Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

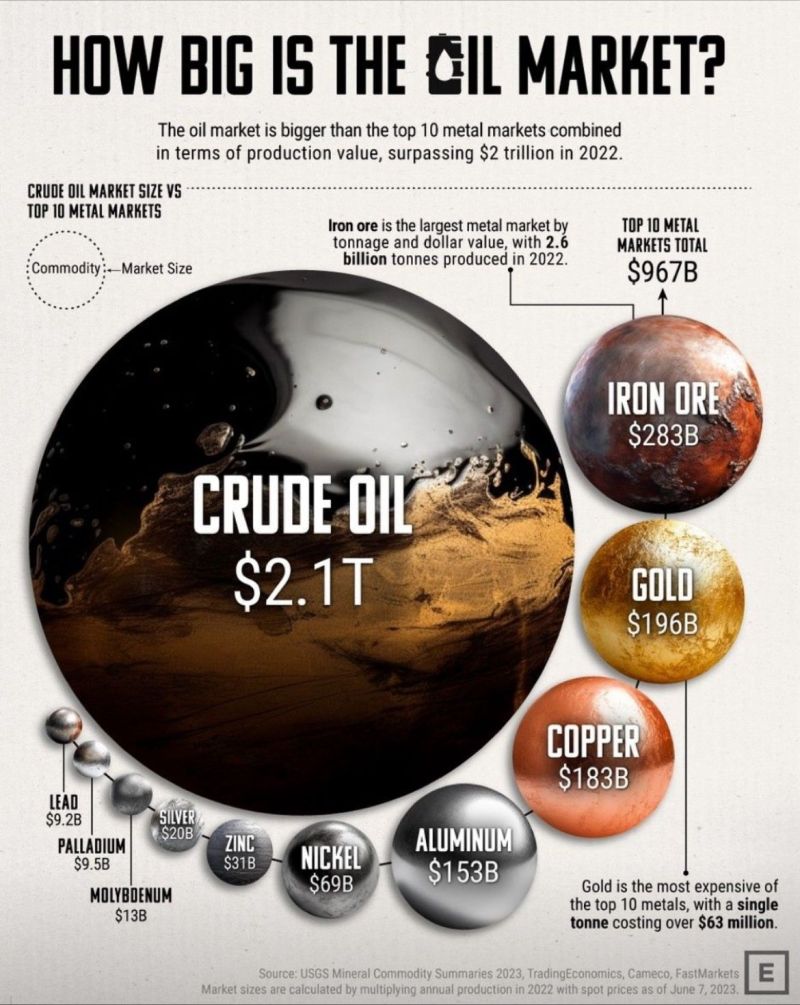

BREAKING: Crude oil prices drop below $70/barrel for the first time since July 2023

Since the September 28th high, oil prices are now down ~27%. Meanwhile, the national average gas price is down for 10-straight weeks to $3.25/gallon. Even as OPEC+ agreed to additional supply cuts last week, oil markets are selling off. A welcomed development for global liquidity, for inflation and for the Fed. Source: The Kobeissi Letter

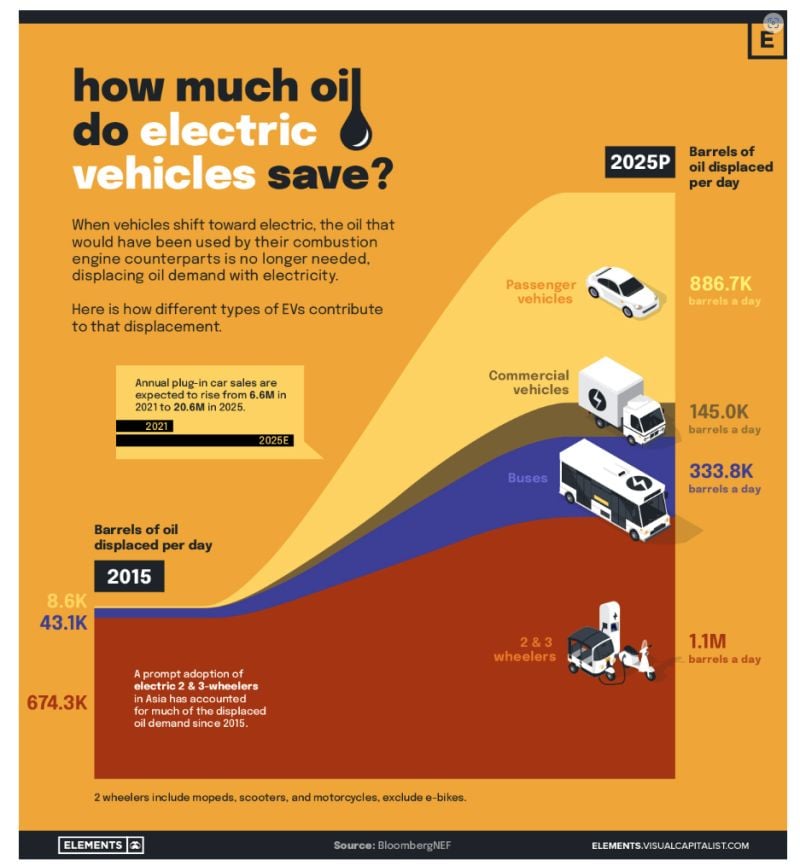

The EV Impact on Oil Consumption by E`LEMENTS / Visual Capitalist As the world moves towards the electrification of the transportation sector, demand for oil will be replaced by demand for electricity

To highlight the EV impact on oil consumption, the above infographic shows how much oil has been and will be saved every day between 2015 and 2025 by various types of electric vehicles, according to BloombergNEF. Link to full article: https://lnkd.in/eYm5iJ8d

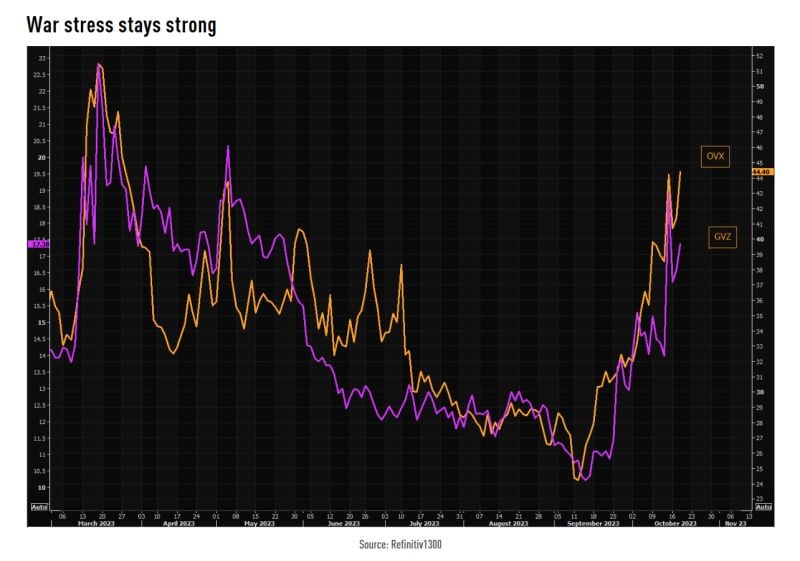

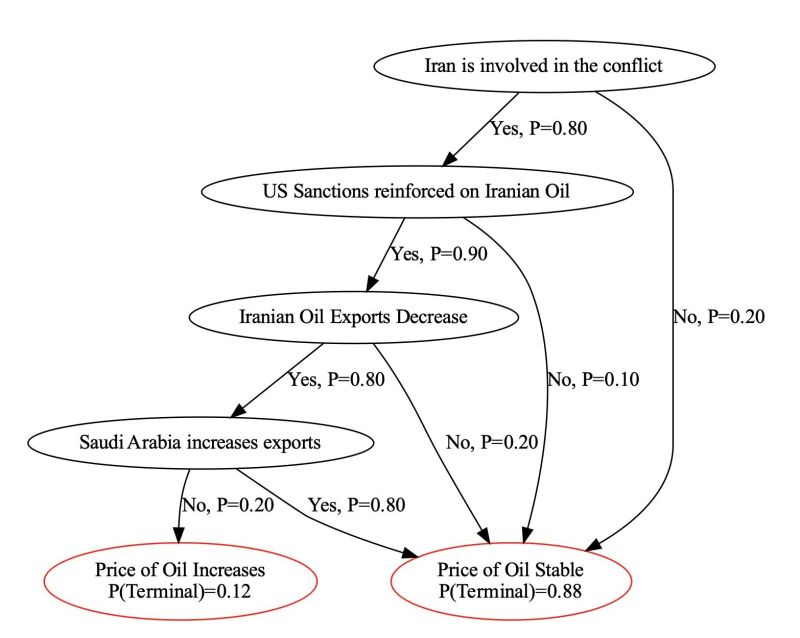

Will oil prices react to the Israel-Gaza conflict?

A probability tree by Alexandre Kateb, CFA

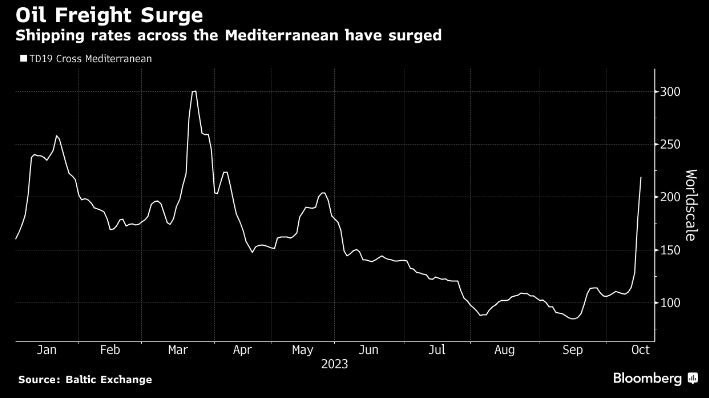

Cost to move oil has surged!

Since Hamas attacked Israel, freight rates on 16 global routes are up +50%. Biggest gain has been for shipments across the Mediterranean Sea, which are up 2x. This is inflationary Source: Bloomberg, Genevieve Roch-Decter

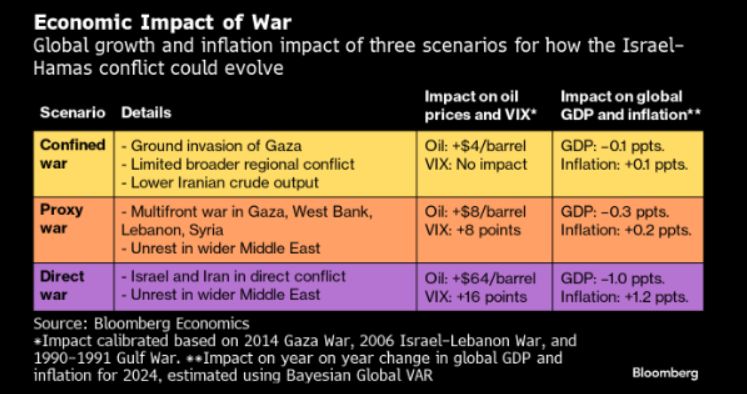

Bloomberg analysis on war potential economic and market impacts

Source: Bloomberg

WIth the Vix <17, Brent oil<$90/bbl and S&P 500>4350, do you feel that risk is currently mispriced?

Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks