Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

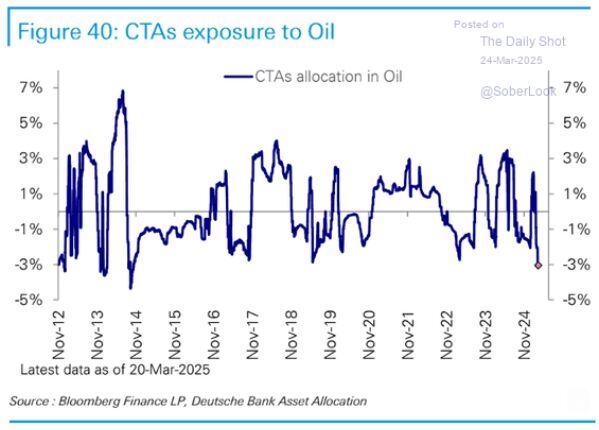

CTAs have now built the largest short position in Oil since 2014

Source: Barchart, The Daily Shot

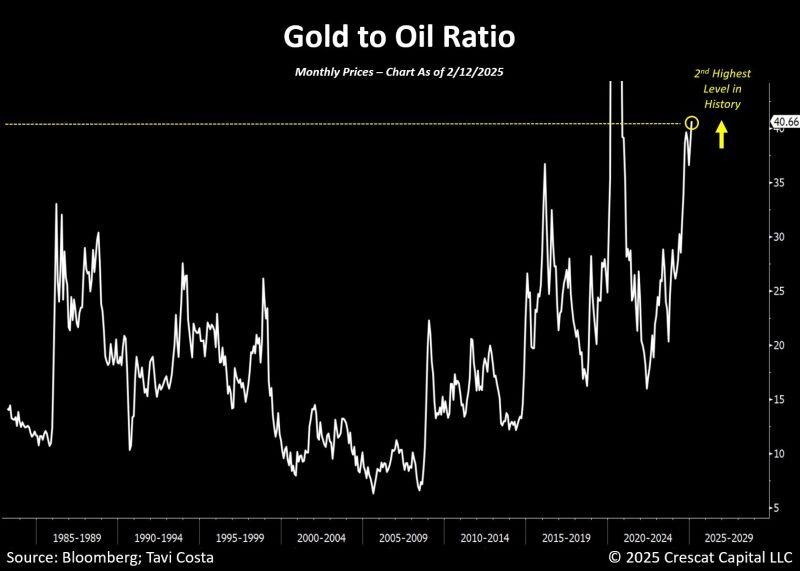

The gold-to-oil ratio just hit its highest level ever on the monthly chart—excluding the COVID spike.

Could the mining companies be the biggest beneficiaries? This directly impacts their margins, which are expanding significantly as metal prices climb. As pointed out by Tavi Costa, Gold is up nearly $1,000/oz from a year ago, while production costs have risen only about $100–$200/oz, depending on the mine. Source: Crescat Capital, Bloomberg

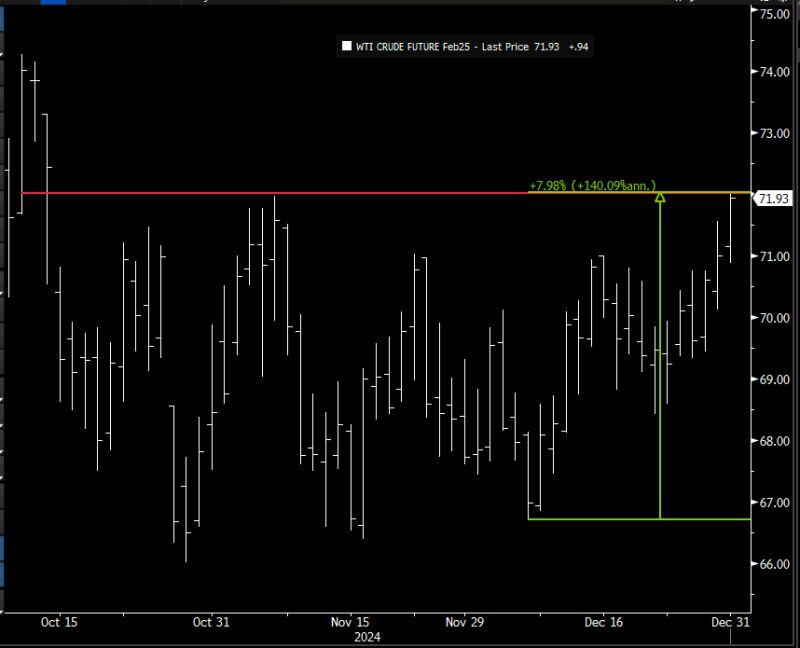

An unexpected behavior by oil...

As the red line shows, WTI is at its highest price since October. The green annotation shows that it has increased by 8% in the last few weeks. The rise of oil prices took place despite Trump win (and the subsequent "Drill, baby drill") and Scott Bessent being nominated Treasury Secretary nominee (and says the US should add 3 million barrels/day of production). So why isn't crude oil slumping and now on the verge of breaking out? Source: James Bianco, Bloomberg

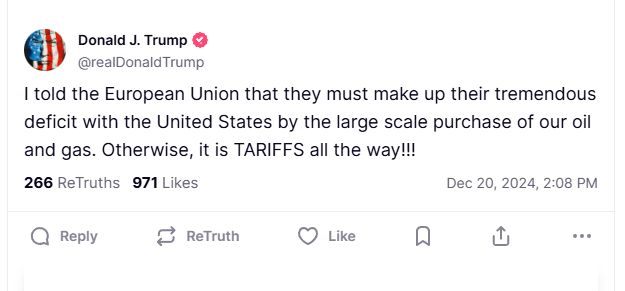

Trump threatens tariffs if the EU doesn't buy more US oil and gas

The President-elect said he told the EU they must "make up their tremendous deficit" with large scale purchases of American fuel The US is the world's top LNG exporter, and the biggest Oil producer. Source: Stephen Stapczynsk

US shale oil production crossed 1 mil b/d in 2011.

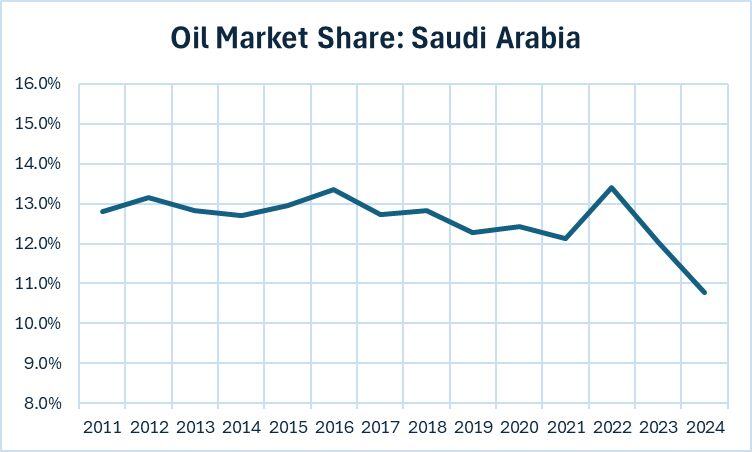

Since then, Saudi's market share has been on slow but steady decline, punctuated only briefly by steep price drops in 2015-6 and 2020. How can Saudi regain market share? Either they maintain a $60+ price and see their market share continue to erode, or they increase production to reclaim market share, and see prices plummet. Either way, it's lower revenue in the short term. Should they pump more to decrease prices and regain market shares? Taking the market to <$40 again will be painful for them in the near-term, but they have the financial wherewithal to survive. Source: John Arnold on X

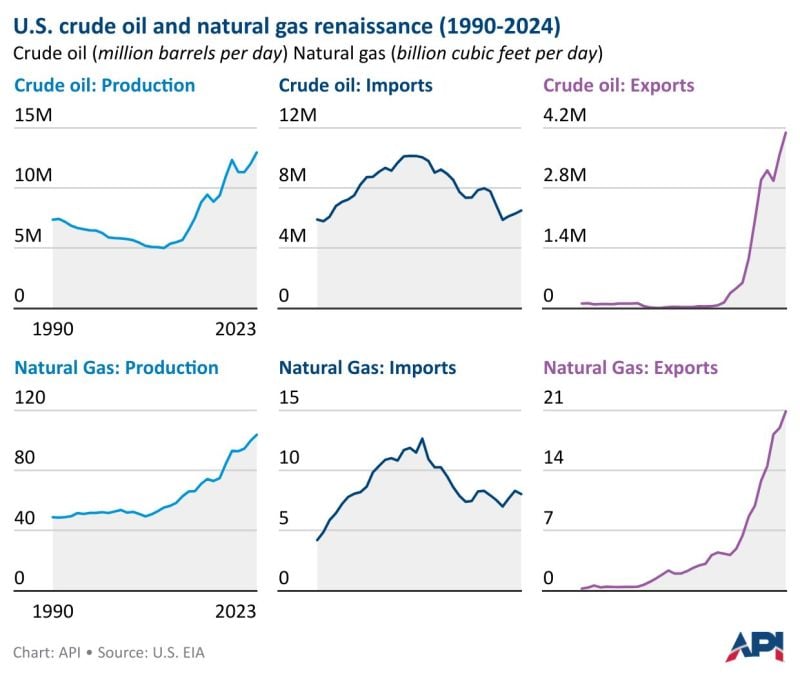

The U.S. crude oil and natural gas renaissance, in one panel chart...

Source: Mason Hamilton, API

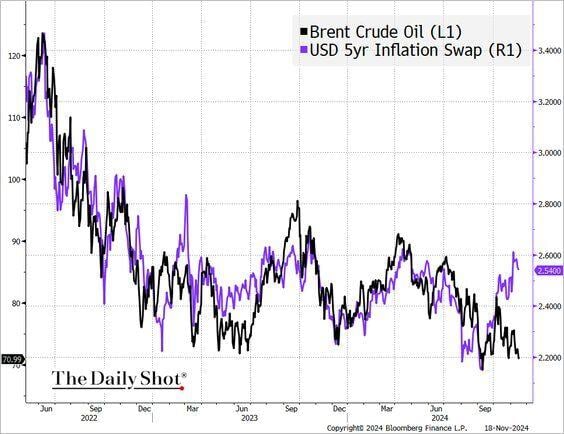

Inflation expectations have diverged from crude oil prices.

Source: The Daily Shot

Another poor US Treasuries auction yesterday.

This was the trigger that pushed yields higher (despite oil prices crashing -6%...) Bond yields no longer have much to do with how strong/weak the economy is. It’s all about deficits, high government spending, and huge Treasury auctions. Source: QE infinity

Investing with intelligence

Our latest research, commentary and market outlooks