Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

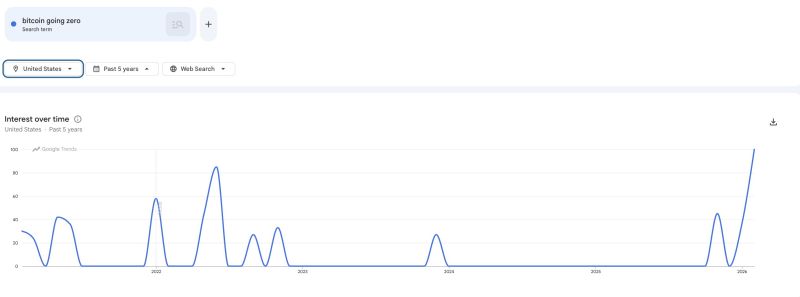

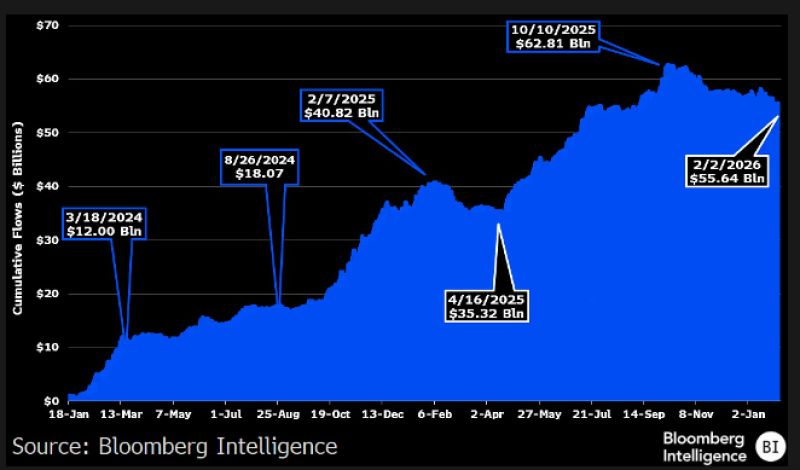

Bitcoin ETF's cumulative net inflows peaked at +$63B in October. Today (after the "massive" outflows) it's +$53B. That's NET NET +$53B in only two years.

Initially, most predictions were for $5-15B in the first year. This is an important context to consider when looking/writing about the $8B in outflows since 45% decline and/or the relationship between $BTC and Wall street, which has been overwhelmingly positive. h/t @JSeyff

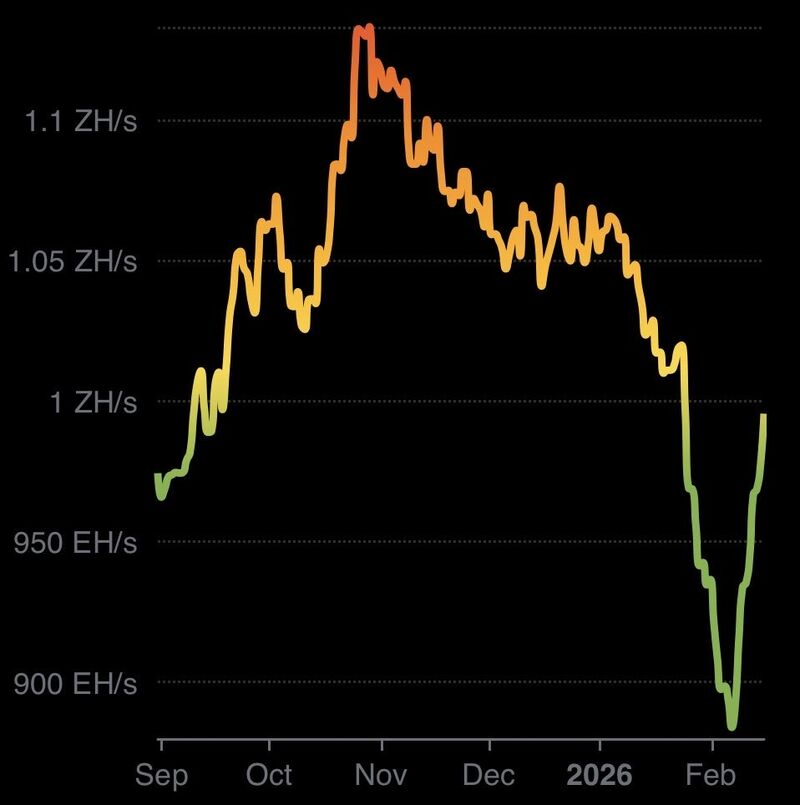

The February hashrate drop was a "perfect storm" that triggered an 11.4% downward difficulty adjustment, the largest since 2021.

Why it happened: - Texas Weather: Severe winter storms forced industrial miners to shut down to save the power grid (or sell their energy back for higher profits). - Price Correction: Bitcoin’s drop toward $60,000 made older rigs unprofitable. Some firms pivoted their hardware toward AI training for better margins. - Regulation: Renewed crackdowns on "gray" mining in Russia and China removed significant hardware from the network. The Result: The network has already begun a "V-shaped" recovery. The lower difficulty has made mining profitable again for the remaining operators, and hashrate is already bouncing back. This is actually one of the sharpest V shape recovery in hashrate we've ever seen. Source: ₿ Isaiah ⚡️ @BitcoinIsaiah

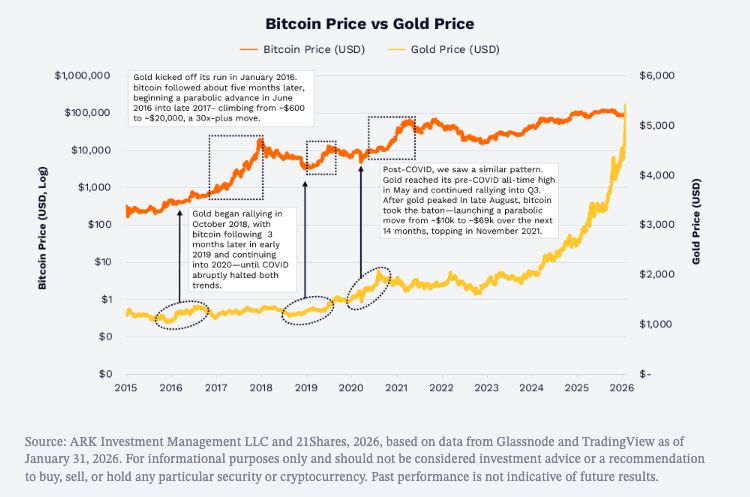

BITCOIN VS GOLD

- Gold rallied first in 2016 → Bitcoin followed months later (+30x into 2017) - Gold rallied again in 2019 → Bitcoin followed into 2020–21 - In 2025, gold surged to new highs while Bitcoin lagged - Since 2020, BTC–gold correlation: 0.14 Historically, gold has led. Source: Ark Invest Tracker @ArkkDaily

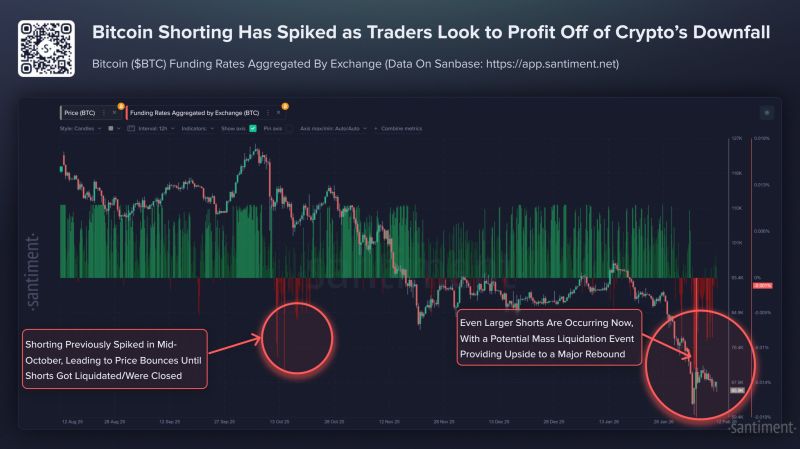

IS THE BOTTOM IN FOR BITCOIN? Aggregated data says "Squeeze Incoming

Aggregated data shows extremely negative Bitcoin funding rates, signaling overcrowded short positions. Historically, similar conditions preceded a market bottom and an 83% rally within four months. Negative funding means short sellers pay longs, increasing squeeze risk if prices rise. High leverage amplifies liquidation potential, forcing rapid buying. This imbalance reflects widespread fear and low confidence. Although not guaranteeing immediate gains, such extreme sentiment often creates conditions for reversals. Investors should remain patient, avoid emotional reactions, and monitor funding dynamics closely. Source: Santiment

Another data source for analyzing BTC and Bitcoin ETFs on the Bloomberg terminal: BTC volatility

James Seyffart @JSeyff

Investing with intelligence

Our latest research, commentary and market outlooks