Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

More Bonds Are Teetering on the Brink of Junk

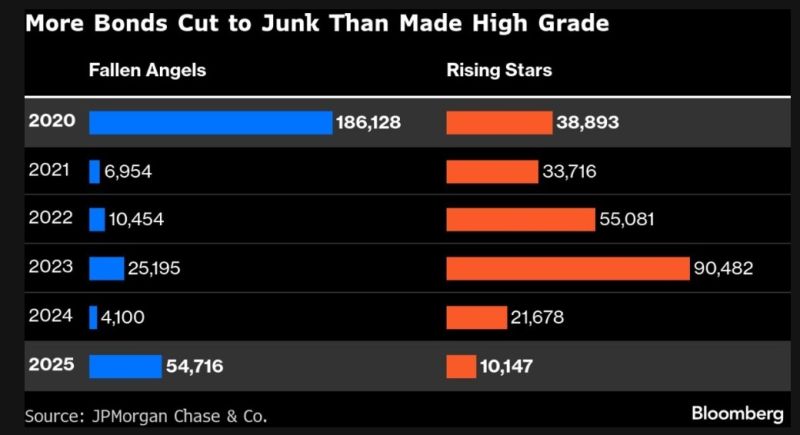

JPMorgan doesn’t anticipate market turmoil anytime soon. Demand from investors is still strong, and earnings will probably be relatively strong in the coming weeks, leaving spreads relatively rangebound. But there are still risks in credit. About $55 billion of US corporate bonds migrated from investment-grade to junk status in 2025, becoming “fallen angels,” according to JPMorgan. That far exceeds last year’s $10 billion of “rising stars,” or firms elevated to high-grade. And the trend is set to continue, the strategists say. Source: Bloomberg, Tracy Shuchart (𝒞𝒽𝒾 ) @chigrl

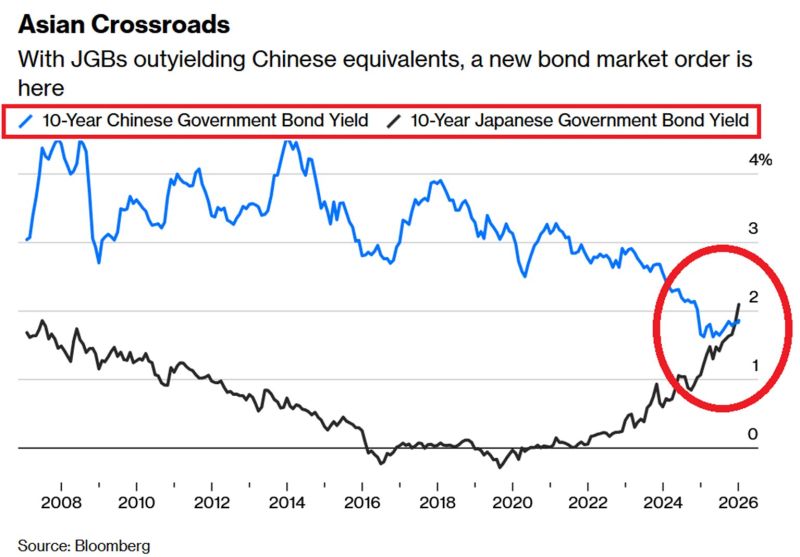

🚨 A HISTORIC REVERSAL IN ASIA. 🚨

For 15+ years, one rule dominated the macro landscape: Chinese yields stay higher than Japanese yields. China was the growth engine; Japan was the land of "Lower for Longer." That world just ended. 🌏 For the first time in decades, Japanese 10-year yields have officially overtaken China’s. We are witnessing a total regime shift in real-time. 📈 The Great Divergence: By the Numbers JAPAN: 10-year JGB yields have skyrocketed from -0.28% (2019) to 2.10%—a level not seen since 1999. CHINA: 10-year yields have plummeted from 3.05% to 1.86%, hovering near record lows. Why is this happening? It’s a tale of two opposite crises: 🇯🇵 In Japan: The BoJ is hiking to 30-year highs. Prime Minister Takaichi is pushing a record FY2026 budget with massive military spending. Fiscal expansion + Rate hikes = A bond market under siege. 🇨🇳 In China: The real estate downturn is biting hard. Deflation risks are mounting, and the central bank is forced to keep easing just to keep the lights on. The "Lose-Lose" Trap for JGB Investors 🪤 If you're holding Japanese bonds, where is the exit? Scenario A (Growth Re-accelerates): The BoJ is forced to hike faster than anyone expects. Bond prices tank. 📉 Scenario B (Growth Slows): JGBs underperform higher-yielding peers like US Treasuries. Investors flee for better returns elsewhere. ⚠️ The Contagion Risk This isn't just a Japan problem. This is a Carry Trade Nightmare. For years, traders borrowed "cheap" Yen at 0% to bet on global assets. Now, the cost of that debt is exploding. If the Yen strengthens and yields keep climbing, the "unwind" could send shockwaves through global markets. The era of free money in Japan is officially dead. Is your portfolio prepared for a world where Japan is no longer the "anchor" of low rates? 💬👇 Source: Global Markets Investor

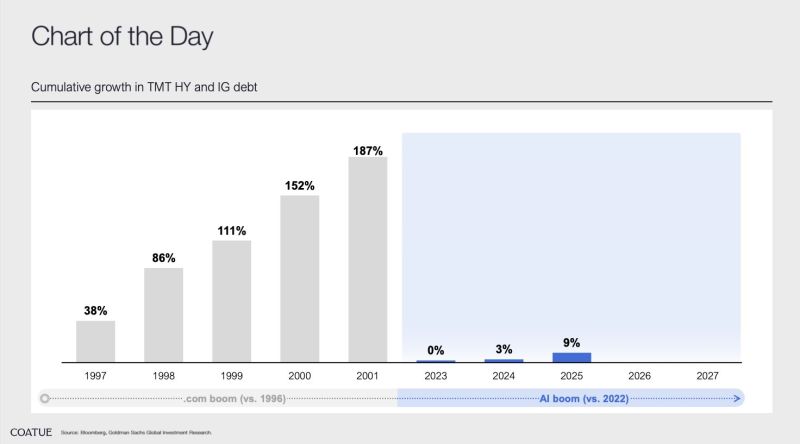

The dot-com boom ran on debt. The AI boom runs on balance sheets.

That difference matters. Source: Goldman Sachs, COATUE

LARGEST FED FUND FUTURES TRADE IN HISTORY 🚨

A bond trader just made the largest fed fund futures bet in history. The trade was a total of 200,000 contracts for January which amounts to a total risk of $8 million per basis point move. Source: Barchart @Barchart Bloomberg

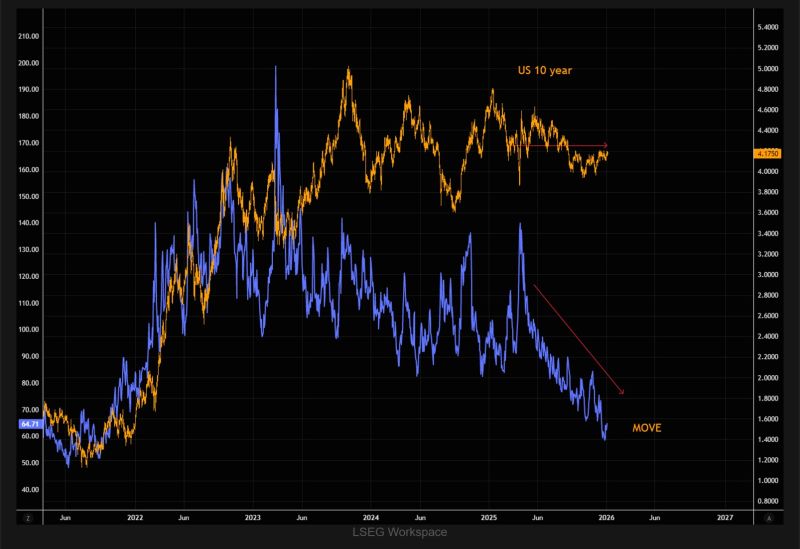

The great vol reset

We’ve seen a massive reset in bond volatility since the Liberation Day chaos. US Treasuries yields have gone nowhere, but at these levels owning some bond volatility offers limited downside with asymmetric upside. Source: The Market Ear, LSEG

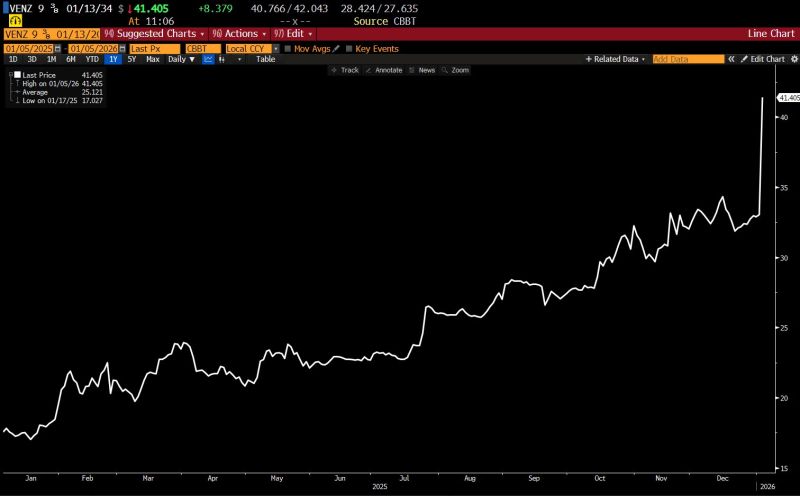

Bonds - not oil - were the play... Venezuela debt has doubled in the last 6 months.

Source: The Long View @HayekAndKeynes

Venezuela sovereign bond CUSIPs below

Source: Bloomberg (These are NOT investment recommendations)

Italy and Spain shake off ‘periphery’ tag as borrowing premiums hit 16-year low

For years, Italy and Spain were labeled the "risky periphery" of the Eurozone. Today? They are the new safe havens. Here is what’s happening in the markets right now (and why you should care): 1. The 16-Year Milestone 📉 Italian and Spanish borrowing costs have hit their lowest levels relative to Germany since 2009. The "risk gap" is evaporating. 2. The "Tale of Two Europes" ↔️ While the South is belt-tightening and growing, the traditional "safe" anchors are drifting: Spain: Set to be the world’s fastest-growing large advanced economy in 2025 (2.9% GDP growth). Italy: Winning over markets with fiscal discipline and a crackdown on tax evasion. France: Struggling with political turmoil and a budget deficit that has pushed its borrowing costs above Spain’s. 3. From "PIIGS" to "Prudent" 💎 Remember the Eurozone crisis? That memory is being replaced by a new reality. Fund managers like Vanguard and BNP Paribas are no longer seeing these as "distressed" assets. They are seeing them as core investments. 4. The Institutional Shift 🏦 The ultimate signal? Ultra-cautious central banks are now looking at Italian and Spanish debt for their foreign reserves. That is the highest stamp of approval a sovereign bond can get. The Lesson: Markets have long memories, but they aren't static. Resilience is built in the tough times. The "periphery" isn't the periphery anymore. It’s the engine. 🚀 Agree? Or is this just a temporary honeymoon phase for the South?

Investing with intelligence

Our latest research, commentary and market outlooks