Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Brent Crude Oil could plummet to $60/barrel in 2025 warns Citi

Source. Barchart

Foreign investors have flocked to saudiaramco’s $12 billion share sale, people familiar with the matter said

This marks a turnaround from the oil giant’s 2019 listing that ended up as a largely local affair. The deal attracted significant interest from foreign investors, according to the people, who declined be identified as the information is private. It wasn’t immediately clear exactly how much demand came from overseas, but those investors put in enough bids to more than fully cover the offering, the people said. Source: Bloomberg

Oil prices crash nearly 10% in 5 days over fears around weakening global demand.

Even as OPEC just extended oil production cuts of 2 million barrels per day, oil prices are nearing their 2024 lows. Recent data suggests that US economic activity in manufacturing and construction is slowing. As a result, oil prices are down 16% from their April peak and up just 3% year-to-date Source: The Kobeissi Letter

As expected, OPEC+ agreed to extend its oil supply cuts, delegates said, as the group continues its efforts to avert a global surplus and shore up prices.

The so-called “voluntary” cuts from key members including Saudi Arabia and Russia, which total roughly 2 million barrels a day and were set to expire at the end of June, will continue until the end of 2024, delegates said, asking not to be named because the talks were private. Source: Bloomberg

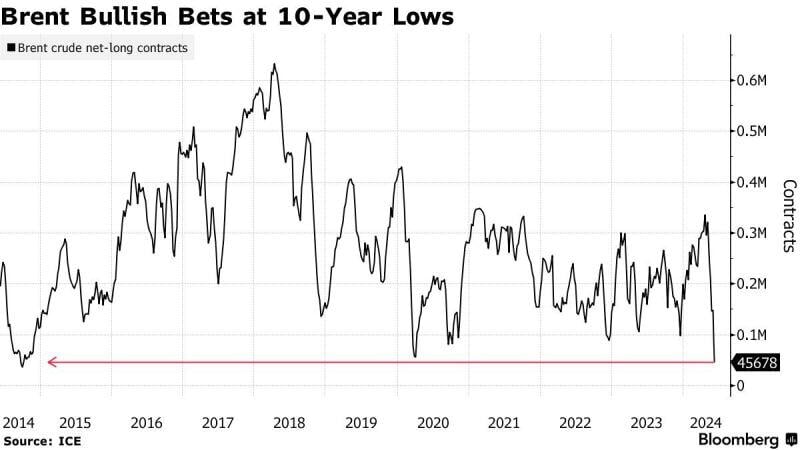

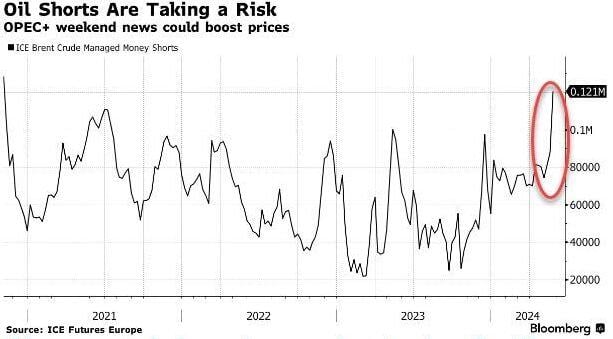

Speculators have built the largest Brent Oil short position since 2020

Source: Barchart, Bloomberg

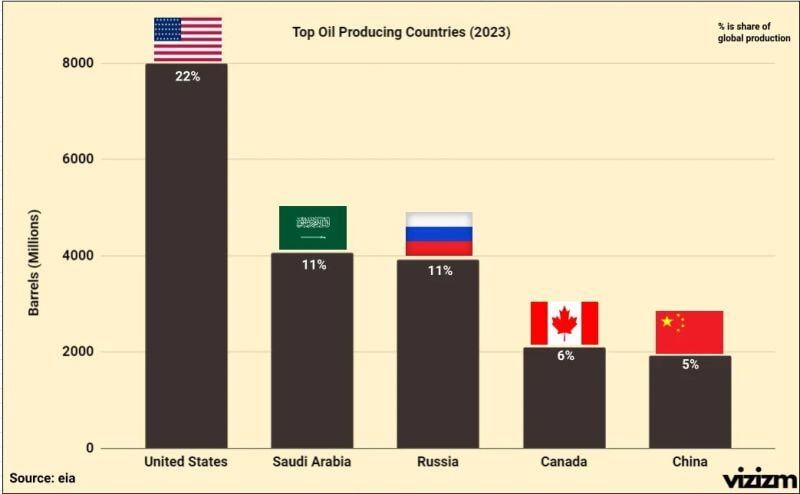

The US is the largest oil producer in the world, by quite a lot...

Source: Markets & Mayhem, Vivizm

Investing with intelligence

Our latest research, commentary and market outlooks