Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

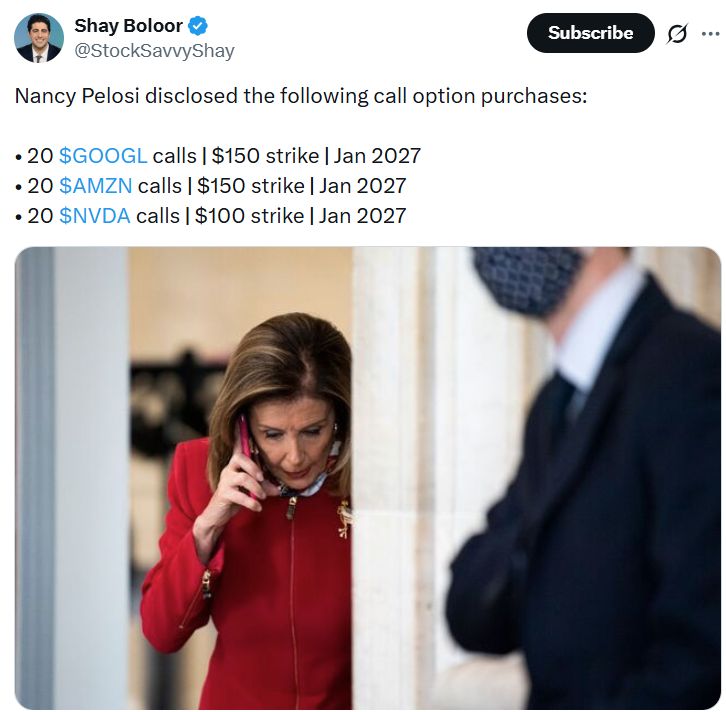

Nancy Pelosi just filed ~$69M worth of new stock trades

Including selling $50M of Apple $AAPL Major sells include: - Sold $50M shares of Apple $AAPL - Sold $5M shares of Nvidia $NVDA - Sold $5M shares of Disney $DIS She bought new call options: - Bought $500K of $GOOGL LEAPS - Bought $500K of Amazon $AMZN LEAPS - Bought $500K of Apple $AAPL LEAPS - Bought $250K of Nvidia $NVDA LEAPS Source: Nancy Pelosi Stock Tracker on X

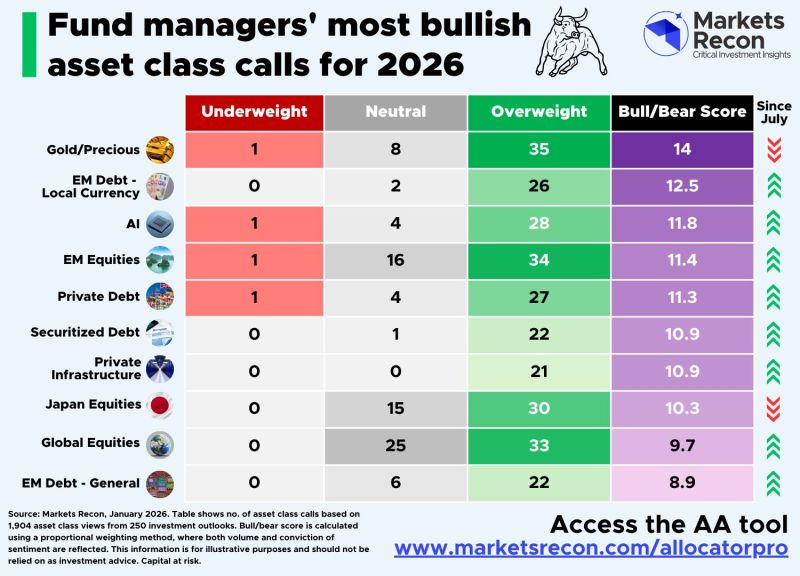

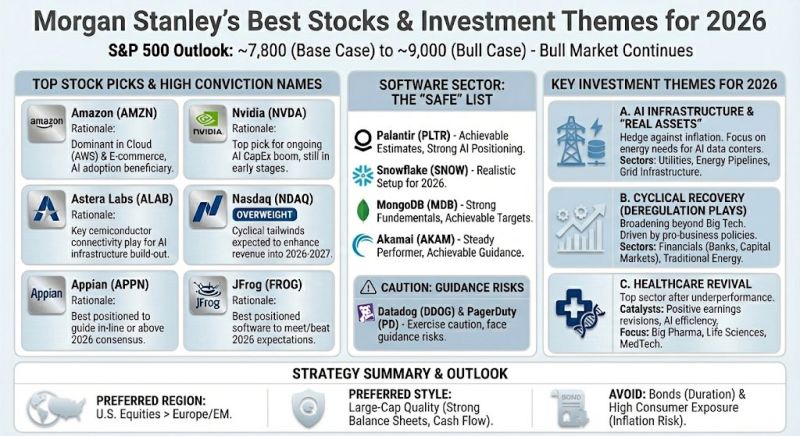

Where are fund managers most bullish for 2026? 🤔

Based on Markets Recon's review of ~250 asset manager outlooks for 2026, the most frequently mentioned overweight call was... GOLD 🥇 What else do asset managers like for 2026 portfolios? 📈 In Equities, it's AI 🤖, EM 🌍, and Japan 🇯🇵 stocks getting the most love. 📄 In Bonds, its EM Debt 🌎 and Securitised Debt 🧩. And in Private Markets, Infrastructure 🌉 is the most admired. Source: Stephen White, CAIA from Markets Recon

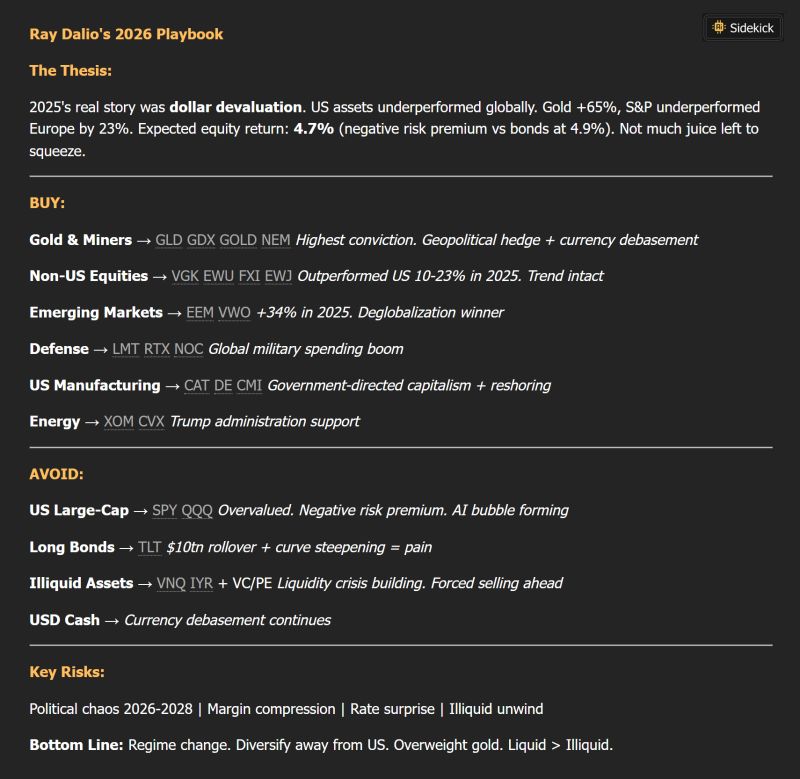

The founder of the world's largest hedge fund just dropped his roadmap for 2026.

We ran it through Sidekick to break down the key takeaways and where he’s positioning as markets shift. Here’s the breakdown: Source: TrendSpider @TrendSpider

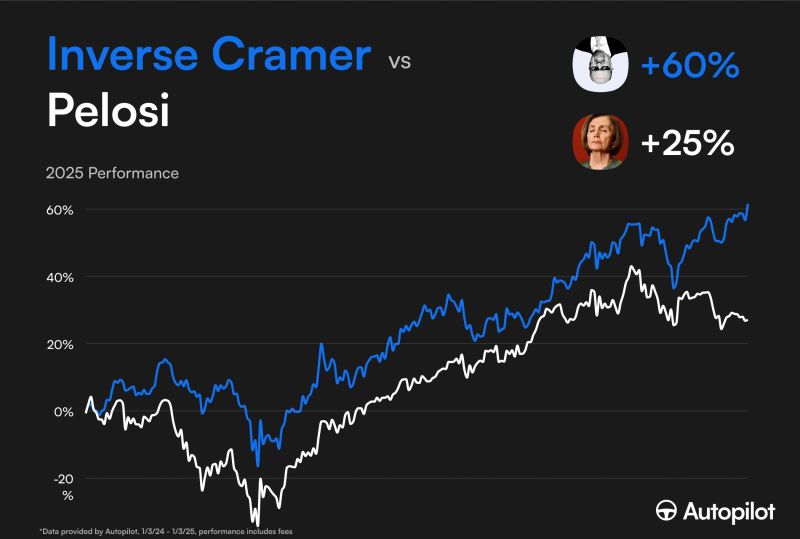

The Queen has been dethroned

Inverse Cramer officially beats out Pelosi for the top portfolio on Autopilot Source: Nancy Pelosi Stock Tracker ♟ @pelositracker

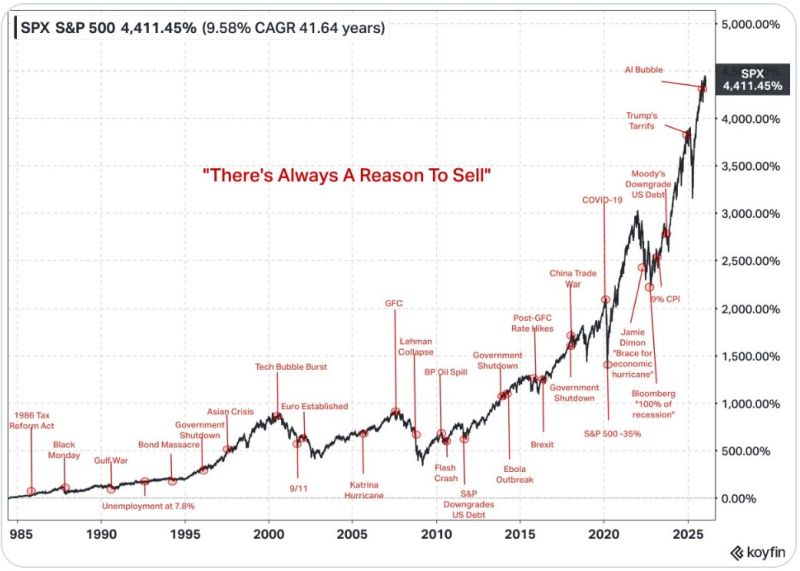

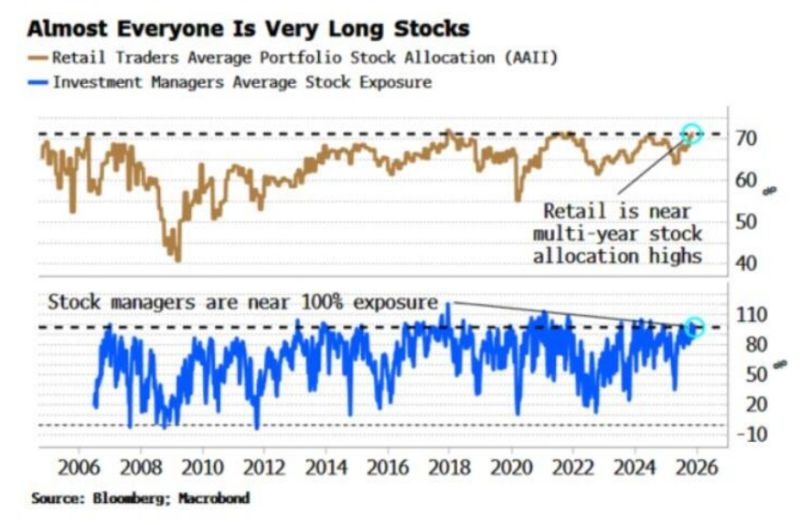

Risk appetite is through the roof.

Stock market investment is at 20+ year highs. Meanwhile, retail asset allocation to stocks is up to ~70%, near the highest in 20 years, according to the AAII survey. This is in-line with the highs seen during the 2021 meme stock frenzy. To put this into perspective, stock allocations were just ~55% during 2020 and fell to ~40% at the 2008 low. At the same time, average stock exposure among investment managers is up to nearly ~100%, one of the highest readings over the last 20 years. This has risen ~65 percentage points since the April low. Source: The Kobeissi Letter, Bloomberg

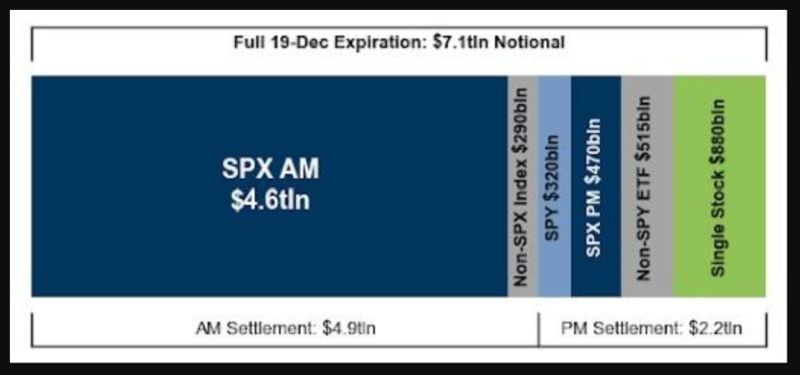

Today is the largest options expiration in history...

Goldman's options guru John Marshall estimates that this December options expiration will be the largest ever with over $7.1 trillion of notional options exposure expiring, including $5.0 trillion of SPX options and $880 billion notional of single stock options. Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks