Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Brent crude futures extended gains on Monday, inching up amid political uncertainty in major producing countries after Iran’s president died in a helicopter crash.

But as always, things should be put into perspective: Iran has raised oil output over the last few years, with majority of exports going to buyers in China. Output is now >3mln bbl/d, the highest since 2019, making it the 3rd-biggest producer among OPEC members. But there are questions about how much higher Iran can take production considering capacity constraints. (BBG) Source: HolgerZ

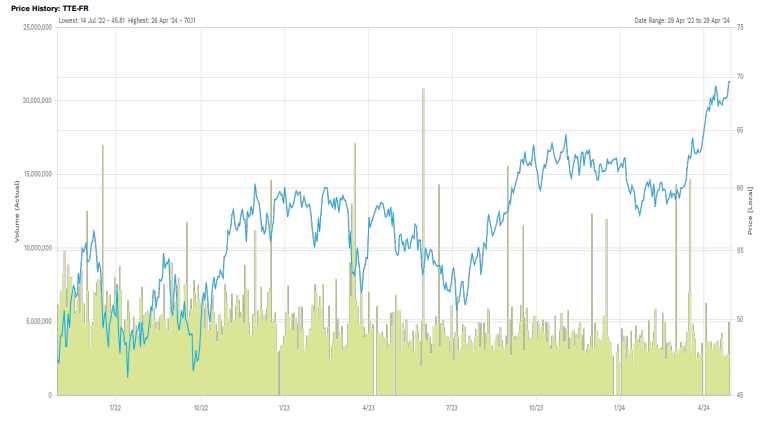

TotalEnergies is assessing to move its primary listing to the US.

On Friday, TotalEnergies’ CEO Patrick Pouyanné declared that the company’s board is considering moving its primary listing to the US as the European shareholder base now holds a minority position in the company’s capital mainly due to the strict European ESG standards that discourage investments in fossil fuels. The American shareholder base, on the other hand, represents over 45% of Total’s capital. Source: FactSet

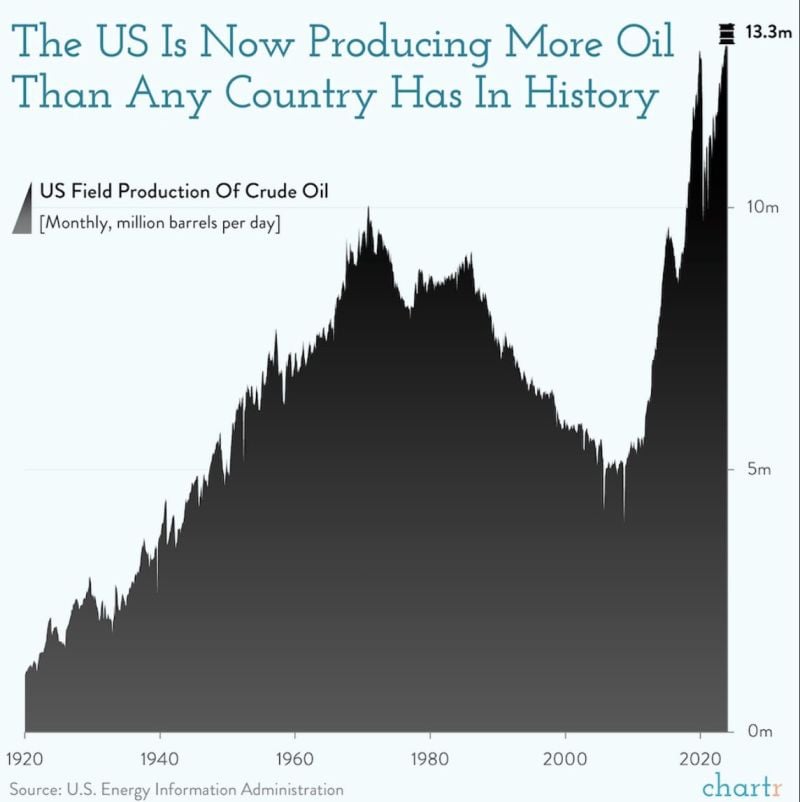

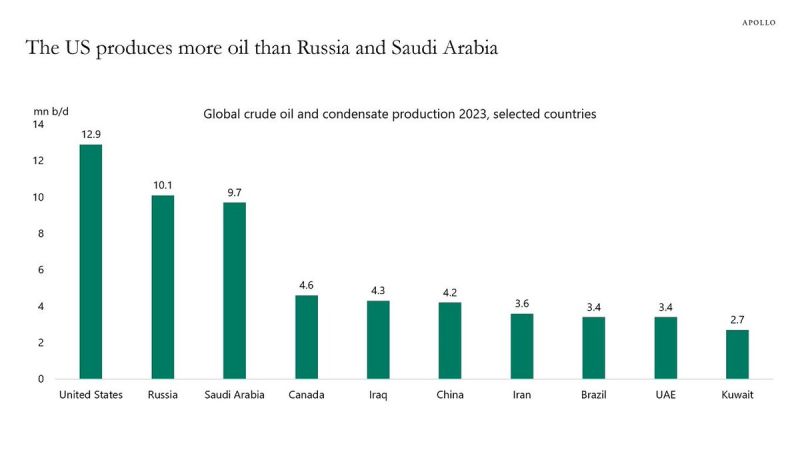

The US is officially the largest oil producer in the world, and it's not even close.

Currently, the US is producing 12.9 million barrels per day of crude oil. This is nearly 30% more than the 10.1 million barrels per day that Russia produces and 33% more than Saudi Arabia. In fact, the US alone pumps 45% of the output produced by the entire OPEC combined. Furthermore, the US now produces nearly 4 TIMES as much oil as Brazil. Source: The Kobeissi Letter, Apollo

BREAKING: US oil futures surge above $85/barrel after reports of a retaliatory strike by Israel in Iran.

Iran has just suspended all flights to Tehran, Isfahan and Shiraz. Stock market futures are down nearly 1% on the news. Source: The Kobeissi Letter

Oil prices are now down nearly 10% from their highs as fears over higher interest rate policy spread.

With markets now seeing less than 2 rate cuts in 2024, demand outlook is questionable. This has put oil prices at their lowest level since March 28th. However, prices are still up more than 15% from their February 2024 lows. Source: The Kobeissi Letter

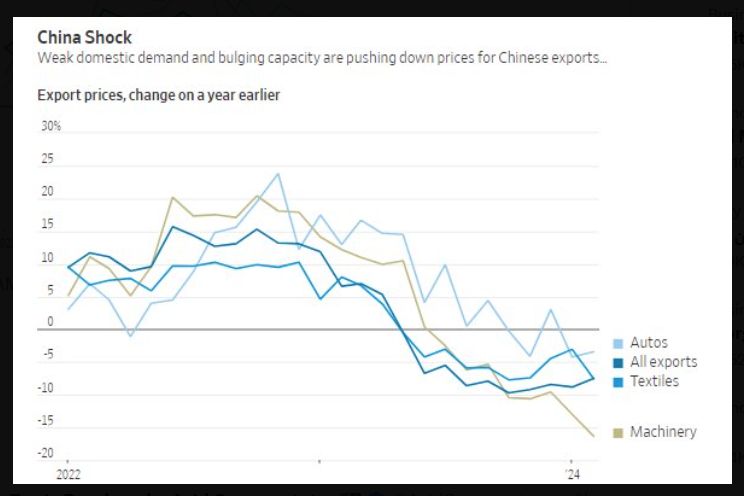

Will the big deflationary wave out of China offset the inflationary pressures stemming from rising oil prices and hot job market in the US?

Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks