Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This looks like a very strong trend

Japanese 10-year government bond yield hit 2.07%, the highest since the 1990s. Gold prices hit a record $4,440, rising +68% year-to-date. Finally, silver prices surpassed $66 per ounce for the first time in history, now up +134% year-to-date. When will it end? Source: Global Markets Investor

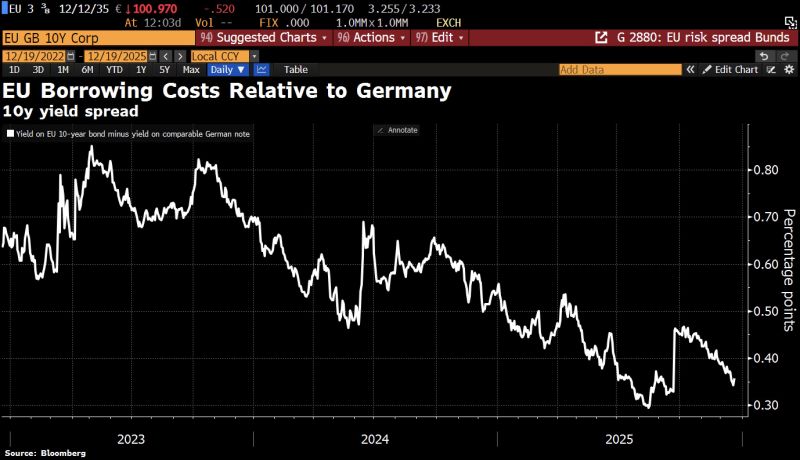

Interesting view by HolgerZ on X

"Chancellor Friedrich Merz has now suffered a setback in foreign policy as well. He was unable to push through the Mercosur trade deal – an agreement that matters greatly for Germany’s economy – and the plan to support Ukraine’s debt relies on the issuance of joint EU debt. As a result, Germany is slowly losing one of its last competitive advantages: its superior credit rating. The risk premium on EU bonds relative to German Bunds has narrowed sharply in recent weeks". Source: HolgerZ, Bloomberg

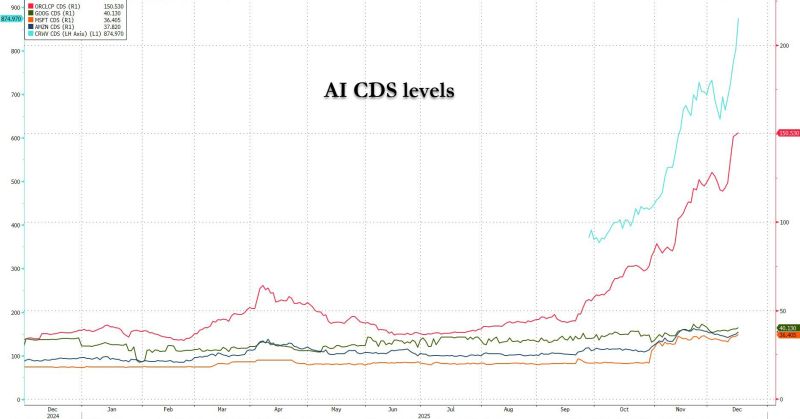

AI CDS levels update

Coreweave in blue Oracle in red Source: www.zerohedge.com

Everyone is talking about Oracle CDS, but Coreweave $CRWC CDS is the real gem...

Source: RBC, Bloomberg

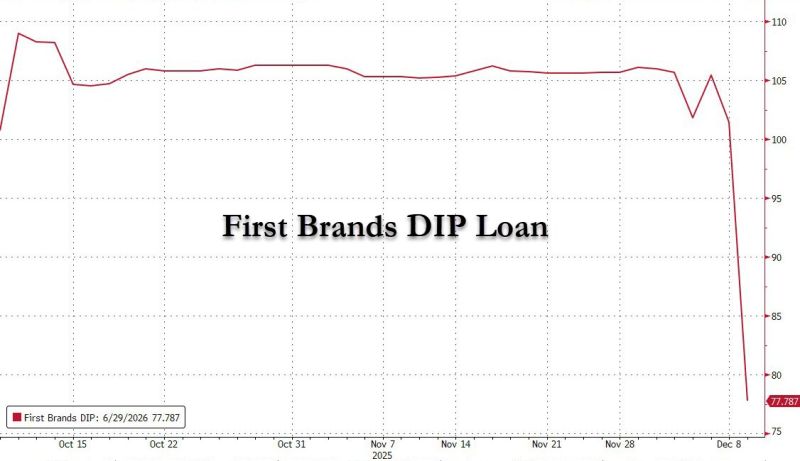

It looks like those who did zero homework on the First Brands term loans did exactly zero homework on the First Brands DIP loans.

A DIP (Debtor in Possession) loan is a form of financing that is provided to companies facing financial distress and who are in need of bankruptcy relief. In other words, the main purpose of DIP financing is to help fund an organization out of bankruptcy. Source: www.zerohedge.com, Bloomberg

Oracle 5Y CDS graph looks exciting $ORCL until you run the math and realize that it is only pricing in 1.93% probability of default per year.

And a 9% 5 year cumulative probability of default... Historically, ORCL CDS traded around 20–40 bps, so 117 bps represents a material repricing of risk, but not a distressed profile. Source: Special Situations 🌐 Research Newsletter (Jay) @SpecialSitsNews

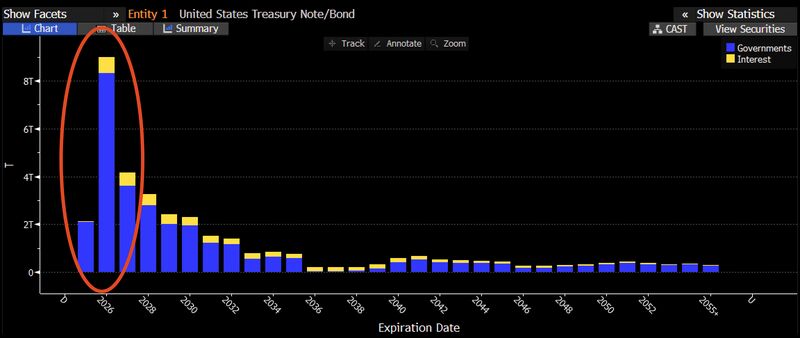

Interesting comment by James Lavish on X:

"With 10 Year UST yields continuing to rise on the eve of another Fed rate cut, it begs the question: Why is the Treasury pushing so hard for more cuts if the market is saying that it will only be inflationary in the long term? Answer: Because so much of US government debt is now short term T-Bills, with every 25bp cut, annual interest expense drops by ~25 billion. Cut rates low enough, and it could slash interest expense in half within the next two years". Source: James Lavish

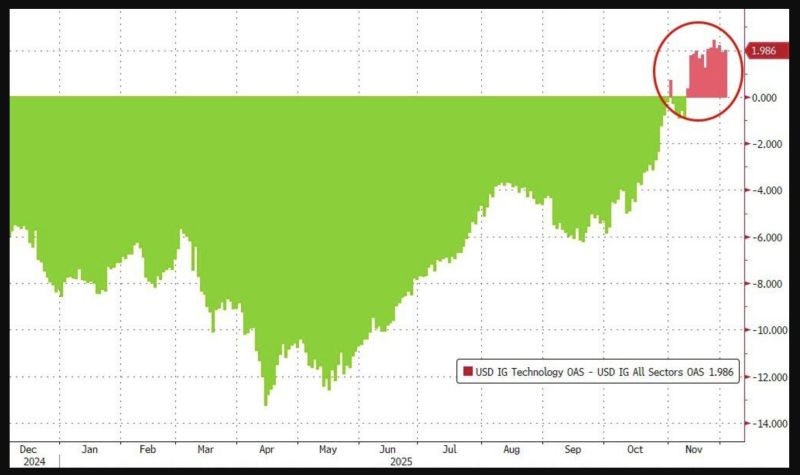

Overall Tech credit Spreads continue to trade wide to the overall IG credit market...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks