Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

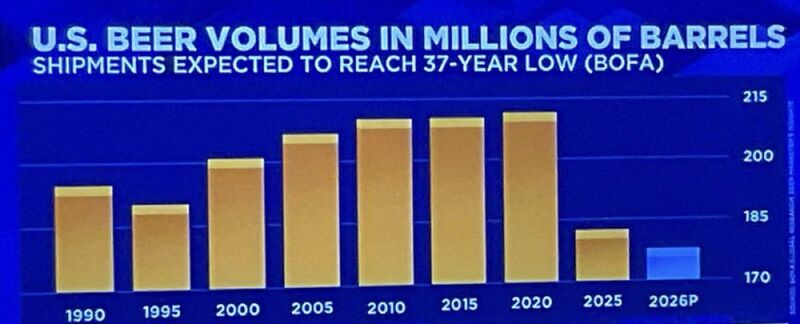

BREAKING Beer

Beer Shipments on track for worst year since the 1980s Source: Barchart @Barchart

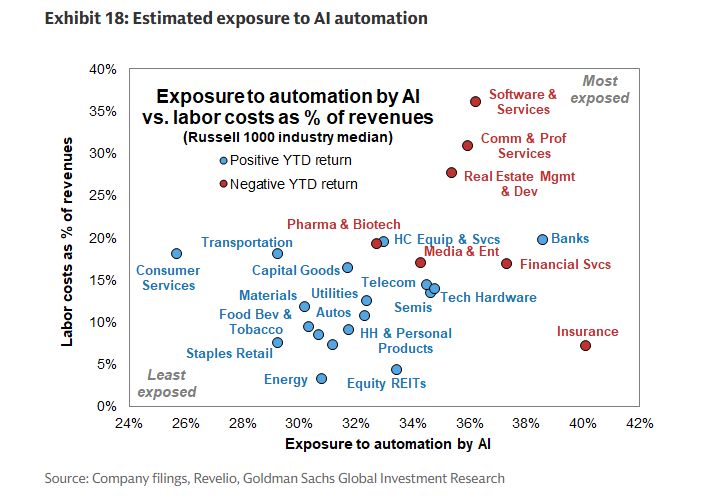

Disruption risk from AI, a sector point of view

The most exposed are in the high/right corner, and most of these have a negative YTD return. Source: Credit From macro to micro @Credit_Junk

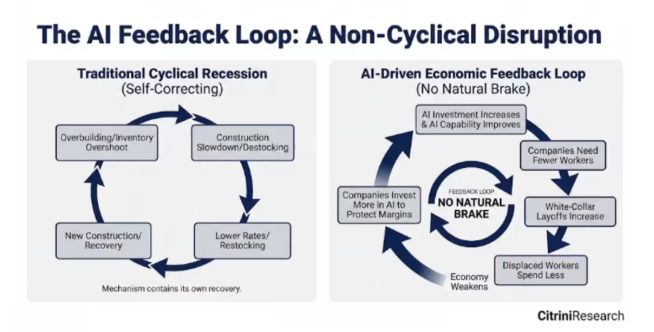

Here's a MarketWatch article on how AI could eventually lead to a job-destroying feedback loop leading to double-digit unemployment rate in the US.

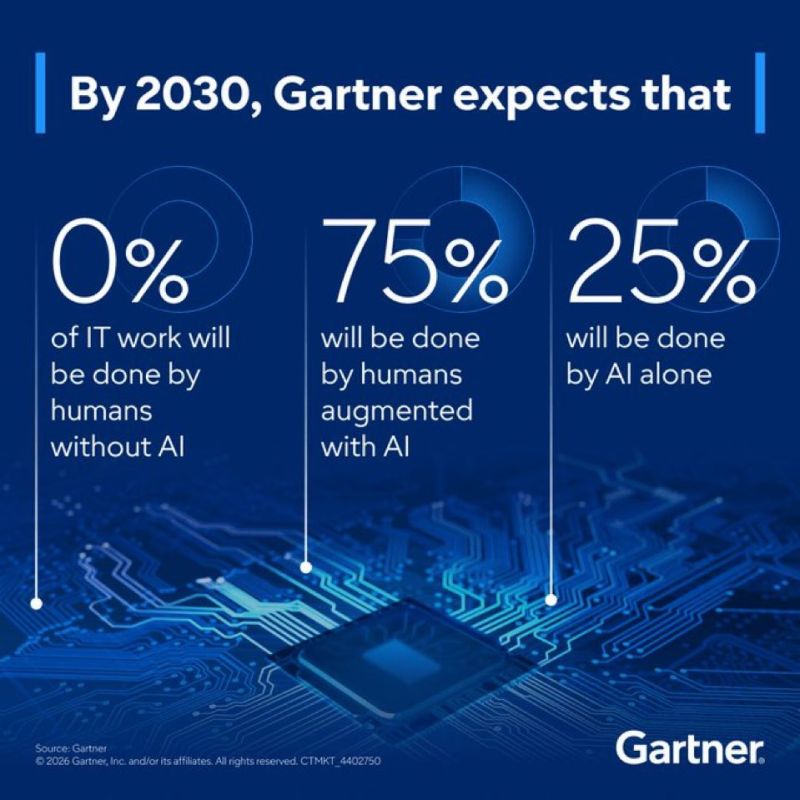

The piece, co-authored by Citrini Research and guest Alap Shah, managing partner at Lotus Technology Management, is written as a lookback from June 2028, when the unemployment rate has just risen to 10.2% and the S&P 500 is down 38% from its Oct. 2026 highs around 8,000. It starts with software-as-a -service companies losing sales as client demand falls, but AI usage quickly this year becomes the default among consumers and businesses constantly finding the cheapest and best option, reducing margins and profits. This leads to a collapse in white-color hiring (white-collar workers represent 50% of employment and drive roughly 75% of discretionary consumer spending), but the downturn will be secular as companies lean into AI, "a feedback loop with no natural break". Initial jobless claims spike to 487,000 by next February, the S&P 500 drops, and by the second quarter of 2027 there’s a recession when “the daisy chain of correlated bets” will start to fracture rippling through the economy impacting everything from house prices to elections. "This isn’t bear porn or AI doomer fan-fiction. The sole intent of this piece is modeling a scenario that’s been relatively underexplored,” they say. Source: Citrini Research, Neil Sethi @neilksethi

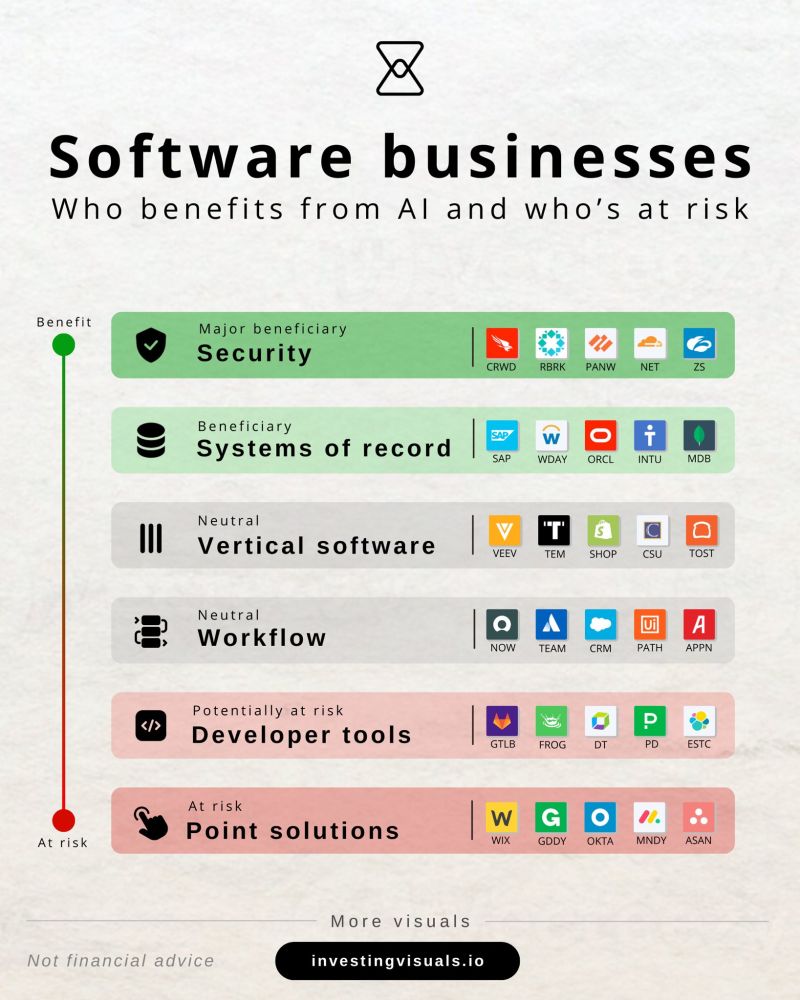

Here’s a mental framework by InvestingVisual on the software universe.

The market keeps selling off high quality names. Not all software is created equal, but the market is treating it like that. Some buying opportunities?

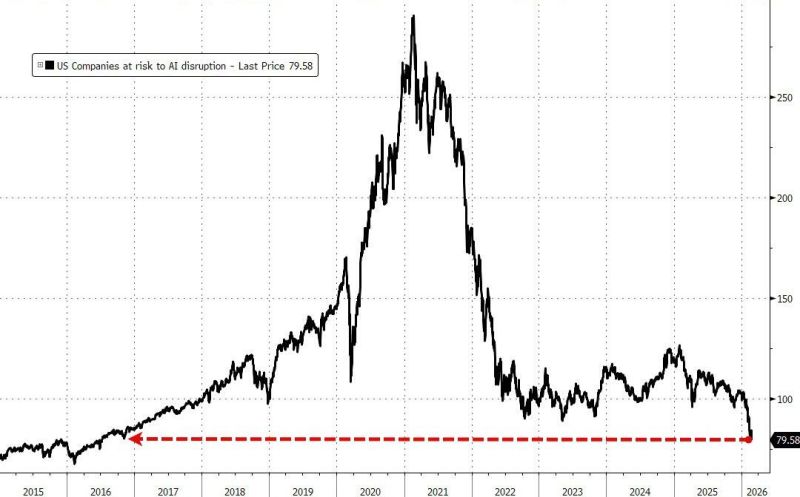

Yesterday, rising anxiety over the impact of AI disruption on multiple sectors resurfaced

exacerbated by a note from Citrini Research that was passed around getting over 20mm views, saying nothing new but re-highlighting the potential impact on jobs and tech firms in the next few years... “The sole intent of this piece is modeling a scenario that’s been relatively underexplored,” a preface to the article, which was published Sunday, said. “Hopefully, reading this leaves you more prepared for potential left tail risks as AI makes the economy increasingly weird.” Investors, once again, dumped shares of any company seen at the slightest risk of being displaced which lead Goldman's AI-at-Risk basket fell to its lowest since Nov 2016... Since: Bloomberg, zerohedge

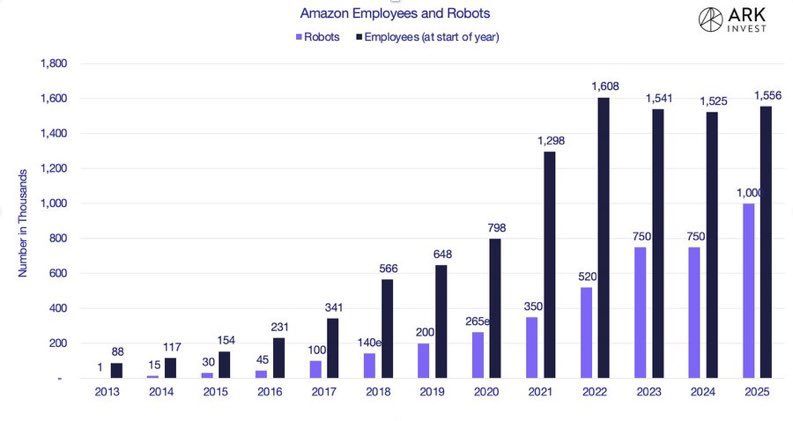

$AMZN has 1.5 million employees and deployed 1 million robots.

It’s actively replacing humans with robots as human/robot ratio declined from 3 in 2020 to 1.5 in 2025. Imagine what’ll happen to margins as the number of robots deployed passes the number of employees. Source: Oguz Erkan @oguzerkan Ark Invest

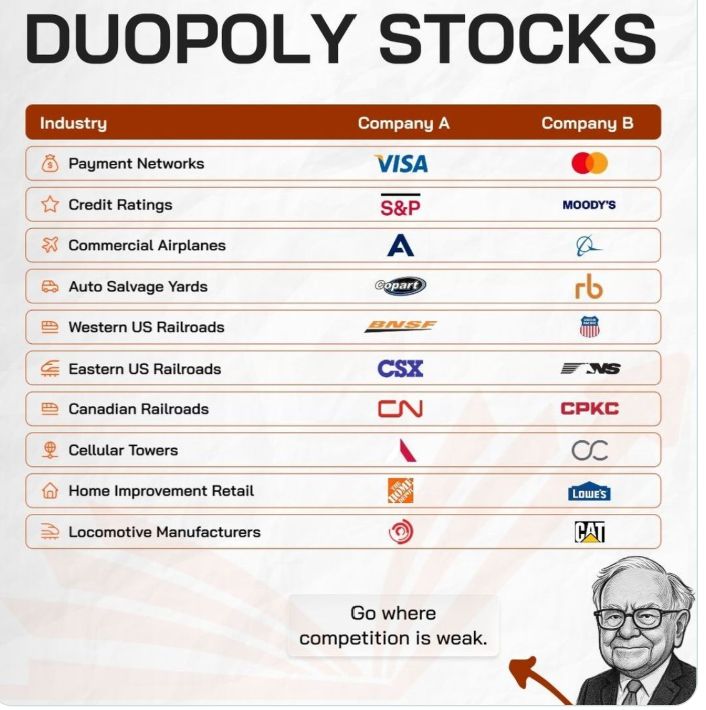

Among the strongest duopoly stories in the world

NB: These are NOT investment recommendations Stocks World @anandchokshi19

Investing with intelligence

Our latest research, commentary and market outlooks