Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Elon Musk has shown off his “Cybercab” in an eagerly anticipated event for Tesla investors

But was vague on crucial details as he predicted that its self-driving taxi would be available for less than $30,000. Musk said production of the robotaxis was likely to start before 2027, with the caveat that the service needed to be approved by regulators. He also unveiled a prototype for a 20-person autonomous vehicle called “the Robovan”. Since Tesla announced a “robotaxi day” on April 5, its shares have risen 45 per cent in anticipation of the unveiling. Musk has said the new electric vehicles could take the company’s valuation as high as $5tn, about seven times its current market value. Musk has repeatedly missed his own targets to roll out self-driving taxis, first promising fully autonomous rides from Los Angeles to New York by the end of 2017. In 2019, he predicted that 1mn robotaxis would be on the road by the following year. On Thursday, he said unsupervised rides using its self-driving software could be available in Texas and California from next year. Source: FT >>> https://lnkd.in/esX_w5P2

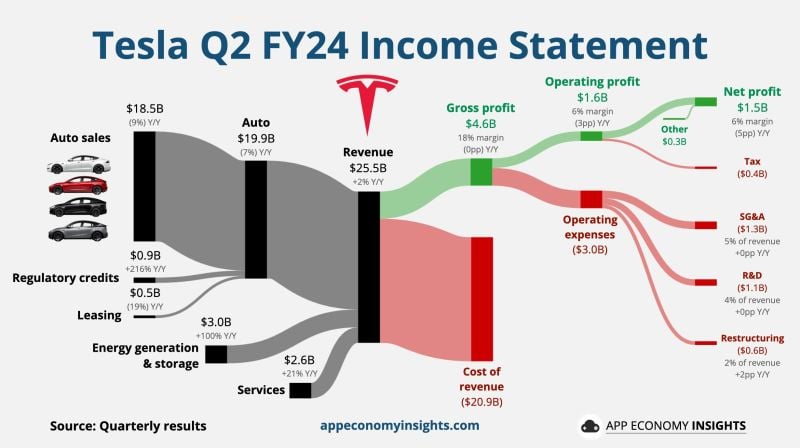

Tesla reports disappointing earnings for second quarter as revenue rises 2%

Tesla reported weaker-than-expected earnings for the second quarter as automotive sales dropped for a second straight period. The stock slid more than 2% in extended trading. $TSLA Tesla Q2 FY24 by App Economy Insights: • Revenue +2% Y/Y to $25.5B ($0.8B beat). • Gross margin 18% (-0.2pp Y/Y). • Operating margin 6% (-3pp Y/Y). • Capex +10% Y/Y to $2.3B. • Free cash flow +34% Y/Y to $1.3B. • Non-GAAP EPS $0.52 ($0.10 miss).

Tesla is making the comeback of the year...

Tesla, $TSLA, is now the 12th largest public company in the world. Since the April 2024 low, Tesla stock is now up over 80% and has added $350 BILLION in market cap. The stock is also now just 1.5% away from being UP year-to-date after falling nearly 40% in the first 4 months. If $TSLA hits ~$257 per share, it will be one of the top 10 largest public companies in the world. Just 2 months ago, Tesla briefly fell off the top 20 list as worries over the EV market arose. Source: Kobeissi Letter

BREAKING >>>

Tesla Inc. investors voted for Chief Executive Officer Elon Musk’s compensation package and moving the company’s state of incorporation to Texas, signaling confidence in his leadership despite slumping sales and a precipitous drop in the stock price. The electric-car maker announced the results at its annual meeting Thursday in Austin without disclosing the breakdown of votes. Musk had foreshadowed the outcome the night before in a post on X, saying both resolutions were “passing by wide margins.” The pay vote is only advisory and doesn’t guarantee Musk will get his money. A Delaware judge nullified Musk’s 2018 compensation plan in January, and Tesla is expected to appeal. If that appeal fails, moving the company’s legal home to Texas would allow the board to revive the pay package in a new state with potentially more favorable courts. Source: Bloomberg

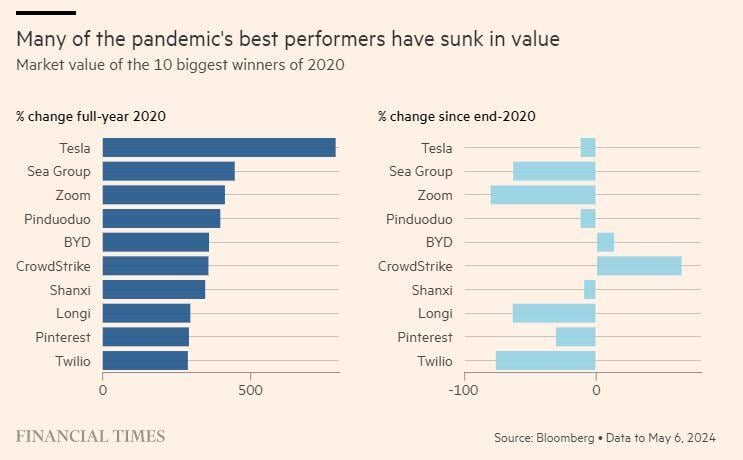

8 of the 10 biggest winning stocks in 2020 have lost value since the end of that year including Tesla $TSLA

Source: Barchart, FT

Investing with intelligence

Our latest research, commentary and market outlooks