Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

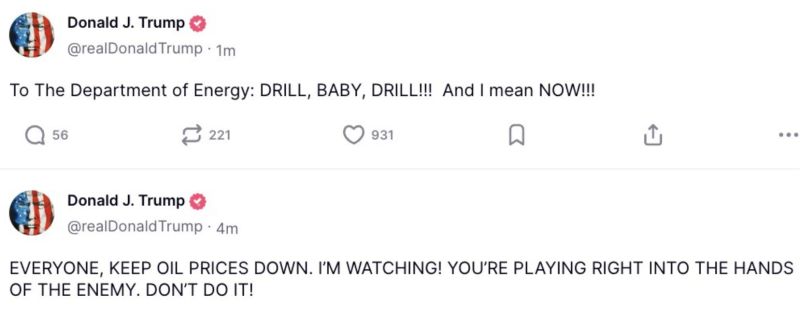

⚠️ President Trump just put out these comments about oil and energy

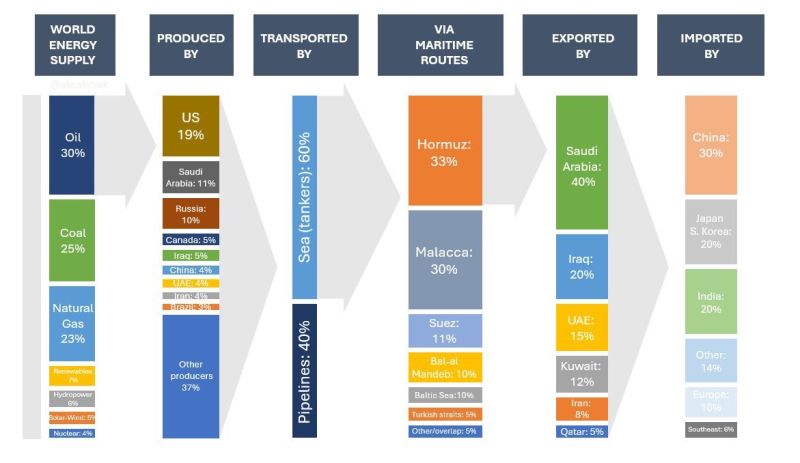

President Donald Trump on Monday demanded that “everyone” needs to “keep oil prices down” or they would play “into the hands of the enemy.” ➡️“EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!,” the president said in a post on his social media platform Truth Social. Trump’s message comes after his decision to bomb Iran’s key nuclear sites over the weekend has put the world on edge that the Islamic Republic might target energy supplies in the Middle East. It wasn’t clear who specifically Trump was speaking to in his post, though he was likely addressing the U.S. oil industry. Some oil companies had warned earlier in the year that they might have to cut production after prices tumbled to multiyear lows on Trump’s tariffs and OPEC+ boosting supply. ➡️“To The Department of Energy: DRILL, BABY, DRILL!!! And I mean NOW!!!,” Trump said in a subsequent post on Monday.

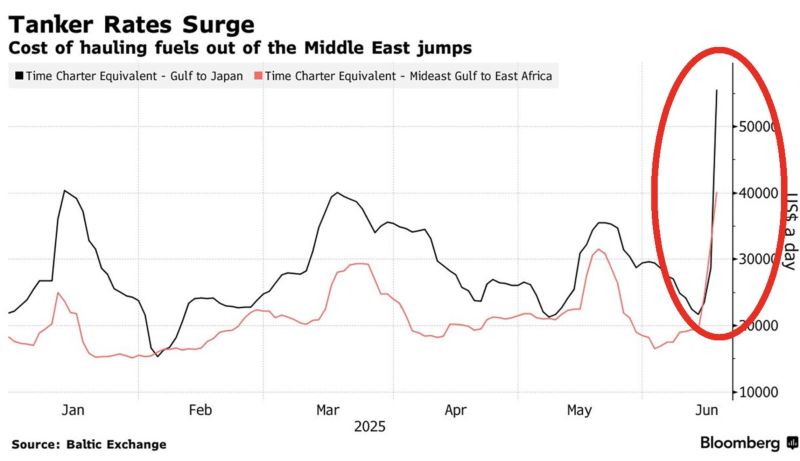

⚠️Middle East oil shipping costs are SPIKING:

Persian Gulf-Japan tanker rates hit $55k/day, the highest in over a year, while East Africa routes hit $40k, a multi-month peak. Costs doubled in 2 weeks amid the Israel-Iran conflict.

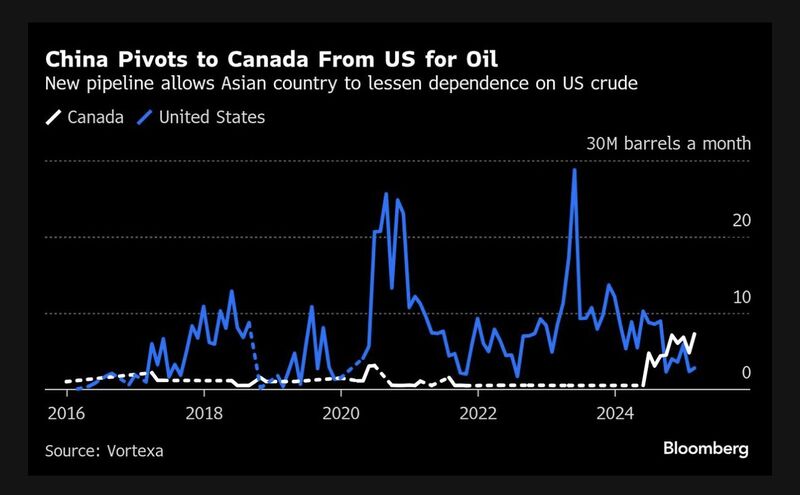

Oil drops on signs conflict may space Iranian crude production

Oil fell as the conflict in the Middle East has so far avoided disrupting crude production and the Wall Street Journal reported that Iran privately expressed willingness to deescalate hostilities with Israel. West Texas Intermediate tumbled as much as 4.9%, after spiking higher at the open, after the newspaper said Tehran would be open to returning to the negotiating table as long as the US doesn’t join the attack. The development quelled fears that a protracted conflict would engulf a region that produces around a third of the world’s crude. Source: Bloomberg

Oil jumped as much as 14%

- biggest daily gain in more than 5 years - as Israel launched a series of airstrikes in Iran, and escalated the long-simmering conflict between the two nations into a full-on war. ➡️ The strikes targeted sites linked to Iran’s nuclear enrichment program, as well as top scientists Fereydoun Abbasi-Davani and Mohammad Mehdi Tehranchi, both of whom were killed, Iranian media reported. ➡️The commander-in-chief of Iran’s Islamic Revolutionary Guard Corps, Hossein Salami, was also killed in a strike. ➡️Netanyahu says attacks would ‘roll back’ Iran threat ➡️Tehran vows retaliation against Israel and US ➡️Washington distances itself from ‘unilateral’ attack. Trump said he will to convene National Security Council meeting. ➡️Oil prices jumped more than 10% as traders anticipated tighter supply. ➡️Gold is up 1.5% at $3,450. S&P 500 futures are down -1.5%. Bitcoin is down 3% at $104k

🟥 Crude Oil is now back above its 100 day moving average for the first time in more than 2 months.

‼️ Oil prices edged higher on Thursday to their highest in more than two months, after U.S. President Donald Trump said U.S. personnel were being moved out of the Middle East, which raised fear that escalating tensions with Iran could disrupt supply. ➡️ Trump on Wednesday said U.S. personnel were being moved out of the Middle East because “it could be a dangerous place,” adding that the United States would not allow Iran to have a nuclear weapon. ⚠️ Reuters reported earlier on Wednesday that the U.S. is preparing a partial evacuation of its Iraqi embassy and will allow military dependents to leave locations around the Middle East due to heightened security risks in the region, according to U.S. and Iraqi sources.

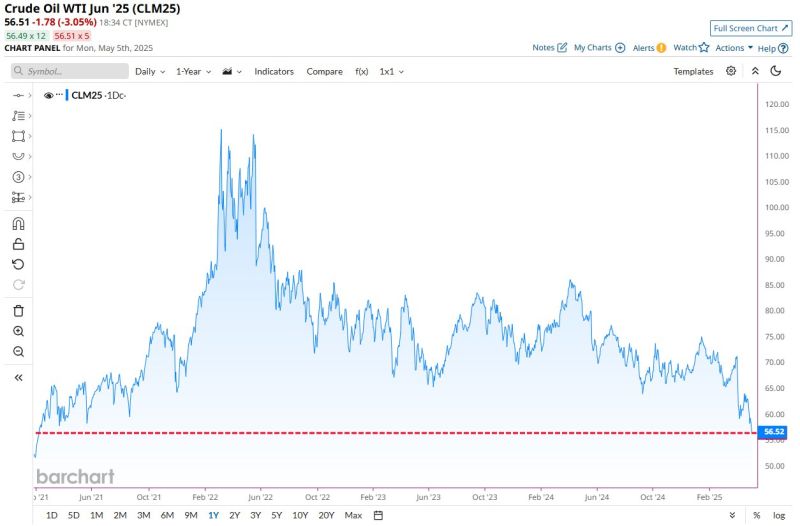

🔴 BREAKING 🚨: Crude Oil is on track for its lowest closing price since February 2021 📉📉

➡️ U.S. crude oil prices fall more than 4% after OPEC+ agrees to surge production in June ➡️ The eight producers in the group, led by Saudi Arabia, agreed on Saturday to increase output by another 411,000 barrels per day in June. The decision comes a month after OPEC+ surprised the market by agreeing to surge production in May by the same amount. ➡️ The June production hike is nearly triple the 140,000 bpd that Goldman Sachs had originally forecast. OPEC+ is bringing more than 800,000 bpd of additional supply to the market over the course of two months. Source: Barchart, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks