Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

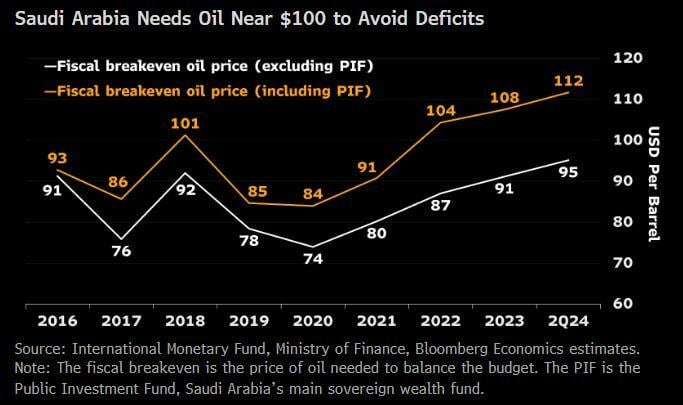

2 key takeaways from saudi budget data in the 1st half of 2024

1. Saudi needs oil at $95 to balance its budget. 2. Adding domestic investments by the sovereign wealth fund, the figure rises to $112. If Oil price stays at this level ($77), deficits are likely to persist. Source: Bloomberg, @ZiadMDaoud on X

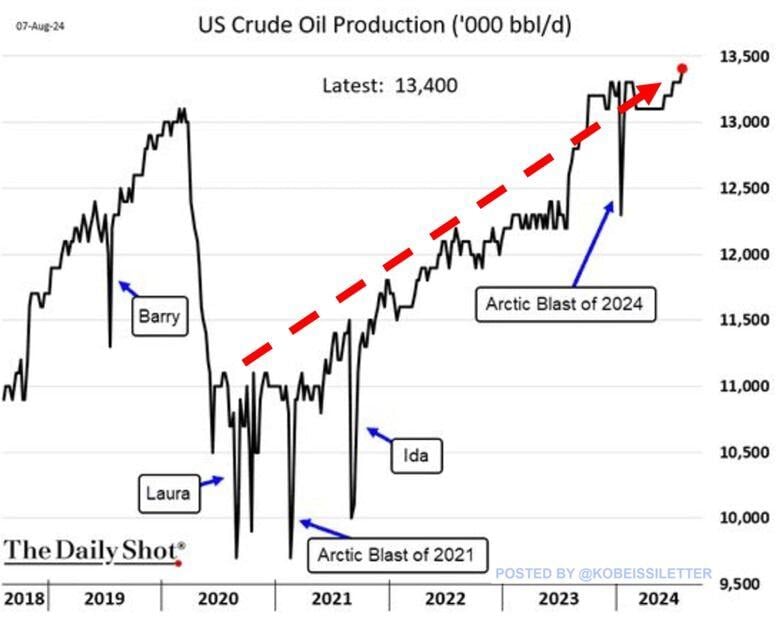

BREAKING: US crude oil production has officially hit a record 13.4 million barrels per day.

Daily oil production has increased by 22% over the last 4 years. Since 2008, production has skyrocketed 350% from ~3.8 million barrels per day. The US is now the world’s largest oil producer exceeding Russia's output by ~35% and Saudi Arabia by ~38%. The US is dominating global oil production. Source: The Kobeissi Letter, The Daily Shot

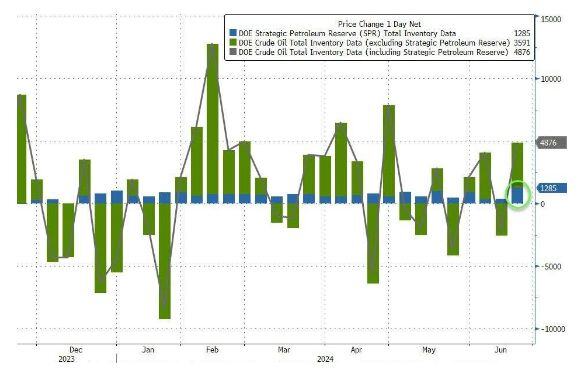

1.285 million barrels of oil were added to the Strategic Petroleum Reserve last week, the largest addition since June 2020

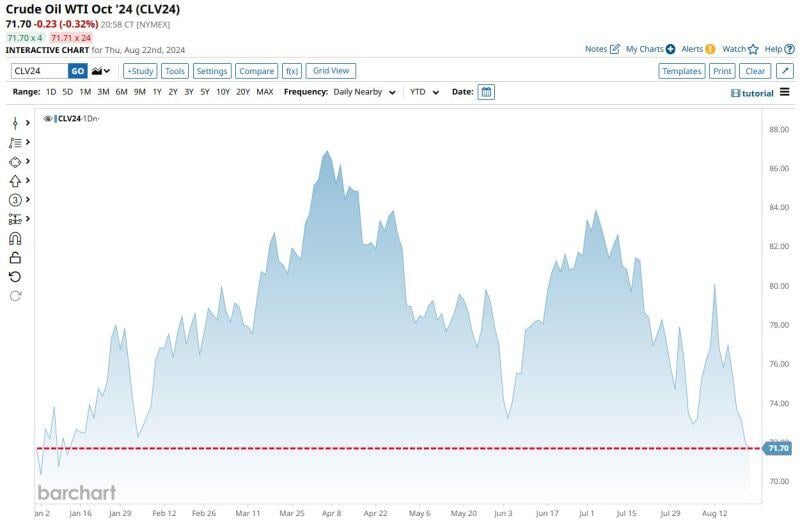

Source: Barchart

1.285 million barrels of oil were added to the Strategic Petroleum Reserve last week, the largest addition since June 2020

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks