Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What’s worrying billionaires?

• Trade tensions, geopolitics, and policy uncertainty top the list • Tariffs dominate in Asia-Pacific and inflation and conflict lead fears in the Americas Source: Visual Capitalist

The Trump Administration secretly smuggled 6,000 Starlink satellite terminals into Iran in January after the Iranian government cut off internet in the country, per WSJ.

Source: The Kobeissi Letter

Japan’s prime minister Sanae Takaichi has led her party to a crushing victory in Japan’s snap general election on Sunday

Japan’s Prime Minister Sanae Takaichi won a landslide election, securing a two-thirds majority that enables major reforms. Her agenda includes strong economic stimulus, tax relief on food, increased tech investment, and possible constitutional change. Markets welcomed the political stability, pushing Japanese stocks to new highs.

Trump: He who has the gold makes the rules

European gold in US custody: - Germany: ~40% of gold holdings - Italy: ~50% - Netherlands: ~30% Not your vault, not your gold ??? Source: Lukas Ekwueme @ekwufinance

Chinese-financed infrastructure projects across Latin America

Source: Amazing Maps

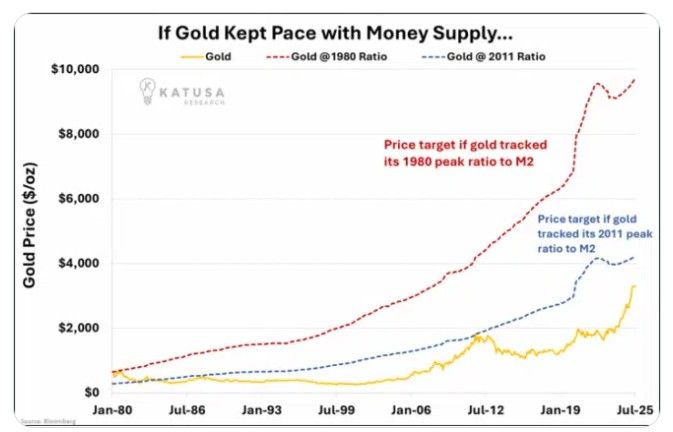

Gold would be ~$9,700 if it kept up with M2 To hit $40,000/oz, Gold would need to add about $246 Trillion in market cap from today's levels.

Source: Katusa Research @KatusaResearch

ECB President Christine Lagarde: "Europe is going to do a big SWOT analysis and decide what do we need to do to be strong by ourselves."

Source chart : FT Source image: Reuters

Investing with intelligence

Our latest research, commentary and market outlooks