Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

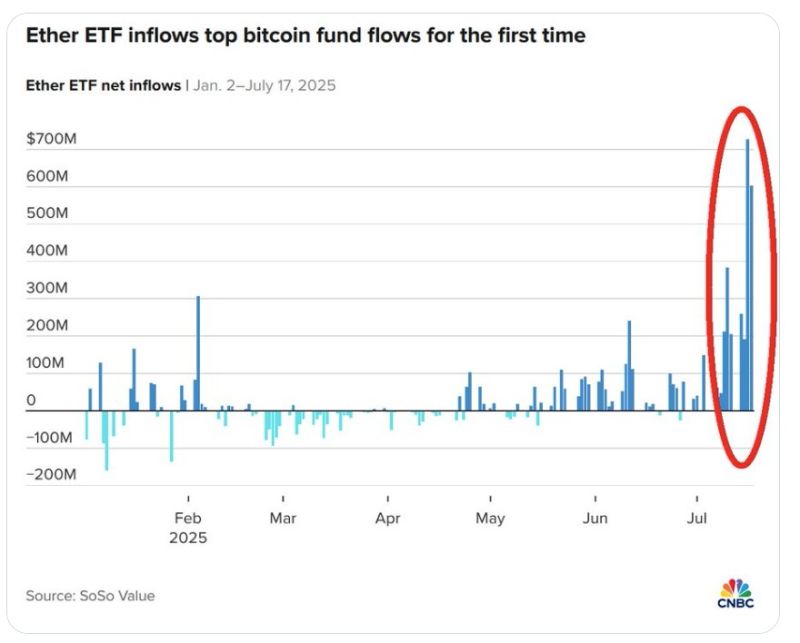

Ether ETFs See Record $1 Billion Inflows

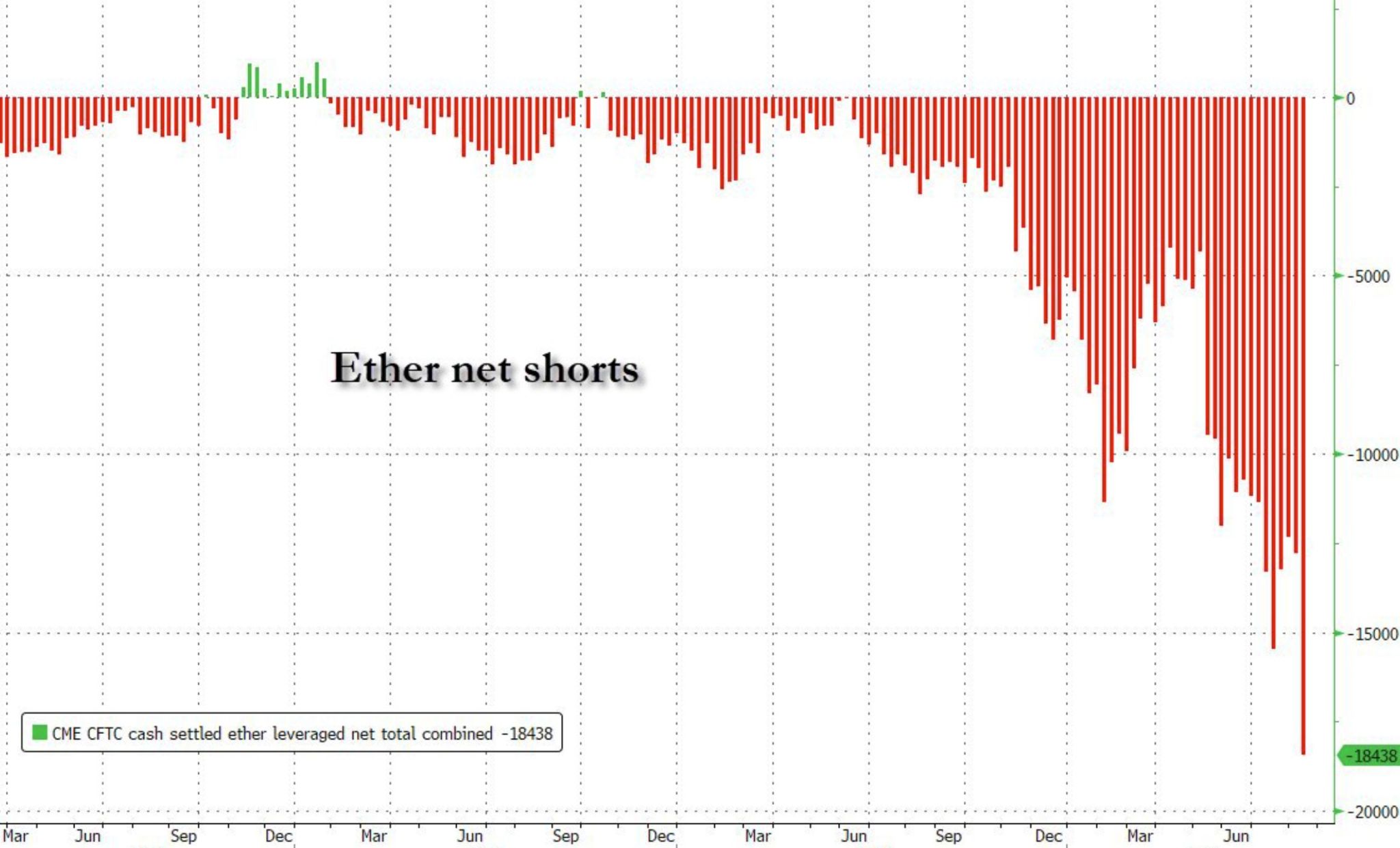

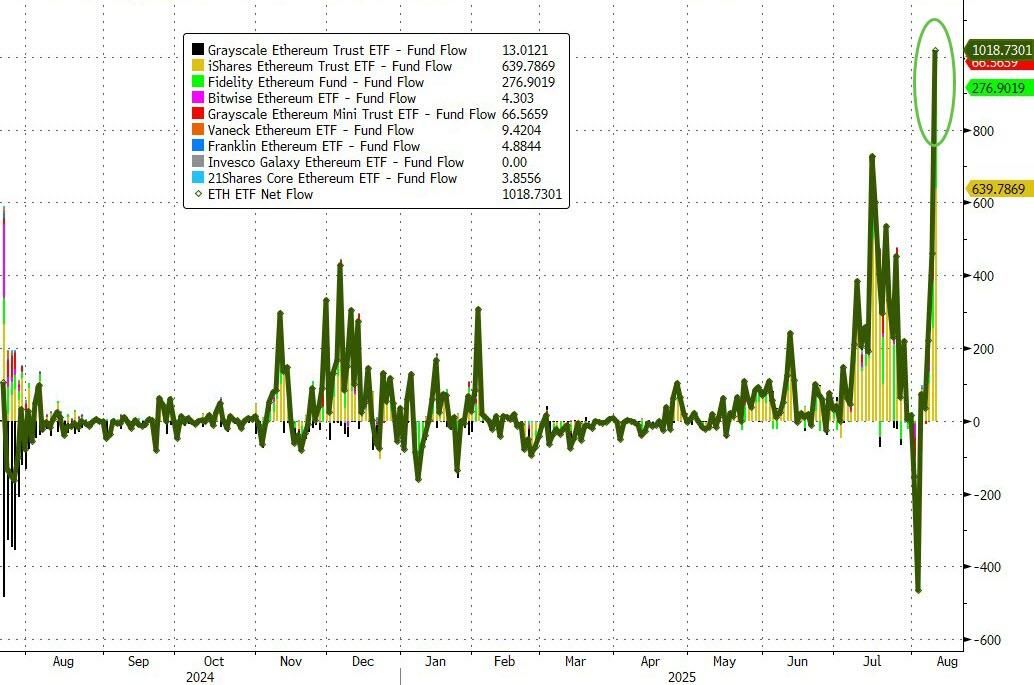

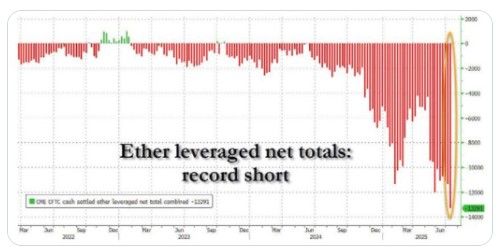

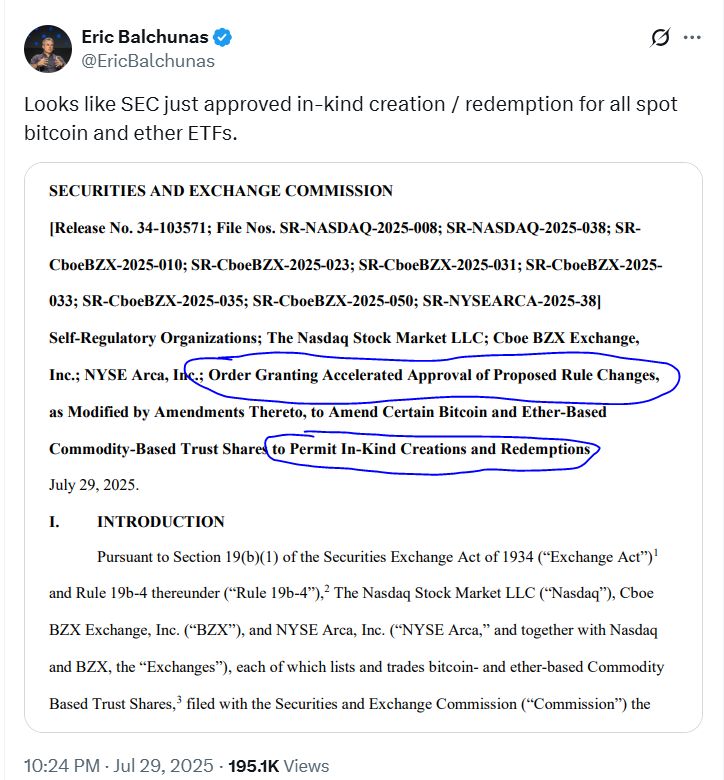

👉 Inflows into Ether ETFs far exceeded those of their Bitcoin counterparts, which saw a net inflow of $178 million on Monday, according to Farside Investors. 👉 CoinTelegraph's Tarang Khaitan reports that for the Ether funds, BlackRock's iShares Ethereum Trust ETF (ETHA) attracted the lion’s share of flows, with a record $640 million going into the fund. 👉 The Fidelity Ethereum Fund (FETH) was the runner-up and also recorded its largest single-day inflow, taking in $277 million. Source: zerohedge, Bloomberg

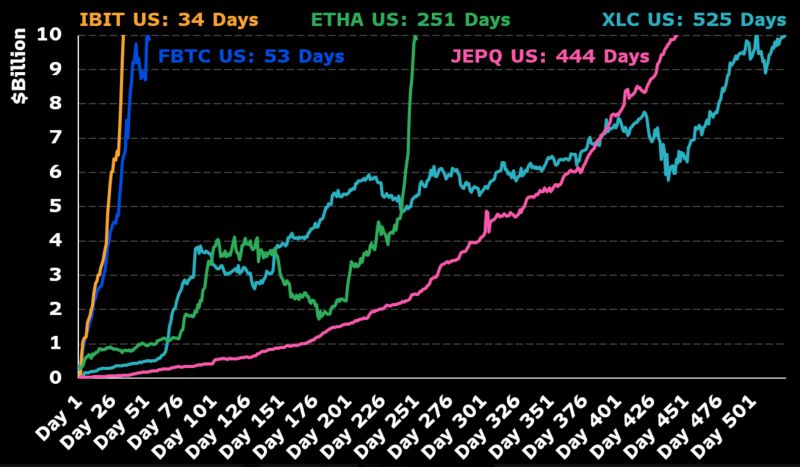

LOOK OUT: $ETHA iShares ethereum Trust ETF just hit $10b in one year flat, the 3rd fastest ETF to hit that mark in history after (you guessed it) two bitcoin ETFs $IBIT & $FBTC.

Amazingly it went from $5b to $10b in just 10 days. The ETF is Top 5 in flows for the last month and the week Source: Bloomberg, Eric Balchunas

Ether ETFs saw $534 million in inflows on Tuesday, the 4th largest on record.

BlackRock alone bought $426 million. That’s now 13 straight days of inflows, totaling over $4 BILLION. Investors including Wall Street are going ALL IN on cryptos. Source: Global Markets Investor

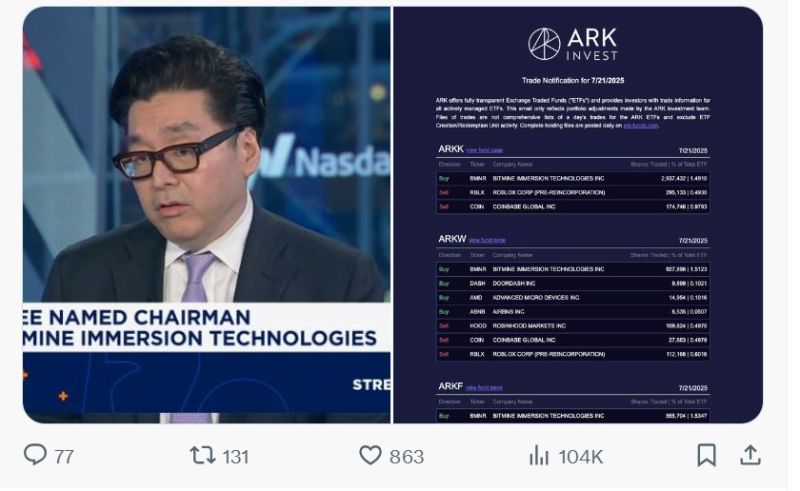

Cathie Wood and Ark Invest bought 4,421,034 shares of Tom Lee's new Ethereum Treasury Company $BMNR

Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks