Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

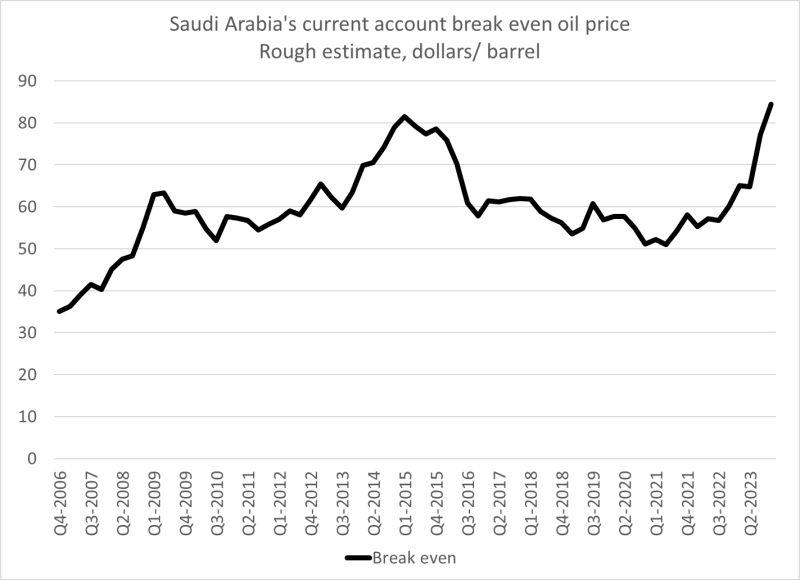

Looks like saudi arabia's balance of payments breakeven oil price (oil price that avoids a current account deficit) is now close to $85 a barrel...

This could explain why there is some scale back from NEOM + the need for oil prices to stay higher for longer... Source: Brad Setser

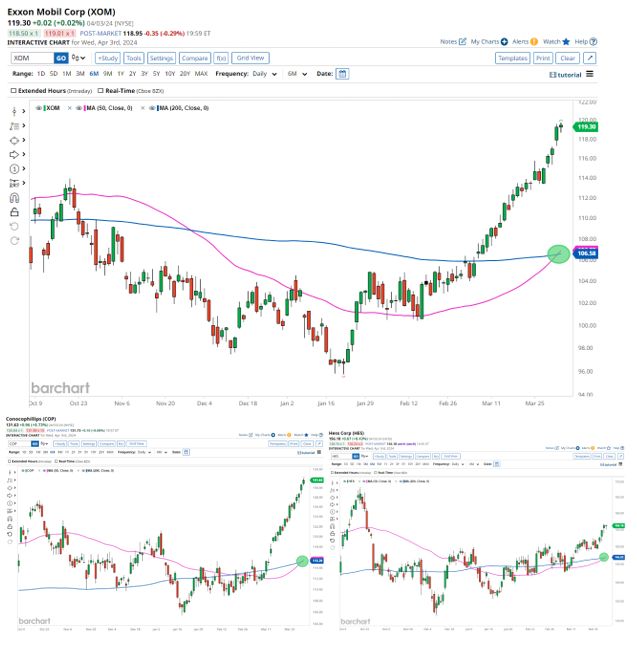

Oil-related stocks are cooking now!

Exxon $XOM, Conocophillips $COP, and Hess $HES have all formed Golden Crosses Source: Barchart

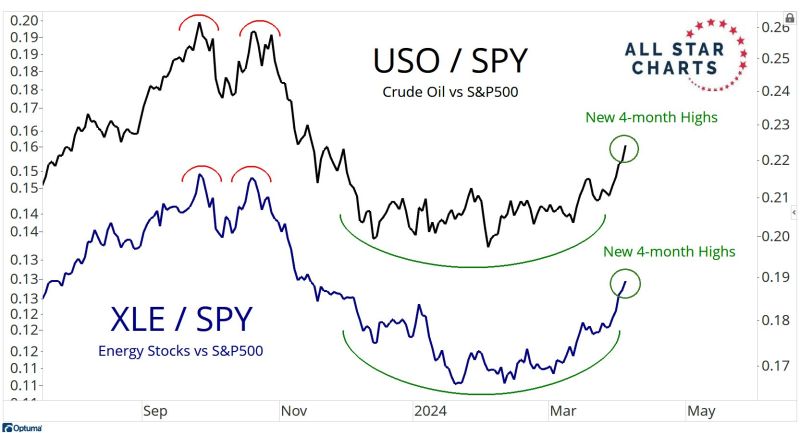

Below the relative chart of oil ETF $USO vs. S&P 500 ETF $SPY and the relative chart of oil stocks XLE vs. S&P 500 ETF $SPY.

Both just hit a 4.month relative high Source: J-C Parets

BREAKING: Oil prices have officially broken above $85.00 for the first time since October 2023.

Since the December 2023 low, oil prices are up over 25% as geopolitical tensions have escalated. This comes as PPI, CPI and PCE inflation all posted year-over-year increases in February. Demand forecasts are being raised and supply disruption risks continue to rise. Higher oil prices are simply just the new normal in the post-pandemic world. Is the fight against inflation really over? Source: The Kobeissi Letter

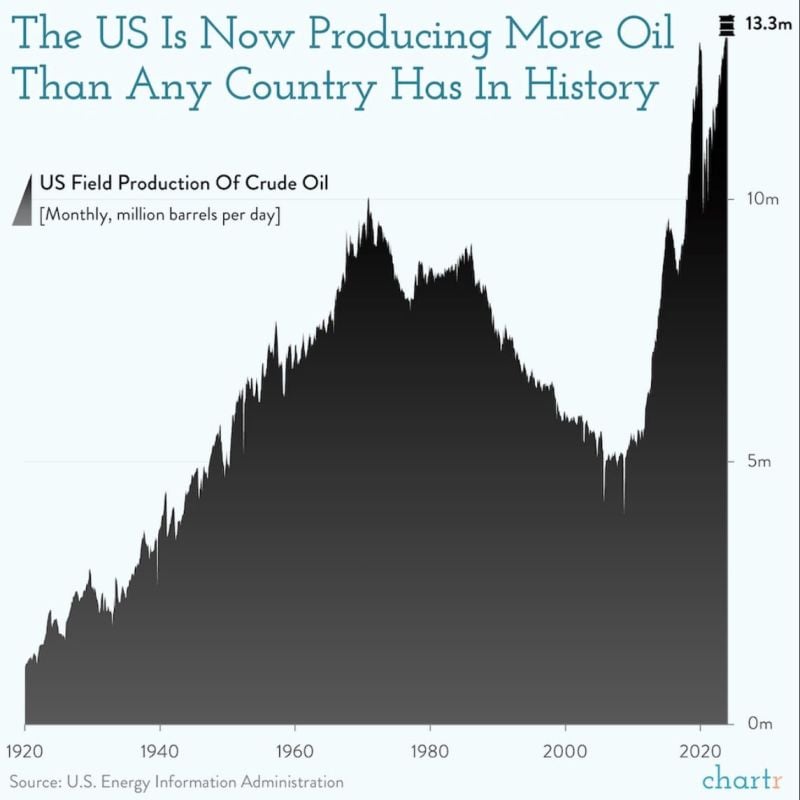

Oil prices are now up 17% this year and well above $80/barrel again.

OPEC remains committed to production cuts and geopolitical tensions have threatened supply. Meanwhile, global demand forecasts are being raised and inflation is rebounding. Even as non-OPEC production is at record highs, oil prices continue to skyrocket. It seems like high oil prices are just the new normal for consumers. And it is not gooing to help healdine inflation to move back to the Fed's target. Source: The Kobeissi Letter

Crude Oil is approaching a Golden Cross formation with an upward sloping 200D moving average.

The last Golden Cross sent Crude Oil soaring to its highest price since August/September 2022. Source: Barchart

Saudi Aramco CEO Amin Nasser said the current energy transition strategy is failing.

The world should give up on the idea of phasing out oil and gas, Nasser said. The CEO called for a reset of the strategy that focuses on reducing emissions, not phasing out oil and gas. “In the real world, the current transition strategy is visibly failing on most fronts as it collides with five hard realities,” Nasser said during a panel interview at the CERAWeek by S&P Global energy conference in Houston, Texas. “A transition strategy reset is urgently needed and my proposal is this: We should abandon the fantasy of phasing out oil and gas and instead invest in them adequately reflecting realistic demand assumptions,” the CEO said to applause from the audience. Source: CNBC

The US is now producing more oil than any country has in history

Source: Michel A.Arouet, Chartr

Investing with intelligence

Our latest research, commentary and market outlooks