Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

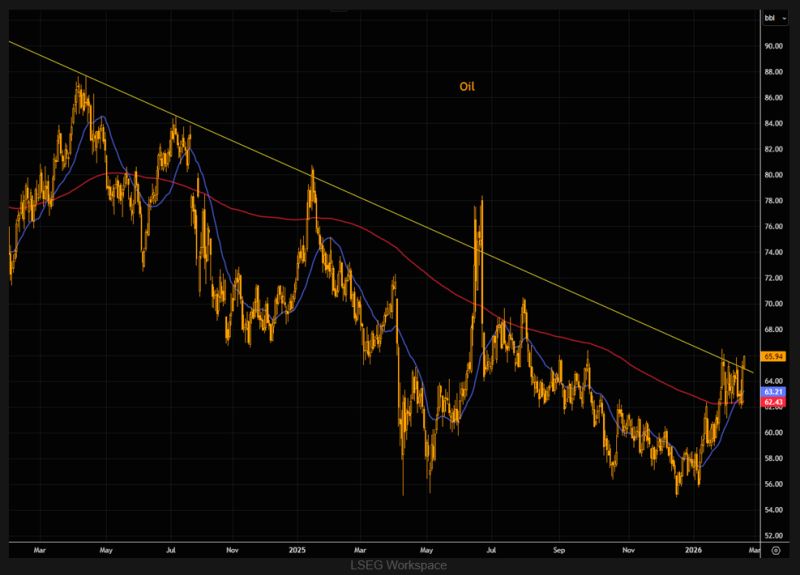

The United States now produces more oil than Saudi Arabia and Russia combined

This also explains why oil shocks today tend to be shorter-lived than in the past. There is simply more swing capacity in the system, and a lot of it sits in the US... Source: Jack Prandelli @jackprandelli

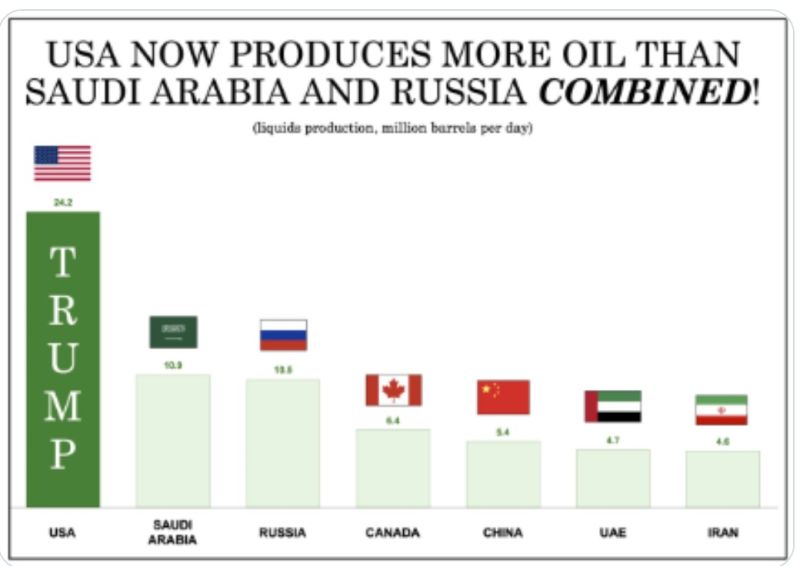

Iran’s Oil Output: A 46-Year Milestone You Might Have Missed

For the first time since 1978, Iran’s oil output has reached about 5.5 million barrels per day, marking a structural shift rather than a simple recovery. After years of volatility, production has surged since 2020, driven largely by growth in condensates and natural gas liquids (NGLs), which are less constrained by sanctions than conventional crude. Much of this supply is moving discreetly to China via shadow fleets, adding hidden liquidity to global markets and helping restrain oil prices despite geopolitical risks. Bottom line: Iran is re-emerging as a major energy player in a form that is harder to sanction, raising questions about how effective traditional oil sanctions remain in today’s market. Source: Jack Prandelli on X

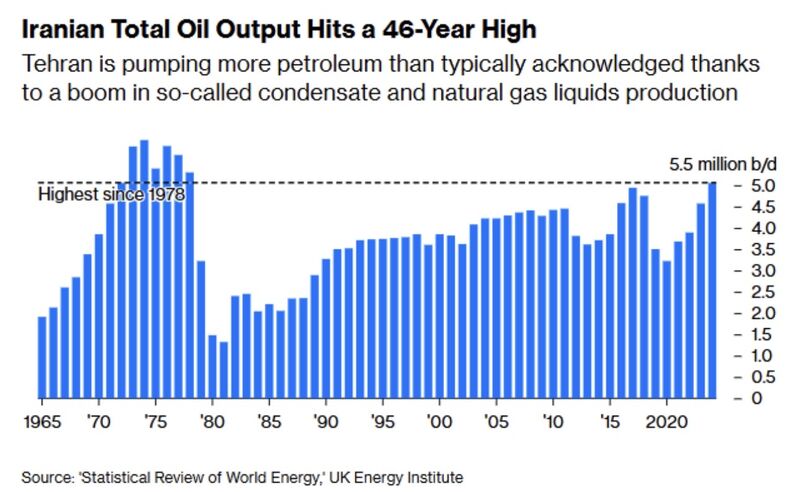

Iran is now the #1 risk for global oil markets

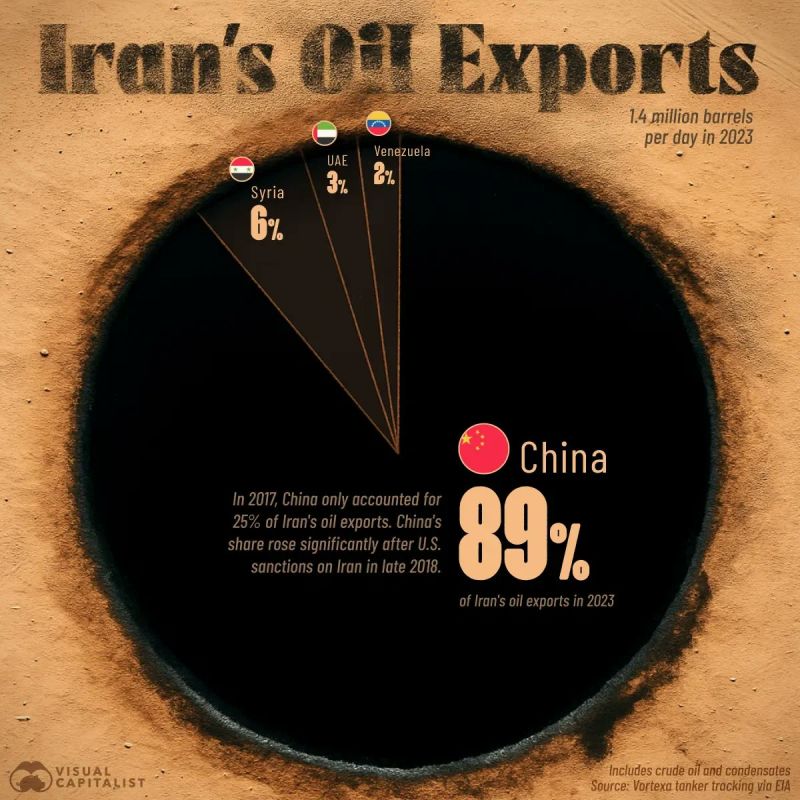

The global energy balance has shifted sharply as China now absorbs nearly 90% of Iran’s oil exports, up from 25% in 2017, creating a dangerous concentration of risk. Any disruption in Iran now directly threatens China’s energy security. The 2026 oil market is under pressure from rising political instability in Iran, already reflected in a $3–4/barrel geopolitical risk premium. Iranian oil stored offshore has reached record levels as buyers hesitate amid escalating sanctions and military risks. At the same time, the U.S. is threatening 25% tariffs on countries trading with Iran, extending the conflict from energy into global trade. With Iran increasingly reliant on Chinese “teapot” refiners, a break in this relationship could trigger severe economic fallout for Tehran and disrupt sanctioned oil flows globally. The system moving sanctioned oil is fragile, raising the risk of a supply shock for China and a major test of U.S. enforcement credibility. Source: Jack Prandelli in X, Visual Capitalist

We aren't just talking about trade embargoes or "backdoor deals" anymore. We are talking about a direct naval showdown on the high seas. 🌊⚓️

Here is the situation: The U.S. is moving to seize the Marinera, a Russian-flagged tanker carrying sanctioned Venezuelan oil. Russia’s response? They deployed a submarine to escort it. 🇷🇺🇻🇪🇺🇸 The Breakdown: -> The Move: The U.S. is enforcing sanctions with physical force. -> The Counter: Moscow is signaling they will use military hardware to protect their assets. ->The Global Ripple: China is watching closely. 🇨🇳 Why this matters: This isn't just about oil prices. It’s about the shift from Economic Diplomacy to Kinetic Confrontation. If the U.S. succeeds, American sanctions become the ultimate global law. If Russia blocks them, the era of U.S. naval dominance faces its biggest test in decades. Source: Mario Nawfal on X, Reuters, @sentdefender, WSJ

30,000,000 to 50,000,000 barrels. 🛢️

That is the scale of the move Donald Trump just announced. The US is officially escalating its push into the Venezuelan oil sector. Here is the breakdown of what is happening right now: 🚀 The Move: A US flotilla is already inbound to Venezuelan waters. The goal? To load up to $3B worth of "stranded" crude and bring it directly to US docks. ⚖️ The Control: Trump has stated this money will be controlled by the White House to "benefit the people of Venezuela and the United States." Energy Secretary Chris Wright is already on the move to execute. 🏗️ The Crisis: Venezuela’s infrastructure is at a breaking point. Without this "relief," analysts predict a total production collapse. Storage is full. The pumps are stopping. 📉 The Market: Brent and WTI are already reacting, sliding as the world braces for the "Donroe Doctrine." The Big Debate: Is this a strategic masterstroke to stabilize a collapsing neighbor and secure US energy interests? Or, as Yale’s Jeffrey Sonnenfeld suggests, is it an "imperialistic" move in a world already facing an oil glut? One thing is certain: The "wait and see" approach to Venezuela is officially over. We are watching a real-time restructuring of global energy flows. The meeting between the Energy Secretary and Chevron executives in Miami today will likely set the tone for the next decade of South American energy. Your turn: Is this the right move for US energy security, or does it set a dangerous precedent? 👇 Let’s discuss in the comments. Source: FT

US oil stocks react to Venezuela:

1. Chevron, $CVX: +11% 2. Valero, $VLO: +11% 3. ConocoPhillips, $COP: +10% 4. Marathon, $MPC: +10% 5. Exxon Mobil, $XOM: +7% 6. Phillips 66, $PSX: +6% 7. Occidental Petroleum, $OXY: +4% 8. EOG Resources, $EOG: +4% 9. Devon Energy, $DVN: +4% 10. Kinder Morgan, $KMI: +3% These stocks have now added +$100 BILLION in market cap on the news President Maduro being captured by the US. US big oil has won again. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks