Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

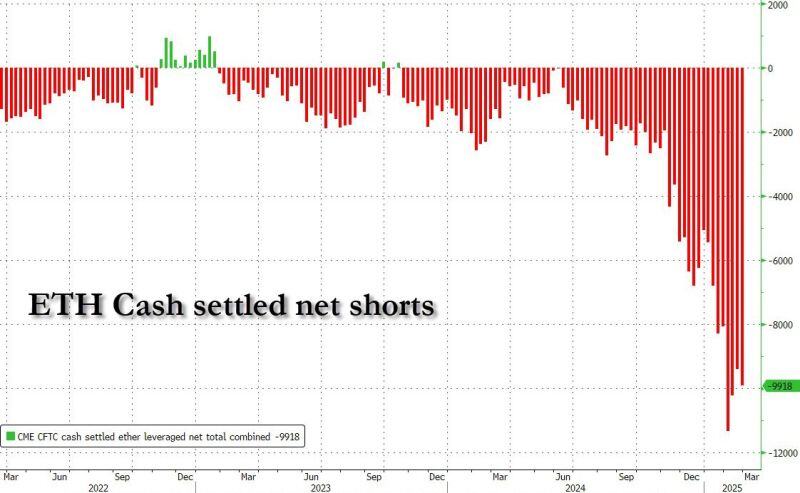

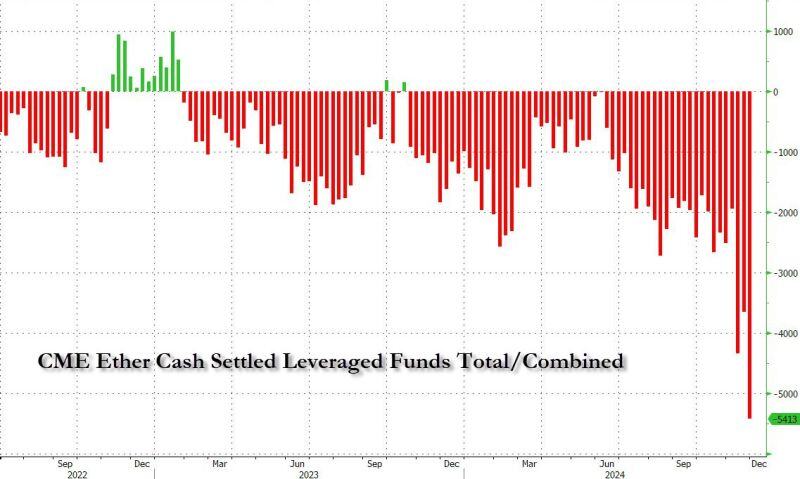

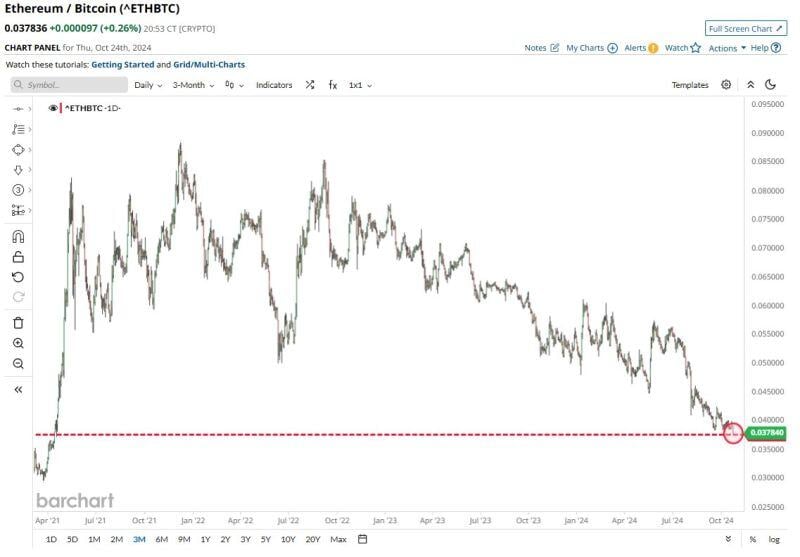

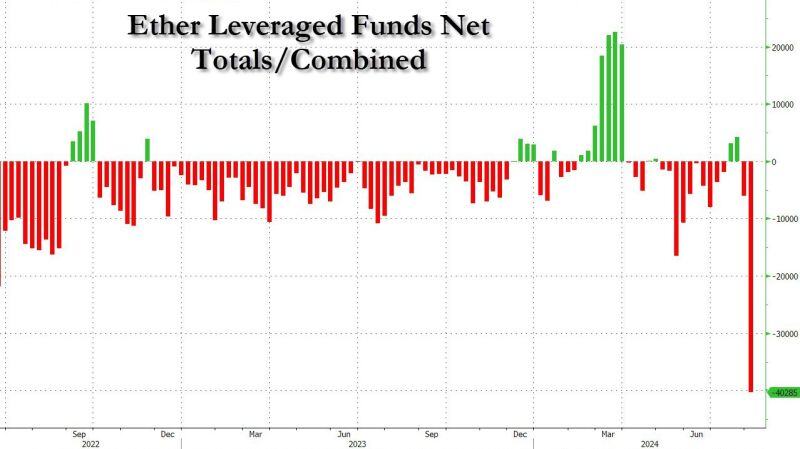

About that ether crash last week: biggest surge in CFTC Ether leveraged shorts on record

Source. Bloomberg, CFTC, www.zerohedge.com

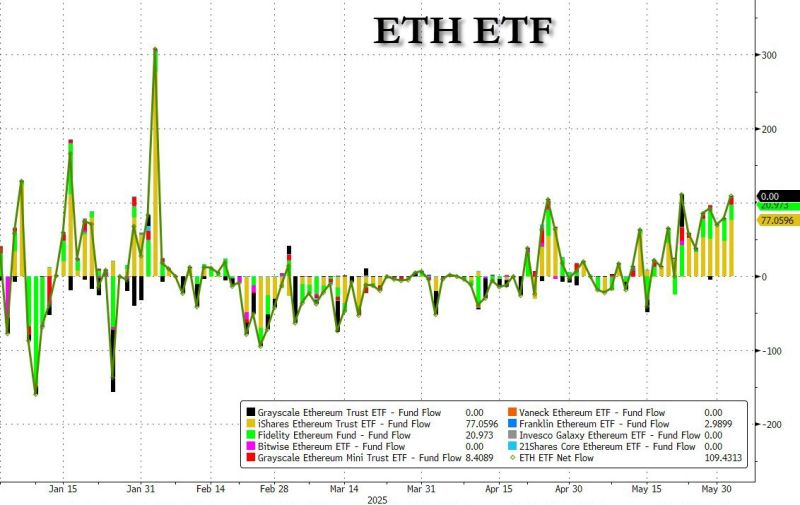

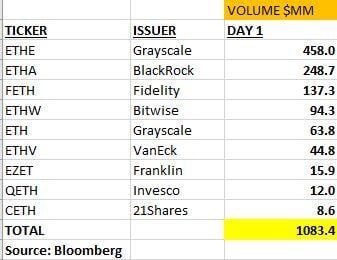

DAY ONE in the books for ETH ETFs who did $1b in total volume, which is 23% of what the spot bitcoin ETFs on their first Day and $ETHA did 25% of $IBIT's volume.

The gap between $ETHE and The Newborn Eight is a healthy +$625m (a sizable chunk of which *should* convert to inflow Source: Eric Balchunas

Investing with intelligence

Our latest research, commentary and market outlooks