Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

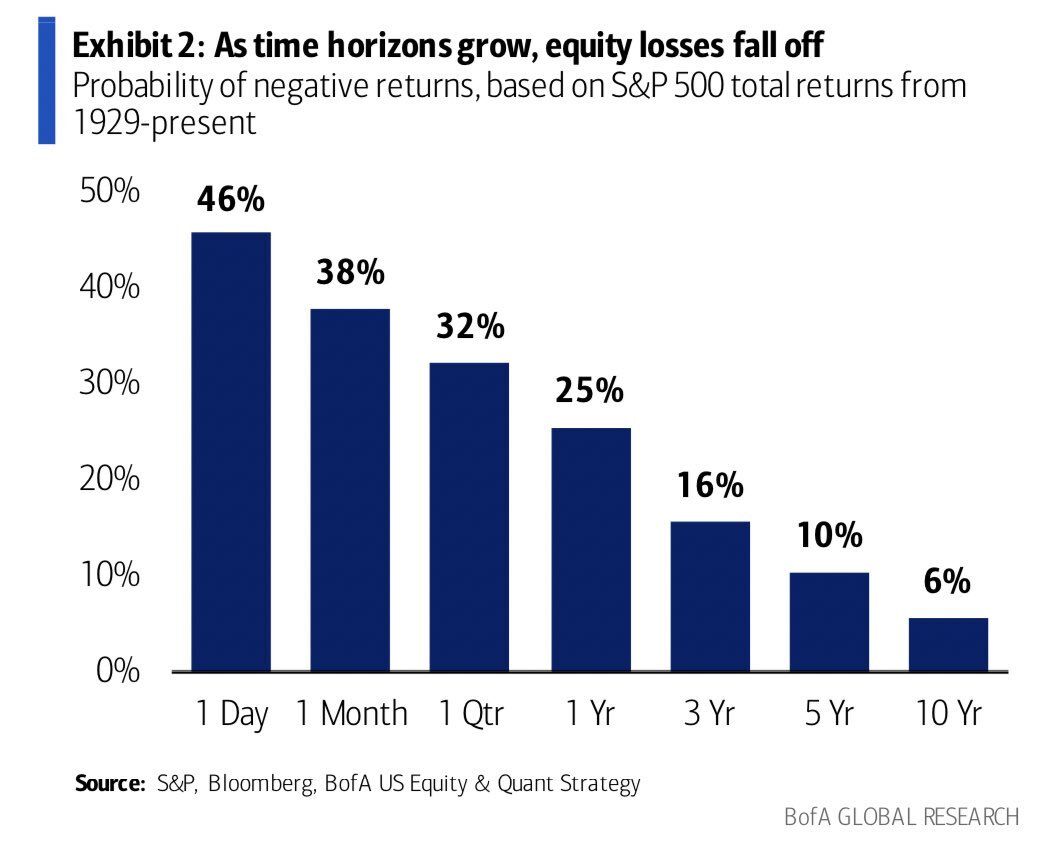

How to not lose money in the stock market

1: Wait longer Source: Brian Feroldi, BofA

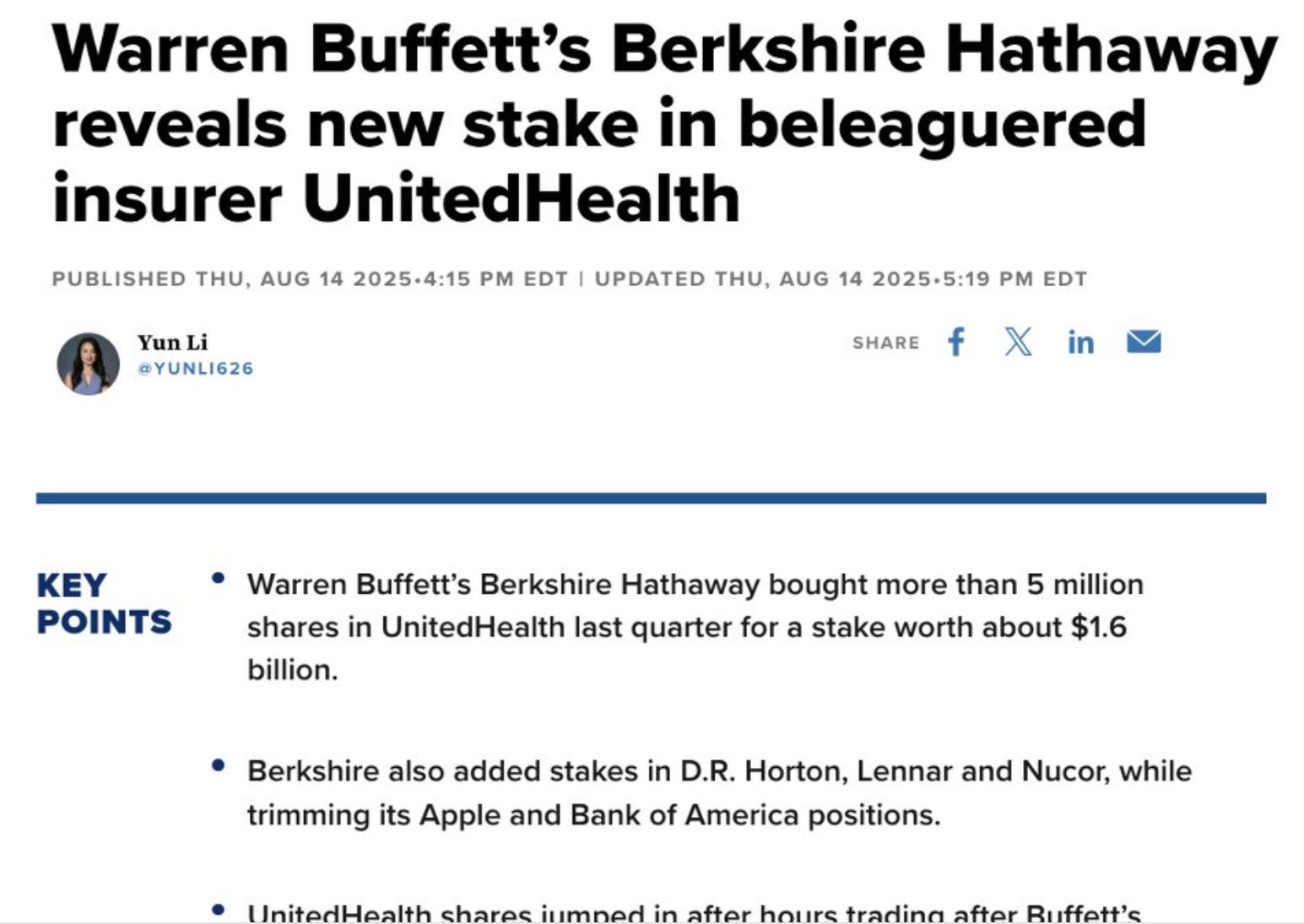

🔴 Warren Buffett's Berkshire Hathaway takes a $1.6 Billion position in UnitedHealth $UNH

Source: CNBC

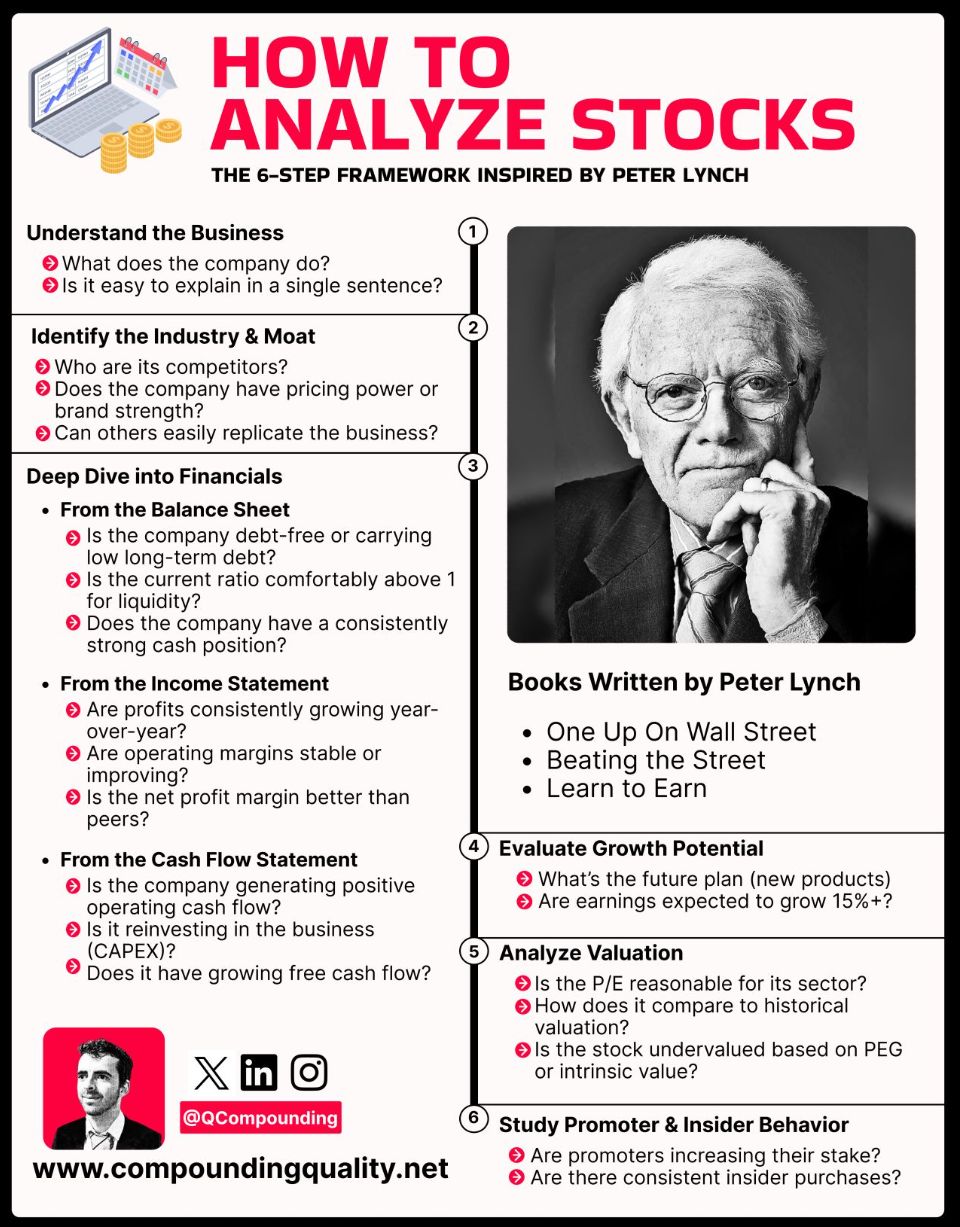

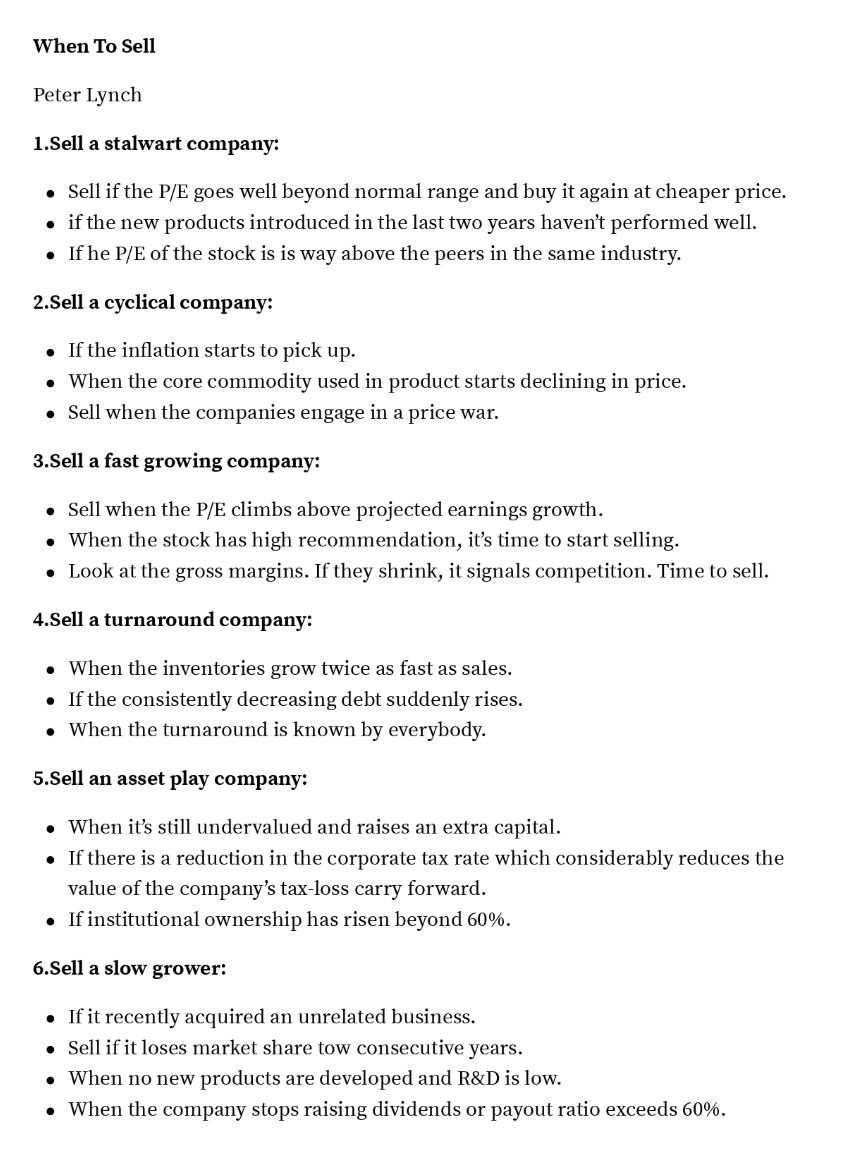

How to analyze stocks

the 6-step framework inspired by Peter Lynch. Source: Compounding Quality

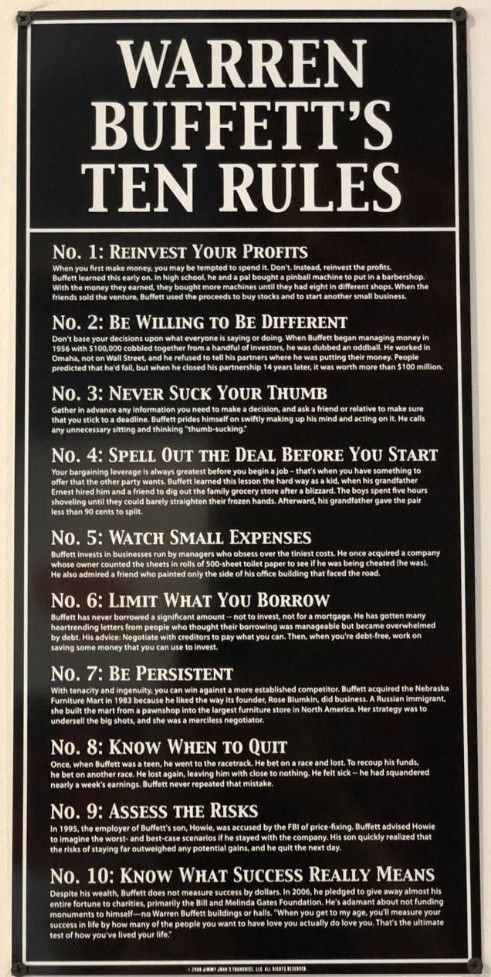

Buffett's 10 investing rules

Source: Invest In Assets @InvestInAssets

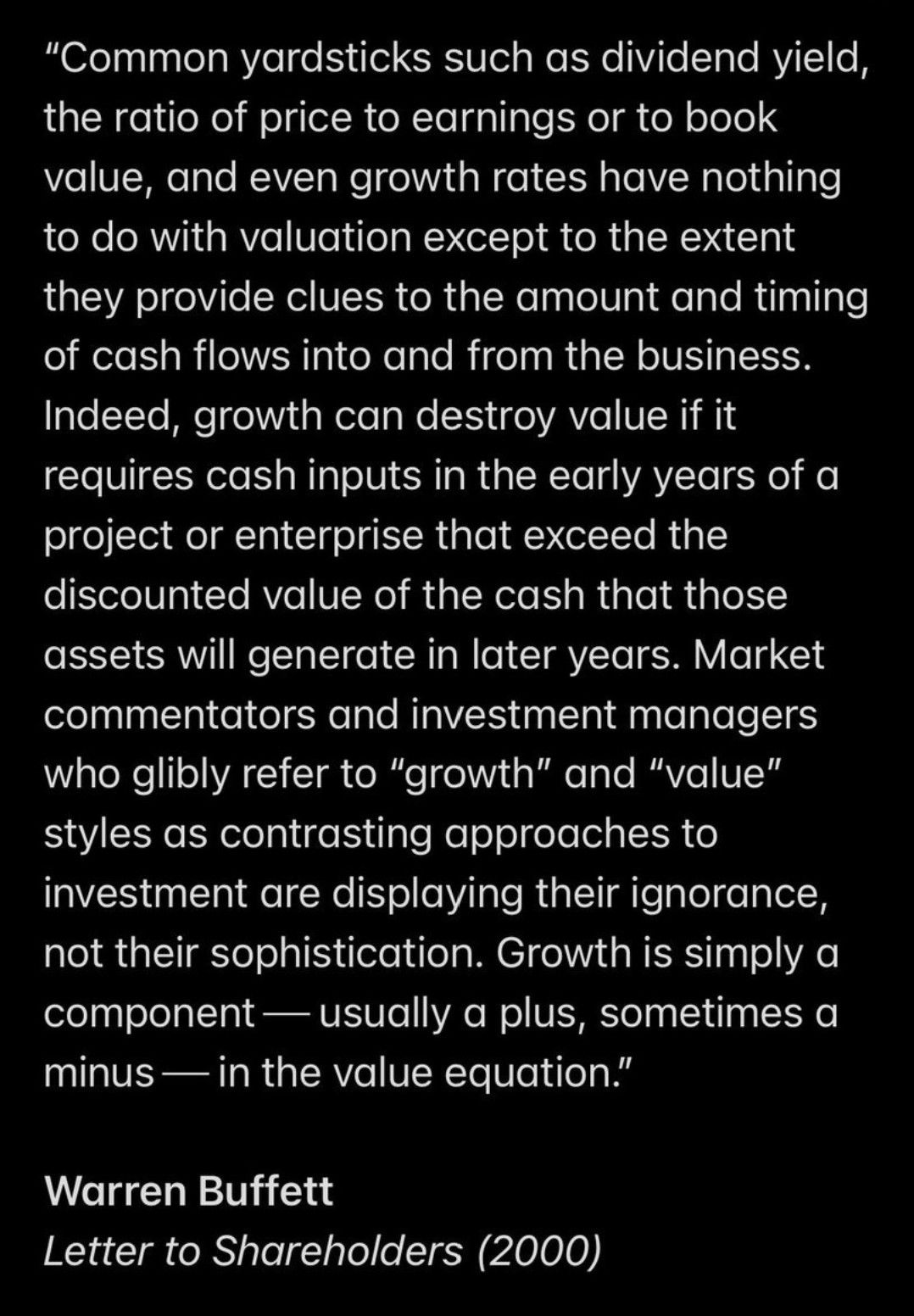

Buffett explains how growth impacts valuation

Source: Brian Feroldi

Investing with intelligence

Our latest research, commentary and market outlooks