Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Saudi Arabia has announced that it will stop pursuing the expansion of its oil production capacity, reversing a key goal in the oil's superpower strategy

Supporters of the energy transition are celebrating, but geopolitics may be more important than what meets the eye. In a nutshell, Saudi Arabia manages together with Russia a very complex political and economic arrangement within the OPEC+ alliance. Riyad and Moscow are coordinating with other producers around the world in order to revive the global oil market, prevent production surplus and keep oil prices higher than non-OPEC producers' policies would. Source: Francesco Sassi

Oil prices jump back above $75 after the US and UK conduct strikes in Yemen.

We are also seeing gold prices up on the news as fears of a larger war resurface. The primary motive for these strikes was the recent Red Sea attacks by the Houthi group in Yemen. Source: The Kobeissi Letter

Iran seizes oil tanker involved in U.S. dispute off coast of Oman. Crude oil is up 2% on the news

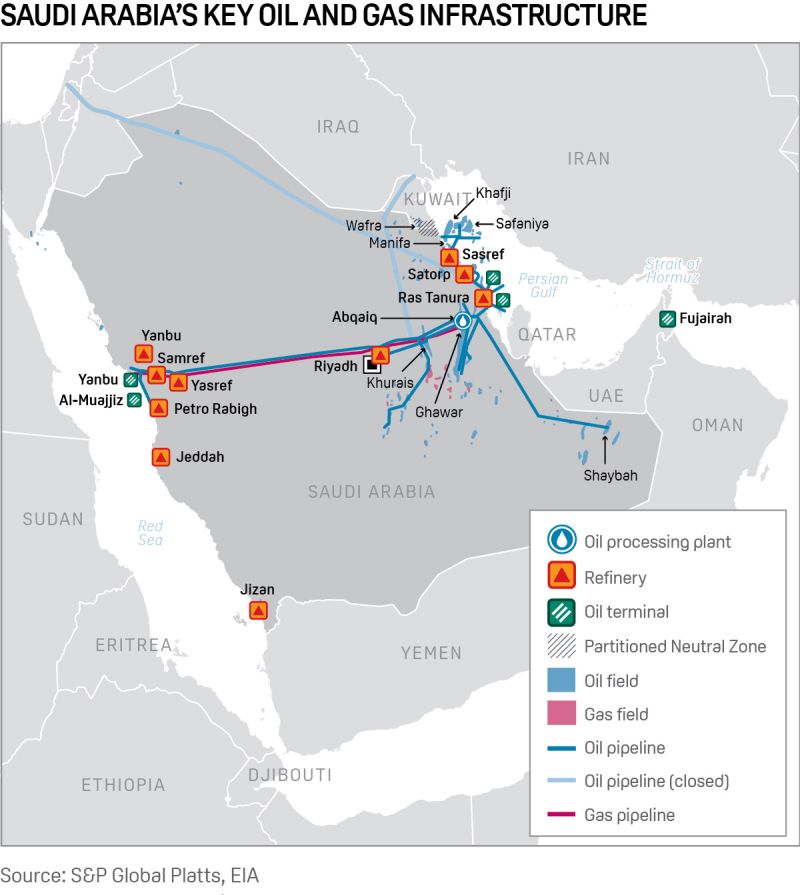

-> Iran has captured an oil tanker previously involved in a Washington-Tehran dispute over carrying U.S.-sanctioned crude, state media said. -> Earlier on Thursday, the U.K. Marine Trade Operations said an unnamed tanker was boarded by armed individuals near the Gulf of Oman and appeared to change course toward Iranian waters. .> The tanker is embroiled in a dispute between Iran and the U.S. and previously surrendered Iranian crude to U.S. authorities following allegations of sanctions violations. -> Bloomberg confirmed that the Marshall Islands-flagged tanker "St Nikolas" is the vessel that was hijacked. A previous report says that St Nikolas was seized by the US last year, sailing under a different name, "Suez Rajan," for transporting unauthorized Iranian cargo. -> Empire Navigation, the vessel's operator, said the tanker was loaded with 145,000 tons of crude from the Iraqi port of Basra and was en route to Aliaga in western Turkey through the Suez Canal. It noted all communication with the vessel had been lost. -> The hijacking incident was near another chokepoint: the Hormuz Strait between Oman and Iran.

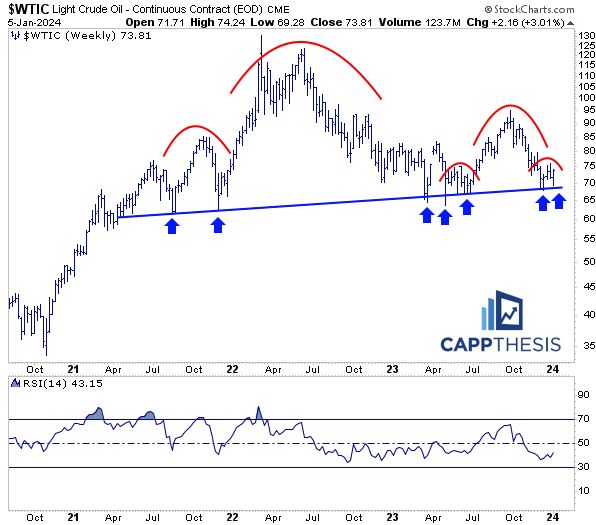

A topping pattern on crudeoil? Or simply finding support at a long-term trendline before a move higher? This one needs to be watched closely

A great chart from Frank Cappelleri thru Ryan Detrick, CMT.

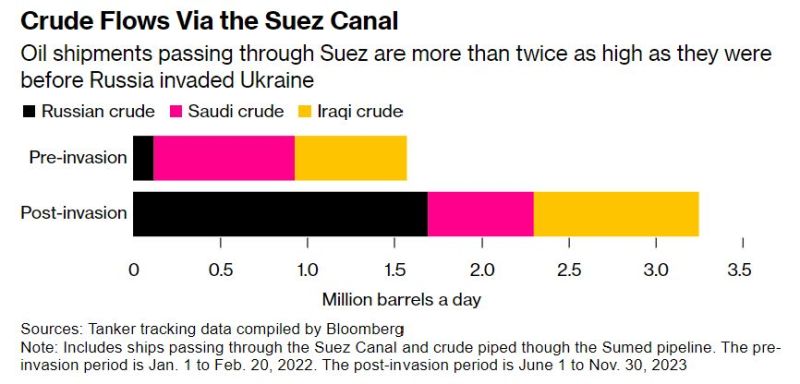

Red Sea disruption to oil supplies is overblown, argues Julian Lee. Why?

1. Houthis unlikely to attack Russian ships heading to India & China 2. Saudi pipeline can bypass Bab Al Mandab 3. Iraqi & Saudi shipments to the US don't go through the red sea Source: Bloomberg, Ziad Daoud

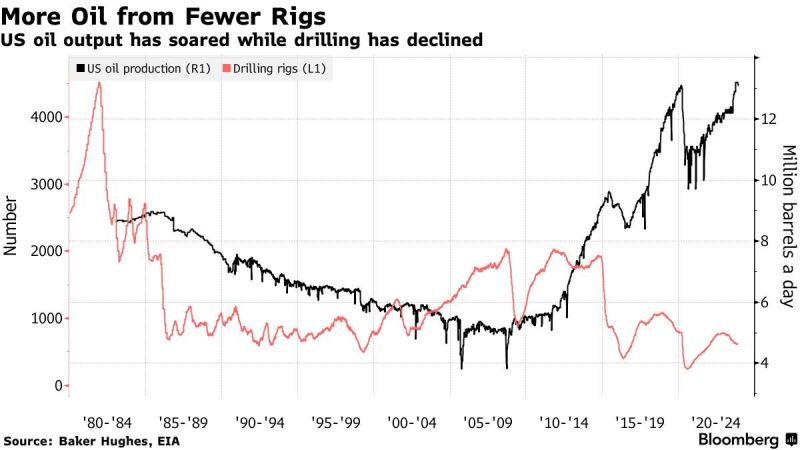

The US added the equivalent of a new Venezuela in oil supply during Q4, with less rigs producing more oil as technological efficiency ramps up

This supply growth has exceeded expectations and furled OPEC's attempt to put a floor under prices, at least for now. Source: Markets & Mayhem, Bloomberg

Maybe oil is not that irrational... As shown on the chart below, Oil (purple line) keeps following the Citigroup US Macro Surprises index (yellow line)

The weaker the data, the lower the prices. Sounds logical. Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks