Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"Super investor performance" 2025 ranking

David Tepper has taken the top YTD performer spot due to his big investments in $BABA and $UNH Source: Victor H Investing @VictorH12581

BREAKING: Robinhood announces that they have filed with the SEC to launch Robinhood Ventures Fund I (RVI), a concentrated portfolio of innovative private companies leading their industries.

It looks like Robinhood is going to IPO a fund that allows retail to invest in the best private companies... “For decades, wealthy people and institutions have invested in private companies while retail investors have been unfairly locked out. With Robinhood Ventures, everyday people will be able to invest in opportunities once reserved for the elite,” said Robinhood Chairman and CEO Vlad Tenev. Source: amit @amitisinvesting

Nicely put by Matthew Yglesias on X as another example that just owning index funds is often the wiser investment decision.

Source: Matthew Yglesias on X

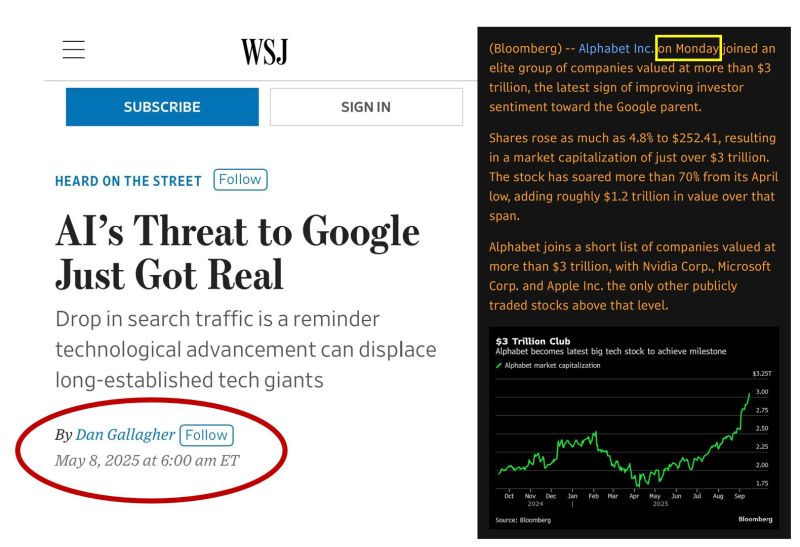

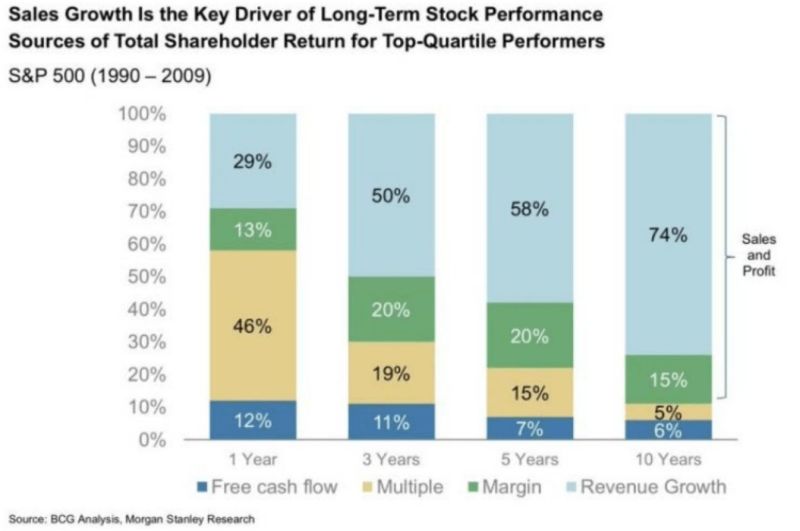

Growth is the best long-term predictor of a stock market winner

Source: Invest In Assets 📈

JUST IN:

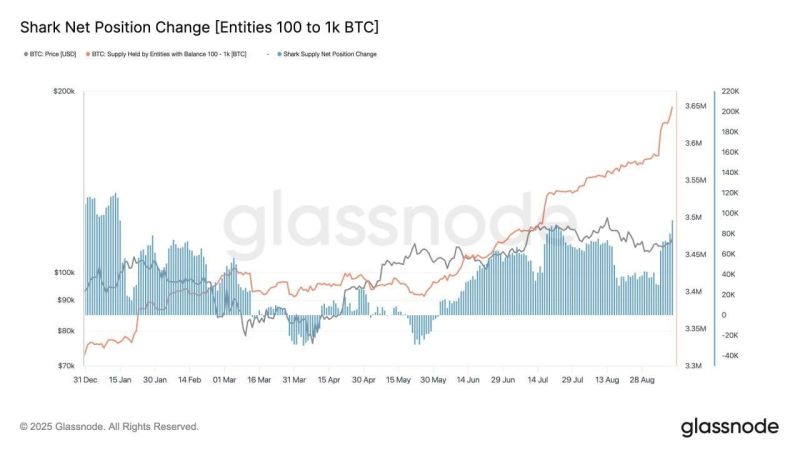

🦈 Bitcoin sharks (100–1k BTC wallets) added 65,000 BTC in the past 7 days. They now hold a record 3.65M BTC. Source: Glassnode, Bitcoin archive

How All the Billionaires in 2025 Made Their Money

Forbes found that nearly one in six billionaires (or 464 billionaires in 2025) made their money in finance and investments. Tech is the second most common sector to find billionaires in (401 in 2025, an increase of 59 billionaires since 2024). Source : Visualcapitalist

Investing with intelligence

Our latest research, commentary and market outlooks