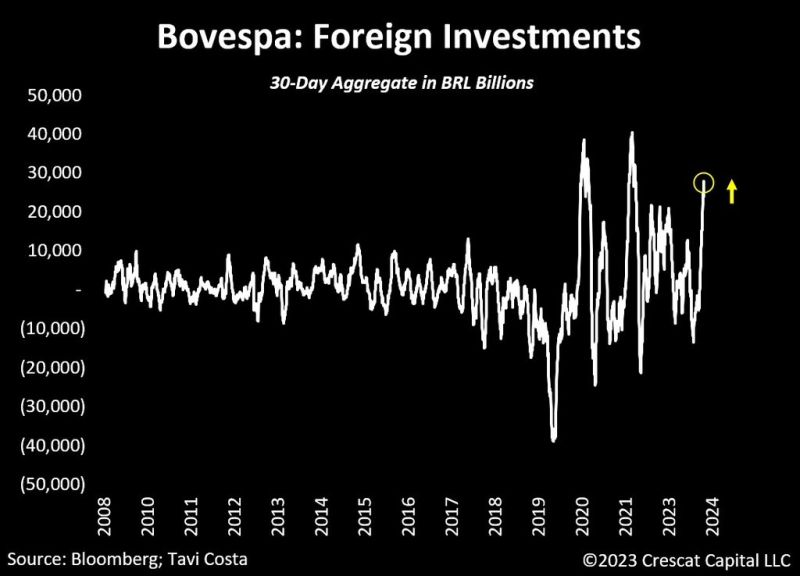

Tavi Costa -> Brazilian equity markets have experienced near-record foreign investments in the last month

Despite all the skepticism about $EWZ is outperforming the S&P 500 by 23 percentage points in the last 2 years. The aggregate market cap of Brazilian stocks relative to its overall money supply remains near historical lows. Source: Crescat Capital, Bloomberg

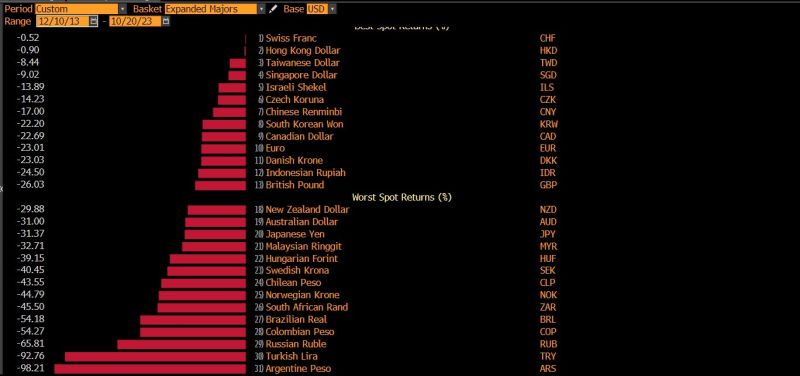

Argentina's currency has lost 96% of its value vs the USD in the past decade

In that period, the central bank has increased the monetary base by 2,046% to finance government political spending... Source: Bloomberg

EM Middle East Sovereign Bonds Impacted by the Israeli-Palestinian Conflict

Since the commencement of the Israel-Palestine conflict, the 5-year CDS (Credit Default Swap) for Middle East sovereign bonds has experienced a significant surge. 📈 Notably, the market's response doesn't reflect heightened concern. This is evident as US equities have continued to climb since the conflict's onset, while interest rates have surged back to previous highs. 📈📊 Thus far, the impact has primarily reverberated in the commodities market, with fluctuations affecting oil and gold prices. Additionally, the Middle East sovereign countries in the EM (Emerging Markets) segment have also felt the repercussions. 🛢️💰 Is the market right to be this complacent in the face of ongoing geopolitical tensions?

Emerging market stocks have fallen to their lowest valuation relative to the S&P 500 in AT LEAST 36 years

Source: Barchart, Bloomberg

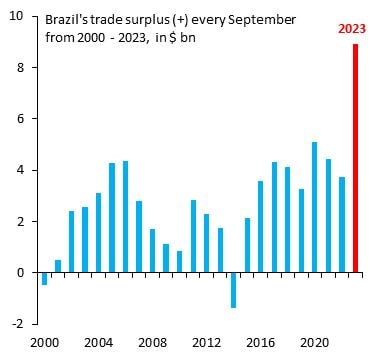

A tweet by Robin Brooks: "Brazil's trade surplus remains in the stratosphere

There is no other EM that has transformed itself over the past decade in the way that Brazil has. The sharp rise in US interest rates is currently weighing on Real, but that's temporary. The massive trade surplus is permanent..."

The BRICS economic coalition of emerging markets has decided to extend membership invitations to six nations.

The BRICS alliance — which presently reunites Brazil, Russia, India, China and South Africa — is set to invite Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates to join, Ramaphosa said in a speech published on the X social media platform, previously known as Twitter. The new composition of BRICS will control 80% of world oil production. The same goes for the sharp GDP growth of the new BRICS countries. It will amount to 30% of world GDP and exceed $30 trillion. Source: Sprinter, MoneyRadar

Investing with intelligence

Our latest research, commentary and market outlooks