Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bloomberg Commodity index $BCOM vs. US 10-year breakevens is now trading with a massive gap

A divergence we rarely see. Source: TME, LSEG

A very important development for global markets ‼️

➡️ JGBs long-term bond yields are moving LOWER (see below the 30Y over the last month) while the Yen is firming against dollar (From nearly 158 on Sunday evening to roughly 155 this morning, it’s been a significant move in USDJPY). Takaichi landslide victory - which implies fiscal stimulus & tax cuts - hasn't trigger a bond or yen crash. Quite the contrary. Meanwhile, Japan equities continue to move upward. This is quite a compelling development overall for Japan macro & markets landscape.

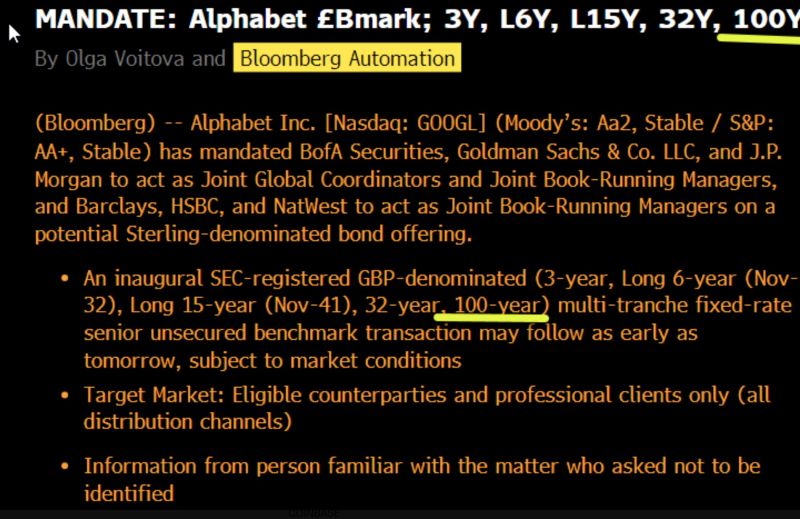

Alphabet has attracted >$100bn of orders for a bond sale that’s expected to be ~$15bn, BBG reports, citing people with direct knowledge of the matter.

The demand is among the strongest ever seen for a corporate bond offering, showing investor hunger to buy debt tied to the AI boom. Alphabet has also mandated banks for potential Swiss franc and Sterling debt offerings, including a rare 100-year Sterling note. Source: Bloomberg, HolgerZ

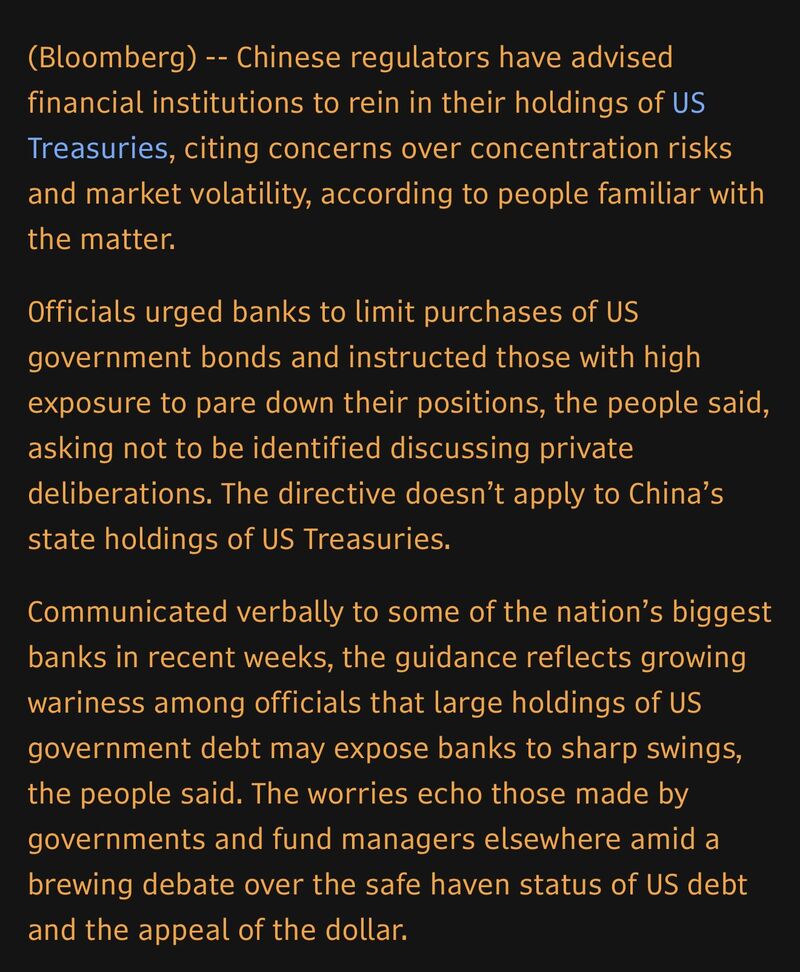

China urges banks to curb us treasuries exposure on market risk

Source: Bloomberg

It looks like negative interest rates are returning to Switzerland...

Government bonds with maturities of up to 4 years are now yielding negative returns. Source: HolgerZ, Bloomberg

Historically, Treasury Yields Rise After Fed Chair Nominations

With the time until the next Fed chair arrives at the Marriner Eccles building fast approaching, BofA Hartnett reminds us that 3 months following seven nominations for Fed Chair since 1970 (Burns, Miller, Volcker, Greenspan, Bernanke, Yellen, Powell), yields were up every time (2-year +65bps, 10-year +49bps)... Source: BofA, zerohedge

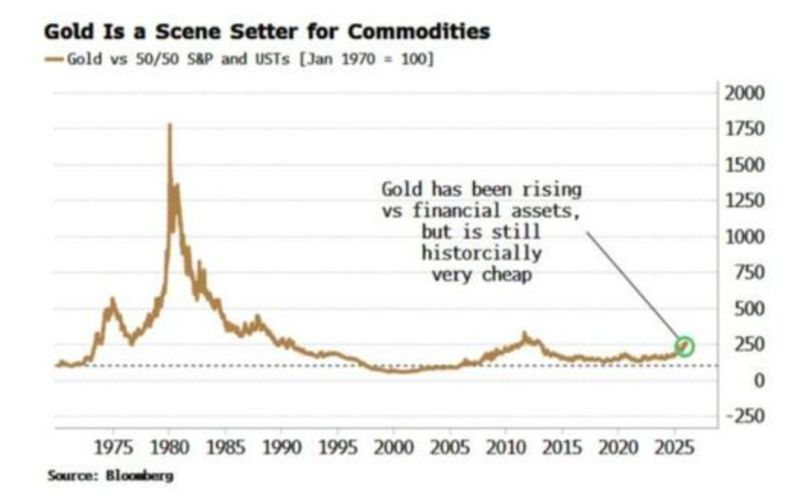

A shocking chart while Gold is flirting with $5,000/oz, it remains historically undervalued versus a 50/50 (S&P 500 / US Treasuries) portfolio

Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks