Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

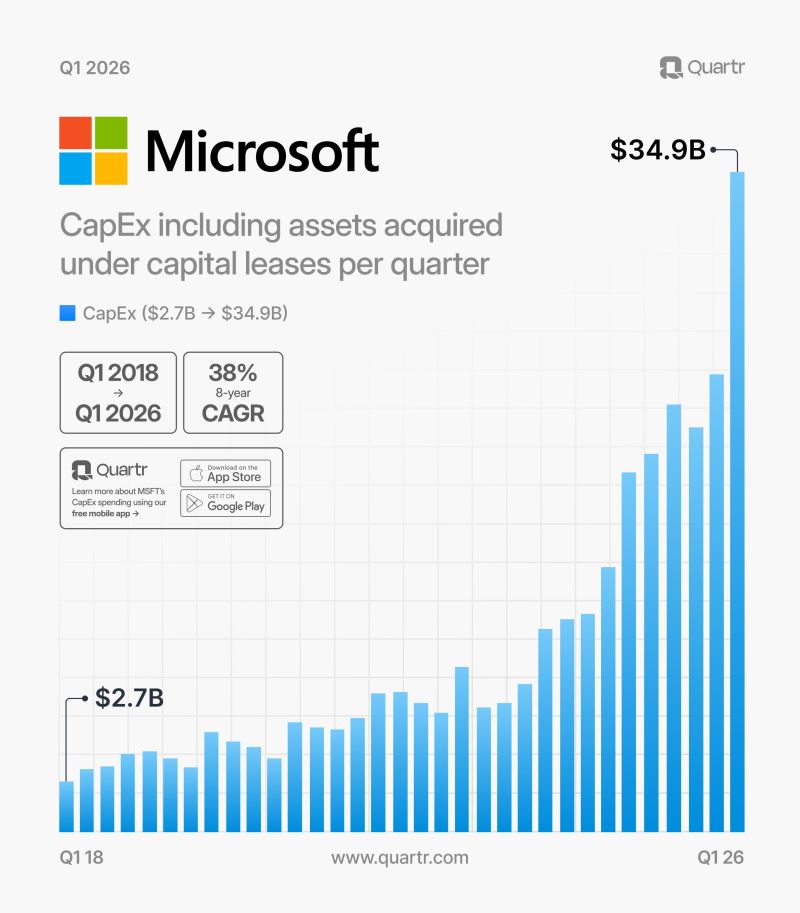

$MSFT with a strong double beat in Q4. The stock is down 6% despite the strong results due to heavy spending.

Microsoft delivered impressive headline numbers, with revenue jumping 17% to $81.3 billion and Azure cloud growth accelerating to 39%, driven by fierce AI demand. The Intelligent Cloud segment is now a massive engine, crossing $32.9 billion in sales. However, capital expenditure nearly doubled to ~$30 billion, raising fears about cash burn. Second, the massive 60% profit jump can be misleading as it includes a $7.6 billion paper gain from the OpenAI investment. Stripping that out, real profit growth was much lower, leaving investors worried that the costs of the AI boom are rising faster than the immediate cash returns. 🔹 EPS: $4.14 vs. $3.91 est. ✅ 🔹 Revenue: $81.27B vs. $80.31B est. ✅ Key takeaways: 🔸 Intelligent Cloud rev: +29% YoY 🔸 Productivity rev: +16% YoY 🔸 Computing rev: -3% YoY 🔸 MSFT Cloud rev: +26% YoY 🔸 Azure/Cloud: +39% YoY Source: KaizenInvestor @Kaizen_Investor Barchart

$MSFT & $ORCL are heavily tethered to OpenAI for their AI backlog.

$AMZN is building AI demand without that dependence which makes AWS growth cleaner while the other two look like a leveraged bet on OpenAI. Source: Shay Boloor @StockSavvyShay FT

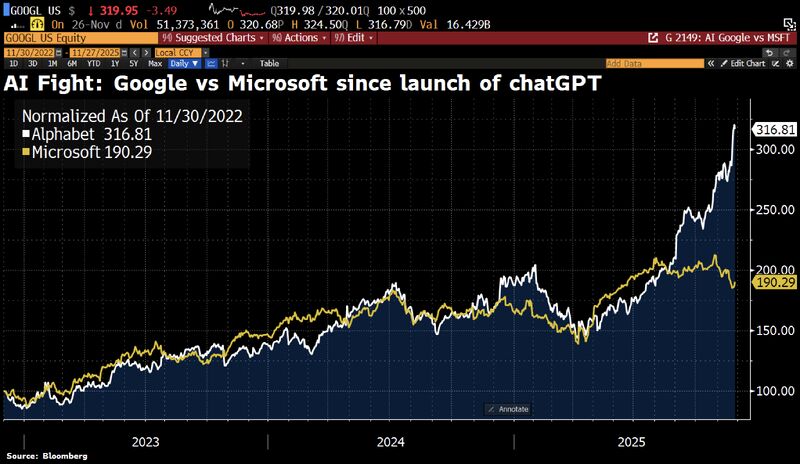

It now looks as if the race between Microsoft and Google for the best AI strategy has been decided

Source: HolgerZ, Bloomberg

Elon predicts that OpenAI will eat Microsoft alive and believes MSFT should stop supporting it.

Source: The AI Investor @The_AI_Investor

💥 Microsoft’s latest SEC filing quietly revealed a lot about OpenAI’s finances.

According to the numbers, OpenAI lost roughly $11.5 billion last quarter — a figure inferred from Microsoft’s own disclosures. 📊 With a 27% stake in OpenAI, Microsoft recorded a $3.1 billion hit to its net income, pointing to massive operating losses at its AI partner. 💸 The filing also shows Microsoft has now funded $11.6 billion of its $13 billion total commitment to OpenAI — and those losses are now being reflected directly in Microsoft’s earnings under equity accounting rules. 🤔 The takeaway: the AI boom is incredibly expensive, and even the biggest players are feeling the weight of the burn rate.

In Q1 2026, Microsoft $MSFT's CapEx totaled $35B, up 44% QoQ

That brings Last Twelve Months (LTM) CapEx to over $100B. Source: Quartr

$MSFT is following the path of $GOOGL

This translates to around $340,000 for every citizen, making it one of the richest countries per capita. Source: Massimo @Rainmaker1973, Quartr

OPENAI IN TALKS WITH $MSFT TO SECURE FUNDING & PAVE PATH TO IPO 😳

OpenAI and Microsoft are rewriting the terms of their multibillion-dollar partnership in a high-stakes negotiation designed to allow the ChatGPT maker to launch a future IPO, while protecting the software giant’s access to cutting-edge artificial intelligence models. Microsoft, OpenAI’s biggest backer, is a key holdout to the $260bn start-up’s plans to undergo a corporate restructuring that moves the group further away from its roots as a non-profit with a mission to develop AI to “benefit humanity”. A critical issue in the deliberations is how much equity in the restructured group Microsoft will receive in exchange for the more than $13bn it has invested in OpenAI to date. Source: Shay Boloor @StockSavvyShay, FT

Investing with intelligence

Our latest research, commentary and market outlooks