Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

When you see this chart, do you really want to go short Tesla ?

Source: J-C Parets, TrendLabs

Tesla said shareholders voted in favor of CEO Elon Musk’s almost $1 trillion pay plan, with 75% support.

Board members recommended shareholders approve the pay plan, which they introduced in September. Top proxy advisors Glass Lewis and ISS recommended voting against it. Results of the vote were announced on Thursday at the company’s annual shareholders meeting in Austin, Texas. The package for Musk consists of 12 tranches of shares to be granted if Tesla hits certain milestones over the next decade. It would also give Musk increased voting power over the company, acceding to demands that he’s made publicly since early 2024. The full award would give Musk, who already holds about 13% of the EV maker, more than 423 million additional shares and take his stake to about 25%. Musk would receive the first tranche of stock if Tesla hits a market capitalization of $2 trillion. Tesla’s current market cap is $1.54 trillion. The next nine tranches would be awarded if Tesla’s value increases by increments of $500 billion, up to $6.5 trillion. Musk would earn the last two tranches if the market cap rises by increments of $1 trillion, meaning it would need to hit $8.5 trillion for Musk to get the full package. Other goals tied to the pay plan include reaching 20 million vehicle deliveries, 10 million active FSD subscriptions, 1 million bots delivered and 1 million robotaxis in commercial operation. To date, Tesla has delivered more than 8 million vehicles, according to its September proxy statement. Source: CNBC

Breaking news

Tesla’s board has proposed a new pay package for chief executive Elon Musk worth $1tn over the next decade if he is able to hit a series of formidable targets. Musk will receive no salary or bonus under the plan unveiled on Friday, but would collect shares in instalments unlocked by increases in Tesla’s market value, combined with milestones including a huge increase in earnings and selling millions of cars, robotaxis and AI-powered robots. “Retaining and incentivising Elon is fundamental to Tesla . . . becoming the most valuable company in history,” chair Robyn Denholm said in a letter to investors. The package is “designed to align extraordinary long-term shareholder value with incentives that will drive peak performance from our visionary leader”. The board stressed that Musk’s incentives were aligned with investors’ interests and he will receive nothing if Tesla’s growth stalls. However, the sheer scale of the deal is likely to revive a fierce debate over the earnings of the world’s richest man. Source: FT

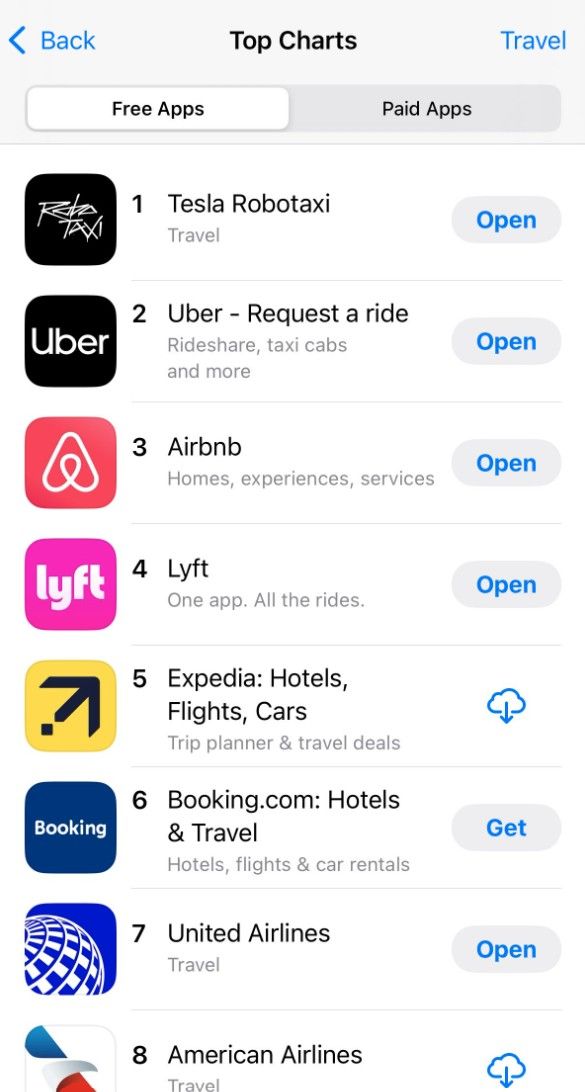

Tesla Robotaxi has already surpassed Uber on the App Store, ranking #1 in the Travel category

99%+ of these users can’t even use the app yet. Source: Ali Mirzaei @AliMirzaei0 on X

😨 New European car registrations of Tesla vehicles totaled 8,837 in July, down 40% year-on-year, according to the European Automobile Manufacturers Association, or ACEA.

🏆 BYD recorded 13,503 new registrations in July, up 225% annually. 🚨 Elon Musk’s automaker faces a number of challenges in Europe, including intense ongoing competition and reputational damage to the brand. Source: CNBC

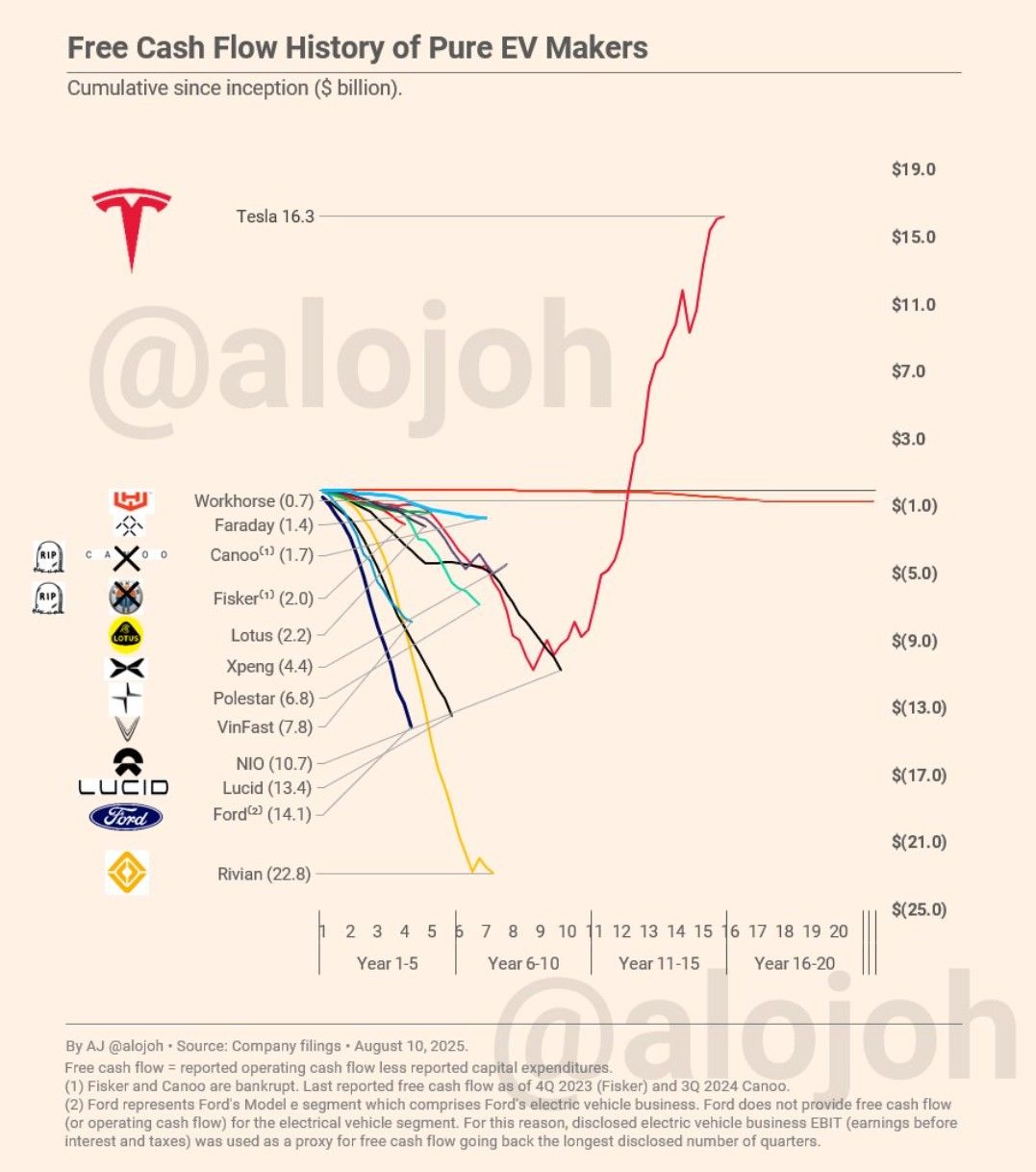

Free cash flow of pure electric vehicles makers

Updated for Tesla, Rivian, Lucid, and Ford EV Q2 2025. His key observations: 1. The EV business is a tough one 2. Only Tesla manages to generate positive free cash flow. 3. Ex Tesla, the shown companies accrued $88 billion in cash burn (net negative cumulative free cash flow). 4. In terms of cash burn, Rivian is the most underperforming EV maker: nobody has accrued a higher cash burn, not nearly. Will we see a similar story with robotaxis? Source: AJ @alojoh

⚠️ Sales of Tesla’s electric vehicles plummeted 60 per cent in the UK last month amid a broader slump in European demand, with Chinese rival BYD surging.

➡️ There were 987 Tesla vehicles registered in July, compared with 2,462 in the same month last year, according to figures from the UK’s Society of Motor Manufacturers and Traders. Meanwhile, BYD registrations in the UK rose more than fourfold year on year to 3,184 in July, according to SMMT. ➡️ In July, Tesla registrations also fell 86 per cent to 163 vehicles in Sweden, 27 per cent to 1,307 cars in France and 58 per cent to 460 vehicles in Belgium, according to official industry data. ➡️The declines came despite the recent release of an upgraded version of its flagship Model Y sport utility vehicle. The slowdown comes amid consumer uncertainty over which models would be eligible for the government’s new EV subsidy scheme. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks